MoreISO/iStock via Getty Images

In my article today, I have three tailwinds that support the potential for CoreCivic, Inc. (NYSE: CXW) shares to rise from here.

We’ll also talk about the major risk for the company and how some of these tailwinds overcome the potential risk in the short run, but in the long run it may be a moot point.

One key risk we’ll talk about is the current political landscape and how that is making a push away from the use of private prison contractors like CoreCivic. It’s already lost several contracts and causing the company to struggle to struggle to fill two facilities it operates and has the potential to slow sales in the coming years.

To potentially offset this major risk, there are three significant tailwinds to watch.

We’ll start by tackling the shifting political landscape and how that can potentially support the company, the resilience of the company’s facility portfolio and look at how the stock can currently be viewed as undervalued even in this market environment.

Political Risks

This is the obvious risk in the room.

The company operates private prisons and correctional facilities throughout the U.S. On January 21, 2021, President Biden signed an executive order to direct the Department of Justice not to use privately operated criminal detention facilities. Two agencies inside the DOJ utilize the company’s services, United States Marshals Service (USMS) and Federal Bureau of Prisons (BOP).

CoreCivic’s risk is with six detention facilities that have separate contracts with the USMS that are set to expire over the next several years and one with BOP expiring in November that the company has already had to sell the building due to the contract not being renewed. The BOP building was 2% of revenues in 2021.

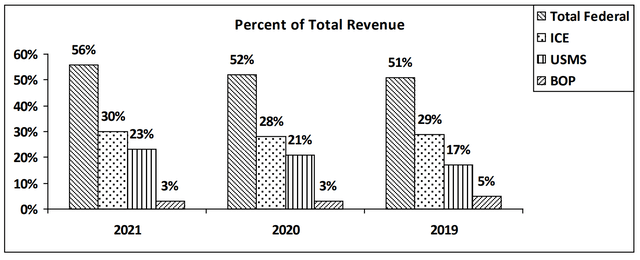

The ongoing part of this risk is if the Executive Order extends to Immigrations and Customs Enforcement (ICE), which would have an even greater negative impact on the company. As of 2021, CoreCivic generated roughly 56% of total revenues from federal facilities.

CXW 10K

Flip Side of Political Landscape

The reality is that the political sensitivities towards private prisons contracted by the Federal Government is largely split down political lines. Former republican president Donald Trump immediately shifted policy in his first year as president to request bids from private contractors. It didn’t take President Biden long at all to use an executive order to direct the Justice Department not to renew contracts.

Essentially, the sentiment for the stock flip flops based on which party is in office. While we don’t have a presidential election until 2024, the negative sentiment occurring right now under a democratic president would quickly be reversed if momentum shifts back to the republicans during mid-terms in November.

The negative news surrounding the executive order is already being priced into the stock’s valuation. That means this headwind has the potential to become a tailwind once again as politics inevitably switch back in the coming years.

Resiliency of Revenues

With roughly 56% of revenues at risk of losing their contracts due to the executive orders and the potential expansion to ICE, it makes the resiliency of their operations a key focus. Because if Biden, or another democrat, wins another four years in 2024, it would likely be the case that the executive order would be extended. However, assuming that is the worst-case scenario, it doesn’t necessarily mean that 56% of revenue just disappears.

Earlier this year, CoreCivic had a contract that expired on June 30, 2022, but was able to go from a USMS contract to a local government agency on another two-year contract. The company believes that they will be able to renew all other contracts with the government partners that have expired or are scheduled to expire within the next twelve months.

That’s a strong statement pulled right from their 10-Q in June.

Despite an executive order signed by the President, CoreCivic is still managing to not only renew leases, but find new tenants to occupy the buildings as well. This resiliency is, in part, due to the constrained supply of beds available in the U.S. correctional system. That could change over time, but it is delaying the immediate impacts the executive order could have had on operations.

Fundamental Analysis

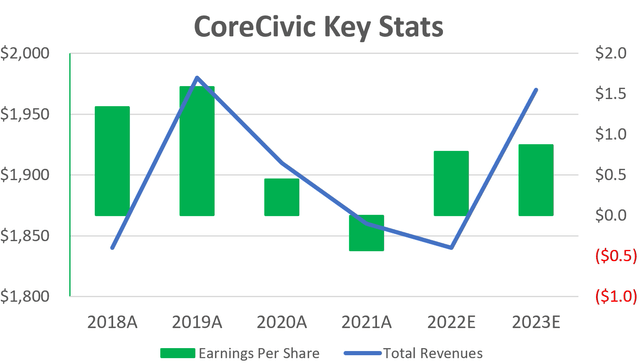

Below, you can see the revenues represented as the blue line on the chart (prices on the left in millions) and earnings per share as the green bars on the chart (prices on right).

Yahoo Finance

There was a clear drop in both, earnings and revenues, when 2020 hit. The pandemic also meant less people committing crimes and being held in detention centers which negatively impacted revenues. That was 2020.

2021 was slowed as the private prison executive order was signed and the company lost two contracts, one was partially utilized by a new county government and gap of several months before getting the other facility under contract. Two other facilities were not renewed and have not found a new operator as of June 30, 2022.

This is the type of issues the company will be dealing with for the foreseeable future.

Driving growth in revenues in 2023 hangs on renewing expiring contracts, finding new contracts for the two empty facilities and the completion of La Palma facility. Which is why we looked at the resiliency of revenues above to deal with this unexpected future.

Valuation Metrics

Keep in mind, CoreCivic used to operate as a real estate investment trust (REIT), which includes special tax status and directions for distributing income to shareholders. In August 2020, the company approved a plan to revoke that status as they believed this conversion improves the overall credit profit and will lower overall cost of capital. But the company still operates and is valued much like a REIT. So, we will look at price to earnings ratio and net asset value to compare valuations to general market.

With the negative sentiment that I’ve talked about surrounding the stock, the price-to-earnings ratio is currently just 13.07 times earnings. The average for the 500 stocks that make up the S&P 500 index is 20.20 times earnings. Current earnings per share is at $0.74, but is expected to climb 17% through 2023 to $0.87. With even a slight improvement in the company’s price-to-earnings multiple to 15 times earnings, at 2023 earnings the stock has a target price of $13.05 per share – a 36% rally from current prices.

A popular real estate valuation metric is net asset value per share. Based on the value of real estate and related assets to long term debt on June 30, 2022, the stock is trading at a 26% discount on September 9th 2022 with the net asset value at 11.96 per share.

CXW had an average financial health as of the quarter ending June 30th. It had a debt/EBITDA ratio of 3.73x, which is an average leverage ratio for real estate companies. Debt-to-equity is 0.97, which is below average for real estate stocks at the end of 2021.

Conclusion

After factoring in the headwinds for CoreCivic, including an executive order weighing on operations, and breaking down the tailwinds that have the potential to offset it, the stock is undervalued enough that it warrants a second look at current price levels.

Be the first to comment