PonyWang

A Quick Take On Wuxin Technology Holdings

Wuxin Technology Holdings Inc. (WXT) has filed to raise $33 million in gross proceeds from the sale of its Class A common stock in an IPO, according to an amended registration statement.

The company provides a variety of Internet of Things [IoT] semiconductor chips and related electronic smart products.

While the low nominal price of the stock may attract day traders seeking volatility, given the company’s slowing growth rate and ongoing regulatory risks of having substantially all of its operations in China, I’m on Hold for the IPO.

Wuxin Technology Overview

Shenzhen, China-based Wuxin was founded to develop technical solutions to network computing products for Internet of Things applications.

Management is headed by Chairman and CEO Mr. Lianqi Liu, who was previously involved in the design and construction of a number of wide area and customer premise networks in China.

The company’s primary offerings include:

-

Chips

-

Modules

-

Antennas

-

Controllers

-

Smart hardware

-

Smart household devices

-

Other smart products

-

Licensed IP

Wuxin has booked fair market value investment of $11.8 million as of December 31, 2021 from investors including a variety of senior management and investment companies.

Wuxin – Customer Acquisition

The company sells its products to a wide variety of customers and also provides related product design services to other manufacturers.

Wuxin also licenses its IP to companies seeking to incorporate the technology into their product or service plans.

Selling & Marketing expenses as a percentage of total revenue have risen slightly as revenues have increased, as the figures below indicate:

|

Selling and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended December 31, 2021 |

3.6% |

|

FYE June 30, 2021 |

3.2% |

|

FYE June 30, 2020 |

3.0% |

(Source – SEC)

The Selling & Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling & Marketing spend, dropped to 3.8x in the most recent reporting period, as the table shows below:

|

Selling and Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended December 31, 2021 |

3.8 |

|

FYE June 30, 2021 |

10.2 |

(Source – SEC)

Wuxin’s Market & Competition

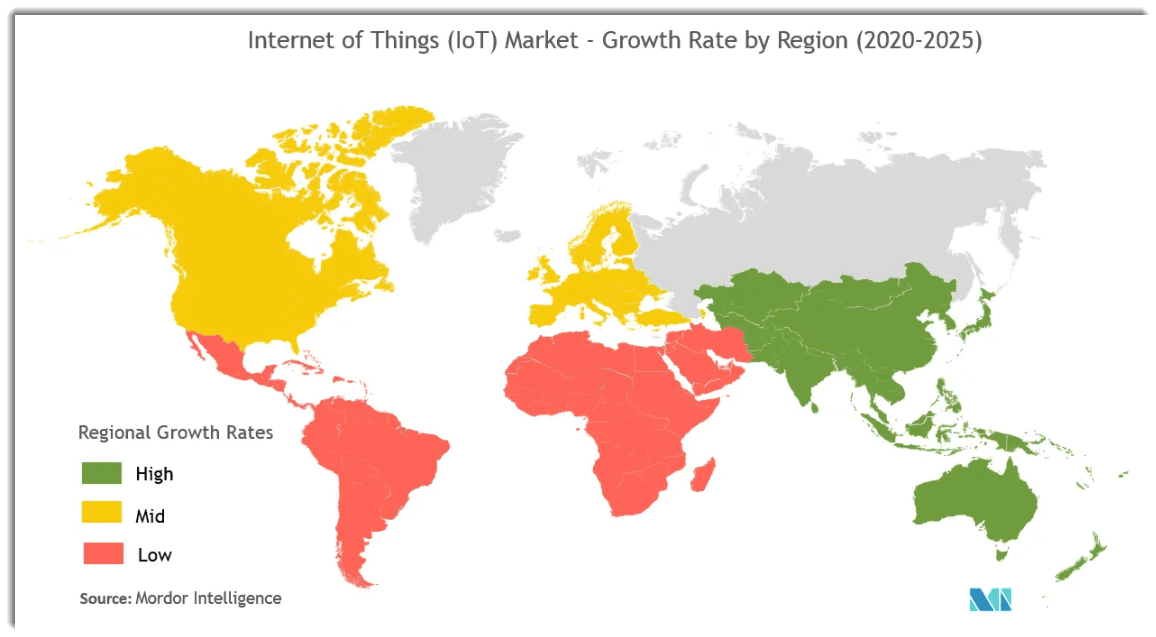

According to a 2020 market research report by Mordor Intelligence, the global market for IoT was valued at an estimated $761 billion in 2020 and is expected to reach $1.39 trillion in value by 2026.

This represents a forecast CAGR of 10.53% from 2021 to 2026.

The main drivers for this expected growth are an increasing adoption of IoT technologies across a wide range of industry verticals, including automotive, manufacturing and healthcare.

Also, a shift to manufacturing “Industry 4.0” is placing an emphasis on complementing and augmenting human labor with robotics to reduce accidents and increase efficiencies.

