Baris-Ozer/iStock via Getty Images

Introduction

I’ve had several requests from readers for an article on Microsoft (NASDAQ:MSFT) over the past few weeks. Even though I’ve written articles about 100+ different high-quality stocks for Seeking Alpha, this will be my first Microsoft article. I think part of the reason I haven’t written on Microsoft before is that my style of analysis places a strong emphasis on proven historical trends, and Microsoft’s business changed a lot over the past decade, so I wasn’t sure how applicable the trends from 2006 to 2014 would be to Microsoft’s future, and that caused me to hold off writing about it until we had more recent data. The other part of the reason is that for most of the past several years, Microsoft has been richly valued, and nowhere close to the price I would consider buying it. I prefer to write about stocks that I want to own and also that have a decent chance of hitting a price low enough that I would actually buy them.

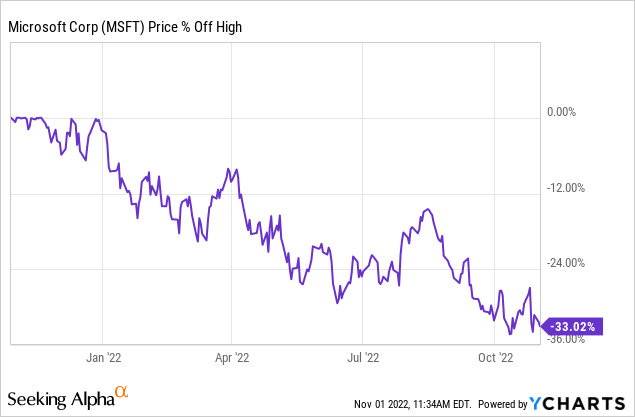

Now, however, with Microsoft stock more than -30% off its highs, and near a 52-week low, the stock is getting at least somewhat close to the price I would consider buying it. So, in this article I will share my process for valuing Microsoft stock, and also share the price range at which I would be willing to buy the stock.

My Valuation Method For Microsoft

The valuation method I use for Microsoft first checks to see how cyclical earnings have been historically. Once it is determined that earnings aren’t too cyclical, then I use a combination of earnings, earnings growth, and P/E mean reversion to estimate future returns based on previous earnings growth and sentiment patterns. I take those expectations and apply them 10 years into the future, and then convert the results into an expected CAGR percentage. If the expected return is really good, I will buy the stock, and if it’s really low, I will often sell the stock. In this article, I will take readers through each step of this process.

Importantly, once it is established that a business has a long history of relatively stable and predictable earnings growth, it doesn’t really matter to me what the business does. If it consistently makes more money over the course of each economic cycle, that’s what I care about the most.

Over the past 20 years Microsoft has only experienced two years of EPS declines, once during the recession of 2009, when earnings fell -12% and once in 2013 when earnings fell a modest -7%. Every other year Microsoft has grown its earnings per share from one year to the next. I would categorize this as very low earnings cyclicality. Based on that, it is appropriate to use a fundamental analysis using earnings to value the stock, and that’s what I’ll do in this article. (If earnings had been more cyclical, I would use a different valuation technique.)

Microsoft Stock — Market Sentiment Return Expectations

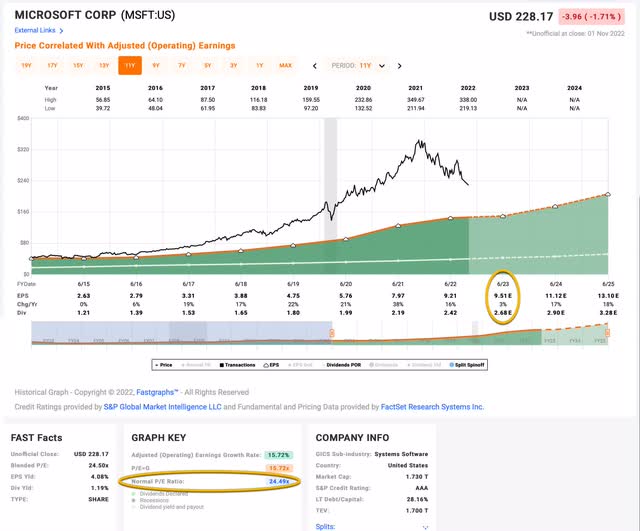

In order to estimate what sort of returns we might expect over the next 10 years, let’s begin by examining what return we could expect 10 years from now if the P/E multiple were to revert to its mean from the previous economic cycle. For this, I’m using a period that runs from 2015-2023.

Microsoft’s average P/E from 2015 to the present has been about 24.49 (the blue number circled in gold near the bottom of the FAST Graph). Using 2023’s forward earnings estimates of $9.51 Microsoft has a current P/E of 23.82. If that 23.82 P/E were to revert to the average P/E of 24.49 over the course of the next 10 years and everything else was held the same, MSFT’s price would rise and it would produce a 10-Year CAGR of +0.31%. That’s the annual return we can expect from sentiment mean reversion if it takes 10 years to revert. If it takes less time to revert, the return would be higher.

