D-Keine/E+ via Getty Images

Co-produced with Treading Softly

Just a few weeks ago, I had to engage in one of my least favorite activities.

We all have required activities we wish we didn’t have to participate in or be a part of. Rarely does one go to jury duty and desire to be there. That’s why it’s tied to the risk of jail time for missing your required service. Few enjoy paying taxes, they do so because it’s required.

So while this activity I engaged in was not tied to jail time, nor was it truly required, it is still one that I will always partake in when it arrives.

I often heard it said growing up that you’ll have a few phases of adult life, the “marriage phase” where all your friends and loved ones are getting married, a time of frequent celebration. This is often followed by a long spell of quiet before the “funeral phase” begins, where we start saying goodbye to those same friends and family as they pass.

I do not think I am alone in that I hate funerals. I attend to show respect to those who have passed and compassion for the hurting and grieving. I don’t ever look forward to them.

Among funerals, while all are hard, funerals for children are especially difficult. It’s one thing to celebrate the life of someone who lived long, it’s another thing entirely when attending the funeral of someone who died before they even had a chance to live. I think we can all relate to that.

We can learn a lot from attending funerals, which can help us adjust our mindset and worldview. It should also adjust how we invest in the market and prepare our methods to care for those we love most. One unpleasant fact of life is that none of us get out of it alive, and it often ends without warning.

An interesting fact about most of our investment accounts is that the accounts held in the names of the dead or forgotten accounts often outperform the living.

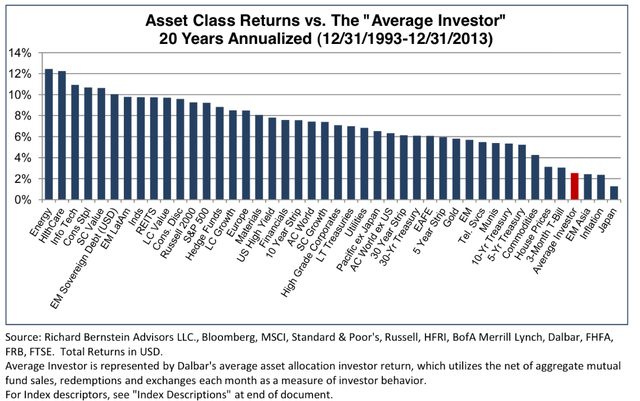

Why is this the case? The average investor who actively trades underperforms the market in general:

So, while we love a good investment and trading strategy, we need to remember a common axiom: “The more you handle the bar of soap, the smaller it gets”.

What can we learn about investing and preparing to care for others? Well, our unique Income Method has many strong principles that relate directly to this. Let’s take a walk to remember how you can be successful.

Get a Long-Term Mindset, a Really Long-Term Mindset

What is your investment horizon? Many of us claim to be long-term buy-and-hold type investors, but few have truly long-term mindsets.

Do you have a financial plan covering 5 years? 10 years? Or are you only thinking 2 years down the road?

The shorter the timeframe you invest, the more prone you are to errors and mistakes. The Federal Reserve is hiking rates, causing many to react accordingly, yet what if you could invest and not worry about the Fed? I’m not saying you can “fight” it, but what if it was a non-event?

A recent study shows you need an investment horizon of just over 41 years to achieve this. Woah. Most of you are active traders if that’s the goalpost of being a long-term investor!

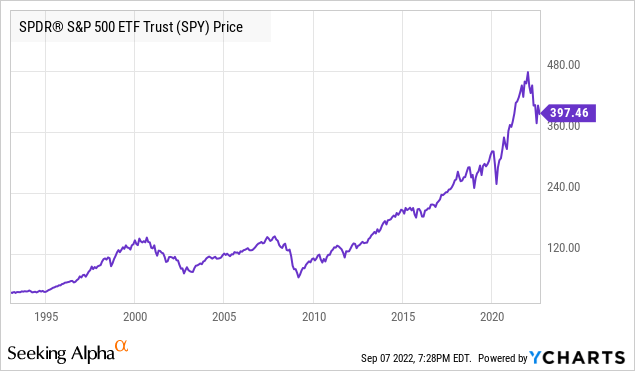

One reason that forgotten accounts are successful is that they have an infinite horizon. No one is trading. It is left to itself, and historically the market climbs higher over the long haul.

