undefined/iStock via Getty Images Regenxbio

In the short run, the market is a voting machine but in the long run, it is a weighing machine. – Benjamin Graham (One of Warren Buffett’s two mentors)

In biotech investing, there are times when you wait for several years but your stock has not appreciated much. Despite great potential, nothing seems to move the needle. Now, don’t give up on such a growth company. That is, if and only if, it’s brewing something far more powerful than what the market can comprehend. Let’s say if your stock is REGENXBIO Inc. (NASDAQ:RGNX), you should continue to be patient. After all, there is something substantial baking in the pipeline.

As a powerhouse innovator of gene-therapy, Regenxbio has the best gene delivery system. Nevertheless, the shares have not delivered much gain in the past few years. Due to various ongoing developments, you can expect this year to bring much better luck. In this research, I’ll feature a fundamental analysis of Regenxbio and share with you my expectation on this growth equity.

About The Company

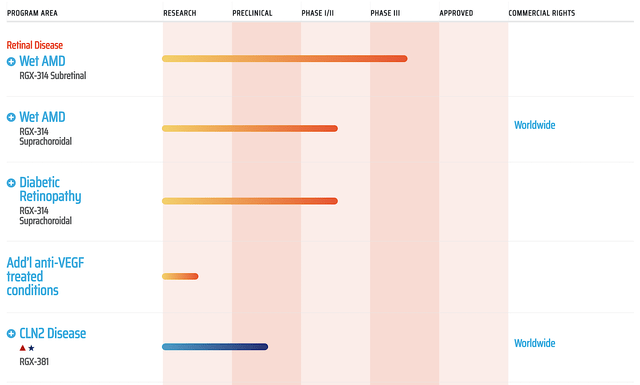

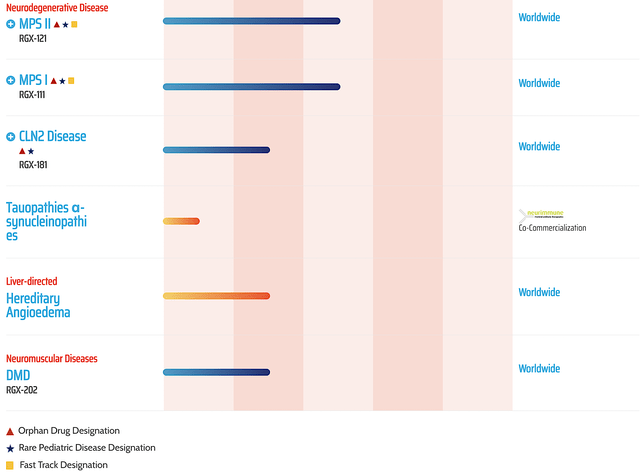

As usual, I’ll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Operating out of Rockville, Maryland, Regenxbio is laser-beam focused on the innovation and commercialization of gene therapy. By unlocking the power of genes, Regenxbio is poised to fill the unmet needs in retinal, metabolic, and neurodegenerative diseases. I noted in the prior research,

Catalyzing growth for Regenxbio is the gene delivery platform dubbed NAV. Of note, NAV uses highly advanced adeno-associated viral (AAV) vectors which confers improved therapeutic success. Specifically, NAV overcame all the setbacks like low efficacy and toxicity that hindered earlier generation AAVs. In fact, NAV works quite well that Regenxbio is able to license this technology to 20 different companies. One notable licensee, AveXis got acquired by Novartis (NVS) for $8.7B. Better yet, its drug Zolgensma is already approved and being commercialized for spinal muscular atrophy.

AbbVie Partnership For RGX314

Back in September last year, Regenxbio entered into a partnership with AbbVie (ABBV) for the development of RGX314 for wet AMD. As you know, this is a big deal for both companies. For AbbVie, the company is now positioned to capture a significant percentage of the $16.3B wet AMD market. Simply put, RGX314 has the capability to replace the mega-blockbuster (i.e., the Queen of wet AMD) Eylea.

As for Regenxbio, the company enjoyed the $370M in an upfront cash payment. You can view cash as the blood of a young company like Regenxbio. In other words, cash is life and king. And, the cash upfront payment was indeed sizable. Additionally, the deal term was quite favorable because Regenxbio is positioned to gain $1.38B for this deal. Moreover, the company will get a 50% royalty in the USA and tiered royalty for rest of the world. With this deal closed back in November, Regenxbio now has ample cash as well as renewed market confidence. To strengthen its fundamentals, the company simply has to deliver on its promises to foster this partnership.