Business Earnings Expectations

We previously examined what would happen if market sentiment reverted to the mean. This is entirely determined by the mood of the market and is quite often disconnected, or only loosely connected, to the performance of the actual business. In this section, we will examine the actual earnings of the business. The goal here is simple: We want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today’s prices and kept all of the earnings for ourselves.

There are two main components of this: the first is the earnings yield and the second is the rate at which the earnings can be expected to grow. Let’s start with the earnings yield (which is an inverted P/E ratio, so the Earnings/Price ratio). The current earnings yield is about +4.20%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $4.20 per year on my investment if earnings remained the same for the next 10 years.

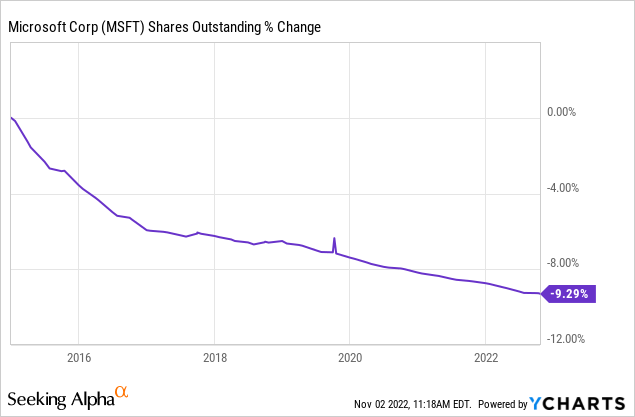

The next step is to estimate the company’s earnings growth during this time period. I do that by figuring out at what rate earnings grew during the last cycle and applying that rate to the next 10 years. This involves calculating the historical EPS growth rate, taking into account each year’s EPS growth or decline, and then backing out any share buybacks that occurred over that time period (because reducing shares will increase the EPS due to fewer shares).

Microsoft has reduced its shares outstanding by about 9% over this time period. I will make adjustments for these buybacks when calculating their earnings growth. After doing so, I get an estimated earnings growth rate for Microsoft during this period of +14.07%, which is very good. Because of my buyback adjustments that number is a little more conservative than FAST Graph’s +15.72%, but it’s worth noting that we never really had a “true” recession from 2015 to 2022 either, so I actually view my current estimate as a little on the optimistic side since Microsoft’s earnings will probably experience at least some decline if we experience a recession, even if the decline is not super deep.

Next, I’ll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. The way I think about this is, if I bought Microsoft’s whole business for $100, it would pay me back $4.20 plus +14.07% growth the first year, and that amount would grow at +14.07% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $193.40 including the original $100. When I plug that growth into a CAGR calculator, that translates to a +6.82% 10-year CAGR estimate for the expected business earnings returns.

10-Year, Full-Cycle CAGR Estimate

Potential future returns can come from two main places: market sentiment returns or business earnings returns. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years for Microsoft, it will produce a +0.31% CAGR. If the earnings yield and growth are similar to the last cycle, the company should produce somewhere around a +6.82% 10-year CAGR. If we put the two together, we get an expected 10-year, full-cycle CAGR of +7.13% at today’s price.

My Buy/Sell/Hold range for this category of stocks is: above a 12% CAGR is a Buy, below a 4% expected CAGR is a Sell, and in between 4% and 12% is a Hold. A +7.13% expected CAGR makes Microsoft stock a “Hold” using these assumptions and means it’s roughly fairly valued here.

Assuming the estimates for 2023 earnings don’t change (and they might) the price at which Microsoft stock would cross the 12% 10-year CAGR threshold and become a “Buy” is $165.80 per share, which is about -26% lower than where the stock trades today.

Recession Considerations

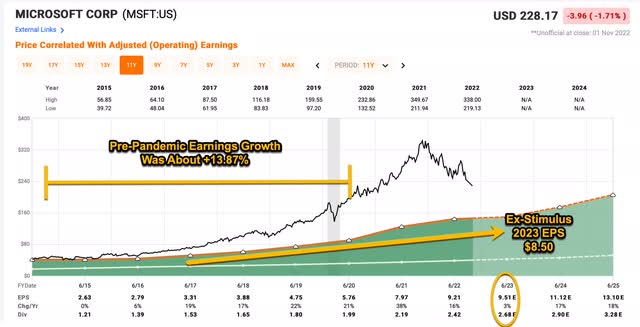

So far, I don’t think Microsoft’s earnings expectations contain realistic recession estimates, but they do look to be at least reasonably close if we avoid a recession and earnings stagnate a bit while digesting the end of economic stimulus.

