Dilok Klaisataporn

Advantages of Brandywine in Philadelphia (Investor Presentation)

The stock of Brandywine Realty Trust (NYSE:BDN) has plunged 41% this year due to the impact of inflation on the REIT and fears of an upcoming recession. While the trust is facing some strong headwinds right now, it has been sold off to the extreme. It is trading at a 10-year low price-to-FFO ratio of 6.1 and is offering a 10-year high dividend yield of 9.3%, which is well covered, with a payout ratio of only 56%. Therefore, the investors who can wait patiently for inflation to subside are likely to be highly rewarded in the upcoming years.

The reasons behind the plunge

Inflation has skyrocketed to a 40-year high this year due to the unprecedented fiscal stimulus packages offered by the government in response to the pandemic as well as the invasion of Russia in Ukraine. Consequently, the Fed is in the process of raising interest rates aggressively in an effort to lead inflation back to its normal range.

Higher interest rates are likely to increase the interest expense of Brandywine significantly. Indeed, the company recently lowered its guidance for its annual FFO per share from $1.37-$1.45 to $1.36-$1.40 due to its expectations for higher interest expense in the upcoming quarters. It is important to note that Brandywine has a high debt load, with a leverage ratio (Net Debt to EBITDA) of 7.4. In addition, its net debt (as per Buffett, net debt = total liabilities – cash – receivables) stands at $2.1 billion, which is 150% of the market capitalization of the stock. As a portion of the debt of Brandywine will mature in the upcoming years, the company will have to refinance that debt at higher interest rates.

Fortunately, management recently stated that it intends to sell some non-core assets in order to reduce the debt load and mitigate the effect of higher interest rates. It is also worth noting that the effect of higher interest rates on the bottom line is limited, as is estimated at $0.03 per share for this year. To cut a long story short, the amount of debt of Brandywine is high but seems manageable thanks to the high-quality properties of the REIT.

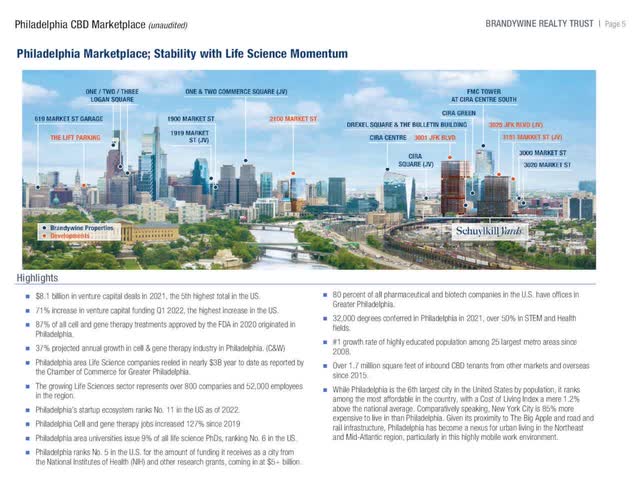

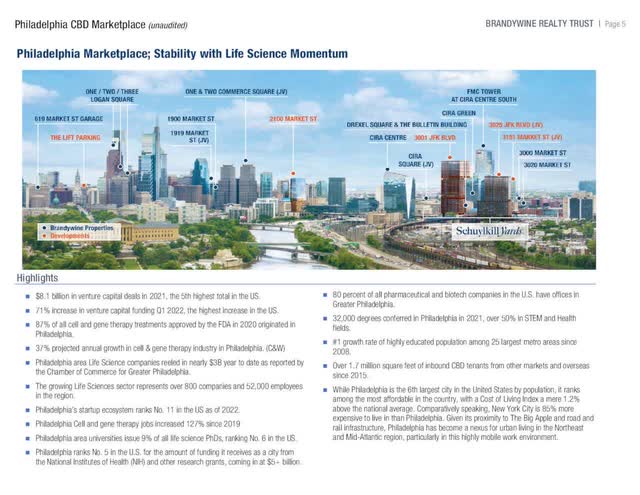

Brandywine generates 74% of its operating income in Philadelphia, which offers some key advantages to the REIT.

BDN competitive advantages (Investor Presentation)

For instance, Philadelphia attracted $8.1 billion of venture capital deals last year, the 5th highest performance in the whole country. In addition, 80% of the biotechnology companies in the U.S. have offices in Philadelphia. All the characteristics of Philadelphia mentioned in the slide above result in Brandywine having a fairly resilient property portfolio.

Another reason behind the plunge of Brandywine is the impact of inflation on the valuation of the stock. High inflation greatly reduces the present value of future cash flows and hence it exerts pressure on the price-to-FFO ratio of most REITs. This is certainly true for Brandywine, which is currently trading at a price-to-FFO ratio of only 6.1, a decade-low level.

However, it is critical to maintain a long-term perspective. The Fed is doing its best to lead inflation base to its target rate of about 2%. Thanks to the aggressive stance of the Fed, inflation is likely to begin to subside next year. When that happens, the stock of Brandywine will enjoy a strong tailwind, as it will probably revert towards its normal valuation level. To provide a perspective, Brandywine has traded at an average price-to-FFO ratio of 10.9 over the last decade. If the FFO multiple of the stock reverts from 6.1 to 10.9 over the next three years, the stock will enjoy a 21% annualized valuation tailwind.

Finally, the stock of Brandywine has declined for another reason, namely fears of the investing community that the aggressive interest rate hikes of the Fed may cause a recession. If these fears prove correct, Brandywine is likely to incur a decrease in its FFO per share. However, even if the economy falls into a recession, experience has shown that the economy has always recovered strongly from such a downturn. Investors should not stay away from stocks due to fears of a recession, as it has proved impossible to predict recessions. In fact, the market has already priced a recession in the stock of Brandywine to a great extent.

Overall, the stock if Brandywine is under pressure due to strong headwinds but all these negative factors are likely to prove temporary. Whenever these headwinds attenuate, the stock of Brandywine is likely to enjoy a strong relief rally.

Dividend

Due to its steep decline this year, Brandywine is currently offering a 10-year high dividend yield of 9.3%. When a stock offers such a high yield, it usually signals that a dividend cut may be just around the corner. However, this is not the case for Brandywine. To be sure, the stock has a solid FFO payout ratio of 56%. In addition, analysts expect essentially flat FFO per share next year and 6% growth in 2024. If they prove correct, the payout ratio of Brandywine will improve even further by 2024.

It is also worth noting that management recently stated that the dividend is well covered. While such reassurance from management is not always a guarantee, the recent conviction of Brandywine’s management undoubtedly bodes well for the safety of the dividend. It is also important to realize that the exceptional dividend yield makes it much easier for investors to wait patiently for a recovery of the stock, especially given the highly inflationary environment prevailing right now.

Risks

As mentioned above, Brandywine has a high debt load. Consequently, the stock will remain under pressure if a recession shows up. In such a scenario, the REIT will probably incur a decline in its FFO per share but it is likely to endure such a downturn without any problem thanks to its somewhat resilient cash flows.

Another risk is the unlikely scenario of persistent inflation. If high inflation remains in place for years, the stock of Brandywine is likely to remain under pressure. Fortunately, given the sustained efforts of the Fed to put inflation under control, such an adverse scenario has low chances of materializing.

Final thoughts

Due to high inflation and fears of an upcoming recession, the stock of Brandywine has become exceptionally cheap. Investors are given the rare opportunity to purchase this REIT at a 10-year low valuation level and lock in a 10-year high dividend yield of 9.3%, which is well covered by cash flows. The only caveat is that great patience may be required, especially if a recession shows up or excessive inflation persists beyond this year. Therefore, only the investors who can tolerate short-term pain and remain focused on the long term should consider purchasing this stock.

Be the first to comment