gorodenkoff

A Quick Take On Acrivon Therapeutics

Acrivon Therapeutics (ACRV) intends to raise $100 million from the sale of its common stock in an IPO, according to an amended registration statement.

The company is developing a drug candidate for the treatment of various cancer conditions.

Given the additional co-approval risk and waiting period before a potential catalyst, my outlook on the Acrivon IPO is on Hold.

Acrivon Overview

Watertown, Massachusetts-based Acrivon Therapeutics was founded to develop a platform (AP3) that overcomes various limitations of gene-based patient selection methods, promising to improve patient outcomes.

Management is headed by President, Chairman and CEO, Peter Blume-Jensen, M.D., Ph.D., who has been with the firm since 2018 and was previously Chief Scientific Officer at XTuit Pharmaceuticals and the same position at Metamark Genetics.

The firm’s lead candidate, ACR-368, is a selective small molecule inhibitor being developed for a number of cancers and is currently in Phase 2 trials.

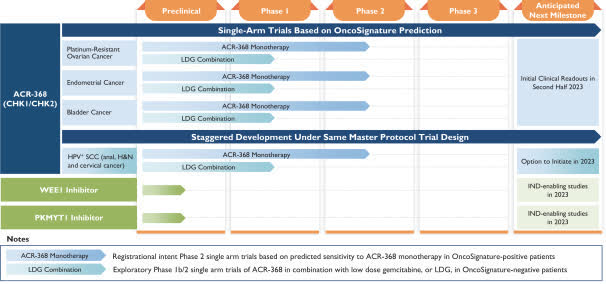

Below is the current status of the company’s drug development pipeline:

Company Pipeline Status (SEC)

Acrivon has booked a fair market value investment of $122.5 million as of December 31, 2021 from investors including Chione Limited, RA Capital Management, Perceptive Life Sciences, Citadel, Wellington Biomedical, and Sands Capital Life Sciences.

Acrivon’s Market & Competition

According to a 2018 market research report by BCC Research, the global market for ovarian cancer therapeutics was an estimated $2.1 billion in 2017 and is forecast to reach $2.9 billion by 2022.

This represents a forecast CAGR (Compound Annual Growth Rate) of 7.1% from 2017 to 2022.

Key elements driving this expected growth are a growing incidence of cancers as global populations age and immune system performance is reduced.

Also, new drug classes are expected to be approved, with five new drugs expected to be approved by 2028.

However, the growth in use of biosimilar products and generics will likely act as a drag on growth of the market’s total dollar value over time.

Notably, the GlobalData estimate for the ovarian cancer market has a much higher estimate, with the market forecast to reach $6.7 billion by 2028.

Major competitive vendors that provide or are developing related treatments include:

-

Sierra Oncology

-

AstraZeneca

-

Merck

-

Zentalis

-

Debiopharm

-

Impact Therapeutics

-

Repare Therapeutics

-

Shouya Holdings

-

Others

Acrivon Therapeutics’ Financial Status

The firm’s recent financial results are typical of a clinical-stage biopharma in that they feature no revenue and substantial R&D and G&A expenses associated with its development efforts.

