smckenzie

In just three years, Disney+ has risen quickly to become the top streaming platform by subscribers. And while Walt Disney Co. (NYSE:DIS) has overtaken Netflix for the lead in streaming, it has come at a high cost. Disney’s streaming platforms lost $1.4 billion in the quarter ending September 30th. The losses grew from the previous quarter even though Disney executives say they are on track for its streaming platforms to turn a profit in 2024.

Disney’s disappointing quarterly revenue and profit misses sent the stock to a new 52-week low and is leading to hiring freezes and cost-cutting measures. The company is restricting corporate travel, creating a taskforce to find ways to slash spending, and says it will limit hiring to only positions that drive business acceleration.

And while Disney expects a possible slowdown in theme park attendance in future quarters, the company hopes to battle its impact on revenue with several new innovations it has put in place to drive per-person spending. Instead of discounting prices to increase attendance numbers, the company uses adaptive pricing to elevate admission prices on higher-traffic days. The company is also reducing theme parks costs by leaning more heavily on mobile ordering at food venues and mobile check-in features.

When considering these current stories about Disney, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. The drop in demand at theme parks and soaring costs for its streaming services may be seen as short-term headwinds. Conversely, Disney’s significant investments in streaming and cost-cutting measures within its parks will help lead to higher revenue generation and profit margins in the long term.

While current news stories, good or bad can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if DIS is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

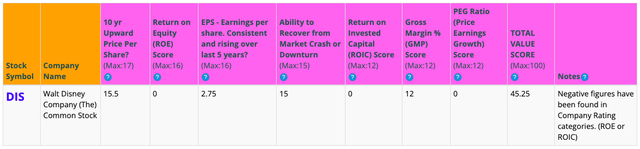

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. DIS has high scores for 10 Year Price Per Share, Ability to Recover from a Market Crash or Downturn, and Gross Margin Percent. It has low scores for ROE, Earnings per share, ROIC, and PEG Ratio. A low PEG Ratio score indicates that the company may not be experiencing high growth consistently over the past 5 years. In summary, these findings show us that DIS seems to have below average fundamentals since most of the categories produce low scores.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

(Source: BTMA Stock Analyzer )

Fundamentals

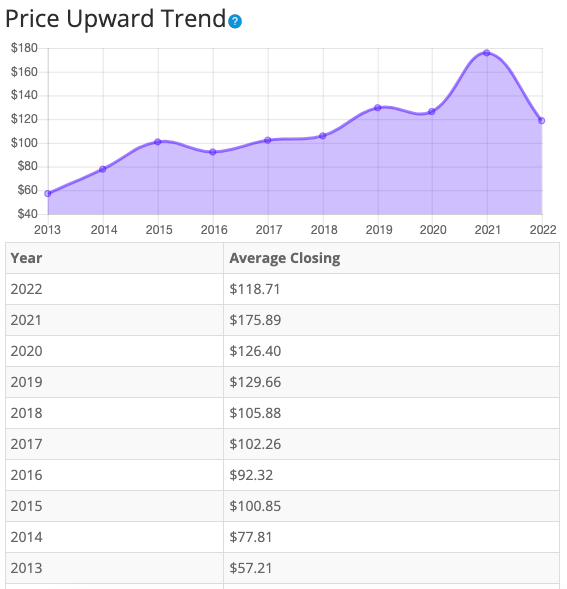

Let’s examine the price per share history first. In the chart below, we can see that price per share has been mostly consistent at increasing over the last 10 years, with only three years where share price declined. While the share price declines in 2016 and 2020 were relatively minor, it’s worth noting the extent of the share price drop in 2022, which set the stock back to levels not seen since 2018. Overall, share price average has grown by about 107.5% over the past 10 years or a Compound Annual Growth Rate of 8.45%. This is a lackluster return for Disney.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Price Per Share History)