Zolgensma

Shifting gears, let us assess other aspects of Regenxbio’s fundamentals. As you recall, Regenxbio out-licensed the use of its NAV technology to AveXis (AVXS), which innovated a gene therapy (Zolgensma) to treat spinal muscular atrophy (i.e., SMA). In the $8.4B deal, Novartis (NVS) acquired AveXis for Zolgensma. After the acquisition, Novartis secured approval for Zolgensma. As of Regenxbio latest quarterly filing, Zolgensma procured $342M for 4Q2021 (i.e., a 35% growth) and $1.35B for Fiscal2021.

You might think that with only over 1.8K patients dosed, Zolgensma would be far-fetched from procuring blockbuster status. Being an orphan drug (i.e., for a rare disease), Zolgensma is reimbursed at a premium to foster innovation. After all, there used to be a lack of innovation in the orphan niche. Without adequate compensation, no companies would spend nearly $1B in a near-decade-long process to develop a medicine only to see it flops in the market.

Of the $1.35B in Zolgensma revenues, Regenxbio received only $7.1M in royalty for the quarter. Keep in mind that, Regenxbio already earned the $80.0M in milestone payment back in 3Q2020 (when Zolgensma hit the cumulative $1B in net sales). Now, imagine if RGX314 would become a blockbuster like Zolgensma (and there is a very good chance it would be), Regenxbio is poised to earn 50% (i.e., $500M) from sales royalty. As such, you can bet that Regenxbio’s fundamentals would be substantially strengthened. Thereafter, the stock price is most likely to increase multifold.

RGX202

Asides from Zolgensma and the crown jewel (RGX314), you can see that Regenxbio is developing RGX202, which is a highly intriguing gene therapy. Developed for the orphan genetic disease known as Duchenne Muscular Dystrophy (DMD), RGX202 leverages on the highly advanced NAV AAV8 to deliver the genes encoding for a novel “microdystrophin.”

As a muscle protein, microdystrophin is defective in patients suffering from DMD. Without this proper muscle protein, their muscles are functionally inept. Manifesting as early as two to three years old, some symptoms include difficulty walking, running, and jumping. Physical signs include a waddling gait and large calves. Later on, the patient’s heart and lungs are also affected. The condition is quite devastating because it substantially reduces the child’s life expectancy. Kids with DMD usually won’t live past their 30s.

In delivering hope to patients, RGX202’s novel microdystrophin gene includes the functional C-terminal (CT) domain plus a specific promoter to prevent muscle damage associated with DMD. As you know, I’ve followed other gene-therapy companies for DMD, but none proved to work. Here, you should be excited, because the best gene therapy company (Regenxbio) is trying to decipher the highly difficult-to-solve puzzle that is DMD.

Despite the favorable odds, I reserve my optimism, and thereby ascribed more than 60% (i.e., slightly favorable) but less than 65% (i.e., more than favorable) chances of success. As you know, most gene therapies for DMD do not work. A possible reason is that having more muscle protein does not equate to muscle strength. The microdystrophin has to integrate into the larger muscular framework for it to function properly.

The great news for patients and shareholders is that the novelty of RGX202 (i.e., concurrently hitting that promoter and the C-T region) would confer a higher chance of success. Coupled with the best technology platform for gene delivery (i.e., NAV), this is it for DMD. If there is a gene therapy for DMD that will work, I believe that RGX202 is the one.

Leveraging strong data and high demand, the FDA granted the Orphan and Rare Pediatric Disease Designation for RGX202. On that note, Regenxbio might get a priority review voucher. A priority review would shorten the FDA review time by three months. If Regenxbio chooses to sell it to another company, it’s worth about $60M. That aside, Regenxbio already received the FDA clearance for its Investigational New Drug (i.e., IND) filing. As such, Regenxbio is poised to start a Phase 1/2 trial coined AFFINITY DUCHENNE in 1H2022.

With RGX202 being an orphan drug and having the best chances of success for DMD (i.e., a highly sought-after market), you can anticipate a future partnership. As more data rolls in, there is a good chance that Regenxbio would either be acquired or able to form another big collaboration. Hence, this RGX202 development might be the ultimate catalyst for Regenxbio, which you all have been waiting for.

Competitor Landscape

Regarding competition, Regenxbio goes toe-to-toe with other gene therapy innovators for rare diseases like Solid Biosciences (SLDB). As you know, Solid also innovates gene therapy for DMD. Notwithstanding, the data for Solid thus far disappointed investors. Asides from Solid, Sarepta Therapeutics (SRPT) is also another dominant player in the DMD niche. For the wet AMD market, Regenxbio squares up against the flagship and mega-blockbuster Eylea.

Financial Assessment

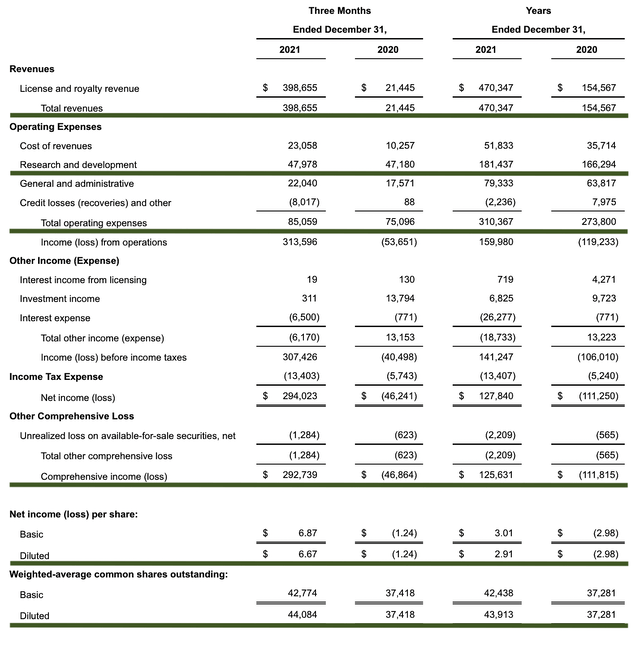

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q2021 earnings report for the period that concluded on December 31.

As follows, Regenxbio procured $398.7M in revenue compared to $21.4M for the same quarter a year prior. The robust revenue increase comes from the upfront payment from the AbbVie partnership and the increase in royalty from Zolgensma, which is now a blockbuster. For the next quarter, do not expect this same revenue leap because the cash is a one-time payment from the aforesaid partnership.

That aside, the research and development (R&D) for the respective quarters registered at $47.9M and $47.1M. I view the 1.6% R&D increase positively because the capital today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $292.7M ($6.67 per share) net income compared to $46.8M ($1.24 per share) net decline for the same comparison. As you can see, the strong bottom-line improvement is due to the upfront cash from AbbVie.

About the balance sheet, there were $849.3M in cash, equivalents, and investments. Against the $85.0M quarterly OpEx, there should be adequate capital to fund operations into 2Q2024. Simply put, the cash position is quite strong relative to the spending rate.

While on the balance sheet, you should check to see if Regenxbio is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 37.4M to 44.0M, my math reveals a 17.6% annual dilution. At this rate, Regenxbio cleared my dilution cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Regenxbio to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 44.0M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

RGX314 for various retinal diseases (wet AMD, diabetic retinopathy) |

$5B (estimated from the $40.16B global macular degeneration and retinal disease by 2031, roughly 8.6% CAGR) | $1.25B |

$284.09 |

$170.45 (40% discount because already pending for approval with additional Phase 3 baking) |

| RGX202 for DMD | $1B (estimated from the $14.8B global DMD market by 2028, 43.7% CAGR) | $250M | $56.81 | $34.08 (60% discount because of its early stage of clinical investigation and higher chances of failure) |

|

The Sum of The Parts |

$204.53 |

Valuation analysis (Source: Dr. Tran BioSci)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the biggest concern for Regenxbio is whether the RGX314 franchise will continue to deliver positive data. As I have confidence in their success, I correspondingly ascribed a 35% chance of clinical failure. I also attributed a slightly higher risk to RGX202. In case of a negative data release, you can expect your stock to tumble by 40% and vice versa.

That aside, there is the concern that AbbVie might terminate the mega-partnership as Bristol-Myers Squibb (BMY) did to Nektar Therapeutics (NKTR). That aside, Regenxbio might grow too aggressively and thereby run into a potential cash flow constraint. Nevertheless, the cash runway is quite long.

Conclusions

In all, I maintain my strong buy recommendation on Regenxbio with a five out of five stars rating. On a two to three years horizon, I projected that the $204.53 price target (“PT”) to be reached. As a sleeping giant, Regenxbio is powered by the premier gene-delivery platform NAV. Riding prudent management and an uncanny technology, Regenxbio has been delivering strong fundamental advancements on all fronts. The AbbVie partnership for RGX314 is a testament to Regenxbio’s technology. That aside, over 20 different companies are also using Regenxbio’s NAV for their gene therapies. Just as important, Novartis is enjoying the fruit of Zolgensma as sales already reached the land of blockbusters. Interestingly, Zolgensma’s revenue is growing aggressively. Most significant of all, RGX202 is poised to change the treatment for DMD forever.

After many years of sleeping (i.e., share price stagnating), you are likely to see Regenxbio stock takes off either this year or the next. As an investor, you also should keep tabs on the development of other pipeline assets (i.e., RGX111, -121, -181, -202, and -381).

Be the first to comment