Charday Penn/E+ via Getty Images

Sabra Health Care REIT (NASDAQ:NASDAQ:SBRA) is a real estate investment trust owning buildings used by the healthcare industry. Its nominal dividend yield is near 8%. The majority of stocks I own are biotech pharma companies. While I have done very well, overall, with them, I have aged into wanting a portfolio that generates some dividends. I like to invest where I have knowledge or analysis skills that give me an advantage. I admit to not being particularly knowledgeable about the REIT space. By looking at Sabra I hope to gain knowledge of a REIT in a commercial space I understand better than retail or residential. In this article I will examine whether Sabra is a good investment for its dividend, but I will not be comparing it to other REITS. I already know it currently pays a higher dividend than any of the pharmaceutical companies or healthcare companies I own. I also note that there are other Health Care REIT stocks to choose from.

Sabra Health Care basics

Sabra Health Care REIT is invested in or owns 441 properties and has 75 clients for those properties [SBRA August 2022 presentation, Slide 15]. Most of the properties are skilled nursing or transitional care facilities [Slide 16]. Other significant types of properties owned are behavior health centers and senior housing. Using its equity and leveraging it with some debt, Sabra can lease facilities to operators at relatively attractive rates. It boasts of supporting the expansion of its operator clients while prudently financing its facilities. It emphasizes a growing behavioral health portfolio, including conversion of buildings into addiction treatment centers. For instance, in late 2021 it bought a 132-bed hotel in South Carolina for conversion into an addiction treatment facility. In June 2022 it completed the conversion of a 48-unit memory care facility into an addiction treatment facility.

In May 2022 Sabra completed the acquisition of a Canadian senior housing portfolio in a 50/50 joint venture with Sienna Senior Living (TSX: SIA). The acquisition includes 11 senior communities with 1,048 units. Sienna will operate the facilities. The total cost was $243 million. In Q2 $40 million was raised from the sale of eight facilities, an additional two were sold after the quarter ended, and six more were in the process of being sold.

Sabra Q2 2022 Results

On August 3, 2022, Sabra reported Q2 2022 results. Revenue was $156 million, up 2% from $153 million year-earlier. About $103 million of Q2 revenue was from rents, $49 million from interest or other, and $44 million from residence fees and services. Total expenses jumped y/y to near $130 million, largely because of a $12 million impairment charge. Other expense was $7 million. GAAP income before loss from unconsolidated joint ventures was $19.6 million, down 48% from $37.7 million year-earlier. But the losses from unconsolidated joint ventures declined dramatically from $170 million in Q2 2021 to under $3 million in Q2 2022. All that resulted in GAAP net income of $16.8 million, up from a loss of $132.6 million year-earlier. GAAP EPS was $0.07. Diluted common shares outstanding increased 6% y/y to 231.7 million.

Sabra ended the quarter with $67 million in cash. Real estate assets were valued at just over $5 billion. Debt consisted mainly of $1.7 billion in senior unsecured notes, $554 million in term loans, and $142 million in revolving credit debt

The company gives much detailed information on AFFO, or adjusted funds from operations. In Q2 that was $88 million or $0.36 per share, down 8% from $0.39 per share in Q2 2021. The press release shows the details of how that was calculated. Note it is a non-GAAP figure.

Growth Prospects

Revenue growth for the latest quarter was just 2% y/y, not stellar. Since most cash flow is siphoned off for dividends, and there is substantial debt, any growth would likely require new debt, at rates that are currently higher than they have been in years. Except for the Canadian acquisition described above, I would classify Sabra as low-growth until proven otherwise.

Dividend and Reliability

Sabra declared a $0.30 dividend on August 8, for shareholders of record as of August 17. It was paid out on August 31, so it is a while to wait for the next payment. The $0.30 per quarter level started in May 2020; before that it was $0.45, at least back to the beginning of 2018. Cash use for dividends would have been something under $70 million in the quarter. See also Sabra annual dividend history.