Earnings

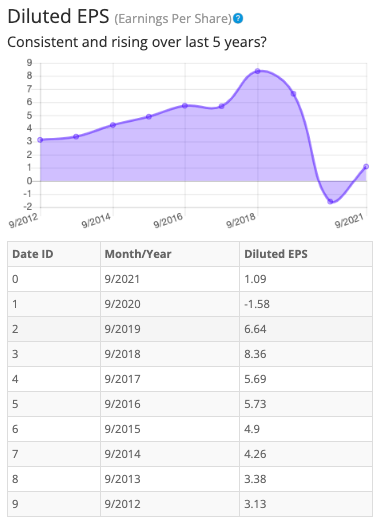

Looking closer at earnings history, we see that the strong earnings growth through 2018 was followed by sharp declines in 2019 and 2020. And in 2020, Disney actually posted a loss before returning to profitability in 2021.

The start of Disney’s steep earnings decline coincided with the company’s acquisition of the majority of 21st Century Fox in 2019. The purchase significantly boosted Disney’s media assets, but also more than doubled the company’s debt and reduced profitability. Prior to the purchase, Disney faced growing threats to its broadcasting and cable television assets. Subscriptions to ESPN, its most-profitable cable property, suffered significant losses as more media consumers “cut the cord” and turned to streaming. Growth in streaming also hit Disney’s broadcast properties. Both the ABC network and its array of network-owned television stations faced revenue declines. Noting the need to pivot to streaming, Disney has invested heavily in Disney+, ESPN+ and continues to push significant amounts of its content to its majority-owned platform Hulu. While the losses mount in its streaming division, its broadcast and cable properties continue to provide the vast majority of Disney’s profits to the tune of more than $8 billion in the last four quarters. And while many focus on Disney’s media holdings, the company also earned significant profits from theme parks, resorts, cruises and licensed products. That division brought in another $7.9 billion in profit over the last four quarters despite the negative drag from the closure of its theme park in China since the onset of the pandemic. Once fully reopened, profits in the theme park segment will soar even higher.

Consistent earnings make it easier to accurately estimate the future growth and value of the company. Prior to COVID and the 21st Century Fox acquisition, Disney had a solid history of consistently improving earnings. But in recent years, have seen much volatility because of COVID and the acquisition, making it more difficult to accurately estimate future growth or current value.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – EPS History)

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

Return on Equity

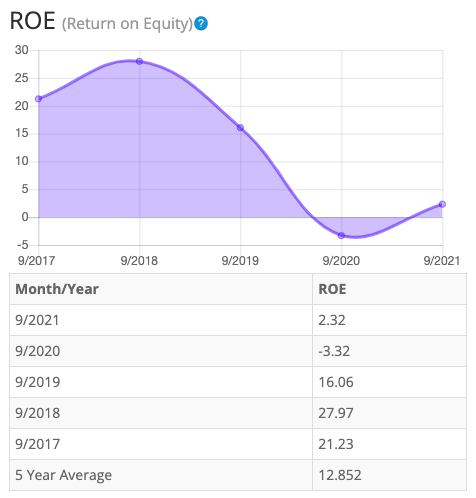

The return on equity has mostly decreased in the period from 2017 to 2021. Similar to Disney’s share price, ROE dropped in 2019 before dropping into negative territory in 2020. ROE returned to a positive number in 2021. Overall, for the 5-year period, ROE decreased. For return on equity (ROE), I look for a 5-year average of 16% or more. So, DIS does not meet my requirements.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – ROE History)

Let’s compare the ROE of this company to its industry. The average ROE of 108 Entertainment companies is 4.28%.

Therefore, Disney’s 5-year average of 12.85% is well above average, and current ROE of 2.32 is well below average.

