Editor’s note: Seeking Alpha is proud to welcome Boring Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

jetcityimage

Investment Overview and Opportunity

Five Below (NASDAQ:FIVE) represents a compelling opportunity to invest in a leading national specialty value retailer in the U.S. with access to multiple levers to drive sustainable growth over the next ~5+ years. This is underpinned by an aggressive store rollout strategy, positive SSSG from a shift in store format (Beyond Five), and the expected continuation of attractive store economics. While the market seems to be pricing in some doubt over management’s ability to fully execute on the planned rollout (~3x today’s store network by 2030), management has so far adopted a conservative outlook on operational leverage, where there potentially remains substantial incremental upside even if only ~50%-60% of the target rollout plan is achieved.

Following weaker-than-expected Q1 results released in early June 2022, which the market partially attributes towards a cut in consumer discretionary spending, the stock has since seen a slight rebound. That’s following the release of Q2 results, as the market is increasingly recognizing FIVE’s attractive value proposition as customers wallet shrinks and trade down. I believe there remains at least ~+20-30% upside, with incremental value from margin expansion yet to be baked in.

Unique Specialty Value Retailer in the U.S. With ~1.2k Stores

FIVE is uniquely positioned as the only specialty value retailer in the U.S. providing consumers (primarily teens and pre-teens) with an assortment of on-trend products across a broad range of categories – e.g., tech, leisure, home products – at scale through its ~1.2k stores nationwide. With the increasingly weak macro environment as interest rates rise and recessionary fears amplify, other discount retailers have become more optimistic on their outlook as consumers have started to show signs of trading down to more value alternatives. In some instances, this has also led to upward revision of guidance provided to the market – e.g., see the recent news regarding Dollar General (DG).

Characteristics: A Likely Net Beneficiary During Recessionary Periods

Similarly, FIVE’s management believes the business to be a net beneficiary during recessionary periods as well. While some reduction in consumer spending should be expected due to the discretionary nature of FIVE’s products, this needs to be considered against the shift in purchasing patterns toward items that offer consumers more bang for their buck. Looking back at the business’ performance during the years following the 2008 crisis, FIVE’s revenue grew at ~49% CAGR and store count expanded by ~73% from 2008 to 2010.

While it’s unlikely that similar levels of incremental fiscal stimulus will be introduced into the economy via consumers, comfort can be gained from the resiliency of the business during downturns given their positioning in the overall retail market.

Historical Growth: Largely Organic Driven by Operating CFs

Starting with a single store in Pennsylvania in 2002, the business model has largely remained the same over the past two decades – one that is focused on providing an enjoyable and affordable shopping experience to its target customer, by offering a broad assortment of on-trend products that changes frequently to encourage regular repeat visits. Supported by a cost-efficient merchandising strategy and a proven model with attractive store economics, the business has historically enjoyed stable EBITDA margins at ~12-14%. As a result, the rapid store network expansion since then has largely been funded by operating cash generated by the business and there has been limited reliance on external funding.

Since the 2012 IPO, management has prioritized the optimization of store layouts to maximize value. This has resulted in an evolving store format over time (Vintage to Fresh to Beyond), contributing toward improving run-rate average unit sales and four-wall EBITDA margins. That has demonstrated the strength of the management team and their ability to generate sustainable returns in the long term.

While FIVE Below stores still account for ~70% of the overall store portfolio and typically sells products for below $5, it’s worth noting that they had previously broken the $5 barrier and were selling products for as high as $25, which represent higher value items typically still at a discount to alternatives on the market. Compared to traditional dollar discount businesses, the $5 “ceiling” provides greater pricing flexibility for the FIVE Below business. As such, the business was historically comparatively better positioned to pass on cost price increases through to consumers, which is crucial in the current inflationary environment.

Argument for Unsustainability of the Business Model: Execution Has Proven Otherwise, Argument Also Extends to Competitors

Consumer trends/fads are a meaningful contributor to FIVE’s business – e.g., fidget spinners alone contributed ~500bps SSSG lift in mid-2017. On the surface, it’s unclear if the process of identifying and exploiting the latest product trends can truly be consistently repeated and a successful moat can be built, since management themselves have in the past admitted that trend advantages tend to be limited to a few quarters before products become widely distributed. However, the business has been able to ~10x revenue over the past decade since their 2012 IPO.

Smaller players looking to compete in the space would not have the scale and resources needed to adequately diversify across a broad enough product basis and to be abreast of the latest consumer trends. Replicating an internal system able to consistently and accurately identify the latest trends is also challenging. That might have contributed to discouraging potential competitors from entering the market at scale.

