peshkov/iStock via Getty Images

Introduction

There are numerous funds that “own” commodities, which do well when demand outstrips supply, like in today’s world. Supply issues started with the economic shutdowns initiated to fight COVID that interrupted tightly coordinated international trade routes. The world was adjusting and then China’s “Zero COVID” policy shutdown a major exporting terminal, the port of Shanghai. This is again limiting many manufactured goods or critical components.

Then Putin’s war on Ukraine shut down a leading country for grains and other important inputs companies depended on. Boycotts and the possible embargo of Russian fossil fuels have pushed oil prices into triple digits for the first time since 2014.

Government policies and COVID fears have hurt companies’ ability to expand or even maintain previous production levels, as finding employees is still a challenge. Massive amounts of government checks now fuel demand in a world of scarcity, an ideal situation for the inflation the world is experiencing now.

Funds like the iPath Bloomberg Commodity Index Total Return ETN (NYSEARCA:DJP) attempt to keep investors “whole” by investing in critical inputs that drive the world’s manufacturing economy or feed its population.

Exploring The iPath Bloomberg Commodity Index Total Return ETN

The managers provide this overview of the ETN:

The iPath® Bloomberg Commodity Index Total ReturnSM ETNs (the “ETNs”) are designed to provide exposure to the Bloomberg Commodity Index Total ReturnSM (the “Index”). The ETNs are riskier than ordinary unsecured debt securities and have no principal protection. The ETNs are unsecured debt obligations of the issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of or guaranteed by any third party. Any payment to be made on the ETNs, including any payment at maturity or upon redemption, depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due. An investment in the ETNs involves significant risks , including possible loss of principal, and may not be suitable for all investors.

The Index reflects the returns that are potentially available through an unleveraged investment in futures contract on physical commodities comprising the Index plus the rate of interest that could be earned on cash collateral invested in specified Treasury Bills. The Index is a rolling index that is rebalanced annually. Owning the ETNs is not the same as owning interests in the commodities futures contracts comprising the Index or a security directly linked to the performance of the Index. For additional information regarding the risks associated with the ETNs, please see “Selected Risk Considerations” below.

Source: ipathetn.barclays

I checked out the “Selected Risk Considerations” and the four listed were standard for most investments, except for the reminder that this ETN is only as strong as the Barclays Bank backing it.

The Seeking Alpha description adds some more details to the above:

The note seeks to track the performance of the Bloomberg Commodity Index Total Return. The index represents the commodity markets. It comprises of future contracts on commodities which include aluminum, coffee, copper, corn, cotton, crude oil (WTI and Brent), gold, ULS diesel, lean hogs, live cattle, natural gas, nickel, silver, soybeans, soybean meal, soybean oil, sugar, unleaded gasoline, wheat, and zinc. The ETN will mature on June 12, 2036.

Source: seekingalpha.com DJP

DJP has $1.3b in assets and comes with a 70bps expenses cost. DJP currently makes no distributions.

Understanding The Index Construction Process

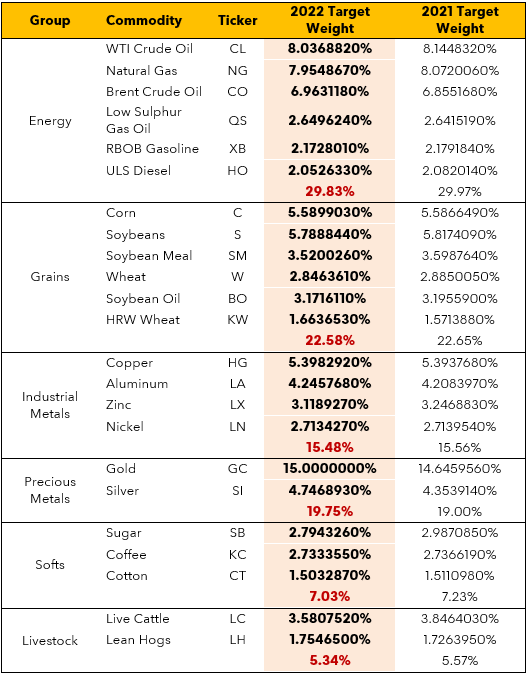

bloomberg.com index-2022-target-weights

Each year around November, Bloomberg resets the weights used in their Index. The same document provided guidance to the weighting rules.

- Liquidity and production data in a 2:1 ratio and are subject to the following requirements regarding capping and diversification:

- No sector weight can exceed 33%

- The aggregate weight for each single commodity and its derivatives cannot exceed 25%

- No single commodity weight can exceed 15%

The following criteria were provided by the Index Methodology document:

The value of the Index is computed on the basis of hypothetical investments in the basket of commodities that make up the Index. The Index embodies four main principles in its design:

- Economic Significance: A commodity index should fairly represent the importance of a diversified group of commodities to the world economy. To achieve a fair representation, BCOM uses both liquidity data and U.S.-dollar-weighted production data in determining the relative quantities of included commodities.

