georgeclerk/iStock via Getty Images

Capstone Copper Corp. (OTCPK:CSCCF) recently announced a potential increase in the life of the Mantos Blancos project, and continues to successfully develop the Mantoverde mine. I conducted research on the company’s most relevant mines, and obtained a fair valuation for Capstone Copper. Even considering political risk, accidents, and changes in the price of copper, I believe that the company is too cheap at the current market price.

Capstone Copper

Capstone Copper produces copper and silver thanks to mines in the United States and Mexico as well as a project in Chile. Capstone’s main projects were highlighted on the company’s website with the following words:

Company’s Website

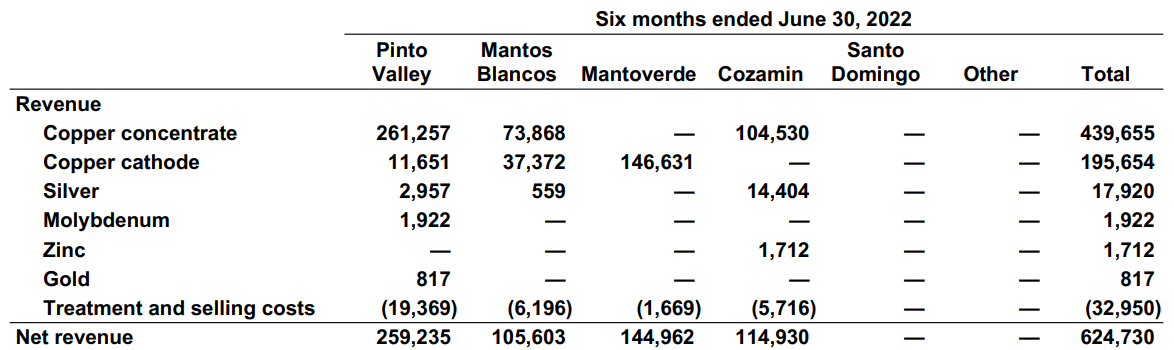

Capstone Copper reports that four of the company’s mines are currently producing a combination of copper concentrate, copper cathode, silver, zinc, gold, and other minerals. The most valuable and most relevant products are copper concentrate and copper cathode. I wanted to keep things as simple as possible, so I assessed the valuation of the company by forecasting only future production of copper concentrate and copper cathode.

2022 Q2 Report to Shareholders

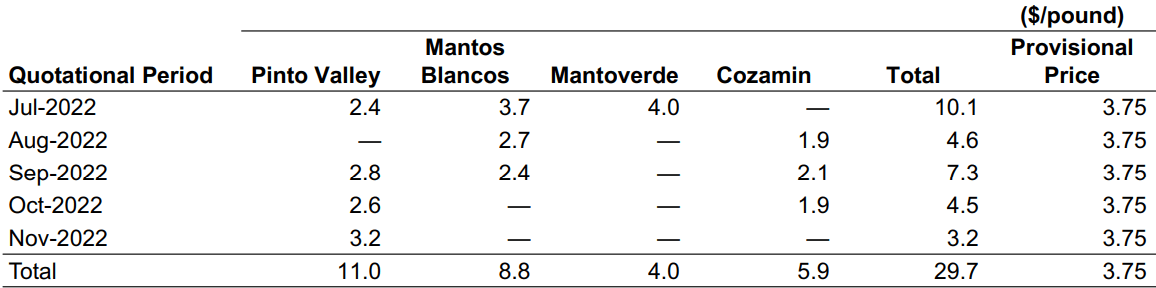

In July 2022, the price of copper concentrate was close to $3.75 per pound. I wanted to make conservative assumptions, so I used a price of less than CAD 4.79 per pound in my financial models.

2022 Q2 Report to Shareholders

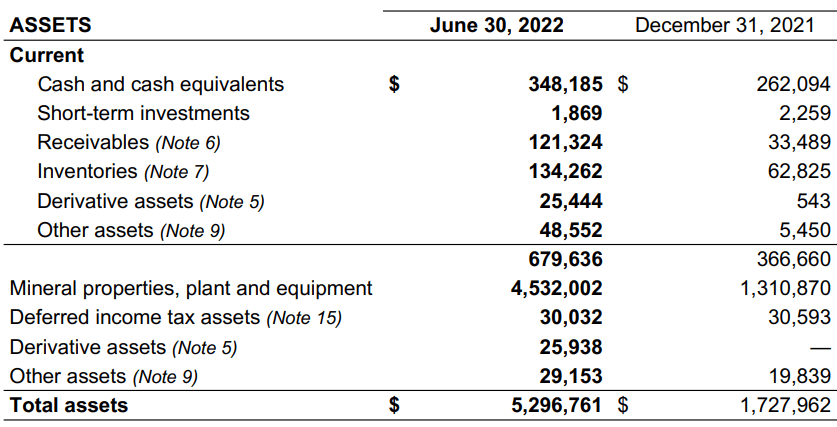

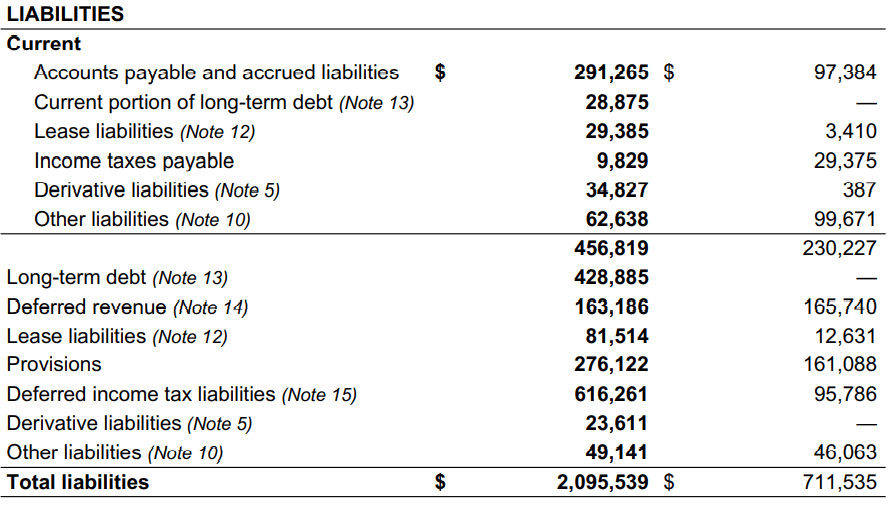

Balance Sheet

As of June 30, 2022, Capstone Copper reported $348 million in cash, $5.2 billion in total assets, and $2 billion in total liabilities. In my view, the financial situation appears quite beneficial.

2022 Q2 Report to Shareholders

Capstone Copper will most likely need equity financing or more debt for its capex. Right now, the net debt is $242 million, which, in my view, is not worrying. In three or four years, I believe that Capstone Copper will likely report free cash flow of more than CAD 400 million, so the total amount of debt seems small. Bankers will likely offer more debt financing to Capstone Copper if necessary.

2022 Q2 Report to Shareholders

My Base Case Scenario Includes A Valuation Of CAD 4.07 Per Share

I assumed that under normal circumstances, the development of Mantos Blancos Concentrator would help increase production in the mine. Let’s note that the company expects an increase in recoveries from Q3 2022.

Mantos Blancos Concentrator Debottlenecking Project is ramping up to design capacity to achieve targeted throughput rates and recoveries in Q3 2022. Source: Q2 Report to Shareholders

Management is discussing an increase in the life of copper cathode production. If the Mantos Blancos project produces more copper for a longer period of time, investment analysts will likely increase the target valuation for the company. The stock price would likely increase:

As part of the Mantos Blancos Phase II Project we are also evaluating the potential to extend the life of copper cathode production. A pre-feasibility study on the Mantos Blancos Phase II Project was completed in Q2 2022 which will be incorporated into an Advanced Basic Engineering Study in Q4 2022. Source: Q2 Report to Shareholders

Besides, the Mantoverde mine, which is far from being completed, is progressing well. In my view, as the company continues to offer further information about the development of this mine, more investors will take a look at the mine. More production will likely bring more revenue and more market capitalization:

Mantoverde Development Project remains on schedule and on budget. Major construction is progressing well on the primary crusher, concentrate thickener and tie-in of the water desalination plant. Procurement, contracts and engineering are over 99% complete, with manufacturing and fabrication approximately 95% complete. Overall project completion was 60% as of the end of July 2022. Source: Q2 Report to Shareholders

In order to obtain the valuation of the company, I assessed separately the total expected production of each mine. Using the total production of copper concentrate and cathode, I made several assumptions with respect to the future price to obtain the total revenue.

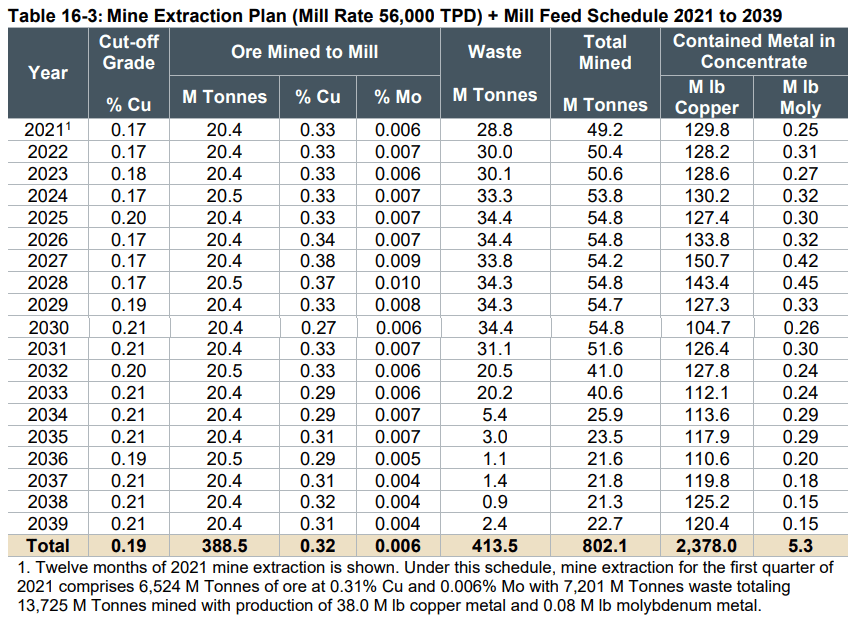

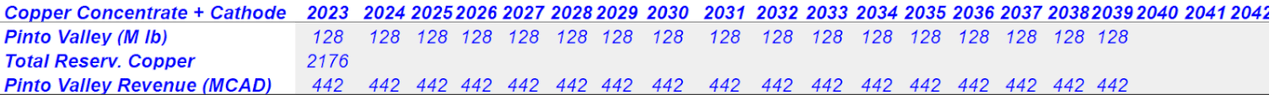

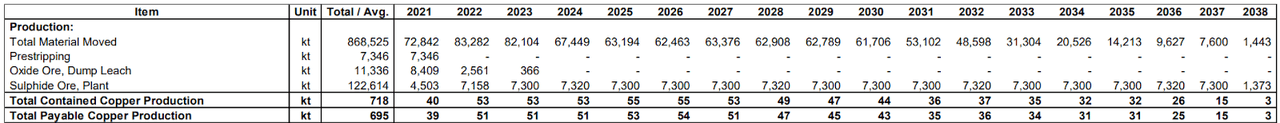

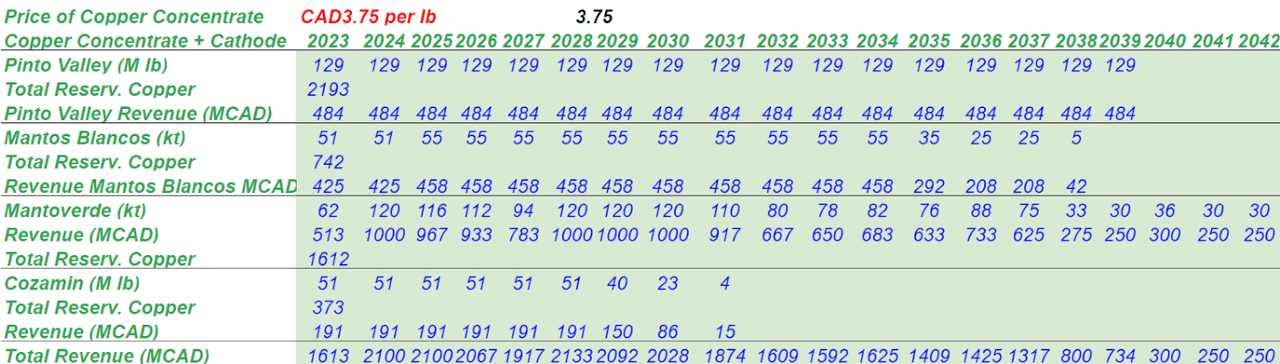

According to the technical report on the Pinto Valley mine in Arizona, Capstone Copper expects to produce copper from 2022 to 2039. Concentrate production is expected to be close to 128 million pounds per year. My numbers are shown in blue in the table below. They include an assumption of CAD 3.45 per pound.

NI 43 101 Technical-Report

Author’s Work

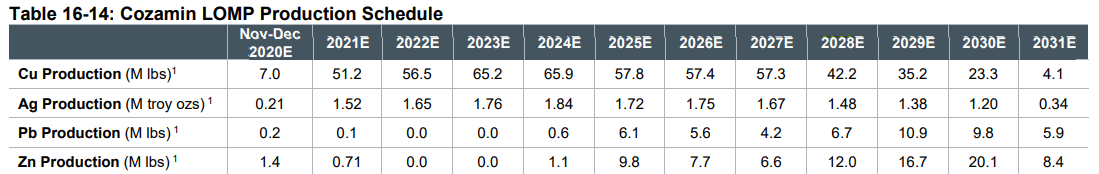

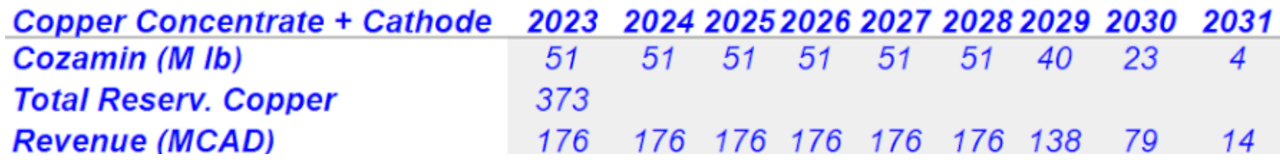

Under normal circumstances, from 2022 to 2031, Cozamin will likely produce close to 65-23 million pounds. Under my own assumptions in this case scenario, I would say that revenue could stand at approximately CAD 176 million per year.

Author’s Work

Author’s Work

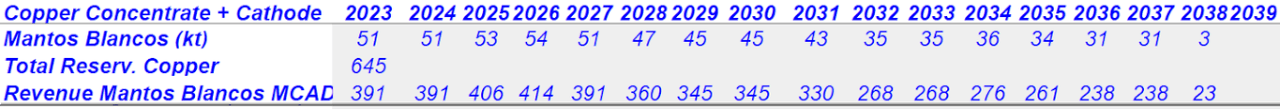

Mantos’s technical report includes copper production close to 51 kt from 2022 to 2038. With approximately the same figures, I obtained revenue close to CAD 391-CAD 238 million per year.

Mantos Blancos Technical Report

Author’s Work

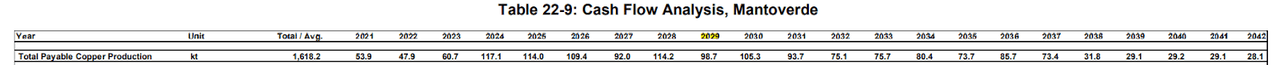

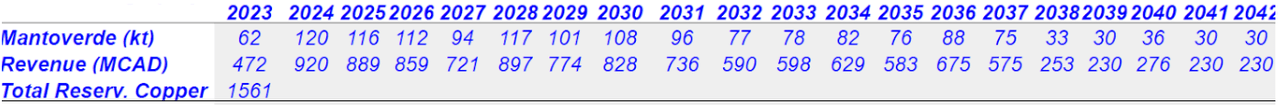

Mantoverde’s production is expected to be close to 117 kt in 2024. From 2022 to 2024, the increase in production will grow significantly, which will likely have a beneficial impact on the company’s revenue. In my view, only investors researching the production plans and the technical reports very carefully will know about the incoming increase in production. My financial models include an increase from CAD 472 million in 2023 to about CAD 920 million in 2024.