Effective Cost Controls in Place

On the cost side of the business, while components have not been made publicly available, the largest cost items are likely to consist of merchandising expenses, freight rates and store rental and staff costs. Given the scale that FIVE operates with, the business maintains a diversified supplier base where products are sourced from across 1k+ vendors and none of them represent more than 5% of purchases.

While global supply chains continue to be impacted due to the ongoing COVID-19 pandemic and the Ukraine/Russia war, FIVE has the flexibility to navigate these global constraints by shifting purchases between different suppliers. In 2021, FIVE also proactively secured multi-year ocean container contracts that cover ~90% of the business’ product demand for 2022 to 2023, ensuring margin impact from higher freight rates are minimized.

Investment Thesis (Bull Case)

Management has access to multiple levers to execute on a credible growth strategy underpinned by future new store openings. With respect to store rollout, management projects ~3x the store network by 2030 with limited cannibalization impact (the base case assumes ~2x).

Central to this investment thesis is the store rollout roadmap presented by management during their March 2022 Investor Day, representing ~70% of top-line growth over the forecast period. After growing the network by ~670 units over the past five years to ~1.2k today, management is guiding toward an incremental ~1k stores by 2025 and a tripling of stores by 2030 to reach ~3.5k. This is expected to largely encompass a “densification” strategy where an overwhelming majority of new outlets are expected to be rolled out in existing markets – e.g., management expects to double stores in Philadelphia from 60 to 120.

While management points toward prior successes in fully delivering on their roadmap presented in 2016 (to double stores to ~1k by 2020), the plan does seem slightly aggressive especially in contrast to the relatively weak retail market overall and considering existing state-by-state store per capita metrics (the state with highest store count to population reached c.6.5 stores/m; applying this to all states where FIVE has an existing presence in implies ~2.5k stores). Adopting a conservative approach, the base case assumes FIVE can successfully execute until 2023 before a ~50% discount is taken to projected store additions to reflect potential challenges in densifying existing network as planned, reaching ~2.5k stores by 2030.

SSSG: 3%-5% Guidance for Conversion to FIVE Beyond Format (2023-25)

The accelerated phase of store format conversion to FIVE Beyond since 2020 has seen overwhelmingly positive consumer response so far as new SKUs are introduced and consumers continue to find value in FIVE’s products vs other retailers – in line with FIVE’s overall value proposition. Management has historically demonstrated an ability to consistently upgrade formats to meet consumer needs (e.g., Classic to Vintage to Fresh) and delivering on SSSG as a result. Additional comfort can also be gained from the ~100bps that management has already baked into this guidance to account for potential sales cannibalization of existing stores.

Store Economics: Highly Attractive Payback Period at <1 Year

Assuming a six-month ramp-up period, the costs associated with a new store opening estimated by management at ~$400k is highly attractive compared to a run-rate annualized four-wall EBITDA of $500k+. Combined with an aggressive store rollout roadmap where the real estate team has historically had a very strong record in securing attractive leasing terms, FIVE is projected to generate highly attractive returns over the forecast period.

Forward Guidance, Current Stock Price Unlikely to Reflect Full Impact of Incremental Value Drivers

Capturing Attractive Rental Opportunities Due to COVID-19

Since FIVE’s stores are typically found in high traffic locations – e.g., malls and shopping centers, cheaper rental opportunities in new markets and access to more attractive locations following the impacts of COVID-19 help provide a pathway for FIVE to roll out stores in new areas that would otherwise not have been considered viable by management. For instance, FIVE expects majority of urban location openings in 2022 to be in New York City, where rents were considered too high pre-pandemic.

While rental expenses will likely see upward revisions over time as the pandemic continues to ease, this window allows FIVE to penetrate new catchment areas, increase brand awareness, and grow market share at a subsidized rate in the near term. This could potentially facilitate viable economic models in the longer term, in areas FIVE would otherwise not have expanded their footprint into altogether.

5-Node Distribution Center Network Near Completion

Following the opening of the Indiana distribution center (DC) in 2022, FIVE will be able to service ~90% of stores within a day and does not expect to open more DCs “for a few years.” This follows a relatively aggressive expansionary phase where FIVE only had one DC in 2012. Management has also confirmed that post completion the network will have the flexibility to sufficiently support a ~2.5k store network. This has been a key initiative for management over the past decade and now frees up resources for FIVE to focus on the store rollout strategy executing that may have previously been slowed due to the constraints of their distribution network.