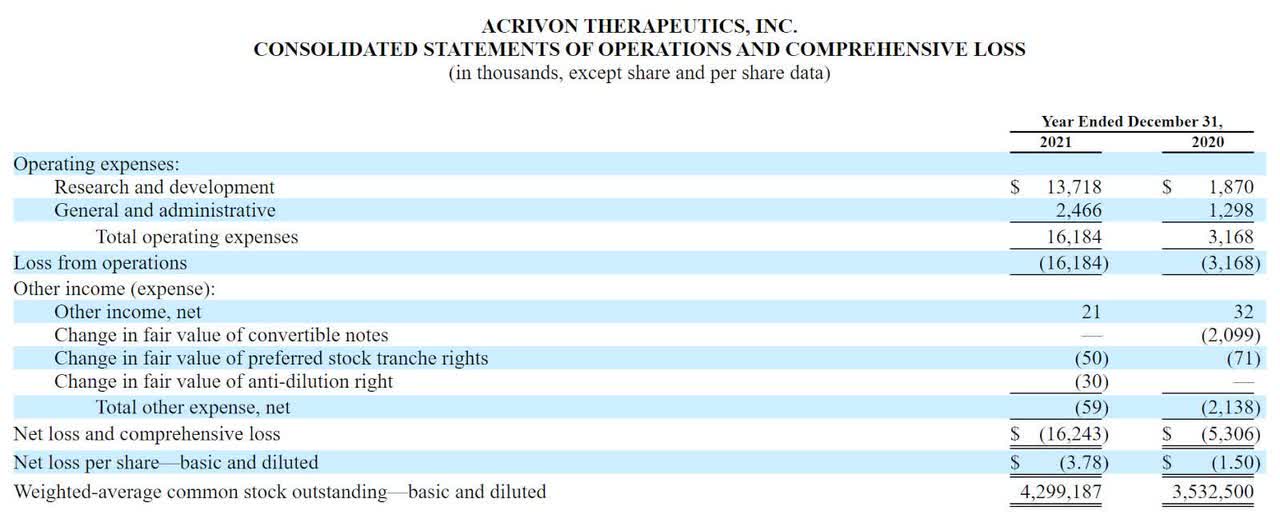

Below are the company’s financial results for the past two years:

Statement Of Operations (SEC EDGAR)

As of December 31, 2021, the company had $99.6 million in cash and $7.9 million in total liabilities.

Acrivon’s IPO Details

ACRV intends to sell 5.9 million shares of common stock at a proposed midpoint price of $17.00 per share for gross proceeds of approximately $100.3 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $145.5 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 31.4%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $80.0 million to $90.0 million to fund the advancement of ACR-368, including CMC and companion diagnostic development, in Phase 2 clinical trials across our three lead indications into potential registrational phase, pending the results and discussions with the FDA, as well as to potentially initiate Phase 2 trials in patients with HPV+ tumors;

approximately $15.0 million to $20.0 million to complete IND-enabling studies for at least one of our preclinical programs; and

the remainder for continued development of our AP3 platform, other research and development activities, working capital and other general corporate purposes.

Based on our current operational plans and assumptions, we expect our cash and cash equivalents, together with the net proceeds from this offering, will be sufficient to fund our operating expenses and capital expenditure requirements at least into the fourth quarter of 2024. We believe that the net proceeds from this offering, together with our existing cash and cash equivalents as of June 30, 2022, will be insufficient to fund any of our drug candidates through regulatory approval, and we anticipate needing to raise additional capital to complete the development of and commercialize our drug candidates.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not presently the target of any material legal proceedings.

Listed bookrunners of the IPO are Morgan Stanley, Jefferies, Cowen, and Piper Sandler.

Commentary About Acrivon Therapeutics

ACRV is seeking U.S. public capital market investment to advance its primary candidate through Phase 2 trials.

The firm’s lead candidate, ACR-368, is a selective small molecule inhibitor being developed for a number of cancers and is currently in Phase 2 trials.

The market opportunities for the various cancers ACR-368 is targeting are large and expected to grow materially in the years ahead as the global population ages and is subject to a rising incidence of cancer due to reduced immune system function.

Management hasn’t disclosed any major pharma firm collaboration while the company’s investor syndicate includes notable life science venture capital firm investors.

Morgan Stanley is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (33.5%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

As for valuation, management is asking IPO investors to pay an Enterprise Value that is well below the typical range for a clinical-stage biopharma firm at IPO.

A substantial risk for the firm’s primary drug candidate is the ‘co-approval of the OncoSignature test as a companion diagnostic test.’

Also, its first clinical readouts will not be available until late 2023 at the earliest, so investors in the IPO would need to be quite patient.

Given the additional co-approval risk and waiting period before a potential catalyst, my outlook on the Acrivon IPO is on Hold.

Expected IPO Pricing Date: November 9, 2022.

Be the first to comment