Onfokus/iStock Unreleased via Getty Images

iRobot (NASDAQ:IRBT) is one of those companies that through no fault of their own find themselves in complicated situations. It started with the tariffs on products manufactured in China, now it is the semiconductor chip shortage, rising materials costs, and increased oceanic and air transport costs. In fact, supply constraints impacted the company’s ability to hold share in all key regions. Therefore, FY21 revenue was significantly impacted by the semiconductor chip constraints, while higher supply chain and tariff costs further diminished FY21 profitability. To further complicate things the global robotic floor-care growth is estimated to cool down to ~7%, after having been growing in the 20-30%s.

Despite all of these we believe shares can be bought at current prices, since it seems these issues are already reflected in the share price and more, and the company anticipates that ongoing Initiatives will improve access to semiconductor chips and support increased 2H22 volumes. What we’ll show is that, as the company expects, iRobot can return to its historical average performance, in which case shares are incredibly cheap.

Financials

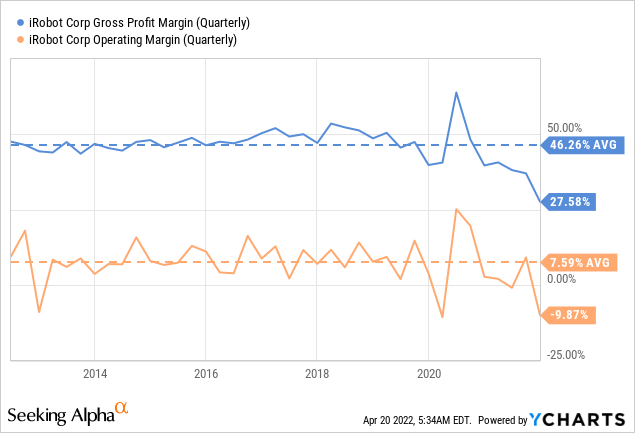

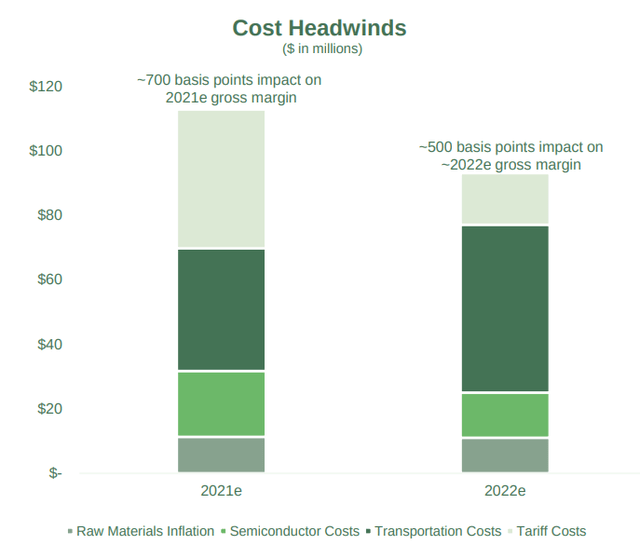

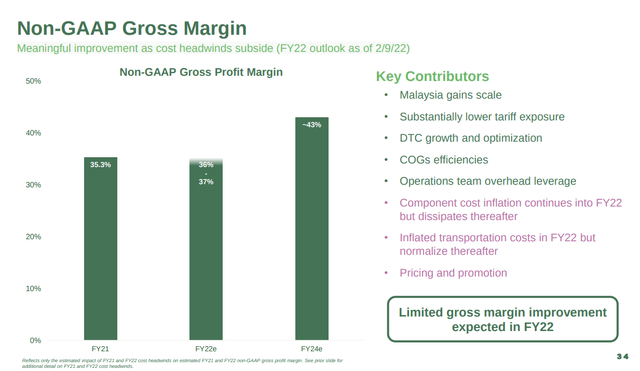

Before the company was hit with all the issues mentioned above, it used to have very stable gross profit margins and operating margins. Gross profit margin averaged ~46%, and operating margin a respectable ~7.5%. However, due to all the issues the company is currently facing, as well as increased competition, gross profit margins have dipped.

The good news is that FY21 is expected to have been the trough level, with improvements starting in FY22. The one category that is expected to increase is transportation costs, but the rest of the headwinds should moderate including tariff costs.

