ADragan

I usually write about growth stocks and tech companies, but I want to do something different today.

I’m building a value-oriented, high-yield portfolio. And I see it today, REITs are looking attractive.

Investment Thesis

REITs are crashing and amidst this chaos, I see wonderful buying opportunities, particularly in certain REIT industries that are being punished more than others.

As they’ve learned from the Great Financial Crisis, REITs have been building stronger balance sheets ever since.

But not all REITs are created equal. I tend to focus on high-quality, well-managed REITs that have a portfolio of the most desirable properties – by class, by location, by tenant, etc.

I covered a few REITs when I first started writing for Seeking Alpha as I saw generational buying opportunities in the space back then (mid-2020).

Today, I’m beginning to feel the same way.

Chaos or Opportunity?

During the Fed’s annual meeting at Jackson Hole, Fed Chairman Jerome Powell left some unexpected remarks:

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

He also affirmed that to curb inflation, higher interest rates are likely to persist for a prolonged period of time.

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.

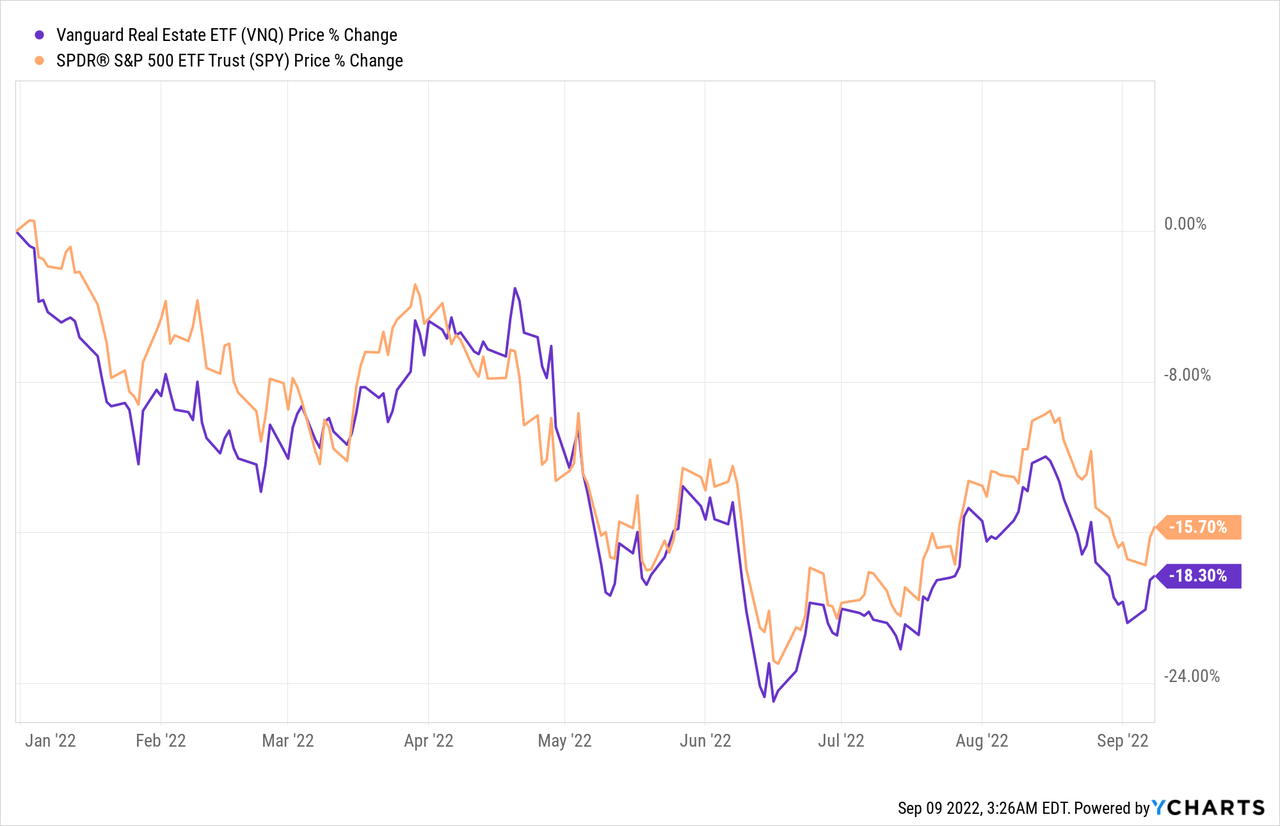

His speech sent the broader indexes tumbling down — the S&P 500 (SPX) fell 3.4%. On the other hand, REITs sustained a softer blow — the Vanguard Real Estate ETF (VNQ) was down by 2.5%.

But year-to-date, VNQ still underperformed SPY, likely because investors anticipate that spiking interest rates would cause more pain to the asset-heavy, debt-ridden real estate market.

Many investors are expecting that high inflation and interest rates will suppress the red-hot real estate market, and as a result, they are quick to assume a 2008-style-kind-of-crash for REITs.

I beg to differ.

