kohei_hara/E+ via Getty Images

A Quick Take On Hengguang Holding Co.

Hengguang Holding Co. (HGIA) has filed to raise $20 million from the sale of its Class A ordinary shares in an IPO, according to an amended registration statement.

The company provides insurance distribution services via its online and offline networks in China.

HGIA has produced contracting revenue in multiple reporting periods, so management hasn’t demonstrated that it can actually grow the business. It faces uncertain regulatory developments as many Chinese companies do, so I’m on Hold for the IPO.

Company

Chengdu, China-based Hengguang, was founded to become a full-service offline and digital insurance distribution provider in China.

The firm operates from 48 branch offices in 15 provinces within China.

Management is headed by Chairman and CEO Zhang Jiulin, who has been with the firm since inception in 2004 and was previously Sales Director of the Zijin Property Insurance Co.

The company’s primary offerings include:

-

Property and casualty insurance distribution

-

Life and health insurance distribution

Hengguang has booked fair market value investment of $7.2 million as of June 30, 2021, from investors, including Haibo Bai, Xuefeng Huang and Chairman Zhang.

Hengguang – Customer Acquisition

The firm seeks client relationships with Chinese insurance carriers for its offline and online distribution capabilities.

HGIA has relationships with more than 70 insurance carriers and gets paid primarily via commissions and fees upon each successful insurance coverage sale.

Selling expenses as a percentage of total revenue have risen as revenues have decreased, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2021 |

11.4% |

|

2020 |

11.2% |

|

2019 |

4.0% |

(Source – SEC)

The Selling efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Selling spend, fell to negative (2.2x) in the most recent reporting period, as shown in the table below:

|

Selling |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2021 |

-2.2 |

|

2020 |

-0.7 |

(Source – SEC)

Hengguang’s Market & Competition

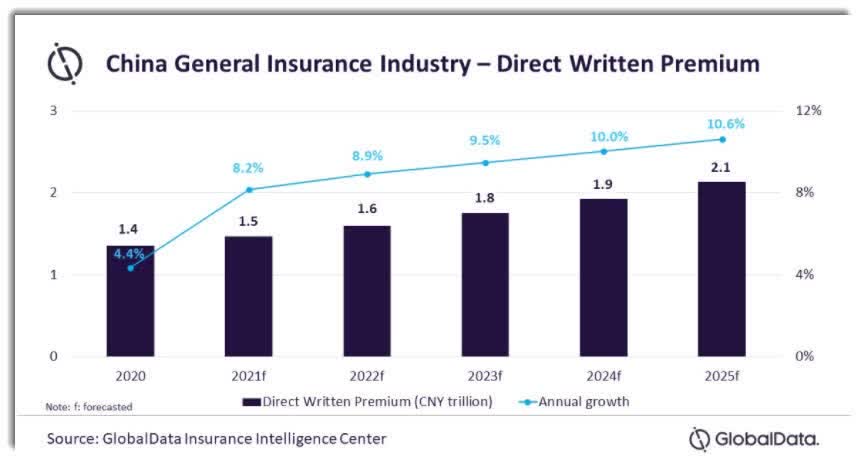

According to a 2021 market research report by GlobalData, the Chinese market for general insurance lines was an estimated $197 billion in 2020 and is forecast to reach $313 billion in 2025.

This represents a forecast CAGR of 9.5% from 2020 to 2025.

The main drivers for this expected growth are an increase in the use of auto insurance, which accounted for nearly 61% of direct written premiums in 2020.

Also, below shows the projected future growth trajectory of China’s general insurance industry (direct written premium) from 2020 to 2025:

China General Insurance Industry (GlobalData)

(Source)

There are thousands of professional insurance intermediary firms in China, including insurance agencies, brokers and insurance adjustment firms.

Additionally, there are numerous offline and online ancillary insurance agencies that refer clients to insurance carriers, including postal offices, airlines, commercial banks and automobile dealerships.