- Diversification: A second major goal of BCOM is to provide diversified exposure to commodities as an asset class. Disproportionate weighting of any particular commodity or sector increases volatility and negates the concept of a broad-based commodity index. This is where the above capping percent are used.

- Continuity: A third goal of BCOM is to be responsive to the changing nature of commodity markets in a manner that does not completely reshape the character of the Index from year to year. BCOM is intended to provide a stable benchmark.

- Liquidity: Another goal of BCOM is to provide a highly liquid index, suitable for institutional investment. The explicit inclusion of liquidity as a weighting factor helps to ensure that BCOM can accommodate substantial investment flows.

DJP Holdings Review

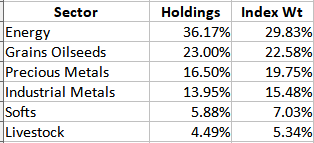

Multiple sources; compiled by Author

The increase in the weight of Energy compared to the initial Index weights set last November reflects how strong they have been in 2022. Despite the concerns that the war in the Ukraine will have on grain supplies, that weighting hasn’t moved as much.

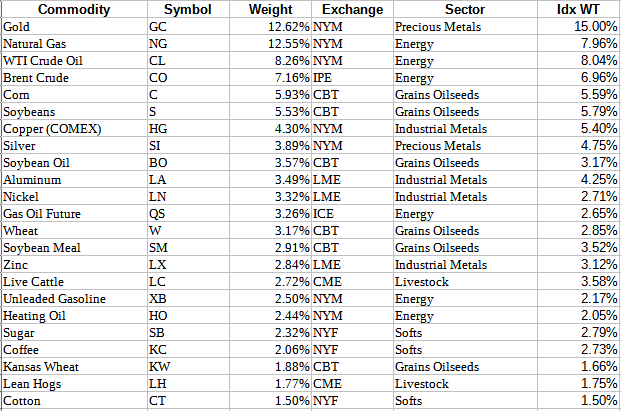

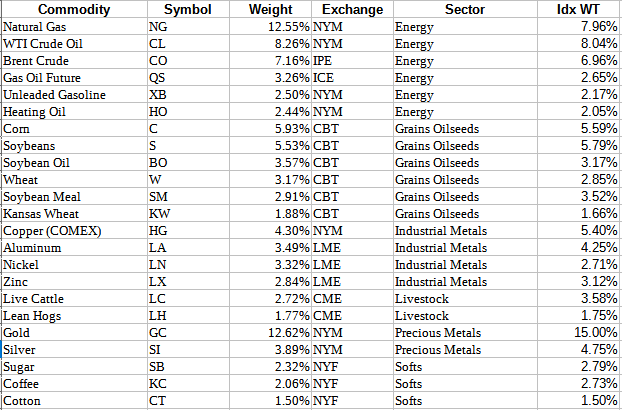

Multiple sources; compiled by Author

This detailed table, in weight order, shows how each commodity compares against its target weight. I reordered the list for those wanting to see it by Sector.

Multiple sources, compiled by Author

DJP Distribution Review

DJP has never had a payout and do not expect that to change.

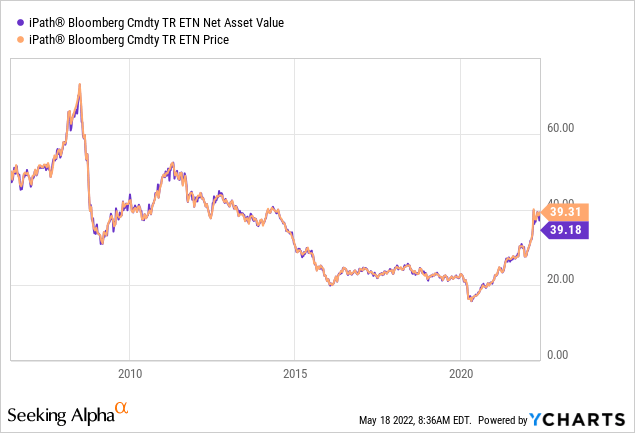

DJP Price And NAV Review

As is with the case for ETFs, ETNs seldom see divergence between their price and the underlying assets. That could start to change with the late April announcement that no new shares of the iPath ETNs will be sold until further notice. Barclay’s has a press release on this.