Here’s why investors shouldn’t worry about another real estate crisis.

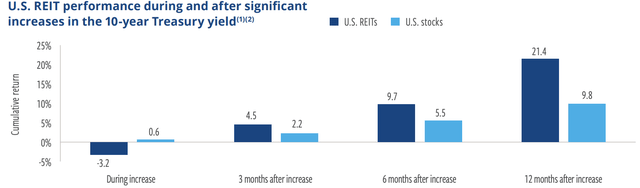

First, REITs may actually outperform the overall markets in a high interest rate environment. While REITs have underperformed equities immediately following interest rate hikes, they are outperformers in the months after such hikes.

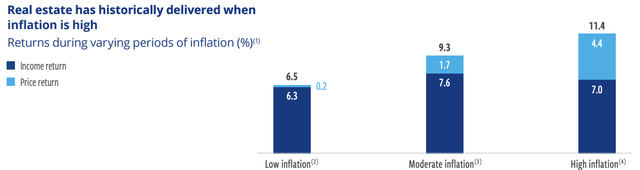

Second, REITs have also historically outperformed the markets during times of high inflation. This is because REITs have high Operating Margins of around 60%, thus helping them withstand the impacts of rising costs. Furthermore, higher rents can be an inflation buffer.

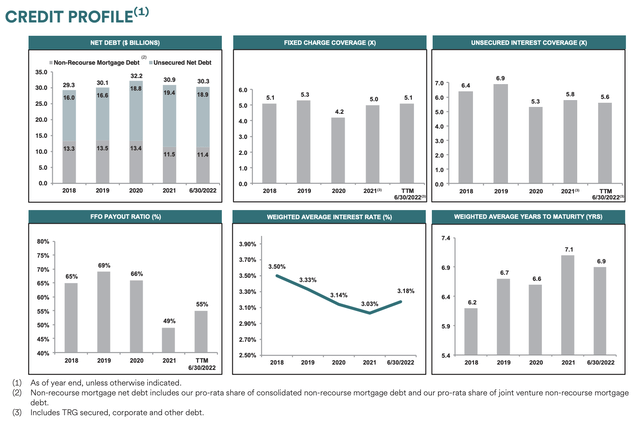

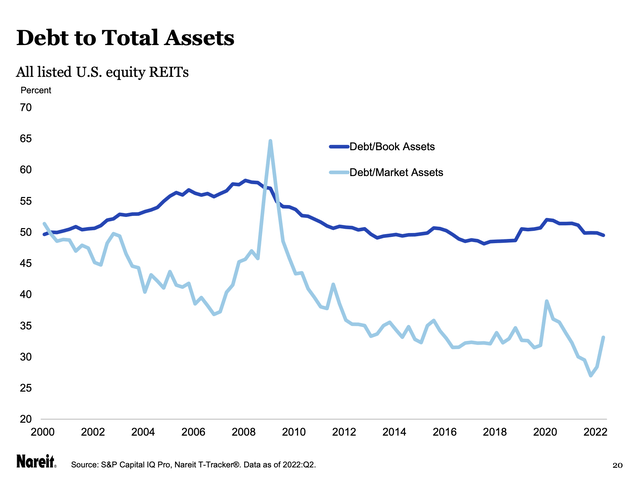

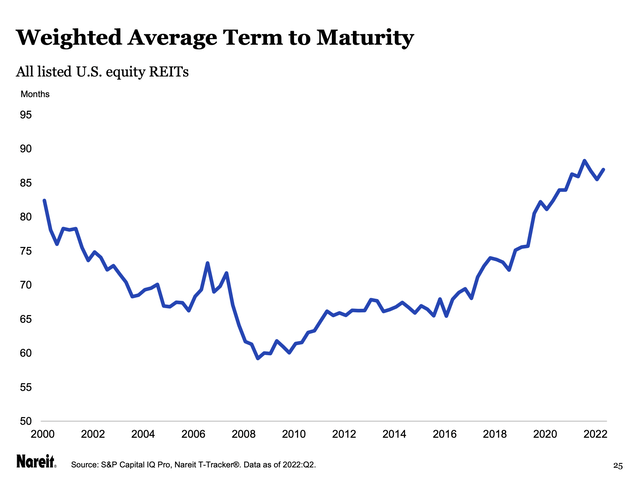

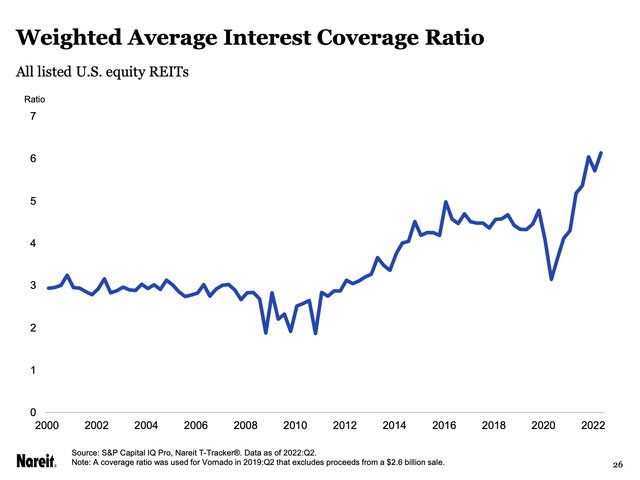

Third, REITs’ balance sheets are the strongest they’ve ever been. The charts below help illustrate my point.

