jetcityimage

It’s been a little over a month since I wrote my latest cautious piece about CSX Corporation (NASDAQ:CSX), and in that time the shares are up just under 1% against a gain of ~5% for the S&P 500. I thought I’d return to the stock on the eve of their next earnings announcement to see if it’s time to pull the trigger or not. I’ll make this determination primarily by looking at recent traffic data. In particular, I want to get a sense of traffic data now relative to the same periods in 2021 and 2019. I’m looking at 2019 in order to “clean out” any residual impact of the pandemic. I’m also going to compare this traffic data with the current valuation to see if the latter makes sense. Finally, I want to take the opportunity to write about, and brag about, my latest options trade on this stock.

Welcome to the “thesis statement” portion of the program. It’s in this paragraph where I give you the gist of my argument in a neatly packaged segment in order to save you as much time as possible, and to insulate you as much as possible from my bad jokes and self congratulation. You’re very welcome. I’ll be buying CSX today. The reason for this is the combination of the fact that the shares are about 24% cheaper now than they were this time last year, in spite of the fact that traffic is down only ~1%. The dividend is secure in my view, and it’s on the high side in my estimation. Finally, although I’ve earned a very decent amount of premium from selling puts, I’ll not sell any today. The reason for this is because I consider short put options to be ideal instruments to deal with an overpriced stock. At the moment, the stock is on sale in my estimation, so I’m going to express my bullishness via stock ownership.

