JasonDoiy

Cisco (NASDAQ:CSCO) used to be a mainstay of early innovation in the first stages of the Internet as it started to mature in the early 2000s. However, as more Asian competitors set in, Cisco appears to have lost its way. With more focus on security and other specialization coverage, Cisco has become a more conservative growth story for investors. Although it is less exciting than before, it does not mean that Cisco has lost its luster, as it has shown moderate performance recently in a challenging year overall.

Fundamentals Are Dull But Profitable

Ratios

Critical fundamental ratios indicate that Cisco has declined since 2018. 2018 was the most robust year for both the current and quick ratios. These ratio stats show how Asian competitors appear to hurt the potential growth of Cisco in my opinion, with dwindling ratios like this over the long run.

|

Metric |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Period |

FY |

FY |

FY |

FY |

FY |

|

Current ratio |

2.287 |

1.506 |

1.720 |

1.490 |

1.432 |

|

Quick ratio |

2.110 |

1.415 |

1.624 |

1.320 |

1.162 |

Source: Financial Modelling Prep

Growth

With a simple moving average of 50 working days, the profitable return is relatively tiny compared to other market sectors.

Sales growth has shown to be robust as potential enterprise-level corporate clientele continue to buy Cisco hardware. Also, there is an anticipated cutting back on staff to help improve its profit margin.

|

Metric |

2022 |

||||||

|

SMA20 |

0.23% |

||||||

|

SMA50 |

3.48% |

||||||

|

SMA200 |

-6.62% |

||||||

Source: FinViz

Enterprise

The stock price declined for Cisco in 2018, while last year was the second strongest. Since 2018, this company has shown flat growth in its stock price and a substantial market cap decline for this year. Compared to this year, Cisco has underperformed compared to other technology players. As this year shows a dip in momentum, 2023 will be crucial for Cisco to show healthy growth against its competition. In addition, it might be necessary for this company to deliver innovation in new sectors to build momentum for potential stock price performance.

|

Metric |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Symbol |

CSCO |

CSCO |

CSCO |

CSCO |

CSCO |

|

Stock price |

46.590 |

47.100 |

42.180 |

59.130 |

45.710 |

|

Number of shares |

4.837 B |

4.419 B |

4.236 B |

4.222 B |

4.170 B |

|

Market capitalization |

225.356 B |

208.135 B |

178.674 B |

249.647 B |

190.611 B |

Source: Financial Modelling Prep

Estimate

Cisco has always been a conservative company after the Internet bust in the early 2000s. However, Cisco can no longer ride out the gangbuster days of the early Internet. With more Asian-based competitors, Cisco seems to operate in a more general lower margin commodity-based security services industry. The future estimates for Cisco over the next three years look relatively conservative, with a 10% to 20% growth rating. As Cisco becomes more conservative in its calculations, one would think that it would start focusing on its dividend growth. The profit level is a little higher, but not worth investing in long-term in my view.