Debt Ratio is at only 35%, as compared to as high as 65% during the GFC.

Lease lengths are also much longer than it has been historically at ~7 years, compared to ~5 years during the GFC.

And lastly, Interest Coverage Ratio — which is EBITDA divided by Interest Expense — is at all-time highs, showing the industry’s ability to pay its cost of debt.

Put simply, REITs today are in much better shape than they were back in 2008 — and history has shown that REITs outperform the markets during times of high inflation AND interest rates.

Furthermore, the recent pullback in REIT stocks provides an attractive entry point for value investors and dividend chasers alike.

I believe there’s over-pessimism in the REIT space today.

But as Chinese philosopher Sun Tzu said: “In the midst of chaos, there is also opportunity.”

In my eyes, with all the ugly headlines and macroeconomic uncertainty, I believe it’s a great time to buy REITs today.

But not all REITs are created equal. And in times of a difficult market environment, I prefer to focus my attention on the highest-quality, best-of-breed REITs.

With that said, here are 5 REITs I’m considering buying soon.

Simon Property Group (SPG)

SPG owns, develops, and manages premier shopping and mixed-use destinations, which consist primarily of Class A malls. As of Q2, SPG owned or held an interest in 198 properties in the U.S and 33 properties in Asia, Europe, and Canada. The company also holds an 80% non-controlling interest in Taubman Realty Group (which owns 24 malls) as well as a 22% equity stake in Klépierre (which owns shopping centers in 14 European countries).

I can already hear the bears growling.

- “The retail apocalypse is not over!”

- “Malls are dead!”

- “E-commerce is the future!”

Yes, these are all valid arguments.

As we’ve seen in the past couple of years, the pandemic accelerated retail store closures, bringing down several malls in the process. The growth of e-commerce also added pressure to retail real estate operators.

As malls fall out of favor, companies everywhere are forced to be prudent with how they allocate resources to build their offline presence. As such, they turn to the most productive locations with the highest foot traffic possible.

Enter SPG.

SPG is not just some retail REIT — it is one of the most well-managed retail REITs with a portfolio of the highest qualities of malls.

As Class B and Class C malls inevitably close, demand for Class-A malls will become stronger, both for consumers and tenants.

Its recent Q2 results explain why the demand for Class-A malls remains strong:

- Comparable FFO grew 1.4% to $1.1 billion.

- Domestic NOI and Portfolio NOI increased by 3.6% and 4.6%, respectively.

- Occupancy was 93.9%, up from 91.8% last year.

CEO David Simon elaborated on that last point:

Occupancy at the end of the second quarter was 93.9%, an increase of 210 basis points and TRG was at 93.4%. The number of tenant terminations this year has been at record low levels. Average base rent increased, average base minimum rent increased for the third quarter in a row and was at $54.58.

Leasing momentum accelerated across our portfolio. We signed nearly 1,300 leases for more than 4 million square feet in the quarter, have signed over 2,200 leases for more than 7 million square feet through the first half of the year, and we have a significant number of leases in our pipeline. Nearly 40% of our total leasing activity in the first 6 months of the year has been new deal volume. This is up approximately 25% from last year.

(CEO David Simon — SPG Q2 Earnings Call)

Such strong leasing activity further confirms the high demand for SPG’s properties.

But what about high inflation, rising interest rates, and the risks of a recession?

Rest assured, SPG has a fortress balance sheet with $8.5 billion of liquidity, consisting of $1.2 billion of cash on hand and $7.3 billion under its revolving credit facilities.

In addition, SPG has a strong credit profile and is also one of several REITs with an investment grade credit rating of A-.

SPG FY2022 Q2 Supplemental Package

Management is also confident in the outlook of the business, raising guidance from $11.60-$11.75 per share to $11.70-$11.77 per share. Furthermore, management also increased its quarterly dividend by 16.7% YoY, with a very safe TTM FFO payout ratio of 55%.

If that doesn’t boost your confidence, I don’t know what will.

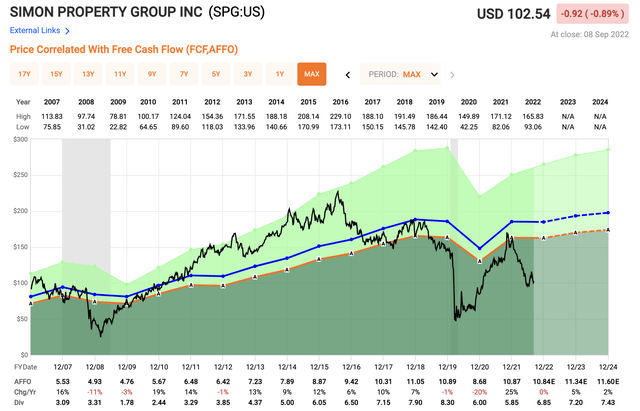

Valuation-wise, SPG is in deep value territory. SPG trades at a P/AFFO of 9.5x, well below its Normal P/AFFO (blue line) of around 17.1x. Investors can also lock in a 6.8% dividend yield, way higher than its pre-covid yield of 4-5%.

Boston Property Group (BXP)

BXP develops, owns, and manages Class A office properties in the U.S., specifically in major metropolitan areas — Boston, Los Angeles, New York, San Francisco, Seattle, and Washington DC.

Again, the bears are loud on this particular REIT.

- “Offices are dead!”

- “There’s no need for offices when you have Zoom (ZM)!”

- “Offices will be left empty because of the urban exodus!”

Yes, the pandemic has demonstrated to us that working remotely is possible, which left companies all over the globe wondering if they really need to pay rent for empty offices.

But just like how there’s a growing demand for Class A malls over lower-grade malls, upper-tier offices will prevail while lower-tier offices suffer. Moreover, BXP’s markets are characterized by robust job growth that resulted in increases in rental rates and occupancy over time.

Some of the most established companies are still renting office properties in major markets as executives believe that a hybrid working environment is the most reasonable option for both the well-being of their employees and the overall success of their businesses.

This is why Fortune 500 companies are turning to BXP.

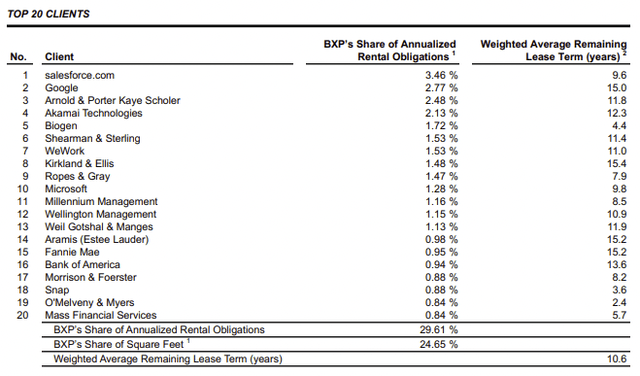

BXP’s clientele includes Salesforce (CRM), Google (GOOG), and Microsoft (MSFT). And the length of BXP’s contracts shows that its clients are investing in offices for the long run — the weighted average remaining lease term of its top 20 clients is 10.6 years.

BXP FY2022 Q2 Supplemental Package

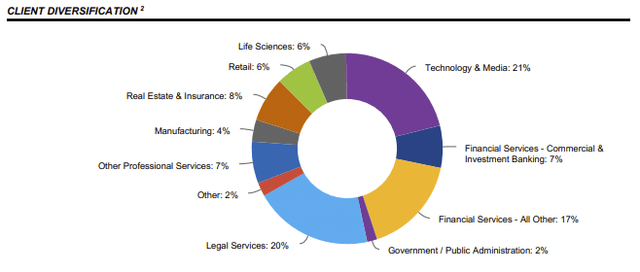

Customer diversification is also a strong suit for BXP, which is spread across a variety of industries.

BXP FY2022 Q2 Supplemental Package

Leasing volume is not slowing down either — Q2 saw the strongest leasing quarter since Q3 2019, which was also 140% of its historical 10-year average for the quarter.

To remind everybody, beginning with the third quarter of ’21, we signed 1.4 million, 1.8 million, 1.2 million and this quarter, 1.9 million square feet of leases. So that’s 6.3 million square feet of signed leases in the last 12 months. This activity has occurred in the midst of the Delta variant, the Omicron variant, remote work fits and starts and most importantly, significant labor market headwinds.

(President Doug Linde — BXP Q2 Earnings Call)

Q2 results showed strong momentum in the business:

- Revenue grew 8% YoY to $774 million.

- FFO grew 13% YoY to $305 million.

Management also raised its full-year FFO guidance from $7.40-$7.50 per share to $7.48-$7.53 per share.

Despite the upbeat guidance, headlines of company layoffs, looming recession, and rising interest rates continued to put pressure on the stock. The stock is now close to its Covid bottom of $70 per share.

The markets are certainly discounting the fact that more companies are likely to cut their workforce, and therefore, their office spaces. As of Q2, its occupancy rate is 89.5%, which is a bit concerning in my opinion.

But the valuation looks attractive.