Let’s Try to Maintain Some Perspective

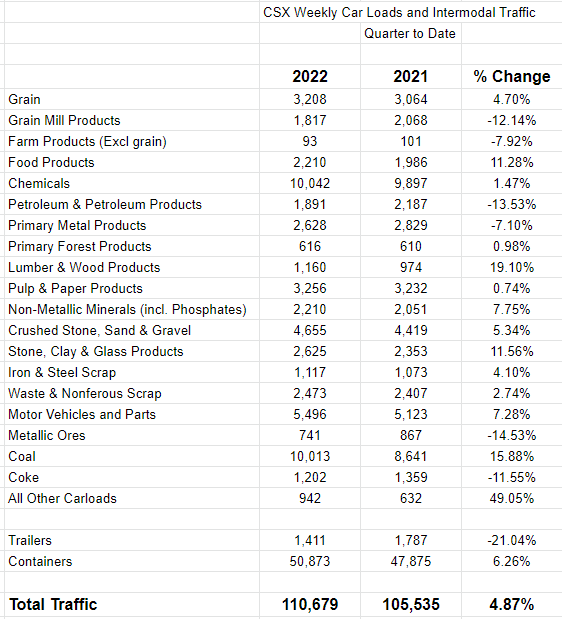

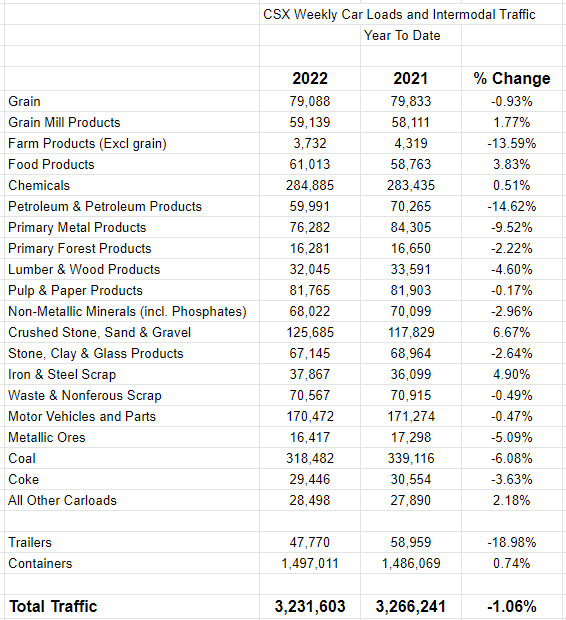

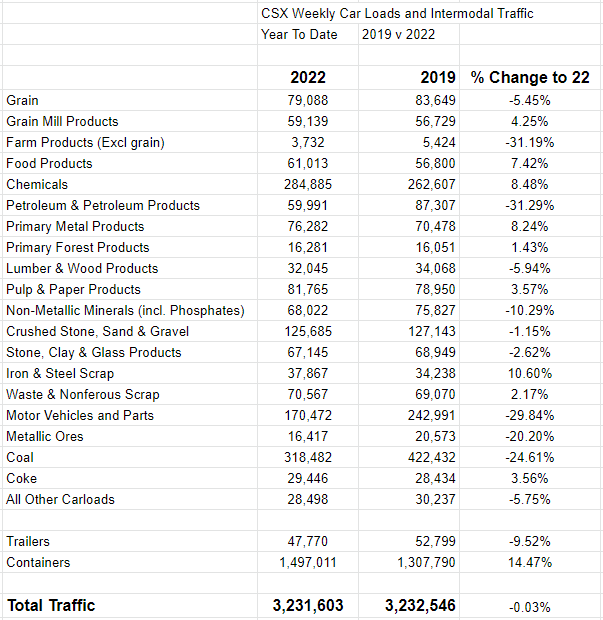

Class 1 railroads earn money from hauling stuff around. With the exception of motor vehicles, they specialize in hauling very large amounts of heavy items that are low value per unit of weight. This is what makes them compelling. If you want to haul lots and lots of waste and non ferrous scrap, for instance, railroads are the way to go. Because they get paid to haul all of this stuff, I think the first thing we should try to do is to anchor our analyses in what exactly is happening to the levels of traffic that is being hauled. Thankfully the AAR (American Association of Railroads) publishes weekly traffic data, and I’ve reproduced some of the results in the Appendix below for you enjoyment and edification. Specifically, I’ve enclosed data looking at traffic patterns over the past quarter compared to the previous period. I’ve also looked at year to date figures relative to the same period in 2021. Finally, I’ve looked at the current (27 week) period in 2022 relative to the same period in 2019 to try to wash out any lingering effects of the pandemic. Here’s what I found:

-

Traffic is actually up about 5% over the past quarter.

-

Traffic is down about 1% this year relative to last.

-

Traffic is down about .3% this year relative to 2019.

So traffic is about 1% lower during the first 27 weeks of this year relative to the same period last. That may matter a great deal to you, but it doesn’t bother me much as I’m aware of the existence of the business cycle. Things don’t move in a straight line in nature, so we should expect some variability. The point is made even more starkly when comparing the most recent period to 2019. The first half of 2022 is down only ⅓ of a percent relative to 2019. Given all of this the impression that business is dropping off dramatically is a bit overdone in my view.

