Spencer Platt/Getty Images News

Chinese video streaming player iQIYI (NASDAQ:IQ) has shifted its attention from growth to profits and has been implementing cost cuts and price hikes to meet this new focus. Provided such cost cuts do not cut into long term competitiveness, rising consumer purchasing power in China, along with international expansion efforts are growth drivers that could support iQIYI’s top line. Apart from question marks over the impact of short term cost cuts to long term competitiveness, several risks could weigh on the stock however including potentially weaker near term ad spend due to weakening economic prospects in China, delisting risks, and liquidity risks.

Shifting focus from growth to profits

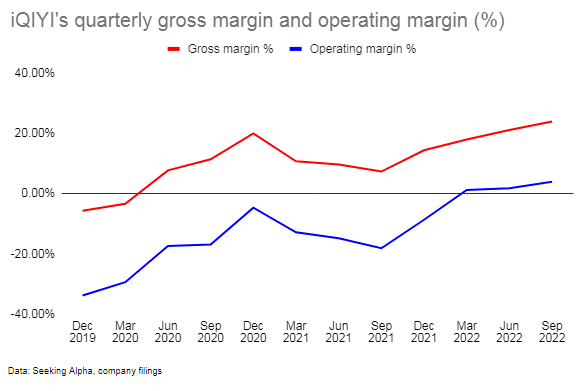

After years of losses, Chinese tech giant Baidu’s (BIDU) video streaming unit iQIYI turned its third consecutive quarterly operating profit in Q3 2022, generating an operating income of CNY 309.7 million compared with an operating loss of CNY 1.4 billion the same quarter last year. Profitability also improved YoY and sequentially, with gross margins expanding to 24% from just 7.4% the same quarter in 2021, and 21% the previous quarter.

Author

Much of iQIYI’s profitability improvement is driven by management switching from focusing on growth to focusing on profitability. Towards that end, content costs were reduced and subscription fees were increased; in Q3 2022, content costs were down 18% YoY, selling, general, and administrative expenses dropped 21% YoY, R&D expenses were down 30% YoY, continuing from last quarter’s momentum; Q2 2022, content costs were down 24% YoY, selling, general, and administrative expenses dropped 32% YoY, R&D expenses were down 29% YoY.

Price hikes had been implemented in November 2020 and then again in December 2021. iQIYI’s actions mirror rivals who have also switched from being growth-oriented to being profit-oriented. Bilibili (BILI) launched a paywall this year for some of its videos while Youku (BABA) raised its VIP fees in mid 2022, for the first time in five years. Like iQIYI, Tencent had already raised prices in 2020 and 2021.

Although the combined actions of price increases and reduced content development resulted in some user churn (iQIYI’s MAUs dropped 10.6% to 428 million in 2021 from 479 million in 2020), it was not isolated (rival Tencent Video (OTCPK:TCEHY) saw its MAUs slide 8.5% YoY to 445 million in December 2021, driven by rising membership fees and the suspension of some of its popular TV shows), and nevertheless resulted in an increase in membership revenues (up 1% in FY 2021).

Going forward, iQIYI expects to post a final net loss in 2023 before turning a profit of CNY 991 million in 2024.

Subscription revenues have room for growth in China and overseas

Just about 74 million of Netflix’s (NFLX) 200 million plus subscribers hail from North America, accounting for about a fifth of the region’s population. By contrast, iQIYI’s paying subscriber base of about 100 million subscribers account for just about 7% of China’s 1.4 billion population. The difference could be due to the disparity between the two regions’ per capita incomes (America’s per capita GDP is about five times higher than China’s, while Canada is about four times that of China), but as China’s per capita incomes rise in the long run, there is room for further growth in subscriber numbers and average revenue per membership (which stood at around CNY 14 in Q4 2021) in its home market China alone.

International expansion could further support subscription revenues. iQIYI set its sights on the international video streaming market in 2019 in an effort to capitalize on rising interest in Asian content, particularly in Southeast Asia which is home to the highest proportion of overseas ethnic Chinese. iQIYI has already launched in several overseas markets including Southeast Asia, the UAE, Saudi Arabia, Egypt, Japan, and South Korea, and recently launched in Spain. A number of these countries have higher per capita incomes than China, and although first mover Netflix may have already captured the low-hanging fruit in these countries (about 150 million of Netflix’s subscribers hail from outside North America, notably Europe, the Middle East, and Africa), iQIYI’s differentiation in terms of content (which tends to be skewed towards Asian and Chinese content) could help it capture a share for itself among audiences seeking Asian-inspired videos.

