Justin Sullivan

Growing a diversified basket of dividend payers can take an investor to many places. For example, I never imagined being a shareholder in Hasbro (NASDAQ:HAS), as the stock always seemed out of reach, but this recently changed as the price became too good to pass up.

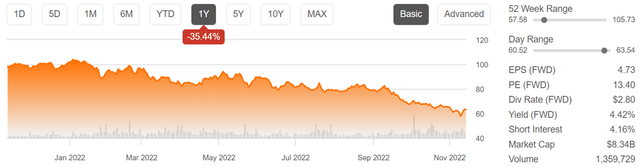

As shown below, Hasbro has become quite cheap, declining by a whopping 35% over the past 12 months. This article highlights why dividend growth investors may want to consider layering into this value stock.

Why Hasbro?

Hasbro is a global toy and branded entertainment leader that connects with people of all ages. It is home to iconic brands such as MTG (Magic: The Gathering), Dungeons & Dragons, Nerf, Play-Doh, Scrabble, Monopoly, and many more. Over the trailing 12 months, Hasbro generated $6.2 billion in total revenue.

Some may wonder why a maker of physical toys should remain relevant in a digital era, especially with all the talk of the metaverse by Meta Platforms (META). Perhaps I’m a bit old school, but I would argue that with Hasbro’s monopoly (pun intended) on many iconic children’s, young adult, and family games, it should remain highly relevant for the foreseeable future.

Moreover, perhaps unbeknownst to some investors, Hasbro does have a digital presence through key licensing agreements with partners such as Discovery Family (WBD) This was highlighted by Morningstar in its recent analyst report:

Hasbro continues to hold a leadership position in the nearly $40 billion domestic toy industry, developing, manufacturing, and marketing well-known global brands that include Transformers, My Little Pony, and Nerf. The firm operates a relatively differentiated business model, thanks to its digital properties exposure, content creation ability, and key licensing arrangements.

Additionally, production capabilities support Hasbro’s multimedia presence, as does Discovery Family, a joint venture with Discovery that brings Hasbro’s brands to television, bolstering the firm’s brand blueprint strategy. Furthermore, Hasbro has historically dominated the big-screen arena, building brand loyalty and generating new streams of revenue from its licensing businesses (like Star Wars and Marvel).

We think Hasbro and the toy industry have a decent runway for growth ahead through international growth and acquisitions of small, strategic players that fit into Hasbro’s portfolio (most recently D&D Beyond).

Meanwhile, Hasbro recently had a challenging third quarter, with revenues declining by 15% YoY (12% decline on a constant currency basis) and operating profit declining by 31% on an adjusted basis. It’s worth noting, however, that revenue is still far above where it was pre-pandemic, with trailing 12 month revenue at $6.2 billion, sitting 31% above where it was at the end of 2019, at $4.7 billion.

Core drivers behind the revenue drop were accelerated shipments by retailers during the second quarter due to anticipated supply chain challenges, as well as a MTG set releases and entertainment content scheduled for release in the fourth quarter versus third quarter last year.

Looking forward, MTG should be a core growth driver for Hasbro, as management expects high-single digit revenue growth for this franchise for the full year. MTG has built a very strong cult following over its 30 years, and is on track to become Hasbro’s first $1 billion brand.

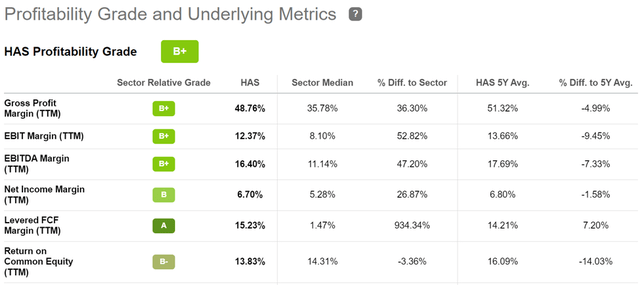

MTG, among other brands, also commands premium pricing due to its loyal following, and this is reflected by Hasbro’s strong margins. As shown below, HAS maintains a B+ profitability grade, with relatively high EBITDA and FCF margins of 16% and 15%, respectively.

HAS Profitability (Seeking Alpha)

Moreover, HAS is far from being a one-trick pony, as it also has emerging games such as Wordle (co-created with the New York Times). These attributes were noted by the management in the recent conference call:

We added the viral sensation Wordle: The Party Game for fans of all ages to our industry-leading games portfolio for this holiday. And we will drive a multi-quarter flywheel of momentum with one of our best entertainment lineup ever starting this November with Marvel Studios’ Black Panther: Wakanda Forever and extending into 2023 with 6 more blockbuster films and 20 scripted and unscripted shows we are merchandising behind, including the upcoming Hasbro event films, DUNGEONS & DRAGONS: Honor Among Thieves in March and Transformers Rise of the Beast in June.

The plan we laid out earlier this month has us on path to drive growth and accelerated profits through focus and scale and enhanced operational excellence. We are concentrating on the brands that give us the biggest growth potential and where we can truly lead and innovate in the category.

Meanwhile, the decline in HAS’s share price has pushed the dividend yield up to a respectable 4.4%. The dividend is also well-covered by a 64% payout ratio. While dividend growth has slowed in recent years, I see potential for it to return to its robust pre-pandemic growth rate after supply chain concerns ease and with the release of its games in pipeline.

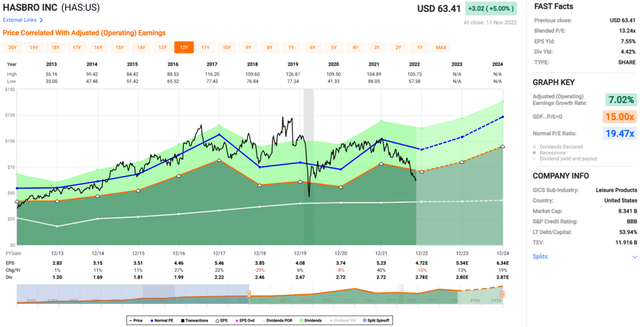

Plus, Hasbro maintains a strong BBB rated balance sheet, and at the current price of $63.41, trades at a blended PE of 13.2, sitting well below its normal PE of 19.5 over the past decade, as shown below. Analysts have a Strong Buy rating with an average price target of $91, translating to very strong potential total returns, especially factoring in the generous dividend yield.

Investor Takeaway

Hasbro has built a strong portfolio of iconic brands that should remain relevant for the foreseeable future. It has navigated the pandemic well with very strong revenue growth since the end of 2019, and is positioned for continued growth in the coming years. The currently shares offer an attractive blend of capital appreciation and income potential, making them a compelling investment at the current price.

Be the first to comment