Bet_Noire

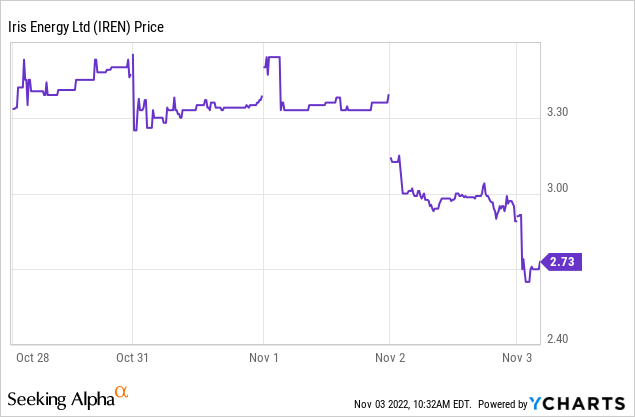

To say the last week has been a rough one for publicly listed Bitcoin (BTC-USD) miners would be an understatement. Every couple days we’ve been hit with a new mining operation that is facing serious liquidity problems. Last week, Core Scientific (CORZ) announced it can’t pay its bills and the future for that company looks very concerning. Ditto for Argo Blockchain (ARBK) (ARBKL) which just days later shared that it wasn’t getting the capital that it had initially planned to receive. Those share prices have largely collapsed in response to those company announcements.

Yesterday, Iris Energy (NASDAQ:IREN) became the latest company to disclose serious liquidity concerns. If you’ve been following my work here on Seeking Alpha, this is a name that I’ve covered twice in the past and have had exposure to from the long side. Simply put, Iris Energy has $103 million in debt outstanding through special purpose vehicles, or SPVs, that have been collateralized with Iris Energy’s miners. We found out yesterday that the company can’t service that debt from the revenue generated by the miners that have been collateralized:

Certain equipment (i.e., Bitcoin miners) owned by the special purpose vehicles currently produce insufficient cash flow to service their respective debt financing obligations, and have a current market value well below the principal amount of the relevant loans. Restructuring discussions with the lender remain ongoing

Those miners project to generate $2 million in monthly revenue but $7 million in monthly payments are required to service the obligations. This is obviously a large shortfall. In response to the news, IREN shares closed down 15% on over 646k shares yesterday. That’s the largest single day volume since mid-May and as of article submission the share price is down again this morning.

Fortunately, this decline hasn’t been a total collapse like we’ve seen in some of the other miners with liquidity problems. A big reason for that is because of the way Iris Energy’s debt agreements were structured. Iris Energy collateralized the mining machines through SPVs that are non-recourse to the parent company. When the SPVs stop paying their lenders, the lenders can either work on new arrangements or just foreclose on the machines. If the latter scenario plays out, then Iris Energy is out the miners.

SPV Details

In Iris Energy’s press release yesterday, the company detailed how much of the company’s exahash has been collateralized as part of these arrangements and it’s a significant amount. Should these machines be foreclosed on, the company would be losing a very large amount of EH/s from the 3 different SPVs combine for nearly 4 EH/s:

- Non-Recourse SPV 1 – $1 million, secured against 0.2 EH/s of miners.

- Non-Recourse SPV 2 – $32 million, secured against 1.6 EH/s of miners.

- Non-Recourse SPV 3 – $71 million, secured against 2.0 EH/s of miners.

The company had originally planned to scale operations up to 4.7 EH/s in Q4 of this year and 6 EH/s in the first half of next year. At the end of September, Iris Energy had dramatically scaled up EH/s to 3.7 from 2.2 at the of August. If the collateralized machines are all lost due to foreclosures from the lenders, the company will have 2.4 EH/s remaining. This would be a big setback to Iris Energy’s scaling plans.