Mantoverde Technical Report May 2021

Author’s Work

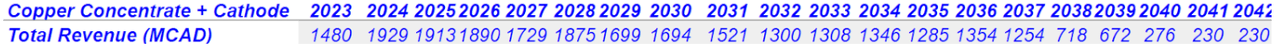

By summing my expected revenue figures from all the mines, I obtained an acceleration of revenue growth from 2024. My figures are a bit lower than that of other analysts because I am not including the production of gold, zinc, or other minerals. Under this scenario, I also did not assume that new exploratory work will increase Capstone’s mineral reserves. With more mineral reserves and production of minerals other than copper, revenue would be larger, and the company’s fair price would likely be larger too.

Author’s Work

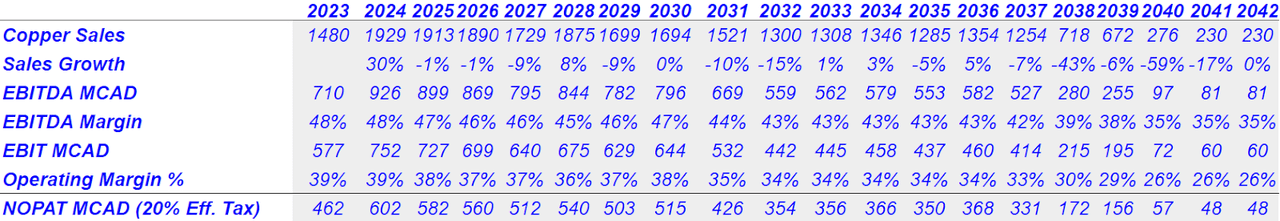

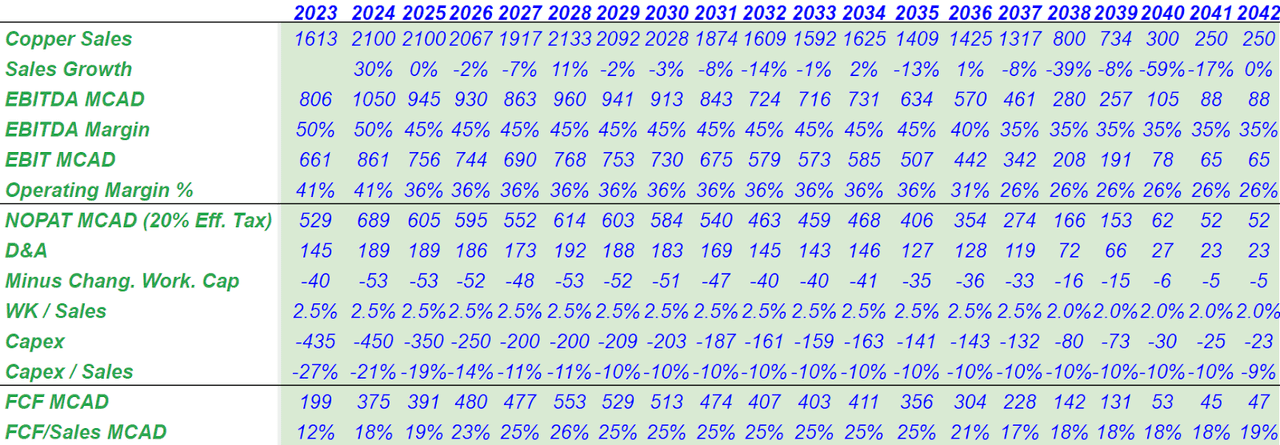

Assuming an EBITDA margin around 48% and 35%, an effective tax rate of 20%, and operating margin close to 39% and 26%, I obtained 2024 NOPAT close to $602 million. Note that without new exploration, in 2042, Capstone Copper would have produced all its reserves of copper.

Author’s Work

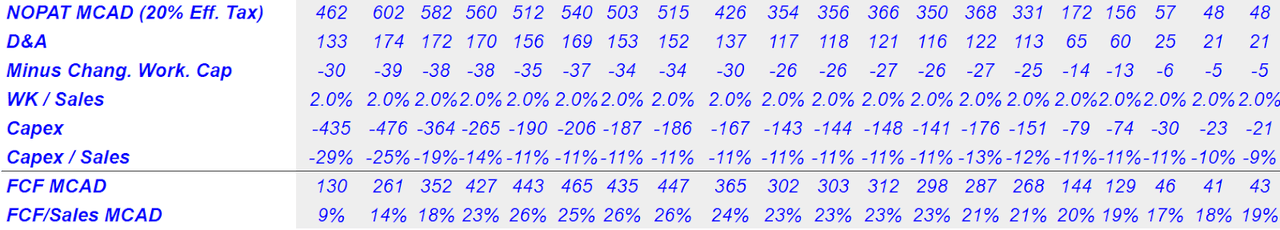

Assuming conservative changes in working capital and relevant capital expenditures in the next five years, the FCF/Sales ratio would stand at close to 14% and 26%. We would be talking about a FCF of CAD 352 million in 2025.

