imaginima

All figures in CAD as that is the company’s reporting currency unless otherwise noted.

Introduction

TransAlta Corporation (NYSE:TAC) has a diversified portfolio of energy generating power plants in Canada, Australia and the US. It trades under (TSX:TA:CA) on the TSX. The total generating capacity is over 6,586 Megawatts over 74 facilities with a weighted average contract life of 6 years.

Utility stocks have never really caught my attention as they carry high leverage and usually do not carry high enough yields. TAC’s remarkable growth over the past couple years and transition towards a renewable energy play has piqued my interest. Its wind and solar assets are owned through its publicly traded subsidiary TransAlta Renewables (RNW:CA) for which it owns 60% of outstanding shares.

As TAC is largely exposed to the whims of the Alberta provincial government who has passed laws to phase out coal production forcing TAC to retire all coal-fired generating assets located in Alberta within their Energy Transition segment and has completed this transition as of early 2022. So one could say their fate has been forced on them.

Q3 2022 Results

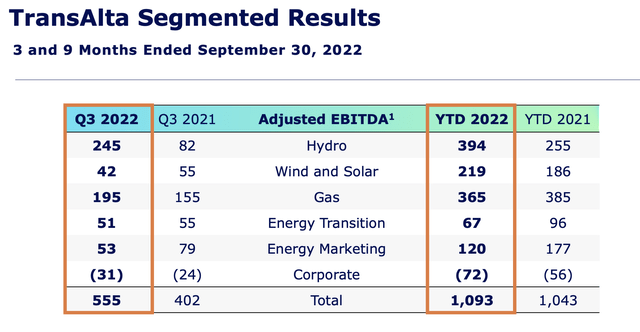

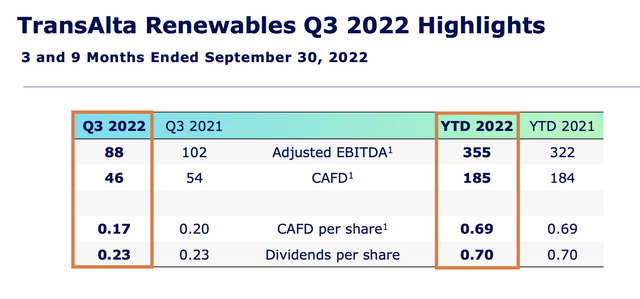

TAC has delivered in spades for fiscal 2022 thus far on almost all accounts. Production for the three and nine months as of Sept. 30, 2022, was down 5,432 and 15,253 gigawatt hours (GWh), respectively, compared to 6,053 GWh and 16,282 GWh in the same periods in 2021 due to the retirement of Keephills Unit 1 and Sundance Unit 4 which are coal powered facilities, and the extended outage at the Kent Hills 1 and 2 wind facilities held under RNW. However, revenues increased by $79 Million and $11 Million, respectively, for the three and nine months as of Sept. 30, 2022, compared to the same periods in 2021, mainly as a result of capturing higher realized energy prices within the Alberta electricity market through and higher realized ancillary services prices and volumes in the Hydro segment which now exceed $230/MWh. The elevated prices in the third quarter lead to a 38% increase in EBITDA in Q3 2022 vs. Q3 2021.

Q3 2022 Investor Presentation (TransAlta)

Q3 2022 Investor Presentation (TransAlta)