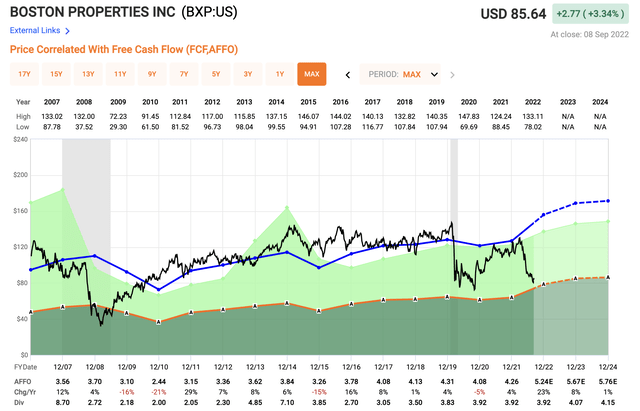

BXP now trades at a P/AFFO of 17.4x, a huge discount from its Normal P/AFFO (blue line) of about 29.8x. BXP rarely trades this cheaply given its high-quality portfolio of Class A office properties. At the same time, investors get to bag a 4.6% dividend yield that is well covered by BXP’s AFFO payout ratio of 75%.

Medical Properties Trust (MPW)

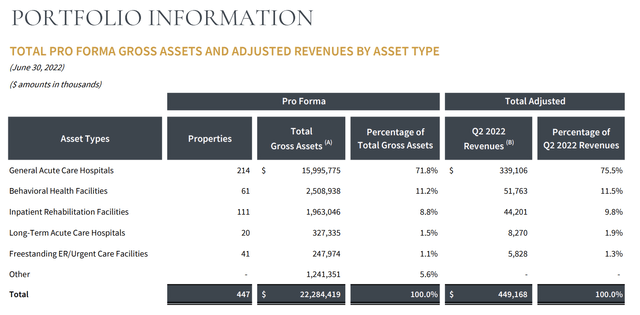

MPW invests in and owns healthcare facilities. Today, MPW has investments in 447 properties, comprising 54 operators and ~46,000 beds, spread across 32 U.S. states and 10 countries.

General acute care hospitals account for approximately 75.5% of MPW’s Revenue with other specialized healthcare facilities making up the rest of Revenue. The pandemic has clearly highlighted the importance of these facilities.

MPW focuses on acquiring essential components of the healthcare system and subsequently rents them out to healthcare operating companies and other healthcare providers. Contracts with these operators are generally net leases, meaning tenants are responsible for all ongoing operating and maintenance expenses of the facility. This leaves MPW with high Operating Margins of 67% as of Q2.

Lease lengths are long with a weighted-average remaining initial term of 17.8 years and 90.8% of leases expiring beyond 2031.

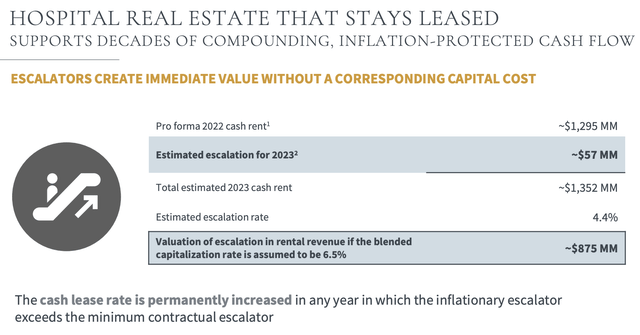

Furthermore, 99% of MPW leases provide annual rent escalations based on increases in the Consumer Price Index — rent increases act as inflation buffers — with an estimated escalation rate of 4.4%.

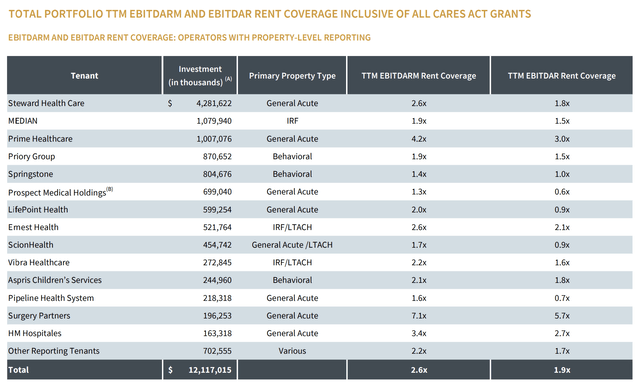

MPW August 2022 Investor Update

MPW seems to have the perfect business model:

- Hospitals are essential facilities, especially in a Covid-ridden world.

- Contracts are structured in a way that makes MPW inflation-proof.

Shouldn’t MPW be outperforming the markets?

Nope — MPW is actually one of the worst-performing REITs, down by 40% year-to-date.

Why is that so?

Its largest tenant, Steward Health Care — which makes up 27.8% of Revenue — is at great risk, as highlighted by a WSJ article.

But in reality, Steward is doing better than what these articles claim. Steward has an EBITDARM Rent Coverage ratio of 2.6x, which is in line with the portfolio’s average of 2.6x. As such, Steward is doing just fine.

In its August Investor Presentation, management also mentioned that Steward operations have improved substantially, and “Steward expects a substantial and sustainable positive free cash flow run-rate beginning in Q4 2022.”

That should put any negative sentiment towards MPW to bed.

But shares continue to fall despite management’s reassurance, presenting a great buying opportunity for investors.

