imaginima/iStock via Getty Images

One of the things about being invested in MLPs like Enterprise Products Partners (NYSE:EPD) and Magellan Midstream Partners (MMP) is that you naturally pay more attention to geopolitical events and other things that can impact energy policy around the world. If the last couple months haven’t made this clear to readers, the US energy policy is complete madness.

From sanctions on Russia, to California’s truly insane gas rebates, and our government reaching out to Venezuela for oil, there seems to be no end in sight to this. You even have some politicians who truly have no understanding of economics suggesting a windfall tax. Anyone with a couple brain cells to rub together can connect the dots from their policies to the current spike in energy prices.

Sanctions, while they may hurt Russia’s economy, are going to lead to significant problems for the US. If California actually wanted to lower gas prices, they wouldn’t have the highest gas tax in the country. If we wanted to produce enough oil to meet demand here in the US, we could pump it ourselves or we could work with Canada, our next-door neighbor. Instead, we reach out to Saudi Arabia and Venezuela from a position of weakness. As far as the windfall tax idea, you will never hear that argument coming from anyone intelligent.

I despise most politicians, but I’m starting to think that it is intentional instead of just pure incompetence. Even an incompetent politician would occasionally get something right out of pure chance, and we clearly haven’t been doing anything right when it comes to energy in the last couple years. I think we could still turn it around if we put someone competent in charge, but my base case for what happens with energy over the next couple years isn’t pretty.

My guess is that we are going to try price controls at some point, which will certainly do more harm than good. Whatever happens with our overall energy policy, EPD and MMP are well positioned for what might be coming in this inflationary environment.

Investment Thesis

There aren’t many publicly traded companies at attractive valuations right now, but EPD and MMP are two that I still like at current prices. Both have huge distributions, with yields of 7.4% and 8.4%, respectively. The valuation on both is still attractive even after double digit gains to start 2022. Investors looking for large current income streams with limited downside risk might want to consider EPD or MMP.

A Brief Overview

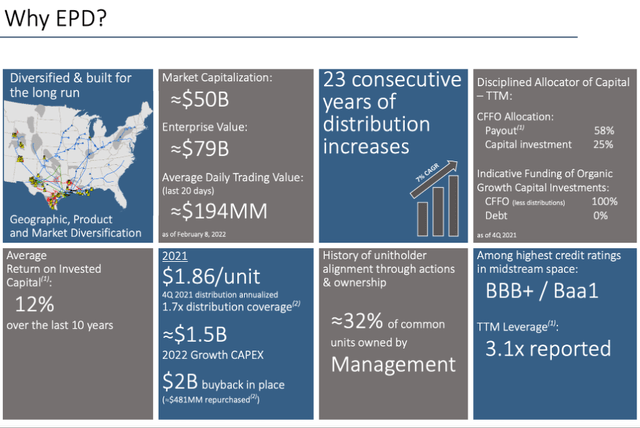

EPD is one of the largest MLPs out there, with a market cap just over $54.4B. MMP is smaller, with a market cap of $10.5B. EPD is currently my largest position, with MMP not far behind. I have no intention of selling either anytime soon, and I might look to add later in 2022 depending on what happens with the unit price. EPD has significant insider ownership (near 33%), an impressive distribution record, and a wide moat due to their irreplaceable asset base.

Investor Presentation (enterpriseproducts.com)

I’m expecting continued distribution growth in the coming years from EPD, and I think the total return will be attractive as well. MMP has been more focused on buybacks in the last year, but I’m expecting distribution growth and double-digit total returns there as well. While the huge distributions will drive significant returns for unit holders, the cheap starting valuations are likely to lead to share price appreciation over the next couple years.

Valuation

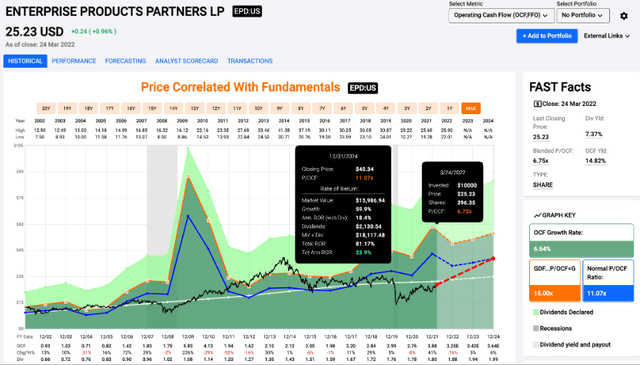

EPD isn’t going to grow at an explosive rate, but units are still very cheap today. They currently trade under 7x cash flows. The normal cash flow multiple is just over 11x, and I wouldn’t be surprised to see units trading above $30 by the end of 2022. I think units are a buy today even after a solid start to 2022. If you can pick up units with a yield over 7%, I think you are likely to see attractive forward returns.

Price/Cash Flow (fastgraphs.com)

MMP is awarded a slightly higher valuation due its higher distribution yield. EPD yields 7.4% while MMP sits at 8.4%. Both MLPs have over two decades of distribution growth, so they have both proven to be reliable operators. MMP currently trades for 9.1x cash flows, with an average cash flow multiple of 11.3x. While MMP isn’t as cheap as EPD, they are both materially undervalued at current prices.

Conclusion

There is a lot of uncertainty today with markets and geopolitical events. The US continues to screw up its energy policy and the recent price increases that we have all noticed at the pump could be just the beginning. Both EPD and MMP provide services that are crucial to the economy and the underlying resources have relatively inelastic demand. One of the things I have been hearing more and more lately is “Energy is the economy.” It might be an oversimplification, but it is the first and most important building block for a healthy economy.

EPD and MMP both come with oversized distribution yields and cheap valuations. They both have strong track records when it comes to distribution growth, and I think investors buying today are likely in for double-digit total returns. In past articles, I was very bullish on EPD and MMP. I still plan to hold my positions for a long time, but after a sizable run to start 2022, the valuations aren’t quite as attractive as they were three months ago. For investors focused primarily on current income, both EPD and MMP are solid buys with huge yields and a likely price appreciation kicker.

Note: Both EPD and MMP require a K-1 tax form. Investors should be aware of this and what it entails before purchasing units of either MLP.

Be the first to comment