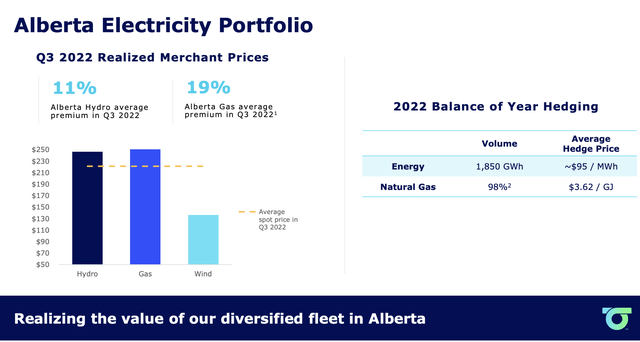

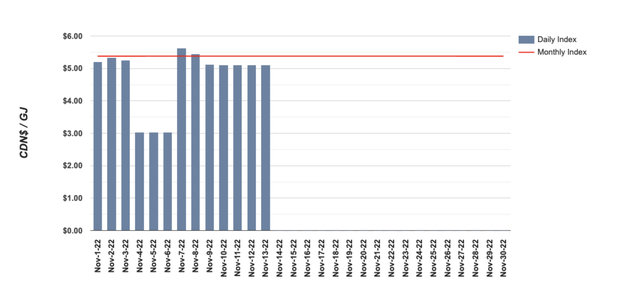

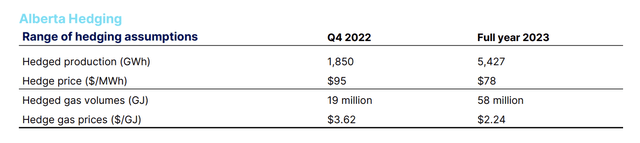

TAC realized 11% and 19% premiums on average for their Hydro and Gas pricing relative to their respective spot prices in Q3 2022. The company is exposed to Natural Gas prices in a negative way (increases fuel and purchase power costs), but it has hedged 98% exposure there as well at $3.62/GJ which is well below prevailing AECO pricing. During Q2 2022, TAC entered into a long-term purchase power agreement (PPA) for the remaining 30 MW of renewable electricity and environmental attributes for the Garden Plain Wind project in Alberta with a new investment-grade globally-recognized customer Pembina Pipeline Corporation (PPL). The 130 MW Garden Plain wind project is now fully contracted with a weighted average contract life of approximately 17 years. Construction is underway with a target commercial operation date in the fourth quarter of 2022.

Alberta Natural Gas Prices – Current Month (Gas Alberta)

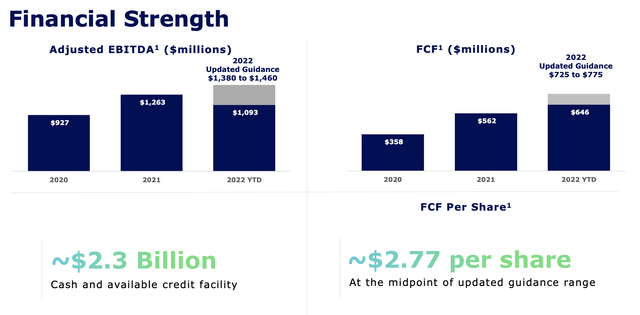

As a result of these positive developments, TAC has revised upwards their EBITDA and FCF guidance since Q2 by as little as 26% and 12% on EBITDA and FCF. This translates into a strong 21% FCF yield using the midpoint of guidance.

Q3 2022 Investor Presentation (TransAlta)

Outlook

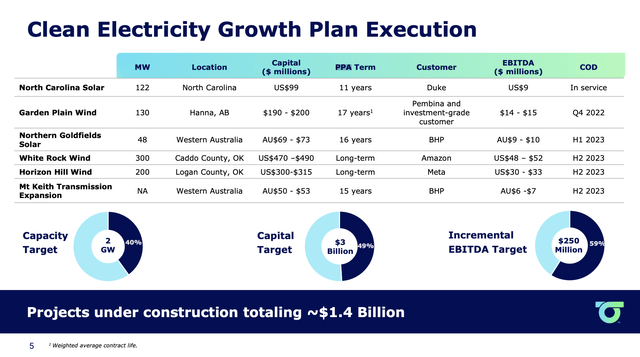

RNW has a number of projects that are expected to come online in 2023 which will add at least $80 Million in annual EBITDA.

The largest projects include the White Rock and Horizon Hill Winds projects.

During the second quarter of 2022, TransAlta identified Amazon Energy LLC (AMZN) as the customer for the 300 MW White Rock wind projects, to be located in Caddo County, Oklahoma. On Dec. 22, 2021, Amazon and TransAlta entered into two long-term PPAs for the supply of 100 per cent of the generation from the projects. Construction activities started in the fall of 2022 with a target commercial operation date in the second half of 2023. TransAlta will construct, operate and own the facility.

On April 5, 2022, TransAlta executed a long-term renewable energy PPA with a subsidiary of Meta Platforms Inc. (META), for 100 per cent of the generation from its 200 MW Horizon Hill wind project to be located in Logan County, Oklahoma. Under this agreement, Meta will receive both renewable electricity and environmental attributes from the Horizon Hill facility. The facility will consist of a total of 34 Vestas turbines. Construction commenced in the fall of 2022 with a target commercial operation date in the second half of 2023. TransAlta will construct, operate and own the facility.

Source Q3 2022 Report

Q3 2022 Investor Presentation (TransAlta Corporation)

RNW which is the better income play of the two companies with a current yield of ~6.5% has a YTD payout ratio a hair over 100% as a result of the extended outages at the Kent Hills 1 & 2 facilities. Although a dividend increase may be unlikely, we should expect the payout ratio to fall below 100% in 2022 as the facilities become fully operational again and as new projects come online.