Return on Invested Capital

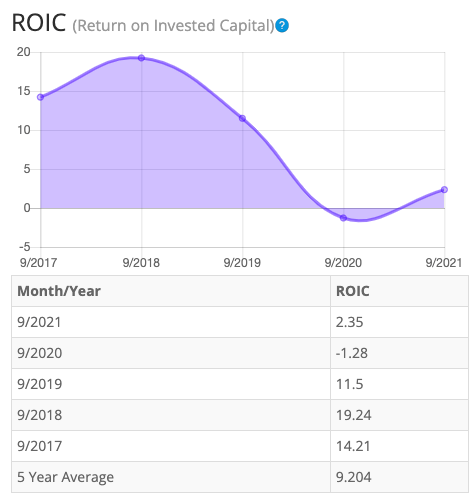

The return on invested capital has also been a consistent decliner from 2017 to 2021. ROIC fell nearly 40% between 2018 and 2019, before dropping into negative territory in 2020. For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, DIS failed this test as well.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Return on Invested Capital History)

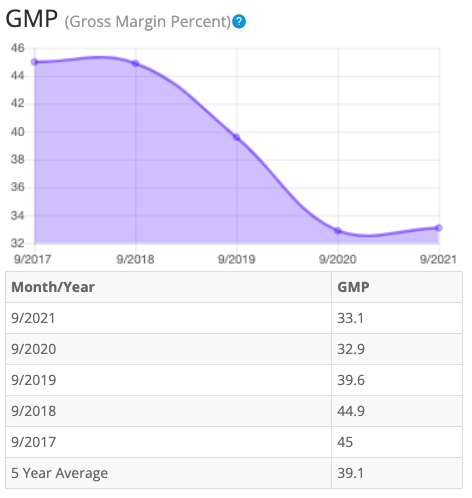

Gross Margin Percent

The gross margin percent [GMP] has mostly decreased over the last five years. GMP decreased in 2018, 2019, and 2020. GMP increased slightly in 2021. Even with the declines, overall gross margin percent is at very high levels. Five-year GMP is good at around 39.1%. I typically look for companies with gross margin percent consistently above 30%. So, DIS has proven that it has the ability to maintain acceptable margins over a long period.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Gross Margin Percent History)

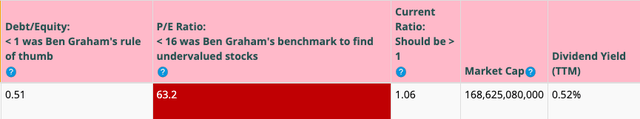

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than 1. This is a positive indicator, telling us that the company owns more than it owes.

Disney’s Current Ratio of 1.06 is satisfactory, indicating it has an adequate ability to use its assets to pay its short-term debt.

Ideally, we’d want to see a Current Ratio of more than 1, so DIS minimally exceeds this amount.

According to the balance sheet, the company appears to be in good financial health. In the long term, the company has more than enough assets to cover its debts. In the short-term the company is generating enough cash, to fulfill its obligations.

DIS does not currently pay a regular dividend.

(Source: BTMA Stock Analyzer – Misc. Fundamentals)

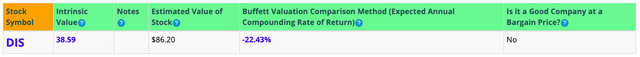

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio of 63.2 indicates that DIS might be selling at a high price when comparing Disney’s PE Ratio to a long-term market average PE Ratio of 15.

The 10-year and 5-year average PE Ratio of DIS has typically been 16.7 and 19.9, respectively. This indicates that DIS could be currently trading at a high price when comparing to its average historical PE Ratio range.

The Estimated Value of the Stock is $86.20, versus the current stock price of $95.01. This indicates that DIS is currently selling above its estimated value.

Summarizing the Fundamentals

According to the facts, The Walt Disney Company is financially healthy in a long-term sense in having enough equity as compared with debt, and in the short-term because the current ratio indicates that it has enough cash to cover current liabilities.

This company has faced significant challenges in recent years that many attribute to COVID. However, the underlying fundamentals were challenged pre-pandemic with the acquisition of a majority of 20th Century Fox. Additional challenges loom on the horizon as the media landscape and consumer preferences change.

Other fundamentals have significantly eroded, including ROE, ROIC, and Gross Margins. While all three improved after falling into negative territory in 2020, they remain far below levels seen in 2017 and 2018. Disney finds itself spending more money investing in streaming while its current product offerings, in most categories, remain flat or are decreasing.