When I invest in my account I want to hold at least 2.5 years, with a goal of holding as long as possible. I do try to optimize at times, moving money to other opportunities as I deem beneficial. However, I don’t buy something with the plan to flip it next week, in a month, or even next year. I actively plan to hold and not trade.

This helps me maintain a long-term mindset and perspective. Our Income Method acknowledges that investing is a marathon, not a sprint.

To use a sports metaphor, a baseball game is won on singles and doubles, not home runs. Take small wins and keep getting them.

To do this, you often need to do less to see better success.

Do Less, Achieve More

With an emphasis on holding for the long term, it means you’ll do less active trading, this is a huge benefit. The largest mistake investors make repeatedly is buying and selling rapidly, trying to squeeze more returns out of the market. They might buy and hold for weeks or months, and then judge whether it is a “winner” or a “loser” and then sell. This often leads to them selling low and buying high instead of doing the opposite.

Let me ask you, if you could ensure 7% returns every year without doing anything, would you do it?

I think most would happily do so.

This is why I love investing for income via dividends. One’s portfolio return is a combination of dividends received and price change over time. Investors like to focus on price change, taking big risks, and attempting to see big changes in their overall “value”. I put value in quotation marks because the dollar value shown on your brokerage account changes every second. It’s simply the value of your portfolio if you liquidated everything at that moment.

That rarely happens as most investors are uninterested in doing so. I think that’s the right choice, don’t panic sell. Instead, I think we need to focus on the income we get from our portfolio. It’s the only aspect of our portfolio we can assert a consistent measure of control over.

The outlook for the future is cloudy in the minds of most investors. Rising rates, housing sales falling, and the risk of a recession climbing all mean investors expect the market to fall further. If you’re focused on the ever-changing value of your portfolio, it’s enough to make you panic!

Stop. Stop doing. If you learn to ignore the panic and noise and accept consistent returns, you can unlock new worlds of relaxation and returns.

A dividend paid is a return locked in. You can do whatever you want with it. Your portfolio value may change day to day, but the returns from dividends will keep on rising with each dividend received. If you re-invest dividends, you will see more the next year and so forth.

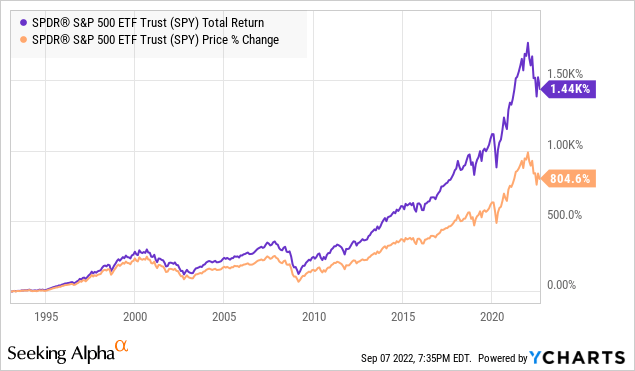

The dividends paid by the market account for a massive amount of its total return, yet short-term-minded individuals will consistently discount their value because they lack the desire to wait and relax.

In the end, having a method that encourages you to do less will often allow you to achieve more success. Our Income Method focuses on investing for income, buying excellent holdings at reasonable values, and sitting back while the money pours in.

The most frequent criticism we receive from commenters on Seeking Alpha is that the short-term trading value of a holding has dropped in a month or two months, etc. Do they think we don’t notice this or perhaps they’re applying their over-active mindset to our long-term income approach?

The answer is and continues to be that we are enjoying excellent income and locking in returns time and again, all while they panic around us for no benefit of theirs or ours. Years down the road, we will have outsized gains because we don’t need to be running around like a headless chicken – both in our income and in our mental health!

Thankfully dividends are not emotionally driven, they are income that is funded by the profitability of the underlying company. You know life is expensive, and emotions are draining. So when it comes to investing, replace emotions and add income in its place.

Remove Emotions, Add Income

Emotions are important. Without them, we would not live a full life and would lack the ability to bond with those around us.

Emotions are non-existent in math. Two plus two equals four, regardless of how you feel about the number two. That’s just the fact of the matter.

So when it comes to math-driven areas in life, emotions are best put aside.

Investing is one such area. Greed and fear are often the two largest emotions driving poor investment decisions. Investors fear missing out on a great investment and buy too high, hoping to sell to someone else at a higher price. Investors get greedy and refuse to sell an investment when they have a large unrealized gain and watch it vanish into nothingness after already counting as if it were a sure thing.

Retirees are exceptionally notorious for one type of behavior – panic selling.

You’ve worked your entire life for your retirement portfolio balance, and watching it go up in smoke is terrifying. Yet more often than not, selling when it’s falling in value makes your worst fears come true. By selling, you remove any chance of its recovery and lock in that loss.

The key mistake is depending on the “Greater fool theory”. This method of investing relies on selling your holdings for a premium to the price you paid to another greater fool than you who bought them first. Millions of investors rely on this, and this mindset entirely drives most workplace 401ks.

It works great with a heavy dash of luck and timing. It also requires a high degree of patience – something most of us lack when your portfolio’s value crashes and panic sets in.

So instead of relying on selling your shares to someone else to unlock their true value, replace the entire idea with something new. I recommend income investing – it’s why I built my entire Income Method that I espouse over and over again.

I get paid for my ownership. Dividends can readily soothe the emotions of investors. Sure the market may be dipping, but if the income you rely on keeps coming, you’ll be much less worried about it. Dividends are extremely sticky; this means the companies are extremely reluctant to cut or stop them. Dividend cuts will only occur when the company needs to cut because their profitability is diminishing or they are changing strategy. No company is going to cut the dividend because of poor sentiment.

Furthermore, I have money to re-invest and grow that income in both good times and bad. A portion of my dividend income is allocated to be re-invested. We’ve had decades of good times in the market, and hard times seem to be on the horizon. I’m not worried, panicked, or fearful. I have a fistful of dollars on the ready and countless dollars of dividend income coming into my portfolio to re-invest or simply to keep for myself. I know that the market goes up more frequently than it goes down.

Sounds relaxing, right? I think so and so do countless others.

Shutterstock

Conclusion

Why do forgotten and dead accounts outperform?

- They have indefinite investment horizons

- they don’t trade

- they are emotion-free

How can we learn and apply this to our current accounts?

- We can extend our investment holding horizons to longer lengths

- We can do less to achieve more

- We can remove emotions and add in income

Retirement is an excellent part of life. Sadly, it does often correspond with the phase in life when we will attend more funerals. It should be a constant reminder that there is more to life than trying to game the market.

I invest for income because it means I can spend less time trying to play the market and more time doing what I love. For me, that means research investments and helping others find success. I’m unusual in that way. For most of you, your interests are elsewhere. You may love playing golf, sailing, or even woodworking. Investing becomes a means to an end. You do it, so you don’t have to work anymore. You do it because it enables you to live financially free and able to do whatever else you want.

I support that and think investing should be a tool to achieve your goals, not the goal itself. So I created my Income Method as a guidebook to help retirees and investors use the tool of the market more effectively. Effective use means spending less time fiddling with the tool and thus having more time to do what you love.

Time is short and valuable. Spend it wisely! I’m pulling for you and wish to see you succeed regardless of how you spend your time.

Be the first to comment