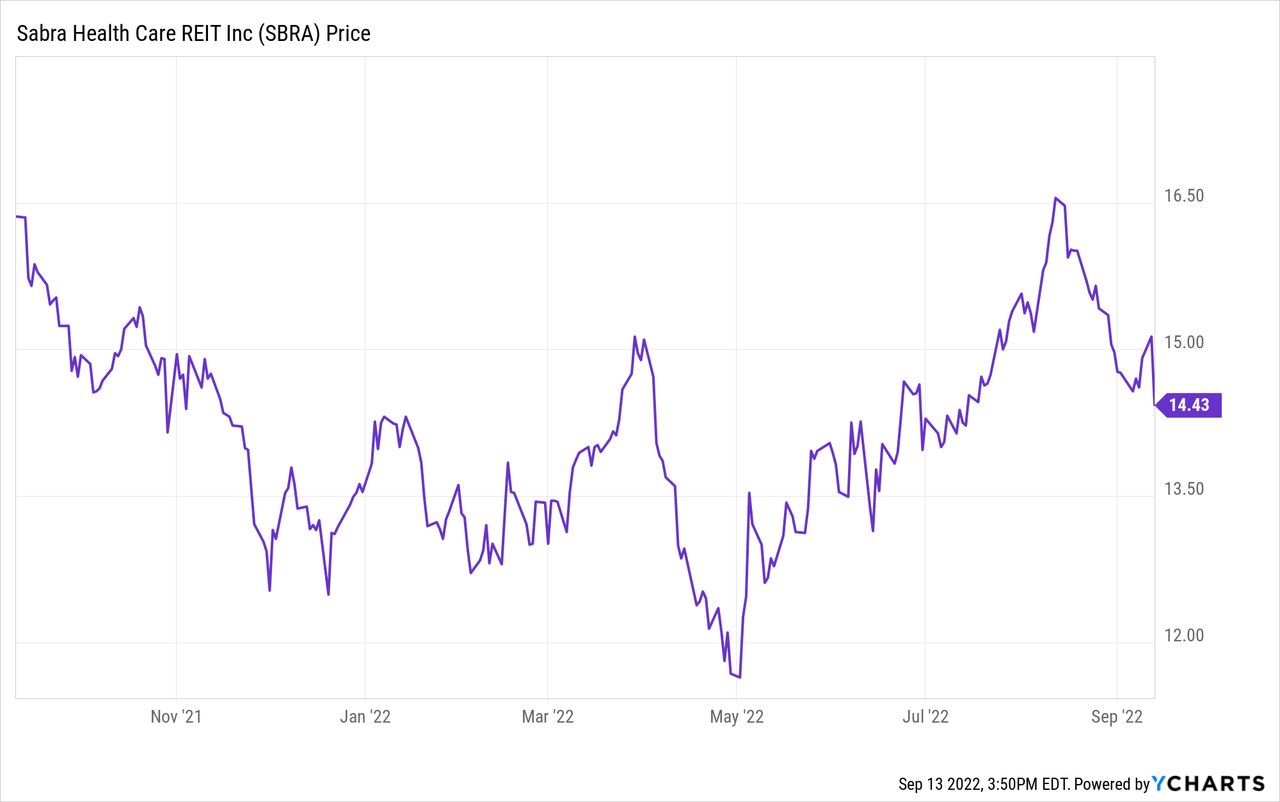

Assuming stability, at $1.20 per year and the closing stock price of $15.13 on September 13, 2022, the yield is 7.9%. The dividend payout in Q2 represented 79% of AFFO. But it was $0.23 per share over Q2 GAAP EPS, which is a caution. In April Fitch gave Sabra a BBB- credit rating, indicating it has an adequate ability to meet all financial commitments.

Given the aging populations of the U.S. and Canada, I see no reason demand for care for seniors will decline. There is uncertainty from costs, including the current high rate of inflation, versus trends in Medicaid payments for nursing providers. The Q2 press release included a table of FMAP (Federal Medical Assistance Percentages) Medicaid Add-On Status in key states. Given the shortage of slots for addicts, expanding in the addiction facilities space seems like a good strategy. Overall, I see income as reasonably stable and capable of covering the dividend under normal conditions. A truly detailed analysis would take into account the ability of the health companies that rent the facilities to keep up payments.

Conclusion

My view is that Sabra Health Care REIT is a dividend with low growth play. Since most of my portfolio is growth oriented with little or no dividend, I do not have a problem with that, as long as the dividend is 8% or so. If the price of the stock goes up and the dividend down, I would find it much less attractive, and vice versa. Whether Sabra is a Buy for other investors depends largely on the portfolio strategy being pursued.

At a higher level, before buying SBRA I should research other health care REITS. The real estate markets are generally in flux right now due to unknowns like future inflation rates and other macroeconomic trends. All companies in the REIT category may be affected by a trend, but by my being price-conscious and quality conscious, the downside can be minimized.

If you are a regular investor in REITS, please feel free to comment below on how you believe Sabra compares to other healthcare REITs. How healthcare REITs compare to other kinds of REITs is also a valid topic here.

Be the first to comment