|

YEARLY ESTIMATES |

2022 |

2023 |

2024 |

2025 |

|

Revenue |

51,184 |

54,144 |

56,289 |

57,867 |

|

Dividend |

1.50 |

1.54 |

1.59 |

1.64 |

|

Dividend Yield (in %) |

3.35 % |

3.45 % |

3.55 % |

3.66 % |

|

EPS |

3.35 |

3.52 |

3.80 |

3.95 |

|

P/E Ratio |

13.35 |

12.69 |

11.78 |

11.32 |

|

EBIT |

17,268 |

17,921 |

19,150 |

19,608 |

|

EBITDA |

19,489 |

19,398 |

20,483 |

20,360 |

|

Net Profit |

14,053 |

14,568 |

15,644 |

16,210 |

|

Net Profit Adjusted |

14,053 |

14,568 |

15,644 |

16,210 |

Source: BusinessInsider

Technical Analysis Show Recovery Could Take a Little While

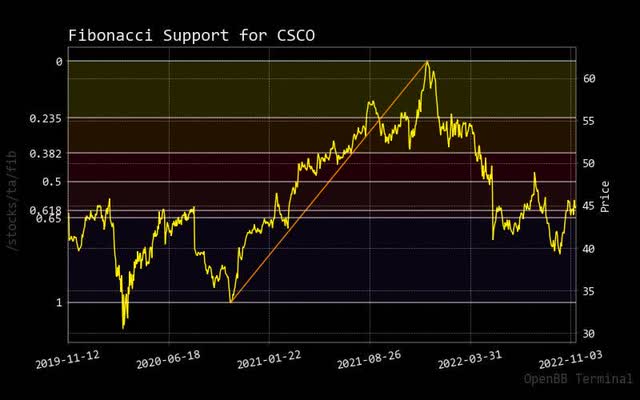

Fibonacci

If one was to follow the traditional methodology of placing market entries when stock price crosses above a trend line, many would wait for a very long time for this to happen with the Cisco stock. The drop is not as severe over the last year, but the pace of recovery from its 2021 historical peak may take a long time.

fibonacci cisco (custom plstform)

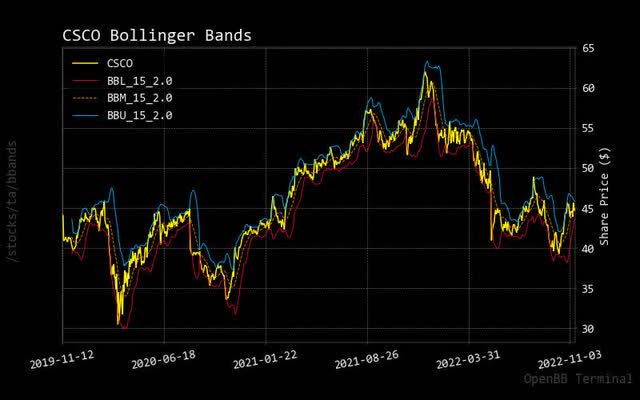

Bollinger Bonds

One positive sign for Cisco is its stock price pushing up toward the upper Bollinger band. But, as said earlier, you might be waiting reasonably long to see its stock price rise excessively.

bollinger cisco (custom platform)

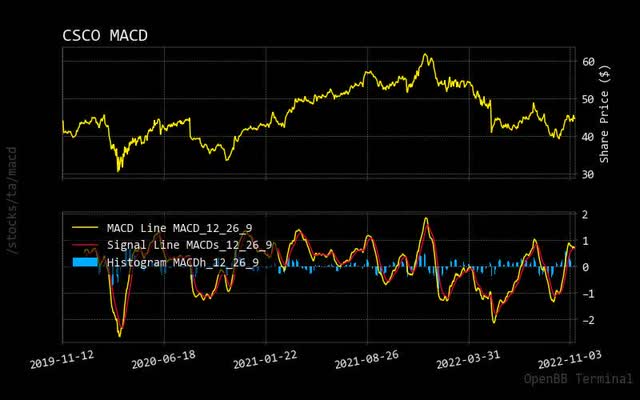

MACD

Even though Cisco’s stock price has not fallen as severely as other big technology companies, the stock price has already broken through the zero line of the MACD signal line. Based on comparative events like this, one can see that the stock price has a high probability of pulling back to its statistical reverting mean.

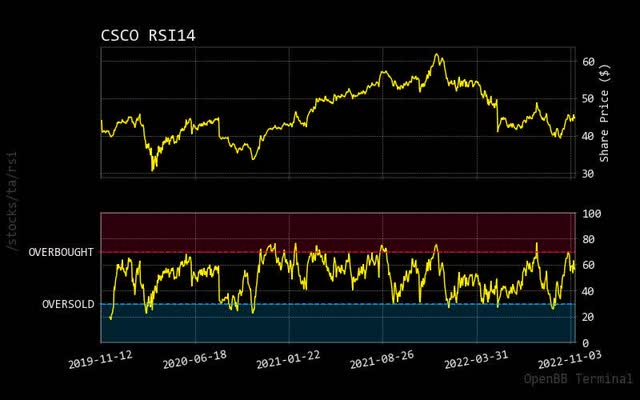

RSI

Like the MACD, the stock price of Cisco has approached the overbought RSI condition, which means there is a higher probability of a pullback. However, one can also take away that this stock should remain reasonably flat but stable over the coming months.

With the current price range between $40 to $60, while the RSI is already pushing towards a market overbought condition, it should be worrying that the stock is so weak in terms of valuation based on the RSI. Cisco needs fresh momentum in its story to build a new narrative for excitement to hold this stock. This indicated new impetus is needed in the stock price to change the history of Cisco’s product position strategy. Some suggestions for Cisco would be taking over an exciting small company within a new sector or introducing new product lines.