Portfolio Strategy

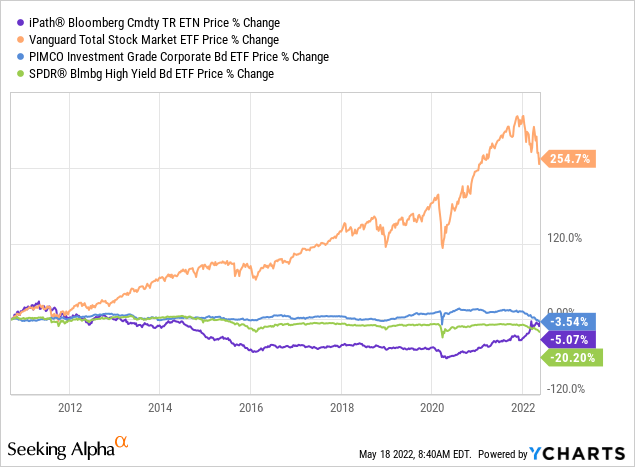

Beside using commodities as an inflation hedge investment, another possible benefit is reducing the volatility of the investor’s overall portfolio.

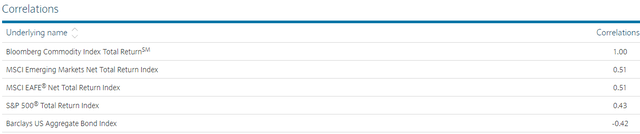

Commodities have a low correlation to equities and actually has a negative correlation to the US Bond market. The next chart illustrates the low correlation to stocks and even to two classes of corporate bonds.

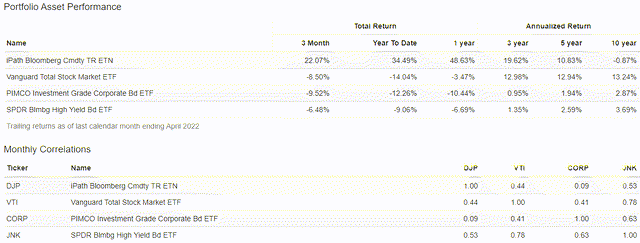

Using the same four funds, I ran analysis using PortfolioVisualizer.com. Based on the data provided by DJP, the results are not surprising: Investment-Grade Corporates and DJP have the lowest correlation factor, a .09.

When you look at the CAGR variations, there an investor’s time horizon becomes critical. Long-term Buy/Hold investors might skip adding a commodities fund and stick with more traditional assets like bonds, as both bond ETFs provided better returns and risk statistics than DJP provided to investors over the last ten years. That mostly flipped over the past five years. While still having the highest StdDev, the risk ratios say the extra CAGR DJP has provided since 2017 saw investors rewarded for that extra risk.

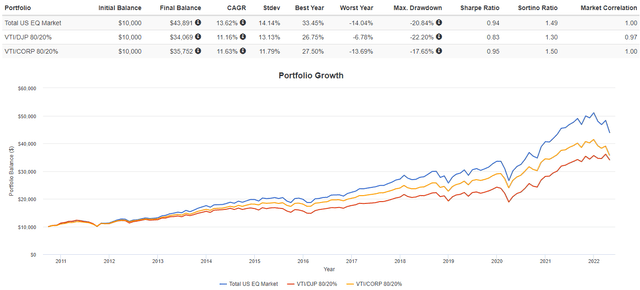

To test how well adding either DJP or the PIMCO Investment Grade Corporate Bond Index ETF (CORP) to portfolio with the Vanguard Total Stock Market ETF (VTI), where VTI was 80%, and the other fund was 20%.

Using CORP, not DJP, blended with VTI, provided the bigger reduction in risk. The VTI/CORP actually had the best Sharpe and Sortino ratios! That said, adding DJP resulted in the smallest “worst year” results.

Final Thoughts

For today’s investors, the question becomes, “Are commodity prices at or near their short-term peak?”. Goldman Sachs would say no, as they believe we are in a commodities supercycle, as they explained in an article recently. The World Bank recently published their Commodity Outlook view.

Commodity trading is definitely not my area of expertise, so with that understanding, my position has been that for commodity funds, ETN or otherwise, a Buy/Hold is usually not a good strategy. These are funds best used with market-timing models or for those who agree with Goldman Sachs market assessment.

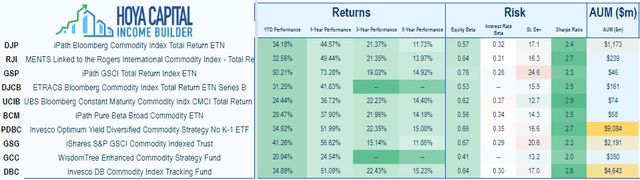

For those still interested in exploring commodity funds, some basic data on six ETNs and four ETFs.

More expanded listings, here are some links to also get you started:

Be the first to comment