The Kent Hills 1 and 2 wind facilities are not currently in operation following the tower failure event that occurred in September 2021. This event has taken approximately 150 MW of gross production offline temporarily as the Company replaces all 50 turbine foundations at the Kent Hills 1 and 2 wind facilities. The extended outage is expected to result in foregone revenue of approximately $3 million per month on an annualized basis (assuming all 50 turbines at the Kent Hills 1 and 2 wind facilities are offline), based on average historical wind production, with revenue expected to be earned as the wind turbines are returned to service.1 Each turbine at Kent Hills 1 and 2 wind facilities will return to service as soon as its foundation is replaced and the turbine is reassembled and tested.

Source Q3 2022 Report

Q3 2022 Investor Presentation (TransAlta)

For the full year 2023, TAC has locked in very low natural gas prices on a higher portion of its planned usage than it did for 2022. Power prices are locked on a smaller portion of its planned generation which will allow it to benefit from rising power prices and be less exposed to increases in natural gas prices.

Q3 2022 Investor Presentation (TransAlta)

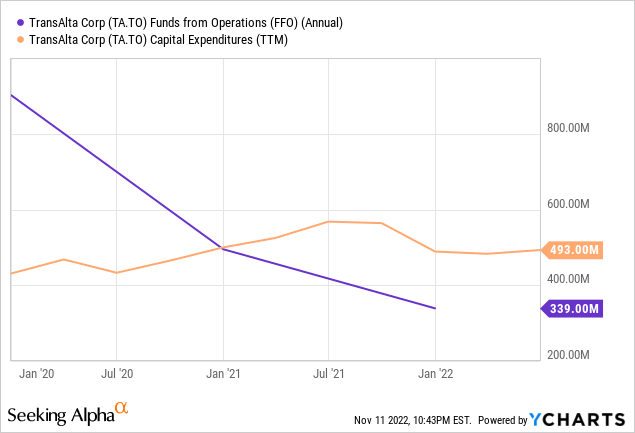

Although TAC is not what you would call a shareholder friendly company with a measly ~1% dividend yield and share buybacks have been reasonably slow. CAPEX as capital expenditures have often exceeded funds from operations and would be a lot more leveraged if it were not for their previous transactions with Brookfield Renewable Partners (BEP) and Brookfield Asset Management (BAM).

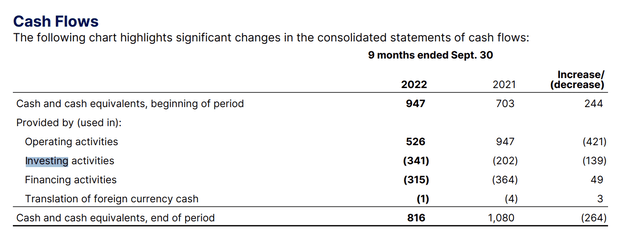

We can see that 9-month YTD FFO is already up to $887M relative to $341M in CAPEX. The reason for the high growth in CAPEX in previous years has been due to the transitioning from coal to gas which is now complete. Granted CAPEX is still up YoY due to project construction activities.

Q3 2022 Quarterly Report (TransAlta)

Valuation

I am using a simple sum of the parts valuation for this company. I’m sure I will get much backlash from people who follow this company more closely, but I do believe this analysis should provide an approximation of fair value.

- I value each of the larger segments separately which are Wind and Solar, Hydro and Gas.

- Hydro consists of 26 facilities across Canada and today is the most valuable TransAlta segment. We use BEP’s valuation formula for the Hydro segment. BEP provides TAC $738 Million in financing at 7% in the form of Exchangeable Securities. After Dec 31, 2024, these securities can be converted into the equity ownership of Alberta Hydro at 13 times EBITDA (averaged over 3 years) less $10M in annual maintenance CAPEX. We annualize 9-month EBITDA and use 2021 and 2020 EBITDA for an average of $317M in EBITDA.

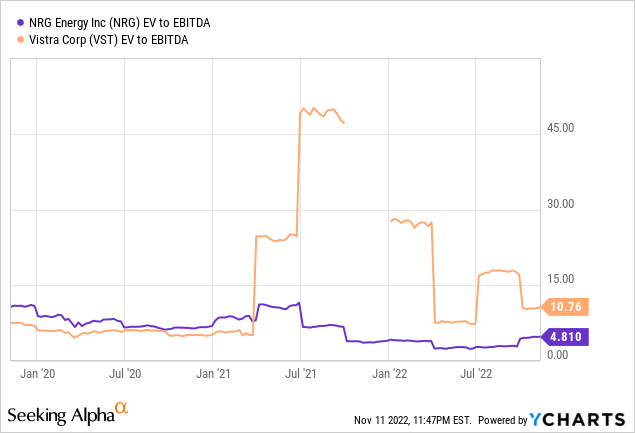

- As coal plants were either cancelled or converted by the end of fiscal 2021 we now have a full 12-months and TAC will not have to realize impairment charges in the segment on a go-forward basis. TTM EBITDA is $474 Million for the segment. TAC’s gas segment is similar to Independent Power Producers in the US like Vistra (VST) or NRG Energy (NRG). These companies are typically valued at 5-10x EBITDA so we use 5x to be conservative.

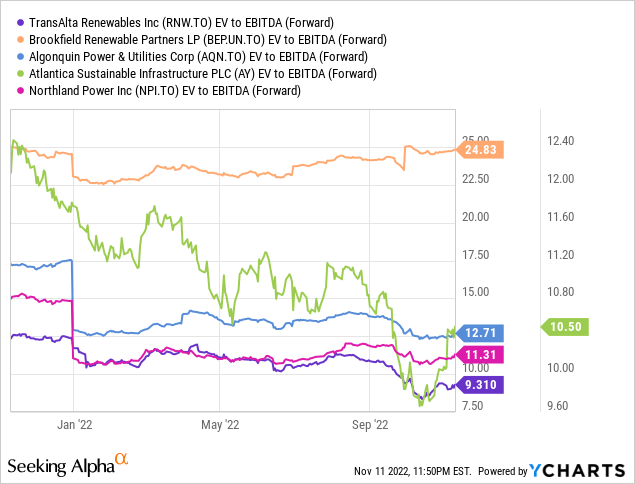

- I value Wind and Solar based on an estimate for run rate EBITDA. 9-month EBITDA was $219 Million which annualized is $292 Million, plus $40 Million in annual revenue which can be expected from the Horizon Hill and White Rock wind projects that are to come online in the second half of 2023. RNW has often traded at major discounts to its Canadian renewable peers likely due to not actually being a pure-play renewables company due to its natural gas exposure. We use a conservative 10x multiple on the segment.

- We use Management’s calculation for Deconsolidated Net Debt for total liabilities on page M54 of the Q3 2022 Report.

| Hydro | $3,991 |

| Gas | $2,370 |

| RNW Ownership | $1,992 |

| Total Assets | $8,353 |

| Deconsolidated Net Debt | $3,370 |

| TransAlta Renewables cash and cash equivalents | $229 |

| TransAlta Renewables long-term debt | ($782) |

| US tax equity financing and South Hedland debt | ($806) |

| Series A-G Preferred Shares | $942 |

| Total Liabilities | $2,953 |

| Net Assets | $5,400 |

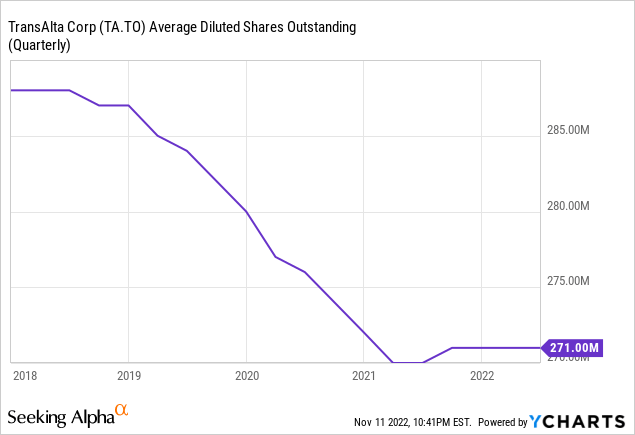

| Weighted Average Common Shares Outstanding | 271 |

| Implied Value per Share | $19.93 |

| Implied Premium/(Discount) to Market Value | (37%) |

Conclusion

As TAC becomes a free cash flow machine, it is highly probable the discount to fair value will narrow as it increases the quarterly dividend which it already did by 10% in Q4 2022 so shareholders can enjoy $0.22/share in annual dividends instead of $0.20/share. It is more likely that we will see modest dividend increases and accelerated share buybacks.

The alternative is that BAM and its affiliates acquire additional shares in the open market as they already own ~13% of the common shares which will also narrow the discount. BAM’s ambitions are rarely ever limited to acquiring minority stakes in their portfolio companies as investors of Inter Pipeline (OTCPK:IPPLF) and TerraForm Power (TERP) are well aware. BEP also provides TAC $738 Million in financing at 7% in the form of Exchangeable Securities which is convertible at the above mentioned formula. BAM and its affiliates could partially finance a takeover based on their much higher multiples and could realize significant synergies through corporate overhead. They could also refinance TAC and RNW’s LTD at better rates.

Either way, I see tremendous returns for disappointed shareholders over the next couple of years.

Be the first to comment