Currently, the market expects $9.51 of EPS for 2023. If the EPS growth trend of +13.87% leading into the pandemic stimulus would have continued without stimulus, we would have expected Microsoft to earn about $8.50 per share in 2023, which is a little bit lower than analysts expect right now, but at least in the same ballpark. What I expect to happen over the next three quarters is for analysts to lower their expectations from where they are now, down to something closer to $8.50. If that were to happen, it would lower my “buy price” down to about $148 per share, and this is probably my base case of what to expect in the first half of 2023. But since there is a pretty big distance between the current trading price and my current buy price, I probably have time to wait and see what the next earnings report looks like and get more information before making these adjustments to my buy price.

What I’m not taking into account with that buy price are any earnings and stock price declines caused by an actual recession (rather than the stimulus earnings trend reverting to normal). A recession scenario could be a much more bearish scenario, so I feel obligated to share it.

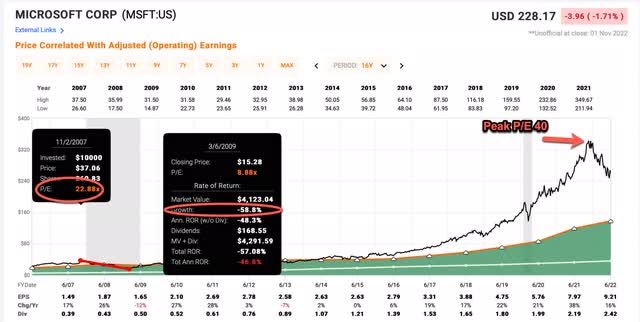

If we go back to the Great Recession in 2008/9, leading into that recession Microsoft had a peak P/E ratio of about 23, and from peak to trough, the stock price fell about -60% off its highs even though EPS only declined -12% at its worst. At one point Microsoft traded at a P/E under 10. The potentially concerning part about the current downturn is that Microsoft’s peak P/E was about 40, nearly double the 2007 peak P/E. This leaves room for a lot more multiple compression and downside price movement.

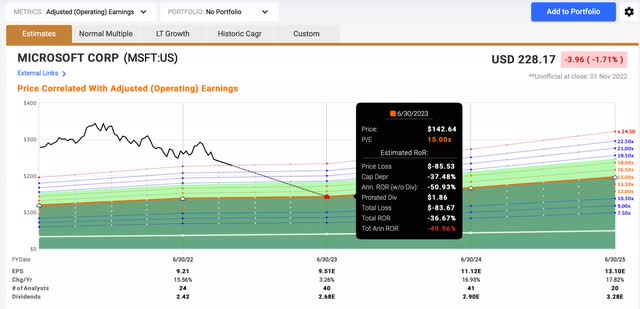

In the forecasting graph above, I assumed a much more optimistic (and perhaps more reasonable) 15 P/E ratio for Microsoft in a recession and used the very generous EPS estimate of $9.51. This still resulted in a -50% drawdown from where the stock trades today. And, if earnings growth declines as I expect it to do, that would lower the expected price even more.

As I’m sure many will point out, Microsoft is a different business than it was in 2007. And that’s true. Additionally, even though I expect a recession in 2023, I don’t yet expect it to be as bad as in 2008. But the assumptions above don’t even assume an earnings decline and aren’t nearly as pessimistic with the trough P/E as 2008 either. So, I just think it’s important for Microsoft investors to know what is possible over the next year or two, and that because Microsoft was valued so richly going into this decline, the stock price could have a long way to fall and investors should be prepared for it. It’s also worth noting that the current interest rate environment is much closer to that of 2008 than it is of 2020 as well.

Conclusion

Given what we know today about earnings expectations for 2023, my current buy price for Microsoft is $165.80, but I expect over the next several months for that buy price to fall down closer to $148.00 as earnings disappoint and the wider economy weakens in 2023. The $148.00 price has a relatively high chance of hitting, and I’ll likely buy around there, but I will have no illusion that will necessarily be the bottom for the stock. If the recession is worse than expected the price could easily go lower, but with a business as high quality as Microsoft, I would hold through any additional downturn at that point because I have no doubt they will eventually recover.

An additional portfolio consideration is that I usually take 1% initial portfolio-weighted positions, and the last time I checked Microsoft was about a 5% weighting in the S&P 500. If I bought at $148, and the price took a 2008-style dive deeper, I would feel comfortable adding a second 1% weighted Microsoft position even though it’s not something I do very often. So, I view the $148 to $166 range of the next 3-4 months as having a very high probability of hitting and giving me a chance to add Microsoft to my portfolio at a decent price. But investors need to be aware the stock could go lower than that, and potentially be prepared to buy a second tranche if it does.

Be the first to comment