CSX Corporation’s Financials

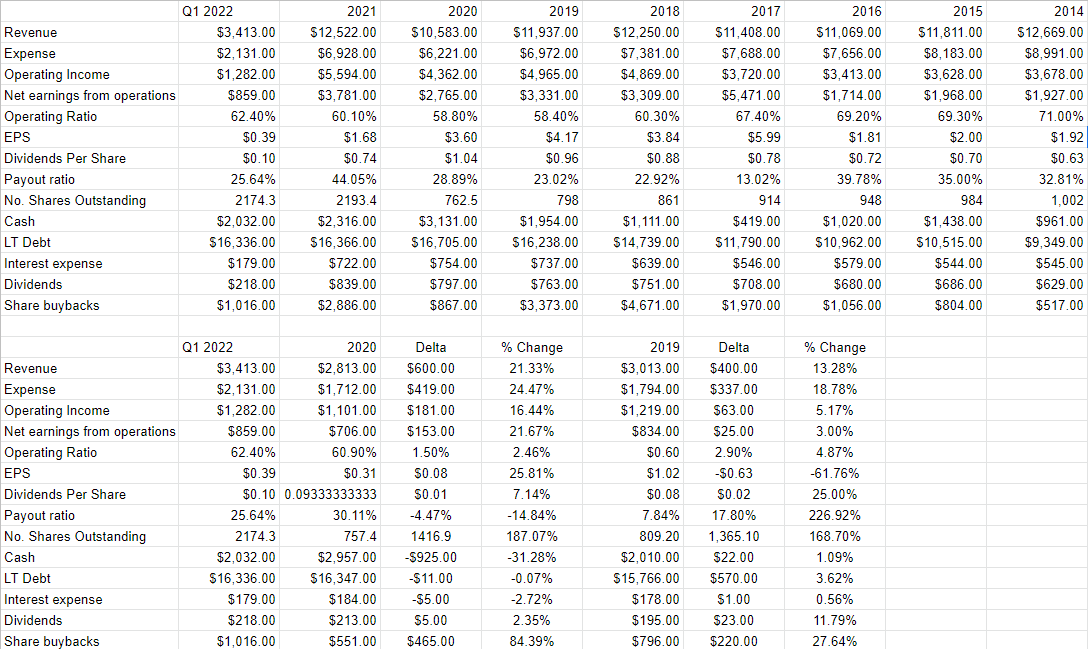

I wrote about these financials previously, but I feel a need to remind investors about how the company did during the first quarter of this year.

-

Revenue was about 21% greater than it was during Q1 of 2021, and was 13% greater than it was in 2019.

-

Net earnings from operations was up about 22% relative to 2021, and was about 3% greater than it was in 2019.

-

In light of this performance, management increased the dividend 7% relative to 2021, and fully 20% relative to 2019.

To refresh your memories from the previous section, traffic is actually holding up rather well relative to both last year and 2019. For that reason, I’d be very happy to buy aggressively at the right price.

CSX Financials (CSX investor relations)

The Stock

As my regulars know, I consider the “business” and the “stock” to be quite different things. In case you’re new here, I’ll let you in on my perspective: I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. The crowd’s views about the future health of the business are informed by many things. To pick one example totally at random, the crowd may develop a view about a railroad that has seen traffic pick up 5% over the past quarter. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. So, in some sense, the stock is “doubly buffeted” by the crowds’ rapidly changing views about a given company, and the crowd’s rapidly changing views about the overall stock market.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations.

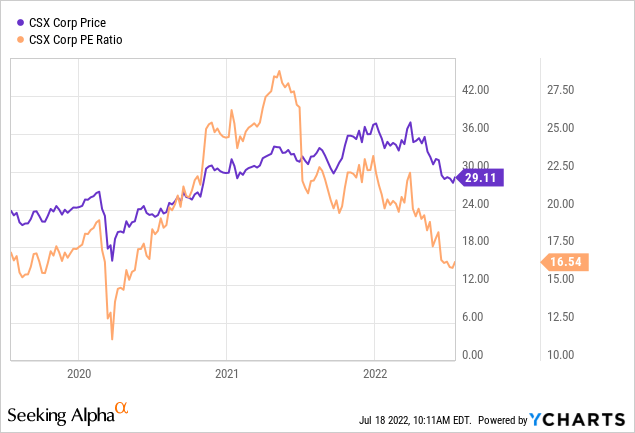

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, I balked because the shares were trading at a P/E of ~16.7. This was much cheaper than it had been previously, hence my title “closer but not yet.” They’re now about 1.8% cheaper per the following:

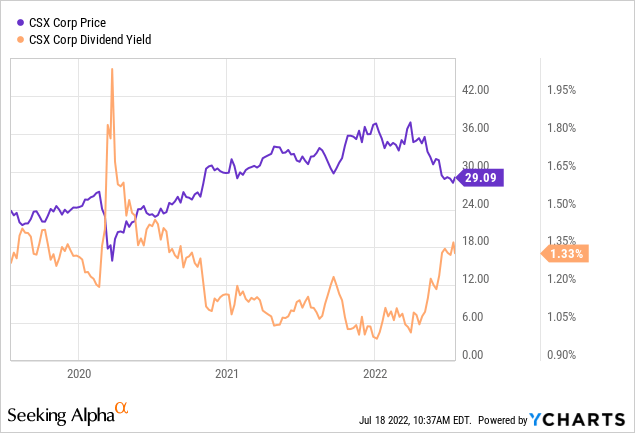

At a time when investors are paying much less than they have for a year, they’re collecting a dividend yield that’s near a multi year high. I like paying less and getting relatively more.

So as of week 27, the year to date traffic is down ~1% in 2022 relative to 2021. That’s not great news, obviously. At the same time, though, the shares are now about 24% cheaper. It may come as a surprise to you, but people are less optimistic about stocks now than they were last year. This is my time to shine. The more miserable people feel, the happier I am as an investor.

This is because of the truth of an old bit of investor wisdom: “buy low, sell high.” When I first heard that as a small kid, I wondered at how these adults weren’t all billionaires, as the idea is so bog simple. As I’ve aged, and then continued to age, and aged some more, I grew to realize that something can be simple in concept, but very difficult to execute. We’re told to “buy low”, and it makes sense to us. We look enviously at a stock chart from March 2009 to the present and think “man, why didn’t I buy aggressively in March of 2009?” The reason you didn’t is the exact same reason people might eschew stocks today. It’s hard to buy amidst pessimism, but the reality is that it’s the most profitable time to buy. For that reason, I’ll be buying CSX aggressively at this point. I was disciplined about staying on the sidelines until it reached my “buy zone.” It’s reached it, so it’s time to put some capital to work.

I expect the ride to be bumpy over the next year or so, but I think the valuation is currently too attractive to pass up. For that reason, I’m buying.

Options Update

I’m currently short 10 of the January 2023 CSX puts with a strike of $27.50. I sold these for an average of $1.54 each. I initially sold five for $1.39 and then sold another five for $1.70. For those who are keeping score at home, this brings my total of put options premium earned on this stock to $18.34. This demonstrates the power of put options. Also, in spite of the fact that the shares have dropped about 16.5% since I sold the first batch, they are currently priced at only $1.65-$1.88. This suggests that the options market isn’t pricing in a huge drop from current prices.

I’m a big fan of short put options, obviously, but I think they’re a tool that’s much more appropriate for an overpriced stock. You sell a deep out of the money put and earn some money. If the shares drop in price and they’re “put” to you, great. If the shares remain elevated and you simply pocket the premium, also great. In the final analysis, though, I think wealth is built by owning great companies at great prices, and so I’ll not write any puts at the moment. I’m going to express my bullishness via stock ownership. If the shares drop in price sufficiently from here, and I’m obliged to buy more at an adjusted price of $25.96 ($27.50-$1.54), I’ll consider that to be a bonus.

Conclusion

The shares are 24% cheaper now than they were in 2021, in spite of the fact that traffic is down only marginally. Additionally, the company posted earnings that demonstrated that they’re able to grow in spite of economic softness. Finally, this is a company with an enormous moat, and you do well with it only when you buy when the shares are on sale. The way you buy when shares are on sale is when other people are nervous about the direction that the company is taking. In my view it makes sense to avoid that noise, and buy this very strong franchise near a multi year low.

Appendix: Traffic Comparisons By Type and Date

Traffic data for the quarter to date periods 2022 and 2021 (CSX investor relations-Weekly Key Metrics)

Traffic Data Comparisons for the first 27 weeks of 2022 relative to the same period in 2021 (CSX investor relations-Weekly Key Metrics)

Traffic Data 27 Weeks 2019 v 2022 (CSX investor relations-Weekly Key Metrics)

Be the first to comment