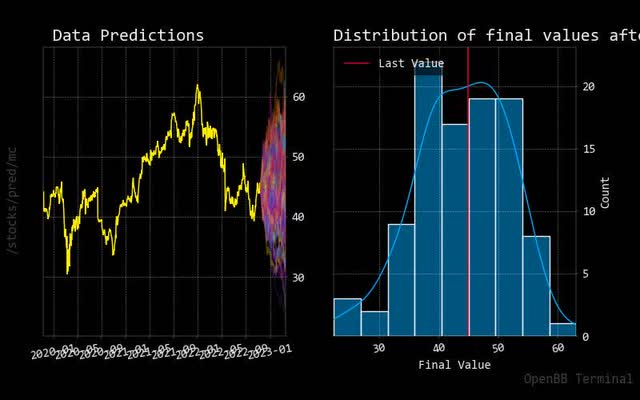

Prediction via Artificial Intelligence

Monte Carlo

As the predictive paths from the Monte Carlo simulation show, there is an even split of probability for market direction, either upward or downward. The same could be said in the normalized distribution chart as well. As there’s no decisiveness shown in the Cisco stock price, one can take away to focus on other stocks or sectors that perform better.

monte carlo cisco (custom platform)

Regression

As hinted by this red regression line forecasted over 30 days, it confirms the theory of how the Cisco stock price will rise moderately and then pull back. Usually, one can see a fast-moving upswing in stock price, but Cisco continues to show moderate underperforming and unexciting stock price moves.

regression cisco (custom platform)

Just Confusing

As shown throughout this report, various indicators show contradicting stock price signals. As a result, this builds into a conclusion that Cisco will underperform with some steadiness to show a continued small profit over the long run.

Recommendation

Selling Cisco might not be needed as market analysts are showing some growth in its stock price, which cannot be said for many companies being analyzed. However, it is safe to say that there are better stocks better higher growth stories.

|

Interval |

RECOMMENDATION |

BUY |

SELL |

NEUTRAL |

|

One month |

SELL |

2 |

15 |

9 |

|

One week |

SELL |

2 |

16 |

8 |

|

One day |

SELL |

1 |

15 |

10 |

Source: Trading View

Price Target

Market analysts have excessively set relatively high targets for Cisco to meet. If this is true, fewer market analysts will track Cisco, which should not affect stock price performance.

cisco target (custom platform)

Source: BusinessInsider

Price vs. Short Volume

One favorable situation for Cisco currently is the number of short expectations. As one can see in the lower panel, the short trading has now dropped below 50. Another reason is that investors might be deploying capital to other exciting companies in the tech sector for much higher returns.

short cisco (custom platform )

Source: StockGrid

Insider Activity

Based on insider activity, one investor might be confused by the insider buying signals of executives accumulating Cisco stock. However, more is needed to indicate that Cisco’s stock price will increase. As any investor knows, fundamentals and technical analysis should prioritize higher than just relying on insider activity to sense the market direction of any particular stock.

|

Date |

Shares Traded |

Shares Held |

Price |

Type |

Option |

Insider |

Trade |

|

2022-10-10 |

107,378.00 |

213,028.00 |

nan |

Buy |

No |

Murphy Sarah Rae |

107378.0 |

|

2022-10-10 |

25,186.00 |

63,344.00 |

nan |

Buy |

No |

Murphy Sarah Rae |

25186.0 |

|

2022-10-10 |

126,327.00 |

292,697.00 |

nan |

Buy |

No |

Robbins Charles |

126327.0 |

|

2022-10-10 |

164,225.00 |

437,532.00 |

nan |

Buy |

No |

Murphy Sarah Rae |

164225.0 |

|

2022-10-10 |

176,857.00 |

398,781.22 |

nan |

Buy |

No |

Sharritts Jeffery S. |

176857.0 |

|

2022-10-10 |

262,759.00 |

894,078.00 |

nan |

Buy |

No |

Martinez Maria |

262759.0 |

Source: BusinessInsider

Conclusion

With its stock price, Cisco looks like a safe bet to get a decent return over the long run. Technical analysis indicates that the timing will be far off for any potential entries to occur once the stock price recovery is entirely underway. This does not mean Cisco should be a hold but a buy instead due to its conservative future growth.

Be the first to comment