ollo/E+ via Getty Images

It has been a long time since our last analysis on Yara International ASA (OTCPK:YARIY, OTCPK:YRAIF). After our recent publication of LSB Industries and Corteva, our internal team has decided to comment on the latest company developments. Last time, we had mixed feelings about the global fertilizer producer. On the one hand, we were optimistic about the long-term opportunity – this was based on the fact that: 1) the global population is increasing as well as food per capita consumption, 2) as we already mentioned in our initiation coverage of Corteva, the seed market has a forecasted CAGR between 2022 and 2031 of 4.5% while the crop protection market has an estimated CAGR of 4.66% between 2021 and 2028, and 3) we were positive on the Russia/Ukraine conflict implication. Thus, according to IHS, Russia accounts for almost 16% of the global finished fertilizers market. From a macro perspective, the European Union has disclosed further sanctions against Russia, so, Yara could take advantage of this development and further increase its slice into the global fertilizer market. On the other hand, we emphasized the energy price impact on Yara’s accounts. Based on our sensitivity analysis, we said that for a $1 increase in NatGas price, EBITDA could be impacted by almost $16 million.

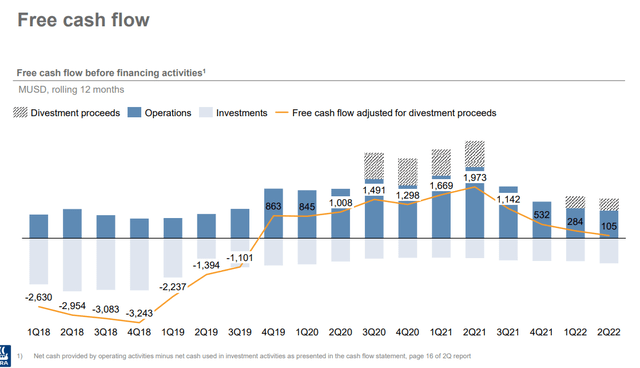

Despite our forecasted higher selling prices, our based assumption was skewed to the downside. In March 2022, we estimated “a potential headwind of almost $2 billion” and a consequent reduction in the free cash flow. This is precisely what has happened.

Looking at the Yara half-year report released at the end of July, on page 7, the company declared:

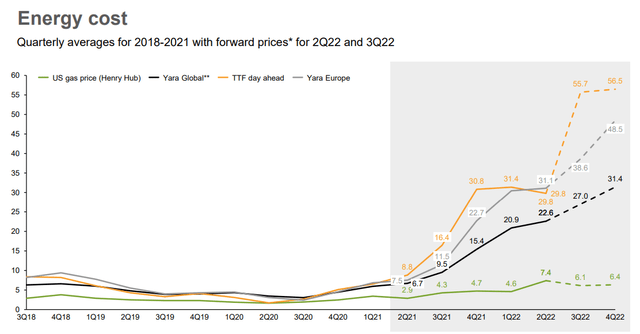

“Based on current forward markets for natural gas (7 July) and assuming stable gas purchase volumes, Yara’s gas cost for the third and fourth quarter 2022 would be respectively USD 1,100 million and USD 920 million higher than a year earlier. Gas costs may change depending on future spot gas prices and local terms”.

Since our sell rating, Yara is down almost 9% at the stock price level (Fig. 1) and FCF was significantly down compared to last year’s period (Fig. 2). Looking at the company notes, this was due to “higher raw material and commodity prices and cash outflow related to financial derivatives, mainly hedging contracts on foreign exchange exposure in key markets“.

Yara: Too Much Short Term Turbulence, A Pass At This Price (Mare Evidence Lab’s previous publication (Fig. 1))

Yara FCF Evolution (Yara International Q2 Results (Fig. 2))

What’s next?

Thanks to the latest company update (released two days ago) and the energy price estimate, we forecast an EBITDA reduction of 7% for the 2022-2024 period. Over the medium-term horizon, we should note that additional capacity is going to be built and is expected in the market by 2023, Yara might also be negatively surprised on the volume side, however, clients’ inventories are at a historic low. Luckily for the company, Yara has only two production sites in Germany so, in the case of gas rationalization, this would not significantly impact the company’s production capability. If the gas price should increase, Yara might lose market share versus the US and North African competitors.

Based on the above, we decided to maintain our underperforming rating but rolling forward our EBITDA assumption, we slightly increase our target price from NOK350 to NOK370 per share. This is based on a 4.5x multiple on EV/EBITDA (2023).

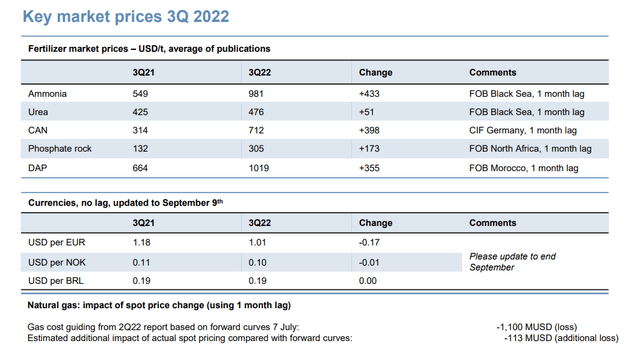

Key Market Prices 3Q 2022 (Yara Corporate Website)

Yara Energy Cost (Yara International Q2 Results)

Mare Evidence Lab’s previous coverage:

- Corteva: Comment On The Investor Day

- Corteva: Additional Upside

- LSB Industries: Still A Good Investment Against Inflation?

Be the first to comment