Just as the company tries to recover from steep theme park and movie revenue declines from COVID, it now faces potential threats from the possibility of a recession looming in the horizon. Disney is already reporting declines in theme park attendance.

In terms of valuation, my analysis shows that the stock is overpriced.

Disney Vs. The S&P 500

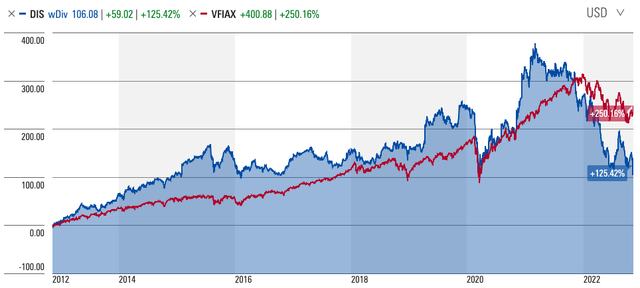

Now, let’s see how DIS compares versus the US stock market benchmark S&P 500 over the past 10 years. From the chart below, we can see that DIS mostly provided returns above the general market. Disney rebounded post-pandemic at even higher levels than the S&P 500 until late 2021. Since then, Disney has fallen well below the index and Disney stock now sits below pandemic lows.

Forward-Looking Conclusion

Over the next five years, the analysts that follow this company are expecting it to grow earnings at an average annual rate of 25.71%.

In addition, the average one-year price target for this stock is at $120.00, which is about a 26.3% increase in a year.

Does Disney Currently Pass My Checklist?

- Company Rating 70+ out of 100? NO (45.25)

- Share Price Compound Annual Growth Rate > 12%? NO (8.45%)

- Earnings history mostly increasing? YES (until 2021)

- ROE (5-year average 16% or greater)? NO (12.85%)

- ROIC (5-year average 16% or greater)? NO (9.20%)

- Gross Margin % (5-year average > 30%)? YES (39.1%)

- Debt-to-Equity (less than 1)? YES

- Current Ratio (greater than 1)? YES

- Outperformed S&P 500 during most of the past 10 years? YES (until recently)

- Do I think this company will continue to successfully sell their same main product/service for the next 10 years? YES

Disney scored 6/10 or 60%. Therefore, according to the facts Disney is not a desirable company to currently invest in.

Is Disney currently selling at a bargain price?

- Price Earnings less than 16? NO (63)

- Estimated Value greater than Current Stock Price? NO (Value $86 < $95 Stock Price)

Valuation metrics suggest that despite its recent price declines, Disney may still be selling at a high price, when compared to the Estimated Value. Its Price Earnings Ratio also indicates that it is overpriced.

For me, Disney presents a dilemma. Factually, the company is facing great headwinds and uncertainty which present much risk. If basing my decision solely on facts, then Disney is not currently a good investment to take on until more certainty unfolds. For instance, I would want to see that Shanghai Disneyland and its Resort makes a commitment to open and stay open.

Next, having more clarity about how Disney’s removal of its special tax district will affect future earnings would be nice.

Finally, it would be beneficial to see Disney’s heavy investment in streaming media begin to pay off.

But on the flip side, I’m already holding Disney. Am I concerned?

Not really. I personally am confident about Disney. I know that it has a solid history of consistently improving fundamentals and long-term returns. Disney might be on the operating table now, but I’m confident that it will pull through and eventually soar again.

Disney is one of those rare companies that can’t be measured only by numbers. It causes something magical to happen in the hearts of children and adults and has been doing so for generations.

It has an alluring portfolio of solid brands that consumers are highly invested in which makes it a best-in-class content and experience creator. The potential for growth and accelerated performance is there, but economic uncertainty could temporarily derail that potential.

If purchased at a fair price, I’m confident that Disney will continue to be a strong long-term gainer to hold in an investor’s portfolio. Since I already feel that I bought the company at a fair to bargain price, I’m happy to continue holding it for the long haul.

But for those who are less confident in Disney or squeamish about volatility, it probably isn’t the best investment at this time, because the near future will likely be a rough ride until more clarity develops in Disney’s forecast.

Be the first to comment