Author’s Work

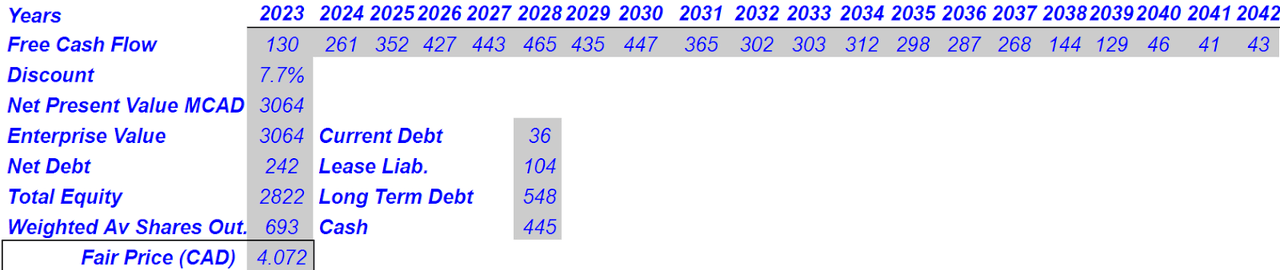

I assumed a discount of 7.7%, which is close to the rate used by experts in most technical reports I had a look at. The NPV of future FCF would be close to CAD 3 billion. Subtracting debt and adding cash of CAD 445 million, I obtained the implied equity valuation, which should not be far from CAD 2.8 billion. Finally, with weighted average shares outstanding of 693 million, the fair price stands at CAD 4.07 per share.

Author’s Work

Best Case Scenario

Under optimistic conditions, I used a price of copper concentrate of CAD 3.75 per pound. I also increased the production in the Pinto Valley and Mantos Blancos mines to include the result of exploratory work. The results include 2023 sales of CAD 1.55 billion and 2024 revenue of CAD 2.1 billion. These figures are slightly better than that in the previous case scenario, but they are very realistic.

Author’s Work

Under this case, I used changes in working capital/sales close to 2.5% and lower capex than in the previous case scenario. The EBITDA margin would also reach 50% in 2023. The results include 2028 FCF close to CAD 553 million, and a FCF/Sales ratio between 12.3% and 25%.

Author’s Work

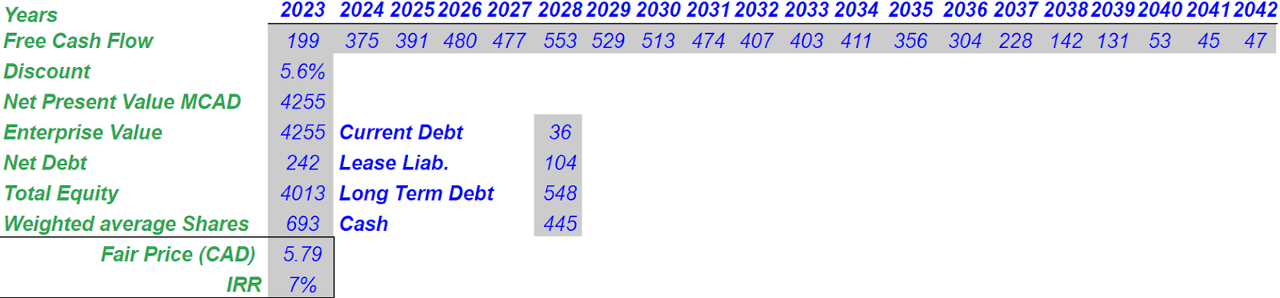

If we sum everything and use an optimistic discount of 5.55%, the net present value of future free cash flow stands at almost CAD 4.25 billion. The equity valuation would be CAD 4.01 billion, and the fair price would stay at around CAD 5.