Advertising revenues can increase

iQIYI generated CNY 7 billion (USD 1.1 billion) in advertising revenues in 2021, a fraction compared to online video behemoth YouTube (GOOGL) who generated more than USD 28 billion in ad revenue in 2021. YouTube has about 2.1 billion monthly active users and after deducting their 80 million paying members, the platform has about 2.1 billion non-paying users who are monetized with ads, which roughly translates into an ARPU of approximately USD 14. iQIYI meanwhile had about 300 million non-paying members as of 2021, translating into an ARPU of less than USD 4. Much like differences in its subscriber average revenue per membership (ARM), the disparity is likely due to differences in consumer spending power (lower in China where iQIYI’s userbase is largely located and higher in developed countries where YouTube has a far greater presence) which translates into differences in terms of cost per video impressions (which, generally speaking tend, to be higher in developed countries compared to developing nations). Rising incomes in China, as well as iQIYI’s expansion into overseas markets could potentially lift advertising revenues.

Risks

Macro headwinds could further impact near term ad revenues

iQIYI’s online advertising revenues were down 25% YoY in Q3 2022, and down 35% YoY in Q2 2022, reflecting a broader trend in the industry which has been hard hit by Chinese advertisers slashing ad budgets in response to soft economic conditions. Domestic video streaming rivals such as Tencent Video, and Mango both reported sagging advertising revenues. Advertising is iQIYI’s second biggest revenue stream, and this sharp decline dragged down overall revenues in Q3 2022 (down 2% YoY to CNY 7.5 billion), and Q2 2022 (down 13% YoY to CNY 6.7 billion).

China’s near term economic prospects are still gloomy with economists downgrading their growth forecasts for the world’s number 2 economy to less than 5% through 2024, which suggests bleak near term prospects for ad spending in the country.

Delisting risks

In April this year, iQIYI was added to the U.S. SEC’s growing list of companies that could be delisted. Although delisting risks reduced with the U.S. and China reaching a deal allowing American officials access to Chinese audit papers, simmering tensions between the two nations may reignite regulatory scrutiny. Unlike many Chinese companies that have secondary listings in Hong Kong, iQIYI as yet does not seem to have a Hong Kong listing.

Heavy debt burden and liquidity constraints

There is doubt over the company’s ability to continue as a going concern. The company’s current ratio is just 0.37 versus Netflix’s 1.14, and their total debt to equity is over 297 versus 80 for Netflix. The company could potentially turn to parent company Baidu for funding, but Baidu is reportedly looking to sell its majority stake in iQIYI and it remains to be seen if iQIYI would be able to find a financially-strong backer.

Summary

Chinese video streaming players are switching from focusing on growth to focusing on profit. Fee hikes for subscriptions, disciplined content development efforts, and reduced R&D spending have helped iQIYI report profits after years of losses, however it remains to be seen whether such cost cuts cut into long term competitiveness as well, potentially limiting their ability to capitalize on long term opportunities in increasing premium subscribers and digital ad spend overseas.

iQIYI’s share price is down 57% over the past year (slightly worse than Netflix whose share price is down 56% over the past year). Despite the drop, iQIYI’s stock trades at a P/E of 26, only slightly cheaper than its more profitable rival Netflix who trades at a P/E of 27.5, and iQIYI still has a high short interest of 17.5% versus Netflix’s 2.75%. Given near term weakness, a P/E that is still relatively pricey, high short interest, potential delisting risks, as well as a fragile liquidity position investors may opt to remain on the sidelines.

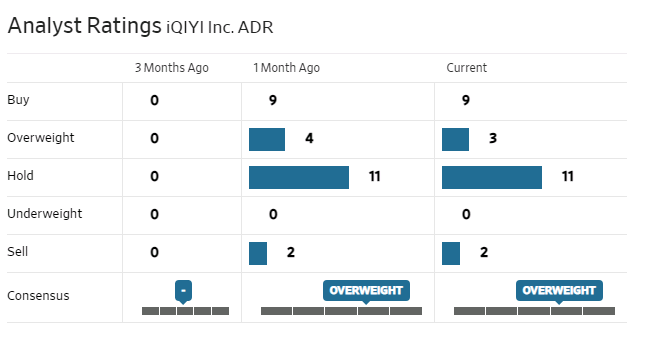

Analysts are mostly neutral on the stock.

WSJ

Be the first to comment