piranka

Investment Thesis

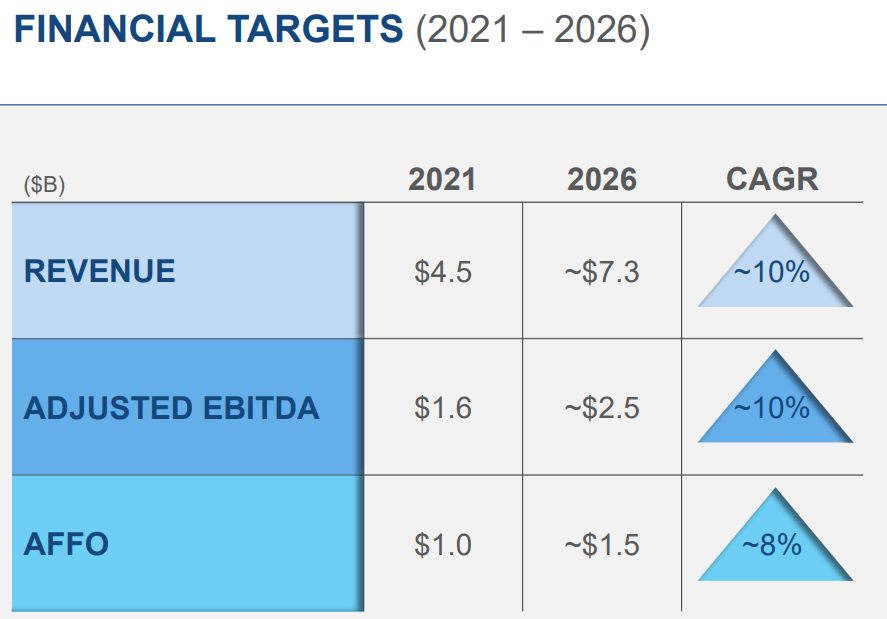

Iron Mountain Incorporated (NYSE:IRM) is a real estate investment trust (“REIT”) based out of Boston, United States. IRM is aiming to grow its revenue at 10% CAGR, and it is expanding its data center capacity to achieve this target. With the data center segment being one of the fastest-growing segments of IRM, I believe the company is on the right track with the decision to expand its data center capacity. I believe IRM’s current growth rate, coupled with a strong 4.7% dividend, makes it a great investment opportunity.

About IRM

IRM is a global storage and service provider operating in more than 50 countries worldwide. The business of IRM can be segregated into two main segments storage and digital services. The company presently has over 85 million sq ft in storage space spread across 1400 storage facilities. The company provides clients with options to store physical as well as digital assets and retrieve them seamlessly through the company’s efficient digital interface and logistics services. The assets include critical business information, historical artifacts, and other valuables.

Along with the storage, the company provides clients with cloud services, digital transformation, data center space, and other digital services to help businesses transform and have a stronger digital presence. Currently, the firm generates 60% of its revenue from the storage segment and 40% from digital services. The company’s client base includes more than 95% of the Fortune 1000 companies and 225,000 consumers worldwide.

Aggressive data center capacity expansion

IRM Investor Relations

IRM has launched Project Matterhorn with the aim of growing its business exponentially over the next four years. As a part of this plan, the company is targeting to grow its revenue and adjusted EBITDA at 10% CAGR and adjusted funds from operations (AFFO) at 8% CAGR. To achieve these targets, the company has been continuously expanding its capacity in the storage and data center space. The company is purchasing new real estate with a view to developing multiple data centers over the next five years. It has also undertaken the acquisition of data centers globally to expand its capacity and global footprint.

Acquisition of XData Properties

IRM has aggressively been pushing to expand its data center capacity, and as a part of this, the company recently acquired XData properties, a data center park in Madrid, Spain. The acquisition is estimated to have cost the company $78 million. XData currently has three operating data centers, and one is under construction. The data center is estimated to add 80-megawatt (MW) capacity to the existing power capacity of IRM over the next five years.

To put that in perspective, let us have a look at the total existing capacity of the company. IRM currently has 665MW of total power capacity with respect to the data center’s operation as well as deconstruction. This acquisition will increase the existing power capacity by around 12%. I believe this will be a major growth booster for the company over the next five years. An additional benefit of this acquisition is the company’s expansion in the European region. The majority of the company’s data centers are located in the North American and Asia Pacific regions. The European region is largely untapped by the company, but this acquisition will help them access the European markets, which have significant growth prospects over the next decade.

The estimates suggest that the EMEA data center market will grow from the existing $11 billion to $19 billion by 2026. I think this acquisition will prove to be instrumental in the company’s growth as it is the fastest-growing segment for the company, with a 20% annual growth rate.

Purchase of land in Arizona

IRM purchased a 10-acre land parcel in Pheonix, Arizona, to develop a data center park with an expected power capacity of 36MW. Phase one of this project is expected to be completed by the end of 2024. This move is yet another step by the company as a part of its data center capacity expansion plan, as we discussed earlier. This project will increase the company’s power capacity by 5%. I believe Phoenix is an optimal location for building data centers, given the efficient digital infrastructure in the area and lower costs compared to other urban locations in the U.S. I believe the data center business will prove to be a game changer in the coming years, with the industries becoming more digitized and the cloud business growing in the double-digits globally.

Additional Catalyst

High dividend yield

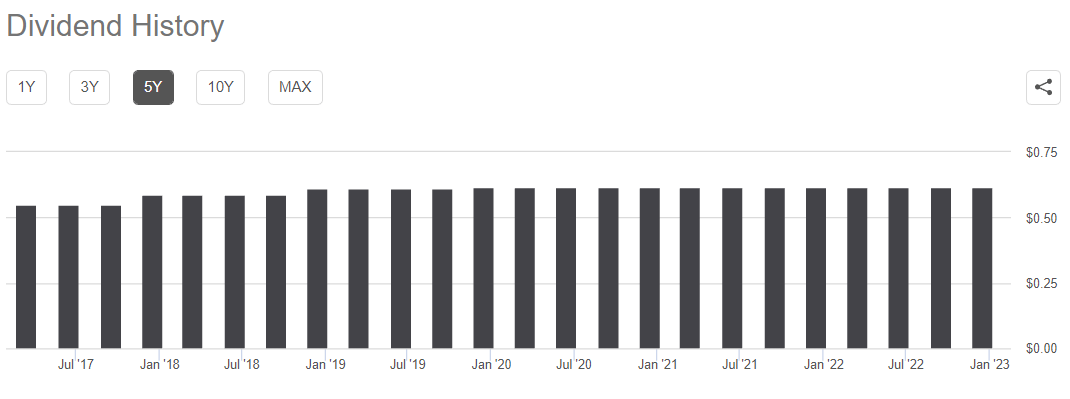

Seeking Alpha

IRM has an annual dividend yield of 4.7% at the current share price of $52. The company has consistently paid dividends for the past five years. The dividend payout has not seen much growth, but the dividend payout has been consistent; even during the Covid-19 pandemic, the company maintained its dividend payout. I believe with the revenue and earnings growth that the company is witnessing, the quarterly dividend payout could increase up to $0.70 by the second half of FY2023.

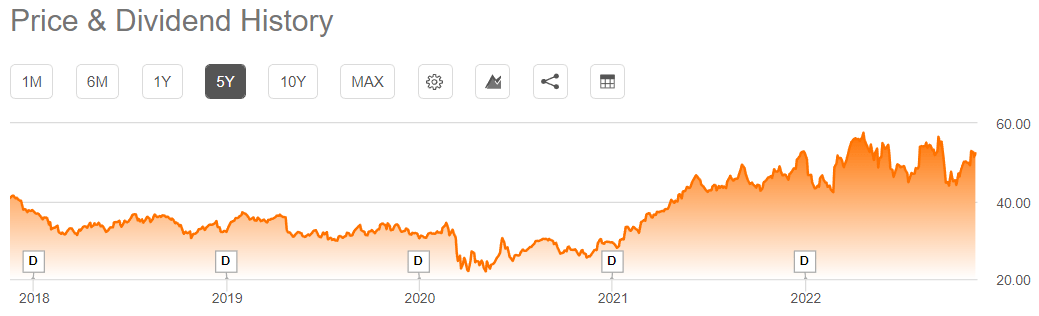

Seeking Alpha

Now, if we look at the stock price in the past five years, we will realize that the stock price has seen a gradual increase over time. Apart from a dip during Covid-19, IRM stock has not witnessed much volatility. The stock price has seen an almost 100% increase since the five-year low of $22, and the stock price has been consolidating in the range of $45-$55 in 2022. I believe the stock is a great investment opportunity with a high dividend yield and a significant upside potential in the share price.

Key Risk Factor

High Debt: As of Sept 30, 2022, IRM had $10.2 billion in long-term debt and just $155 million in cash and cash equivalent. REITs, in general, have high debt obligations as they have a majority of the assets in the form of real estate, which requires huge capital expenditure. However, this is a risk that cannot be ignored, especially in the current market with high-interest rates. In the third quarter of FY22, the company incurred $121.7 million in interest expense, up 17.5% compared to $103.8 million in the year-ago period. This is a significant jump mainly due to continued hikes in interest rates. The increased interest payment puts a great dent in the company’s profit margins. Apart from the interest expenses, the high debt puts pressure on the company’s balance sheet and could limit its borrowing capacity for future growth. The company has managed to keep this risk in check by growing the revenue at a good pace and keeping other costs in control. I believe IRM has managed the risk efficiently so far, but a further increase in the interest rates could have an impact on the company’s performance.

Valuation

IRM is trading at a share price of $52, up 12% in the last one year. The company has a market cap of $15.2 billion. IRM is trading at a forward Price/AFFO of 13.6x with the FY2022 AFFO estimate of $3.82. If we compare this with some of its peers in the industry, like Life Storage, Inc (LSI) with a forward Price/AFFO of 17.9x and CubeSmart (CUBE) with a forward Price/AFFO of 17x, we will realize that the company is slightly undervalued. Some of the major analysts have a median 12-month price forecast of $60 on IRM, representing a 15% upside from current price levels. I believe the stock can witness a 15-20% upside in a 12-month time frame, given its undervaluation and growth prospects.

Conclusion

Iron Mountain is aggressively expanding its data center capacity by acquiring and developing new data centers to maximize the growing data center market globally. With 20% CAGR growth in the data center segment, I believe the company is on the right path, and the expanded capacity will boost significant growth for the company in the long term. IRM has a strong dividend yield of 4.7% with a progressive stock price action over the last few years. The company faces the risk of high debt obligation, but considering the overall risk-reward profile of the company, I assign a buy rating for Iron Mountain Incorporated.

Be the first to comment