Operational Leverage: Management Has Maintained a Conservative Stance

Despite expectations of sales doubling by 2025, management has guided toward ~14% operating margin, which only represents a ~100-200bps premium to pre-COVID margins (where sales were ~2.5x lower). Given the rollout strategy will prioritise store densification, the marginal cost of delivering to a new store would arguably be cheaper (vs. to a new market altogether). This is amplified since FIVE generally ships from distribution centers to stores ~2-4 times a week.

FIVE should also see incremental economies of scale benefits – e.g., in terms of bulk purchasing discounts or securing more attractive rental leases from national shopping mall lessors, etc. When considering this in contrast to the above points, it appears management might be underbaking operating margins in the most recent guidance provided to create additional buffer. For reference, an incremental 1% improvement in operating margin across the forecast period translates to ~$10-$15 in value per share.

Additional Considerations

Separate to the points above, there appears to be additional contributors to growth that management has not reflected in the guidance moving forward. Various cost saving initiatives – e.g., assisted in-store checkout systems – are expected to be chain-wide by 2025 (~60% today), which will provide incremental support to margins by reducing the need for cashiers. The potential introduction of a loyalty program in 2023 will also help to generate additional customer value, and there remains incremental upside from the potential removal of China import tariffs.

Price Target

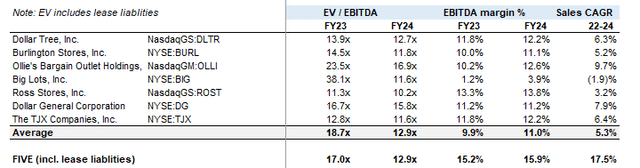

The target price is based on a base case incorporating the above points, while operating margin remains conservatively at <14% in the long term. When benchmarked against select discount retail peers, on a forward FY24 basis FIVE trades in line with peer average EV/EBITDA at ~13x, but is expected to see faster sales growth over FY22-24 (~18% vs. ~5%) and has superior EBITDA margins in FY24 (~16% vs. ~11%). On an EV/EBITDA basis, FIVE is also trading close to a ~2-year low, which suggests the potentially substantial undervaluation of the stock both on a fundamental and comparable basis.

Capital IQ

Investment Risks (Bear Case)

The bear case accounts for a potential recessionary period and a slower rollout strategy, although the impact on FIVE is expected to be relatively muted/unlikely to occur. Some of the key risks for the business include the potential impact a recessionary environment might have on the continued rollout of a store concept centered on higher price points and the viability of management’s store expansion strategy.

Both factors will also likely slow down the conversion of FIVE Below stores to FIVE Beyond. A hypothetical bear case could assume management is only able to execute on ~50% of expected store rollout (reaching ~2.3k by 2030), and expected SSSG targets associated with Beyond format do not materialize as consumers focus on the core $5 and below range of products. While representing an unlikely scenario, the resulting operational deleverage from all of these factors would suggest additional downside to current stock prices of ~20%.

However, it is my view that while consumers may cut back on discretionary spending overall, the impact on FIVE is likely to be comparatively muted given FIVE is expected to offer new SKUs that continue to provide customers with high value for their money vs. competitors. Additionally, the extent parents are willing to cut back on spending for their children (e.g., gifts) is likely to be less, and purchasing power for teens is likely to also remain relatively unchanged as they continue to receive allowances from their parents.

Given management has been envisaging ~2k+ stores since the time of the 2012 IPO, I think it is unlikely that, with significantly more scale and brand awareness a decade later, management does not envisage substantially more stores. Thus, I believe there is a ~50%-60% probability of the base case being achieved, with ~10%-20% probability the downside scenario is realized and the remaining ~20%-30% upside from management’s ability to execute fully on the planned rollout.

Potential Catalysts

While Q1 2022 results released were weaker than expected, this was also partially because of the difficult comps last year which was inflated by significant government stimulus. While management has so far guided to 2%-5% negative SSSG for the rest of 2022, they have attributed the weak outlook as providing a margin of safety for them due to the volatility and uncertainty that they see moving forward. While I expect Q4 2022 results release to remain the key catalyst as demand is expected to remain resilient during the festive period, better-than-expected results releases over the next two quarters could also potentially help reverse this guidance.

Conclusion

In conclusion, it is my view that FIVE represents a compelling opportunity to invest in a leading national specialty value retailer in the U.S. with access to multiple levers to drive sustainable growth over the next ~5+ years. The business is well positioned to ride through a recessionary period (should it materialize), perceived risks are overblown, and there are potential near-term catalysts that the market currently does not seem to be recognizing.

Be the first to comment