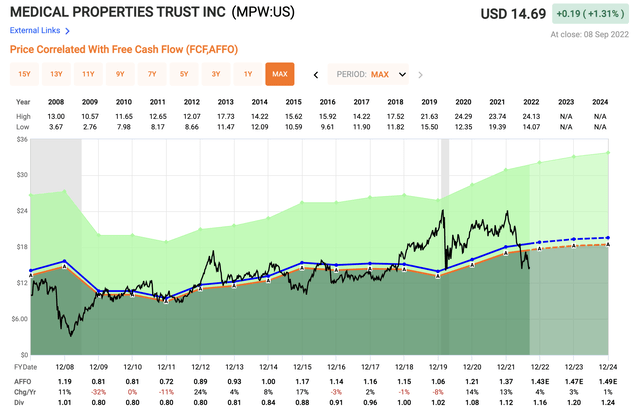

MPW now trades at a P/AFFO of 10.4x. It won’t be long before MPW returns to its Normal P/AFFO (blue line) of about 13.2x. While investors wait, they get to collect a high dividend yield of 7.9%, covered by its AFFO payout ratio of 81%.

STORE Capital (STOR)

STOR is a triple-net lease REIT that acquires, invests, and manages single tenant operational real estate (STORE). Under a triple-net lease, tenants are responsible for ongoing operating, maintenance, insurance, property taxes, and other property-related expenses.

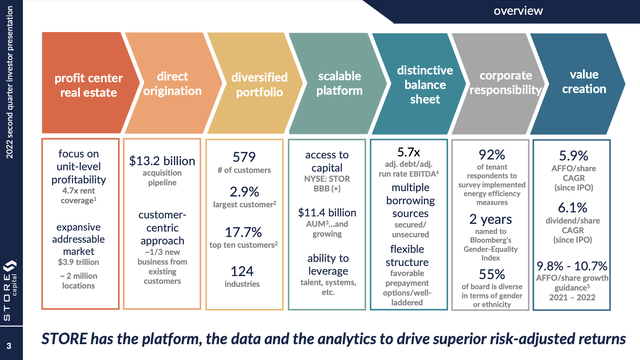

Here’s a snapshot of STOR.

STOR FY2022 Q2 Investor Presentation

The company has 3,012 properties and $11.4 billion of assets under management, with 579 customers spread across 124 industries and 49 states.

The company targets:

- Non-rated, bank-dependent, middle-market businesses, so STOR can acquire these properties at more attractive terms and cap rates.

- Operate in industries that are not readily available online, are internet-resistant, and include a high experiential component.

- Unit-level profitability, which indicates the tenant’s long-term ability to pay rent.

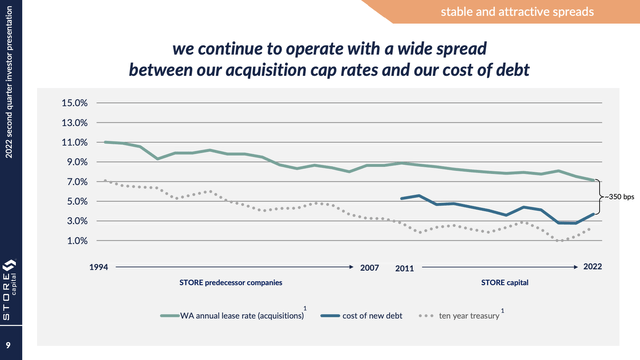

Serving the middle market allows STOR to yield attractive investment spreads, which enables the company to quickly reinvest cash flow.

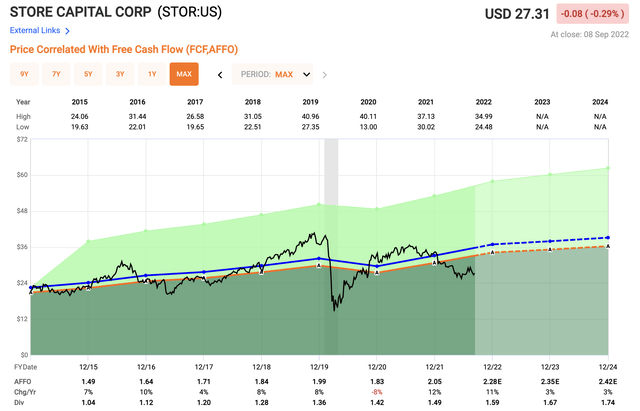

As such, STOR has been able to grow AFFO per share, dividend per share, and Net Income per share at a CAGR of 5.9%, 6.1%, and 8.1% since 2016, respectively.

STOR FY2022 Q2 Investor Presentation

It’s a very simple, yet effective business model.

But in Wall Street’s eyes, serving the middle market proved to be risky, especially in a recessionary environment. STOR’s customer base is not as financially secure compared to Realty Income (O) or W. P. Carey (WPC) — an economic downturn could mean a significant drop in occupancy rates as tenant bankruptcies become imminent.

This is probably why STOR has been an underperformer compared to its net-lease peers.