If there is any good news here it’s that the parent company appears to be on relatively solid financial ground for the time being. In the announcement yesterday, the company’s CEO Daniel Roberts highlighted the importance of the way the SPV agreements were structured and specifically cited the market downturn as a reason:

The limited recourse equipment financing arrangements have been a recent focus for us. We remain committed to exploring a way in which we may be able to allow the lender to recover its capital investment, however, we are also mindful of the current market and that these arrangements were deliberately structured to minimize any potential impact on the broader Group during a protracted market downturn

This protects Iris Energy’s cash and gives optionality as to how the company can move forward with some of the other assets that it holds.

Cash & Prepayments

In the release yesterday, Iris Energy stated $53 million in banked cash as of October 31st and $75 million remaining in mining machine prepayments with Bitmain. Iris Energy previously had an $83 million prepayment position before redeeming some of the prepaid machines from Bitmain and immediately liquidating them through another party to raise more cash.

I reached out to Iris Energy’s IR representative Bom Shin yesterday and asked a handful of questions. Of which, one specifically pertained to how the company would approach the remaining prepayments with Bitmain and hashrate going forward:

We continue to work with Bitmain to secure further mutually beneficial outcomes for both parties on the remaining $75 million of prepayments we have previously paid to them. However we can make no assurances as to the outcome of these discussions (including any impact on the Company’s expansion plans or payments made under the relevant contract). We expect to provide operating hashrate metrics for October in the upcoming monthly report.

Another detail from yesterday is how the company plans to move forward with the data center infrastructure that it retains:

The Group is exploring opportunities to utilize its data center capacity that may become available in the event the Group elects to no longer provide financial support to these financing arrangements and the lender forecloses on the equipment owned by the relevant special purpose vehicles.

This would see Iris Energy potentially offering up the space for hosting services if self-mining can’t be achieved. This could potentially be of interest to companies like Marathon Digital (MARA) or Bit Digital (BTBT); both of which utilize third party hosting services for their Bitcoin mining capacity.

Risks

While I have generally liked Iris Energy’s approach and believe the company was smart to structure the SPVs the way it did, I believe there are considerable risks in this name now. I think it’s going to be very difficult for Iris Energy to scale its operation going forward and pivoting to a hosting service model might not be a saving grace either because the fundamental problem is the mining business is a poor one to be in right now.

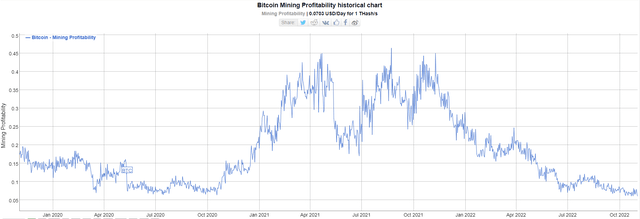

Miner profitability (BitInfoCharts)

Miner profitability is still near all time lows and many of the companies in the industry are dealing with their own problems. Demand for hosting may not be as robust if Bitcoin takes another leg down in price. Which is entirely possible given the apparent commitment to tightening on display from Federal Reserve chairman Jerome Powell yesterday afternoon.

Summary

If/when Iris Energy loses its mining machines, the company is going to see its EH/s capacity cut dramatically. With just 2.4 EH/s and no BTC balance to speak of, this is a pretty significant drawback because miners are running out of time to scale BTC positions before the halving in 2024. What I really liked about Iris’ strategy was that it was scaling a mining footprint that would have allowed it to be a top producer in the space next year. It clearly isn’t going to be able to hit its original EH/s projections and without any BTC treasury to speak of, Iris is going to almost certainly lag other miners with much larger stacks should Bitcoin rally. If Bitcoin doesn’t rally, Iris is going to struggle just like the rest of them.

All this said, Iris doesn’t look like an immediate bankruptcy risk in my view. It still has cash, prepayments, and infrastructure. But if the company needs to raise cash in the future it is probably going to be very difficult to do so at beneficial terms if the SPVs default. In summary; yesterday was bad news. I’m still long Iris. But I sold a large portion of my position and I’m definitely losing interest in the name.

Be the first to comment