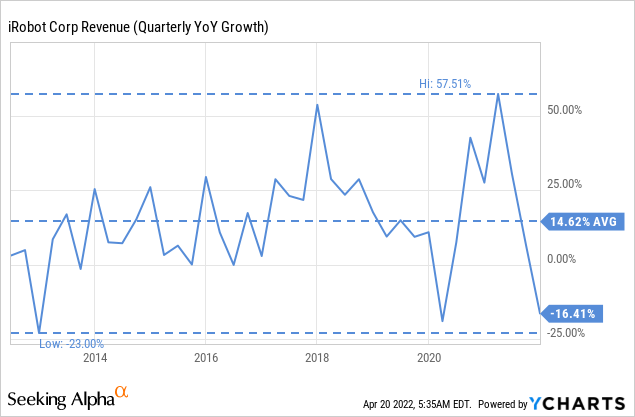

Revenue growth for the company had been averaging ~14% for many years, turning negative last year due to supply constraints that impacted the company’s ability to hold share in all key regions. We believe that as these issues get resolved the company can return to growth mode, and this is what the company is guiding too.

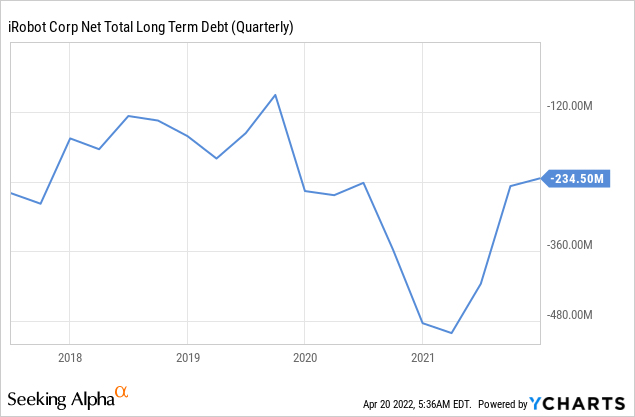

Fortunately, iRobot has a very strong balance sheet with net cash that can support it until better times come along, and to finance the implementation of necessary changes to reposition the company for growth and profitability.

Growth drivers

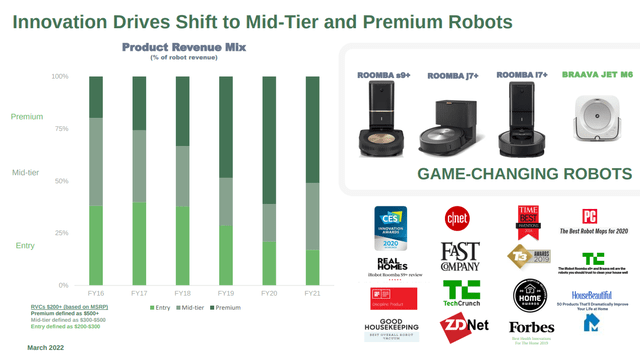

One of the reasons iRobot had been able to continue growing despite increased competition is that they have been very innovation-focused, and are increasingly targeting the premium segment of the market. In FY21 nearly half of its revenue came from the premium segment where most of the innovations are being introduced. This shows that iRobot’s differentiation strategy based on superior software intelligence, high-performance, and beautifully designed hardware is bearing fruit.

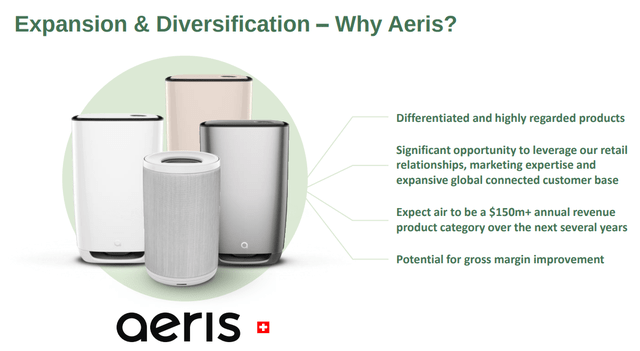

iRobot is also growing through strategic M&A, as it recently did with the 2021 acquisition of Aeris Cleantec AG, adding premium air purifiers to its product lineup. We think these complementary products are a good strategy, since they can leverage iRobot’s innovations in software and good relationships with resellers.

The company anticipates that these efforts, together with a better microchip shortage situation, will result in accelerating top-line growth in 2H22 that continues into 2023 and 2024. Also while retail will still generate the majority of revenue direct to consumer (DTC) is anticipated to grow and become >25% of the total revenue.

Competition

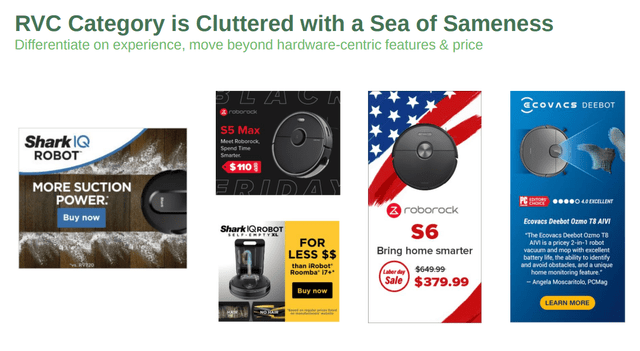

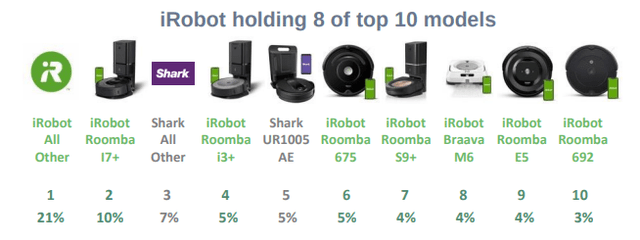

There has been a lot of competition for iRobot, and the company admits the robotic vacuum cleaner (RVC) category is cluttered with products that are not very differentiated and compete mostly on price. Below is a slide with an example of some of the main iRobot competitors and their advertising.