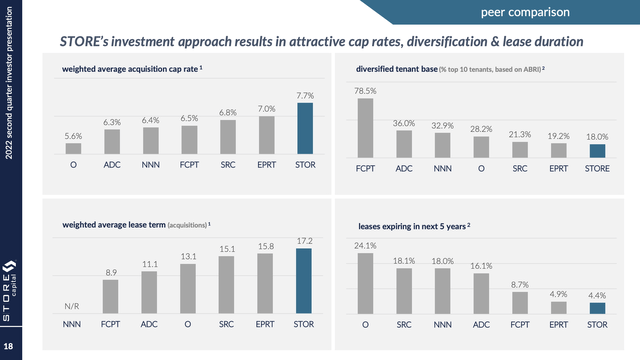

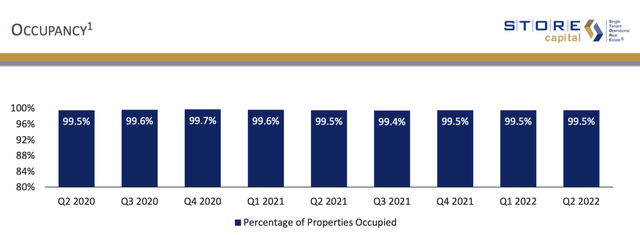

But, as you can see below, STOR has a disciplined investment approach that produces industry-leading acquisition cap rates, tenant diversification, and lease lengths.

STOR FY2022 Q2 Investor Presentation

It has also sustained 99%+ occupancy rates even in the midst of the pandemic. Its contracts with tenants also have built-in rent escalations that should protect the company from inflationary pressures.

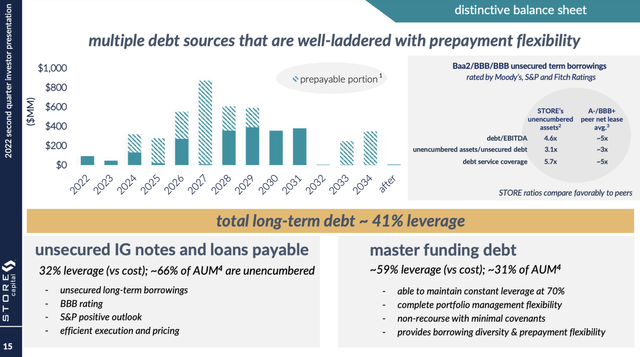

STOR also has a decent balance sheet with a well-laddered debt maturity schedule with Debt to EBITDA of around 4.6x.

STOR FY2022 Q2 Investor Presentation

The company also pays a dividend yield of 5.6%, which is covered by its low AFFO payout ratio of 70%.

STOR currently trades at 12.4x P/AFFO, below its Normal P/AFFO (blue line) of 16.2x, a compelling buy at the moment.

Innovative Industrial Properties (IIPR)

Last on my buy list is a more speculative pick.

IIPR acquires, owns, and manages regulated cannabis facilities. The company currently owns 110 properties across 19 states.

IIPR acquires these properties through sale-leaseback transactions where upon closing of the acquisition, IIPR leases the properties back to the tenant. And similar to STOR, IIPR lease out its properties on a triple-net lease basis where the tenant bears all costs related to the property.

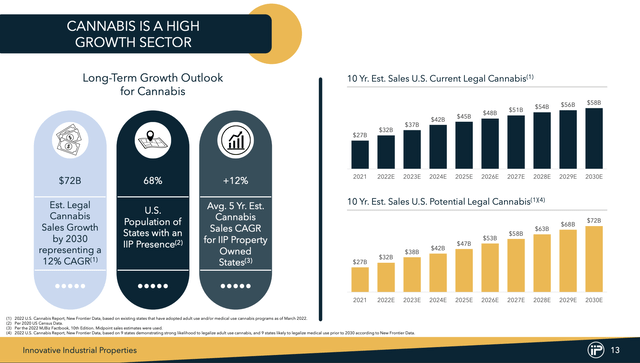

Now, I don’t know much about the cannabis industry but I know that the industry is growing and becoming more widely accepted by the day — the U.S. cannabis industry is expected to grow at a 12% CAGR, reaching $72 billion by 2030. And instead of trying to invest in a particular cannabis company, why not just own a basket of them through a REIT?

IIPR FY2022 Q2 Investor Presentation

One of the few things that drew me to consider buying IIPR is its experienced management team. In particular, this is the same management team that founded BioMed Realty Trust in 2004, a lab and office REIT focused on the life sciences industry. In 2016, the team sold the company to Blackstone Group (BX) for $8 billion.

Management’s proven track record gave me confidence that they have what it takes to bring shareholder value.

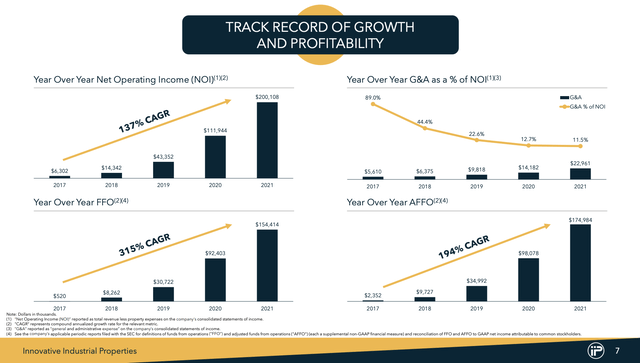

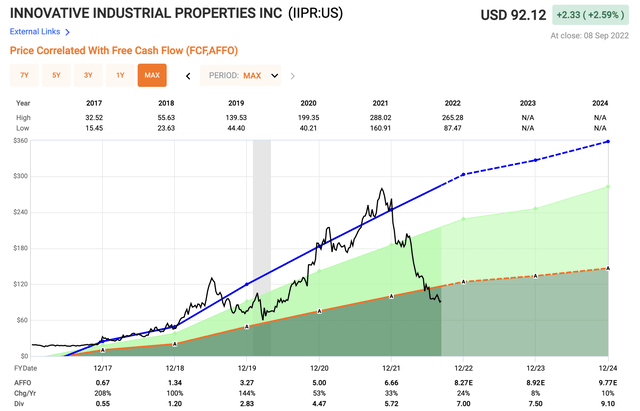

That’s not all — IIPR is in super-growth mode. In the last 5 years, IIPR grew FFO and AFFO at a CAGR of 315% and 194%, respectively. But we all know such growth rates will eventually slow down.

IIPR FY2022 Q2 Investor Presentation

A short seller report also brought some negative sentiment to the stock.

Furthermore, one of its major tenants, King’s Garden, defaulted on its rent obligations, which added more pain to the stock. To make matters worse, some of IIPR’s tenants are unprofitable and their stock prices are declining as well, making it hard for them to raise capital. As such, the risk of more tenant defaults is possible. Its weighted average remaining lease term of ~16 years also doesn’t mean much as some of these companies may not even be around in 5 or 10 years.

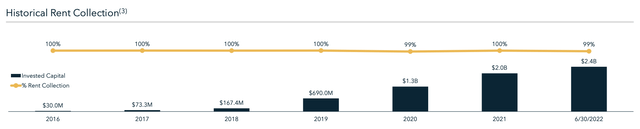

Despite tenant concerns, rent collection was 99% for the first half of 2022, destroying myths of tenants’ inability to pay rent. As a matter of fact, rent collections have been pretty consistent at 99-100% since 2016.

IIPR FY2022 Q2 Investor Presentation

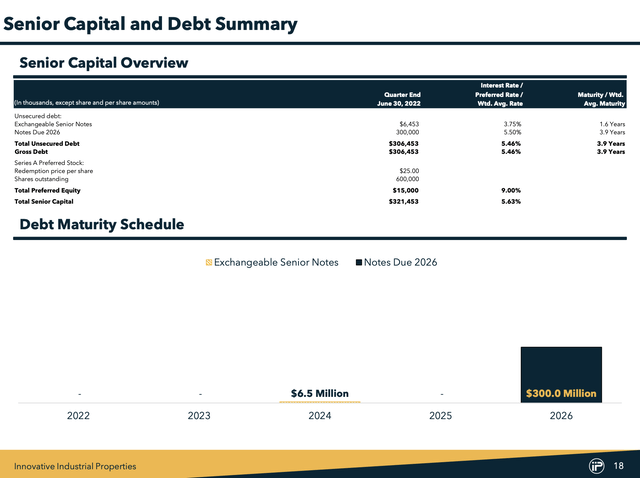

IIPR also has a strong balance sheet with 12% debt to total gross assets and no major debt maturing until 2026.

IIPR also reported strong Q2 results.

- Revenue was $71 million, up 44% YoY.

- FFO per share was $1.97, up 26% YoY.

- AFFO per share was $2.14, up 30% YoY.

Growth may slow down as IIPR grows over a larger base. However, IIPR made investment commitments of $239 million in Q2, the highest quarterly transaction in its history, which should support growth moving forward.

IIPR now trades at a P/AFFO of 11.9x, far below its Normal P/AFFO (blue line) of 36.7x. Although we won’t see multiples returning to 35x+ (due to slowing growth), I see a potential for IIPR to trade at around 20-25x P/AFFO, which is a double from current levels.

While investors wait, they get a high dividend yield of 7.6%. Investors have to be cautious though as IIPR’s AFFO payout ratio is moderately high at 85%.

Conclusion

REITs are getting cheap — but they may be cheap for a reason. Growth is expected to slow down substantially as high interest rates make it more costly for REITs to borrow debt and acquire properties to grow their real estate portfolios. A gloomy economic backdrop also makes REITs an unfavorable investment for many.

But the valuations that we’re seeing today are just too attractive to pass up.

That’s why I’m placing buy limit orders for some of the highest-quality REITs out there.

- SPG — $95.00

- BXP — $75.00

- MPW — $14.50

- STOR — $25.00

- IIPR — $75.00

Real estate is the largest and most durable asset class in the world. They are in much better shape than they were during the GFC.

Don’t let fear, uncertainty, and doubt blind you from this opportunity.

Buy the REIT chaos.

Be the first to comment