Author’s Work

Risk Factors

Capstone Copper could suffer a significant number of inconveniences that usually affect the mining business model. Accidents, wildfires, labor disruptions, flooding, or accidental explosions would lower future production, and may damage the free cash flow line.

Reputational damage could lead shareholders to leave the company, or authorities may stop the company’s operations. Under these circumstances, I believe that the stock price would decline significantly.

Capstone’s operations are subject to all the hazards and risks normally encountered in the exploration, development, construction, care and maintenance activities and production of copper and other metals, including, without limitation, workplace accidents, fires, wildfires, power outages, labor disruptions, port blockages, flooding, mudslides, explosions, cave-ins, landslides, ground or stope failures, tailings dam failures and other geotechnical instabilities. Source: Q2 Report to Shareholders

A significant decrease in the price of copper or other metals extracted by Capstone Copper could make Capstone’s mines unprofitable. If shareholders decide that they can’t extract minerals to obtain positive free cash flow, management may decide to lower production or even close certain mines. As a result, if journalists notice the decline in production, the stock price may decline substantially.

Depending on the expected price for any minerals produced, Capstone Copper may determine that it is impractical to continue commercial production at the Mantos Blancos Mine, Mantoverde Mine, Pinto Valley Mine or the Cozamin Mine, or to develop the Santo Domingo Project. A reduction in the market price of copper, zinc, gold, silver, or iron may prevent Capstone Copper’s properties from being economically mined or result in the write-down of assets whose value is impaired as a result of low metals prices. Source: Q2 Report to Shareholders

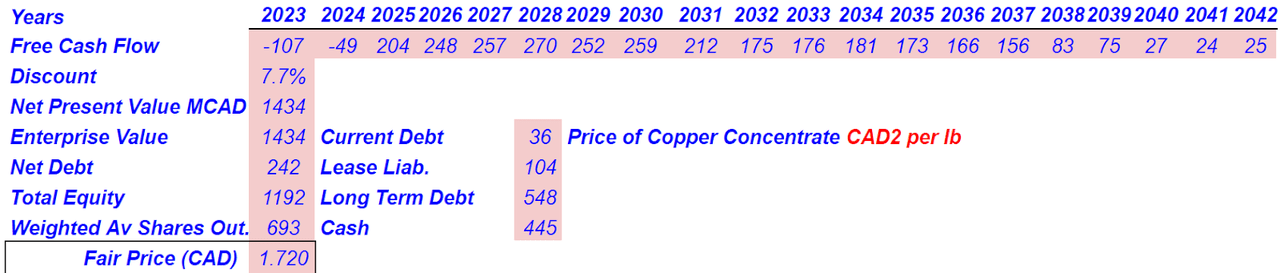

Let’s just give an example of the company’s copper price sensitivity. Under the conditions of the base case scenario, if we assume a copper concentrate price of CAD 2 per pound, the sum of free cash flows would lead to a stock price of CAD 1.72.

Author’s Work

Capstone Copper operates in many countries where political instability could harm the company’s operations. In the last quarterly report, management warned about an eventual increase in taxes in Chile, or violence and work stoppages in Mexico. Finally, management also warned about the consequences of President Biden’s Made in America Tax Plan:

There may be additional risks and uncertainties following Chilean Presidential, Chamber and Senate elections. Although the government’s legislative agenda is not yet fully known, it is known to include a tax reform as a priority. Source: Q2 Report to Shareholders

Local economic conditions, including but not limited to higher incidences of criminal activity and violence in areas, such as Mexico can also adversely affect the security of our people, operations and the availability of supplies. Source: Q2 Report to Shareholders

There are uncertainties related to President Biden’s Made in America Tax Plan which proposes corporate tax reforms that may increase Pinto Valley’s future tax obligations. Source: Q2 Report to Shareholders

Conclusion

Capstone Copper is discussing an increase in the life of the Mantos Blancos project. Management recently noted that the development of the Mantoverde mine is going in the right direction. Using this information, I calculated the NPV of the company’s mines, and obtained a combined valuation that is significantly higher than the stock market valuation. Yes, there are risks from variation of the copper price in the market, accidents in the mines, and political instability. However, in my view, the current price is too low.

Be the first to comment