wdstock

In July 2022, we have published an article on Seeking Alpha, titled: “American Eagle Outfitters: We Expect Short-Term Underperformance“. In that article, we have looked, how American Eagle Outfitters’ (NYSE:NYSE:AEO) stock has performed during periods of low consumer confidence and what headwinds the firm is likely to face in the current macroeconomic environment. We rated the stock as a “hold”, due to its attractive valuation, more than 6% dividend yield and its consistent share buyback program.

Today, after the recent disappointing quarterly earnings results we revisit AEO, and evaluate the pros and cons of downgrading the stock. We will look at factors additional to what we have studied in our previous article.

Pausing of the dividend

The primary reason for our downgrade is the pausing of the dividend. Although we understand the reason for this step, one of our main reasons to rate the company as “hold” in July, was the attractive dividend yield.

Further, in our opinion, the macroeconomic environment has not improved since then, and the firm is likely to keep struggling with elevated costs and declining demand for the near future.

Consumer confidence, a leading economic indicator, which we discussed in detail in our previous article, also does not give a reason for optimism in the consumer discretionary sector in the near term. While the readings have slightly improved, they still remain at extremely low levels. AEO’s Executive Chairman of the Board and Chief Executive Officer also acknowledged the impact of the poor sentiment:

This is an unprecedented time in retail. As we cycle exceptional demand from last year, a tougher macro environment is impacting consumer spending behavior.

We believe the inventory related issues are also likely to persist despite the recent selling of spring and summer products, leading to further steeper discounts and increased promotional activity to get rid of the additional excess items, eventually resulting in a further contraction of margins.

The CEO has also highlighted the impact of inventory related problems:

Second quarter performance reflected […], constraining revenue and amplifying margin pressure as we fully cleared through excess spring and summer goods.

As the near term uncertainty regarding Fed rate hikes, energy prices and COVID-19 related restrictions remains high, it is also highly uncertain, when the firm could resume its dividend payments.

As we believe AEO is not likely to outperform the broader market, and also does not pay the fix quarterly payments anymore, we believe the stock can no longer be rated as “hold”.

On the other hand, there were a few points in the firm’s earnings presentation that we liked and we would like to highlight, in order to keep our argument balanced.

Capital allocation priorities

The three main focus areas of capital allocation are depicted on the following figure:

Capital allocation priorities (AEO)

We like that the firm keeps focusing on potential growth opportunities related the Aerie’s. In our opinion, it is important that even in times of uncertainty and macroeconomic challenges, the firm keeps its longer term goals in focus and allocates capital accordingly. The 25% compounded annual growth rate of Aerie’s, which the company describes as “the most exciting concept in retail”, justifies this focus.

Aerie’s growth (AEO)

The firm has also published a roadmap, how they imagine reaching $2 billion+ in revenue:

Roadmap (AEO)

Although this roadmap gives a general idea about what the firm is planning, we would like to see how efficiently and successfully these steps are executed. While we believe the direction that the firm is taking is appropriate, in the current environment we cannot recommend holding a stock just based on “roadmaps”.

Preserving balance sheet strength and maintaining sufficient liquidity are the basis for financial flexibility in challenging times. Therefore, from this perspective, we understand the decision of pausing the dividend. It is also promising that the firm is still putting shareholder returns, both dividends and share repurchases as their number 3 priority.

Most of the revenue generated in the United States

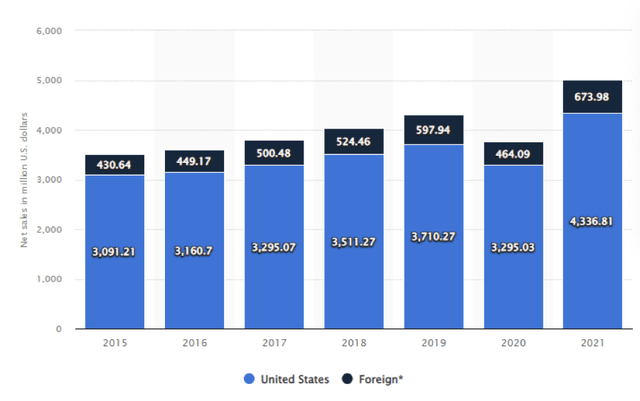

Although not directly related to the last quarterly results, in the current environment, we prefer firms that have a smaller international footprint, in order to avoid potential currency exchange related headwinds. While AEO operates worldwide, over the years, only about 15% of its net sales has been generated outside of the United States. While many of AEO’s competitors suffer from the currency exchange headwinds, we believe AEO is not likely to be significantly impacted, even if the USD remains at the current levels for the near future.

Revenue by region (statista.com)

Key takeaways

Currently the cons of investing in AEO’s stock outweigh the pros.

In our opinion, the macroeconomic environment is likely to remain challenging for the rest of 2022, with consumer confidence readings also remaining below the normal levels. As a result, we do not expect the demand for AEO’s products to dramatically increase during the rest of the year.

While inventory management issues are addressed continuously, we believe that the downward pressure on the margins will remain.

Other factors, like the Fed rate hikes, supply chain issues, COVID-19 related restrictions create further uncertainty.

In our opinion, without the attractive dividend payment, AEO’s stock can no longer be rated as a “hold”.

Be the first to comment