imaginima

I often find myself attracted to some of the most unique companies on the market. And few companies are as unique as satellite operator Iridium Communications (NASDAQ:IRDM). Through its vast constellation of satellites encircling the globe, the company provides various communications services for its clients. And the great thing about it is that, unlike many of the other space-oriented companies today, it is actually generating not only growing revenue, but also positive and growing cash flows. Financial performance achieved by the company this year has helped propel shares higher. And for those who followed some of my earlier articles on the company, upside has been rather significant. But given where shares are priced today, I do think the company is more or less fairly valued even though management recently came out with increased guidance for the year. Because of this, I’ve decided to keep my ‘hold’ rating on the enterprise for now, indicating my belief that it should generate returns that more or less match the broader market moving forward.

Sky-high

The last article I wrote on Iridium Communications was published in early August of this year. In that article, I talked about how good a job the company had done in recent months, between landing a rather sizable contract and increasing its financial guidance for 2022. As a result of these developments, shares of the firm had risen materially, driven by investor enthusiasm for the company’s prospects moving forward. But given how shares were trading at that time, I felt as though upside from that point on was more limited. And as a result, I ended up reducing it from a ‘buy’ rating to a ‘hold’ rating. So far, it looks as though the market has disagreed with my assessment. Even as the S&P 500 has dropped by 8.7%, shares of Iridium Communications have shot sky-high, climbing another 6.3%. Compared to the article that I published about the company in May of this year, the stock is now up 38.8% compared to the 6.5% decline experienced by the S&P 500.

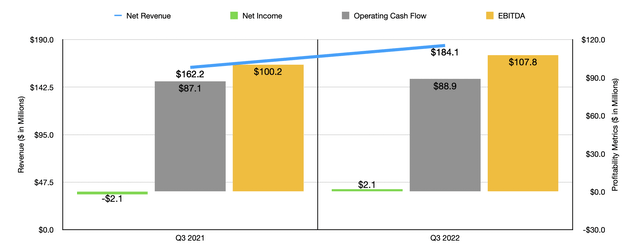

To be clear, this return disparity achieved by the company has not been without cause. To see what I mean, we need only look at financial results covering the third quarter of the company’s 2022 fiscal year. This data was made available on October 20th. During that quarter, revenue for the company came in at $184.1 million. That’s 13.5% higher than the $162.2 million the company generated only one year earlier. Revenue growth for the company occurred across the board, with services revenue up by 8.8%, while subscriber equipment revenue rose by 3.9%. But the real growth for the company came from its engineering and support services operations. Revenue there soared by 128.7%, climbing from $7.5 million to $17.1 million. This increase, management said, which driven largely by increased work that the company performed under certain government contracts, namely a contract awarded by the Space Development Agency that should help to push up sales for years to come. It is worth noting that some of the company’s revenue increase was driven by a greater number of subscribers to its services. For instance, at the end of the latest quarter, the company had 1.973 million subscribers using its offerings. This compares to the 1.875 million reported just one quarter earlier and is up from the 1.690 million reported in the third quarter of 2021.

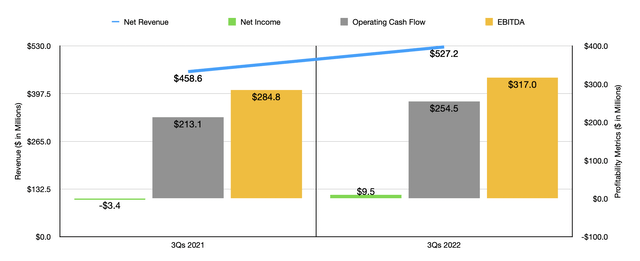

With this increase in revenue also came higher profitability. The company went from generating a net loss of $2.1 million in the third quarter of 2021 to generating a profit of $2.1 million at the same time this year. Operating cash flow went from $87.1 million to $88.9 million. Even EBITDA increased, climbing from $100.2 million to $107.8 million. Naturally, these results in the third quarter were instrumental in pushing up total results for the 2022 fiscal year so far. Revenue of $527.2 million in the first three quarters of the year beat out the $458.6 million reported the same time last year. This was helpful in pushing up the company’s bottom line from a loss of $3.4 million to a profit of $9.5 million. Operating cash flow rose from $213.1 million to $254.5 million. And EBITDA increased from $284.8 million to $317 million.

This was not the only positive thing that we saw. Management also took this opportunity to increase guidance yet again for the 2022 fiscal year. At present, they now expect service revenue to climb by between 8% and 9% year over year. The prior expected range of growth was between 7% and 9%. In addition, the company also is forecasting EBITDA of $420 million. In addition to beating out the $378.2 million reported for the 2021 fiscal year, this number is also at the high end of the prior expected range of between $410 million and $420 million. Along the way, management is also working on both paying down debt and buying back stock. The net leverage ratio of the company right now is 3.4. And by the end of 2023, management expects to get this down to as low as 2.5. During the third quarter of this year, the company also allocated $80.2 million to buy back 1.8 million shares of stock. This leaves $187.2 million under its share buyback program.

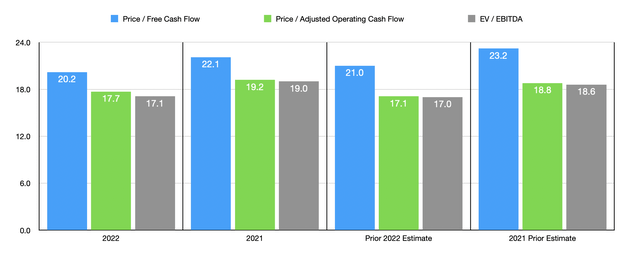

No guidance was given when it came to other profitability metrics. But if we assume that operating cash flow will rise at the same rate that EBITDA is expected to, then we should anticipate a reading this year of $328.6 million. Using this figure, we can calculate that the company is trading at a forward price to operating cash flow multiple of 17.7. This is down from the 19.2 reading that we get using data from the 2021 fiscal year. Management also expects to spend around $40 million annually on capital expenditures. This would imply free cash flow of around $288.6 million. That works out to a price to free cash flow multiple of 20.2, down from the 22.1 reading that we get using data from last year. Meanwhile, the EV to EBITDA multiple of the company should be 17.1. That stacks up favorably against the 19 reading that we get using data from last year.

Takeaway

What data we have available today suggests to me that Iridium Communications is a truly great company that should continue to create attractive value for its investors in the long run. Having said that, it does still seem to me as though the stock looks more or less fairly valued. For those with a very long-term time horizon, it may not be a bad idea to consider a purchase of the shares. But for those wanting to optimize their prospects, I do think it might be worth waiting for a downturn or another increase in guidance without a corresponding increase in share price, to try and get in.

Be the first to comment