Hengguang Holding Co. Financial Performance

The company’s recent financial results can be summarized as follows:

-

Contracting topline revenue

-

Reduced gross profit and variable gross margin

-

Increasing operating losses

-

A swing to cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2021 |

$ 8,878,424 |

-20.0% |

|

2020 |

$ 21,883,400 |

-6.8% |

|

2019 |

$ 23,479,380 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2021 |

$ 1,532,056 |

-11.0% |

|

2020 |

$ 3,492,310 |

-19.6% |

|

2019 |

$ 4,341,794 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2021 |

17.26% |

|

|

2020 |

15.96% |

|

|

2019 |

18.49% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2021 |

$ (848,365) |

-9.6% |

|

2020 |

$ (422,841) |

-1.9% |

|

2019 |

$ 2,465,699 |

10.5% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2021 |

$ (434,659) |

-4.9% |

|

2020 |

$ 402,455 |

4.5% |

|

2019 |

$ 2,759,676 |

31.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2021 |

$ (1,317,750) |

|

|

2020 |

$ 892,769 |

|

|

2019 |

$ 3,590,899 |

|

(Source – SEC)

As of June 30, 2021, Hengguang had $3.9 million in cash and $2.2 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2021, was negative ($1.1 million).

Hengguang IPO Details

HGIA intends to sell 4.44 million shares of Class A ordinary stock at a proposed midpoint price of $4.50 per share for gross proceeds of approximately $20 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Class A stockholders will be entitled to one vote per share, and Class B shareholders will have 10 votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $41 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 30.77%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

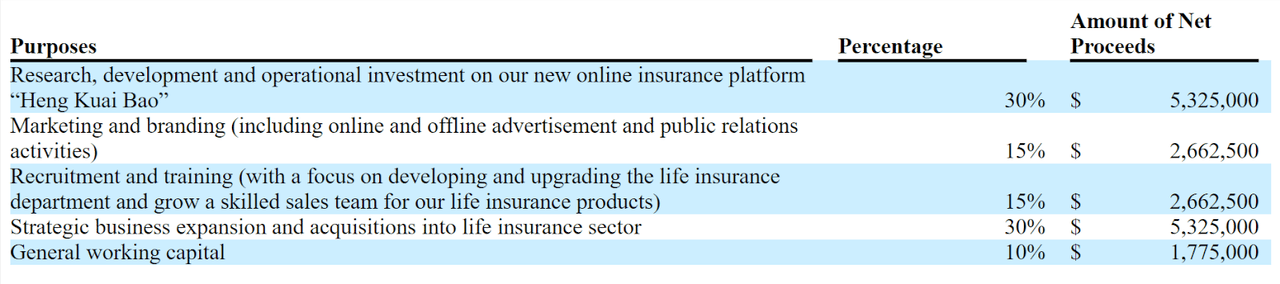

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

Use of Proceeds (SEC EDGAR)

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the firm received a demand letter from a consulting company that asserted a 5% ownership interest in the company in return for services previously provided. Management believes the claim is ‘baseless and plans to defend itself…should the threatened demand letter develop into a legal action.’

The sole listed underwriter of the IPO is Network 1 Financial Securities.

Valuation Metrics For HGIA

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$64,999,998 |

|

Enterprise Value |

$40,608,353 |

|

Price / Sales |

3.31 |

|

EV / Revenue |

2.07 |

|

EV / EBITDA |

-30.05 |

|

Earnings Per Share |

-$0.02 |

|

Operating Margin |

-6.87% |

|

Net Margin |

-1.45% |

|

Float To Outstanding Shares Ratio |

30.77% |

|

Proposed IPO Midpoint Price per Share |

$4.50 |

|

Net Free Cash Flow |

-$1,050,313 |

|

Free Cash Flow Yield Per Share |

-1.62% |

|

Revenue Growth Rate |

-20.03% |

|

(Glossary Of Terms) |

(Source – SEC)

Commentary About Hengguang

HGIA wants to access U.S. capital market funding to invest in further development of its platform and for its general corporate expansion plans.

The company’s financials have shown reduced topline revenue, lowered gross profit and variable gross margin, higher operating losses and a swing to cash used in operations.

Free cash flow for the twelve months ended June 30, 2021, was negative ($1.1 million).

Selling expenses as a percentage of total revenue have risen as revenue has decreased and its Selling efficiency multiple worsened to negative (2.2x) in the most recent reporting period.

The firm currently plans to pay no dividends on its capital stock and anticipates that it will use any future earnings to reinvest back into the business.

The market opportunity for providing insurance distribution services in China is large, but the industry is highly fragmented as well as contains large Internet platforms as competition.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

Network 1 Financial Securities is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (78.1%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the negative and unpredictable regulatory environment from the Chinese government, which can impact the firm’s business operations and its listing viability.

And the firm has produced contracting revenue in multiple reporting periods, so management hasn’t demonstrated that it can actually grow the business, so I’m on Hold for the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment