Luis Alvarez/DigitalVision via Getty Images

Investment Summary

I’ve retained our outlook on iRhythm Technologies, Inc. (NASDAQ:IRTC) as a hold after extensively reviewing its latest numbers. After the Q2 results I noted the reimbursement overhang had potentially settled for the company but concluded the market had it fairly priced at the time. Just a reminder, our hold thesis is built on the fact IRTC’s earnings growth looks clamped in the periods ahead as it grapples operating costs and ECG market, broad market headwinds. Investors can review our previous 4 reports on IRTC [newest to oldest] in the below links:

- iRhythm remains insulated from peers

- Reimbursement blow equals shareholder downside

- Reimbursement overhand squashed, bull thesis back in tact

- Fairly sized at current multiples, no need to size up

The above-mentioned pressures were on full display during the company’s latest earnings period, prompting management to revise down FY22 revenue and adjusted EBITDA guidance. Net-net, I believe there are better opportunities within the space. With shares trading in-line with our fair value estimate of $117 [down from $155], I continue to rate IRTC a hold.

Q3 results: Challenges on full display

IRTC’s Q3 performance was dotted with numerous challenges that clamped top-bottom line growth. Core business revenue grew 22% YoY and 200bps sequentially, with gross margin up 260bps YoY to 68.3%. Both numbers were behind consensus.

Management wasn’t able to overcome cost inflation hurting industry margins last quarter with Q3 OpEx up 13% YoY to $89.7mm. Whereas core EBITDA was a $17.6mm outflow compared to the $20.7mm outflow in Q3 FY21. It pulled this down to a net loss of $0.71 per share, an improvement on the $0.81 loss per share this time last year.

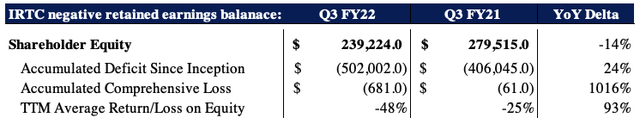

Nonetheless, it’s still paid $41.9mm in stock-based compensation in the 9-months to date, in-line with the $42mm payment at this time last year. IRTC’s accumulated deficit [retained loss] now totals $502mm, up from $406mm in Q3 FY21. Alas, its trailing 12 month ROE weakened from negative 25% to negative 48%, nearly 100% downside from the same period FY21 [Exhibit 1].

Exhibit 1.

Data: HB Insights, IRTC SEC Filings

Looking deeper at the numbers, my key takeouts [both the good and the bad] from the quarter are as follows:

- 1). New store same-store mix accounted for ~50% of revenue growth, up from 38% a year prior, whereas home enrolment was just ~20% of revenue volume. New same-store are accounts that have been open for <12months, by IRTC’s definition. Therefore, around half of IRTC’s Q3 revenue upside came from short-term drivers versus long-term growth levers in my estimation.

- 2). Received devices rate[s] was lower than expected, and is trending below historic averages. This presents a direct challenge for IRTC in my opinion, because the received device rate is what allows it to provide its service and therefore book revenue. It realized greater delays in receiving Zio XT monitors in the quarter, whilst many patients failed to return the device, period.

- Management note the cause to be “physician practices that are having patients leave the office with the device in the box to be applied at home to address capacity challenges”.

- I expect IRTC will have to update its expectations around its received device rates as a result of this latest activity – a large impact on finances, and the predictability of future cash flows. This was brought attention in the earnings call by JP Morgan analyst Allan Gong, as to why it wasn’t brought up in the investor day back at the end of September. CEO Quinten Blackford’s response:

“…while we knew that the returned device rate was a bit lower than what we had historically seen, it was beginning to come back in line with historic trends. The trend line was moving back in the right direction. So coupled the fact that we saw incredibly strong registration growth in the month of September, and that received device rate beginning to bend back towards, what we’ve seen historically, we felt good with respect to the full-year number and where we were at, we felt very strong, particularly with respect to the strong registrations…

…Unfortunately, as we’ve got into October, we didn’t see that that received device rate close all the way back down to historic levels and there continues to be a bit of a gap there. So that was what we did not have visibility to at the time of Investor Day and have realized beyond that, that it’s a bit of the changing behaviors in the physician offices where – in clinic, they’re sending the patients home with the device, that was not something that we had fully expected or anticipated at that point.”

- 3). IRTC issued a customer advisory notice to its Zio AT customers. This surrounded language in the clinical reference manual, in addition to info on the registration process and the likes. Whilst it doesn’t expect any long-term impact to company, management adjusted Zio AT Q4 growth forecasts to ~20% versus ~40–50% recognized this YTD. This is a $3–$4mm impact to guidance.

- 4). FY22 guidance has subsequently been narrowed to 26–27% revenue growth [previously 29–30%] calling for $407–411mm at the top this year. It forecasts adjusted EBITDA of negative $10–$12mm.

Softer growth outlook ahead

Given the uncertainty surrounding its received device rates, it’s hard to envision a period of high-paced for growth in the next 12 months. The available data suggests IRTC will continue printing quarterly operating losses into the coming 2 years, in my estimation.

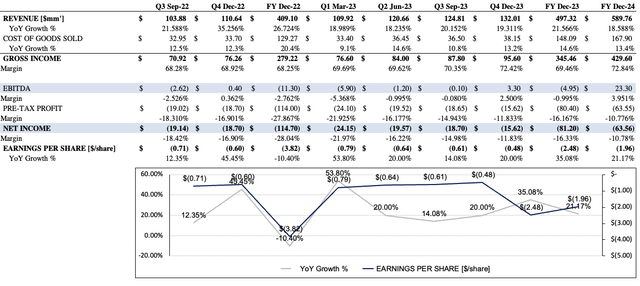

I’ve narrowed our growth outlook for the company into FY24. Estimates are ~27% revenue growth in FY22, pulling back to 21.5% growth in FY23 and ~18.5% the year after. We also project FY22 core EBITDA of negative ~$11mm [mid-range of management’s guidance], leading to a pre-tax margin of negative -$114mm. Consequently we project IRTC to recognise sequential net-losses per share into the coming 24-month period [Exhibit 2].

Exhibit 2. IRTC forward estimates [Qrtly, Annual], FY22–FY24.

Data: HB Insights Estimates

On the chart data is equally weak. Shares have traded within sideways range in FY22, backing and filling from February–October. The stock is now testing the lower bar of this channel after breaking out to the downside in October.

As seen in Exhibit 3, volume trends are flat. Relative strength to the S&P 500 has pulled back whilst the SPX has rallied in October/November. This displays counterweakness and further supports my neutral view. Finally, prices have pulled below the 50DMA and 250DMA [heavy resistance] whilst the 50DMA and 250DMA recently crossed to the downside.

Exhibit 3. IRTC 2-year weekly price action, showing recent counterweakness vs. SPX with cross of key averages

Data: Updata

Valuation and conclusion

Lack of earnings upside and profitability are a challenge when valuing IRTC. Visibility on top-line growth is also murky looking ahead [from the complexities surrounding its received device rates]. It’s also difficult to forecast out the OpEx and EBITDA amid the current macro-landscape.

Nevertheless, IRTC has $7.94 in book value per share (“BV/S”), down from $8.12 per share last quarter, and $9.82/share a year ago. Applying a multiple of 14.8x [its 3-year historical average] to the current BV/S derives a price objective of $117.

Relative to the current market price, I see more selective opportunities elsewhere offering more generous upside capture. Alas, net-net, I rate IRTC a buy on softer growth, valuations, and look forward to providing additional coverage on the name.

Be the first to comment