Thanks to its superior innovation, strong brand, and good relationships with retailers iRobot has been able to hold 8 of the top 10 models in North America, 6 of the top 10 models in EMEA, and 8 of the top 10 in Japan.

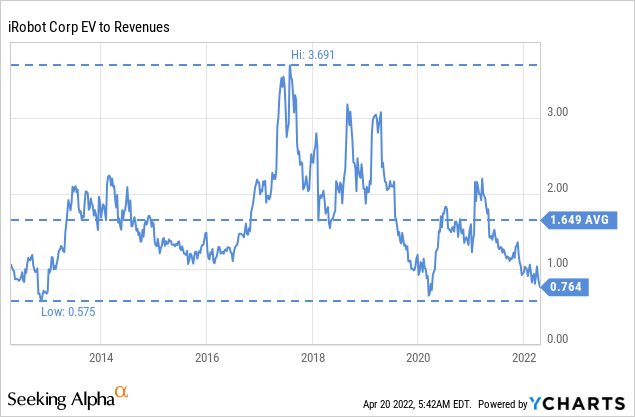

Valuation

Due to the headwinds that iRobot is experiencing it is trading at a very cheap valuation. Its current EV/Revenues ratio is less than half its historical average, and it is almost as low as it was during the stock market crash at the start of the COVID pandemic.

Still, the company is guiding for gross margins to have mostly recovered by FY24, which should set up the company for solid profitability. There are several key contributors to regaining profit margin, including the Malaysian factory ramp-up than should result in significantly lower tariff exposure. Below we show a list of gross profit tailwinds and headwinds for the coming years.

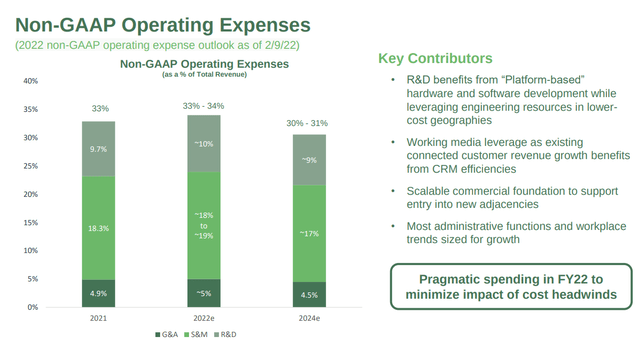

The company is also making efforts to constraint its operating expenses to minimize the impact of the cost headwinds.

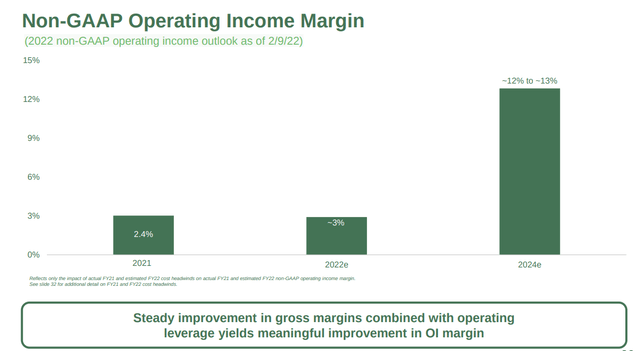

This should result in the operating income margin recovering to ~12% by FY24, which would drastically improve the company’s profitability. With these improvements, the company expects 2024 Non-GAAP diluted EPS to be in the range of $7.50 to $9.25. This would place the company at current prices at a FY24E P/E of ~6-7x, which needless to say is incredibly cheap for a category innovator with a strong balance sheet and perspective of continued growth.

Long term, the company is guiding to a return of 16-18% CAGR revenue growth, gross profit margin of ~43%, operating profit margin in the ~12-13% range, and substantial acceleration in EPS growth starting in 2024.

Conclusion

iRobot is facing a multitude of headwinds, from increased competition to supply chain disruptions, but many of these headwinds are expected to abate in the next two years. After this, the company is well-positioned to accelerate revenue and EPS growth over the long term. As we’ve seen, the share price is already reflecting a lot of the issues, but should the company overcome them, as it expects, in the next two years, shares have a lot of room to run higher.

Be the first to comment