Regional growth rates are estimated in the chart below:

Global Internet Of Things Market (Mordor Intelligence)

Major competitive or other industry participants include:

-

Tuya Smart

-

Sunway Communication

-

Huizhou Shuobede Wireless Technology Co.

-

Shenzhen B&T Technology Co.

-

Harxon Corporation

-

Wunder Mobility

Wuxin Technology Holdings’ Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing gross profit and gross margin

-

Higher operating profit and margin

-

Reduced cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended December 31, 2021 |

$ 25,857,670 |

15.5% |

|

FYE June 30, 2021 |

$ 46,977,350 |

47.6% |

|

FYE June 30, 2020 |

$ 31,833,721 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended December 31, 2021 |

$ 11,317,878 |

35.4% |

|

FYE June 30, 2021 |

$ 15,025,075 |

52.3% |

|

FYE June 30, 2020 |

$ 9,863,152 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended December 31, 2021 |

43.77% |

|

|

FYE June 30, 2021 |

31.98% |

|

|

FYE June 30, 2020 |

30.98% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended December 31, 2021 |

$ 5,671,863 |

21.9% |

|

FYE June 30, 2021 |

$ 6,241,267 |

13.3% |

|

FYE June 30, 2020 |

$ 3,345,881 |

10.5% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended December 31, 2021 |

$ 6,198,573 |

24.0% |

|

FYE June 30, 2021 |

$ 7,705,333 |

29.8% |

|

FYE June 30, 2020 |

$ 3,816,426 |

14.8% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended December 31, 2021 |

$ 631,678 |

|

|

FYE June 30, 2021 |

$ 4,083,189 |

|

|

FYE June 30, 2020 |

$ 3,201,611 |

|

(Source – SEC)

As of December 31, 2021, Wuxin had $6.3 million in cash and $16.1 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021 was $5.4 million.

Wuxin Technology IPO Details

WXT intends to sell 6 million shares of Class A common stock at a proposed midpoint price of $5.50 per share for gross proceeds of approximately $33.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Class A ordinary shareholders will be entitled to one vote per share and Class B shareholders will have 10 votes per share the Chairman & CEO Mr. Liu will have voting control of the company immediately post-IPO.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $181.4 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 15.0%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

20% for research and development;

50% for investment in technology infrastructure, marketing and branding, and other capital expenditure; and

30% for other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently involved in any legal proceedings that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is Prime Number Capital.

Valuation Metrics For Wuxin Technology

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$220,000,000 |

|

Enterprise Value |

$181,438,997 |

|

Price / Sales |

4.36 |

|

EV / Revenue |

3.60 |

|

EV / EBITDA |

23.63 |

|

Earnings Per Share |

$0.20 |

|

Operating Margin |

15.22% |

|

Net Margin |

16.39% |

|

Float To Outstanding Shares Ratio |

15.00% |

|

Proposed IPO Midpoint Price per Share |

$5.50 |

|

Net Free Cash Flow |

$5,357,111 |

|

Free Cash Flow Yield Per Share |

2.44% |

|

Debt / EBITDA Multiple |

0.10 |

|

CapEx Ratio |

7.11 |

|

Revenue Growth Rate |

15.54% |

(Source – SEC)

Commentary About Wuxin Technology

WXT intends to raise U.S. investment to fund its general corporate expansion plans.

The firm’s financials have produced increasing topline revenue although at a slower rate of growth, higher gross profit and gross margin, elevated operating profit and margin but lower cash flow from operations.

Free cash flow for the twelve months ended December 31, 2021 was $5.4 million.

Selling and Marketing expenses as a percentage of total revenue has risen slightly as revenue has increased while its Selling and Marketing efficiency multiple fell to 3.8x in the most recent reporting period.

The firm paid dividends on its capital stock in 2021 but has not characterized its intentions to do so in the future.

WXT’s CapEx Ratio is 7.11x, which indicates it is spending lightly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for IoT technology solutions is large and expected to grow at a substantial rate of growth in the coming years, so the company has positive industry growth dynamics in its favor.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure, or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, most of which are located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Management has said that its auditor is in compliance with PCAOB inspection requirements, so the firm appears to not have exposure to potential delisting actions by the U.S.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Prime Number Capital is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (51.8%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the uncertain Chinese regulatory environment for technology companies, leaving the firm and investors at risk of sudden changes in the company’s status.

As for valuation, management is asking IPO investors to pay an EV/Revenue multiple of 3.6x, which is not pricey given the firm’s growth rate, positive earnings and cash flow.

However, the company’s topline revenue growth rate is slowing significantly, while cash flow from operations has dropped considerably.

While the low nominal price of the stock may attract day traders seeking volatility, given the company’s slowing topline growth rate and ongoing regulatory risks of having substantially all of its operations in China, I’m on Hold for the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment