Imagesbybarbara/iStock Unreleased via Getty Images

Introduction

It’s earnings season, which means on top of the usual macro indicators and stories, we’re getting a load of specific company data and comments, which not only helps us to assess the stocks we own or want to buy but also to add more pieces to an already complex macro “puzzle.” In this article, I want to preview Norfolk Southern’s (NYSE:NSC) upcoming earnings. We’re going to do that by assessing the tricky situation for railroads based on the ongoing threat of strikes, operating efficiency issues, economic growth expectations, and the just-released earnings of its direct competitor CSX Corp (CSX), as well as the largest stock-listed railroad Union Pacific (UNP), which services all major economic ports and hotspots on the West Coast.

The good news is that a lot of weakness has been priced in. The bad news is that the stakes are high with headwinds unlikely to fade anytime soon.

So, let’s look at the details!

The Bigger Picture

On July 19, I wrote an article titled “CSX and Union Pacific: 2 Railroads I Love And 1 Major Risk.”

My article was focused on the bigger picture for railroad investors as these two companies cover every economic hotspot in the United States – when put together. Union Pacific on the West Coast, CSX on the East Coast. They more or less meet in the vertical line south of Chicago.

On a side note, CSX also covers New England after buying Trans Am rail this year.

ResearchGate

Norfolk Southern is the main competitor of CSX with the main difference being that CSX has a bigger footprint in Florida, where its headquarters is based.

That said, railroads face two types of challenges:

- Economic challenges consist of slower economic growth and a Federal Reserve eager to use rates to weaken economic demand in order to combat inflation.

- Supply chain challenges include the ongoing bullwhip effect and precision railroading, which is backfiring.

In my UNP/CSX article, I highlighted the risks of a mass labor strike in the rail industry.

CNN Business

Allow me to quote myself:

Basically, worries are that supply chain problems in the US could go into overdrive. Last week Friday, Biden prevented 115,000 railroad workers from striking. The strikes were initially planned to start on Monday this week.

Strikes would have impacted all Class I railroads, threatening to halt close to 30% of the nation’s freight. I don’t need to explain how devastating that would be.

As I said, this disaster has been avoided for now.

Yet, we’re far from finished. The Presidential Emergency Board that Biden named on Friday has no more than 30 days to come up with a solution that suits both railroads and its many employees. If it fails to come up with a suitable solution, another 30-day period starts. The so-called “cooling off” period.

In other words, negotiations could last until mid September. At that point, the 12 unions representing railroad workers could go on strike, or major railroads could lock out the workers and try to work on a deal where Congress intervenes and imposes a labor deal to their liking. Both of these things need to be avoided. Especially because the government is already blaming inflation on big businesses. For example, Biden is blaming “big oil” for high gas prices, meat processors for high meat prices, and railroads for bad services.

Achieving a deal in the next 60-ish days would be very beneficial for railroads.

One of the things I highlighted in my quote above are “bad services.” Supply chain problems in the industry are caused by two things. First, factors railroads cannot influence. These factors include the “bullwhip” effect that was caused by pandemic-related lockdowns in 2020. Businesses shut down, causing orders for i.e., inventory to drop – after all, the existing backlog was expected to be sufficient given high economic uncertainty.

Then, demand came back roaring, overwhelming companies upstream of pretty much every supply chain. It caused companies to boost output, hire more people, and invest in trucks, ships, you name it.

Fast forward a few months and we’re now dealing with slower demand.

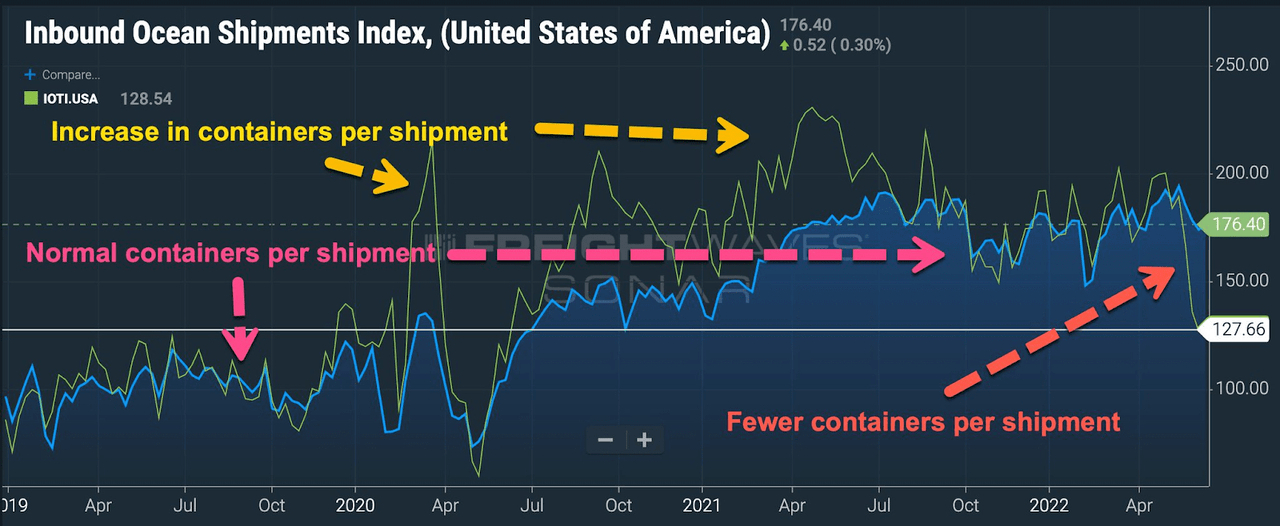

The following chart shows what this means. We’re now in a situation where ocean shipments see a much lower number of containers per shipment compared to any point after the pandemic.

FreightWaves

On top of that, China is still sticking to its zero-COVID policy, which means it shut its ports and transportation hubs at least two times. This caused the backlog to get even worse. At certain points, the number of ships reaching western ports from China was low, while at other times ports encountered too high demand to handle. One can imagine what this does to railroads who have to anticipate these issues in order to put the right amount of equipment to work.

Putting the right amount of equipment to work relies on labor. Railroads require trained personnel to get the job done, and that’s the biggest bottleneck of the industry right now.

Why? Because of Precision-Scheduled Railroading (“PSR”). As I explained in prior articles, this is a radical change of operations railroads have implemented in the past 30 years to boost operating efficiencies. In 1993, Hunter Harrison implemented PSR at the Illinois Central Railroad, where he became CEO in the same year. Illinois Central is now Canadian National Railway (CNI).

PSR has been implemented at almost all major railroads. CSX, for example, started working on it in 2017 when Harrison became CEO of the company before he passed away eight months later.

As I wrote in my CSX/UNP article:

PSR means that railroads have set times for when they pick up cargo from their customers, similar to commercial airlines. Prior to that, railroads used to wait for cargo.

It allowed railroads to reduce capital investments and headcount while boosting free cash flow […].

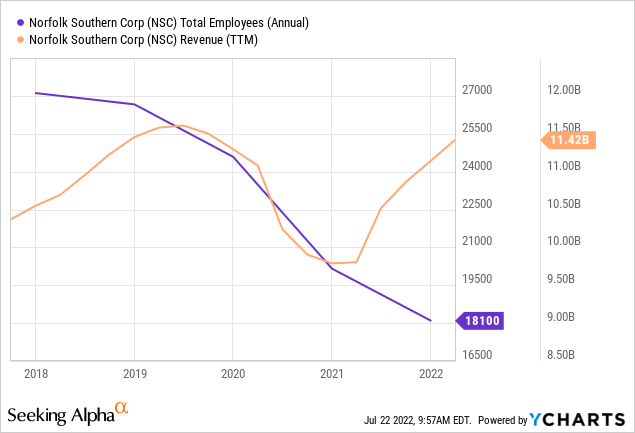

Using Norfolk Southern as an example, the company cut its employee headcount from roughly 27,000 in 2018 to barely 18,000 going into this year. Meanwhile, the company is still doing close to $11.5 billion in revenues. Firing employees is easy. Finding new employees in a labor shortage is harder. Especially when trying to focus on costs.

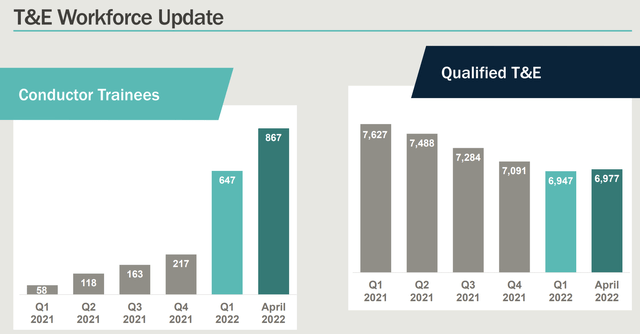

In April of this year, Norfolk Southern had 867 conductor trainees as it tries to rebuild its workforce. Between 1Q21 and 1Q22 alone, qualified T&E dropped by almost 700 people. The company is now hiking pay for trainees from $185 to $200 per day, with additional incentives.

Norfolk Southern

And the bad news keeps coming. A recent Wall Street Journal article slammed freight rail companies as service levels deteriorate.

Wall Street Journal

According to the paper:

Containers are piling up at terminals across the country, exacerbating delays and frustrating customers. Railroad executives cite the tight labor market, saying they haven’t been able to hire and retain enough workers despite offering incentives such as higher sign-on bonuses. Existing rail employees say they are overworked and waiting for wage increases that are overdue.

With that said, companies also are to encounter economic weakness, something they cannot influence themselves.

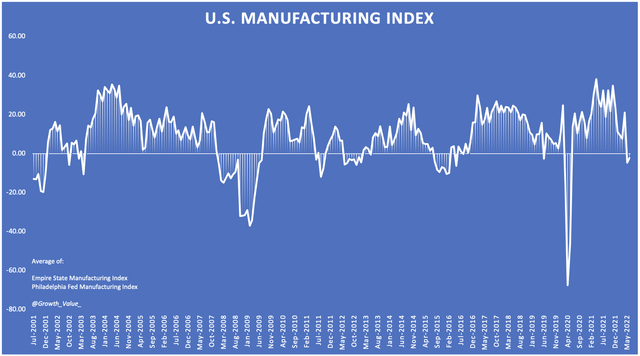

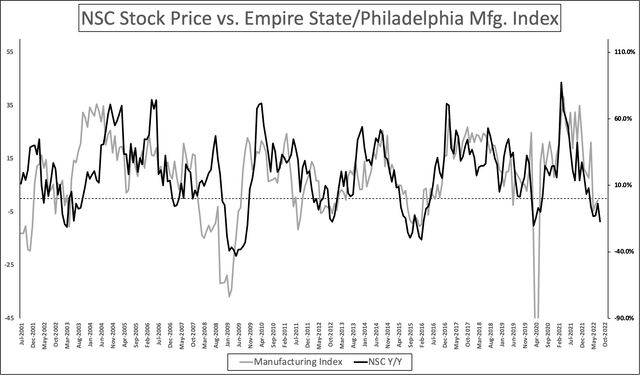

For example, manufacturing surveys are pointing at a manufacturing recession.

Author

More often than not, this is bad news for railroads. In this case, railroads have priced in a lot of weakness.

The chart below compares NSC to the data in the chart above. As NSC is down 17% from its all-time high, a lot has been priced in, which is why I have been buying industrials during the past few weeks.

Author

This is what S&P Global commented on the US economy as it released its flash PMI reports:

The preliminary PMI data for July point to a worrying deterioration in the economy. Excluding pandemic lockdown months, output is falling at a rate not seen since 2009 amid the global financial crisis, with the survey data indicative of GDP falling at an annualised rate of approximately 1%. Manufacturing has stalled and the service sector’s rebound from the pandemic has gone into reverse, as the tailwind of pent-up demand has been overcome by the rising cost of living, higher interest rates and growing gloom about the economic outlook.

With this in mind, what did Norfolk’s peers say this week?

Earnings Outlook and Peer Performances

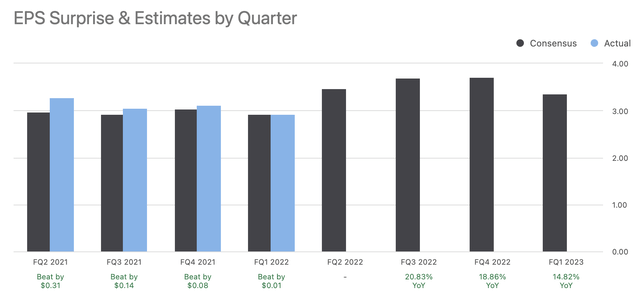

On July 27, NSC reports earnings before the opening bell. Earnings are expected to come in at $3.47/$3.44. I’ve seen different estimates using different sources. This is based on a total of eight estimates/analysts. Four analysts have downgraded their 2Q22 expectations in the past four weeks. Three analysts have also downgraded the outlook for 3Q22, which makes sense given economic conditions. In other words, I wouldn’t bet against NSC beating earnings as it has a history of beating estimates and because analysts are all aware of ongoing challenges.

Seeking Alpha

However, beating earnings isn’t what the upcoming earnings are about. As a long-term investor in Norfolk Southern, I mainly care for operating performance statistics and comments regarding everything I discussed so far in this article. Nothing is more important than improving the railroad supply chain without sacrificing operating efficiencies.

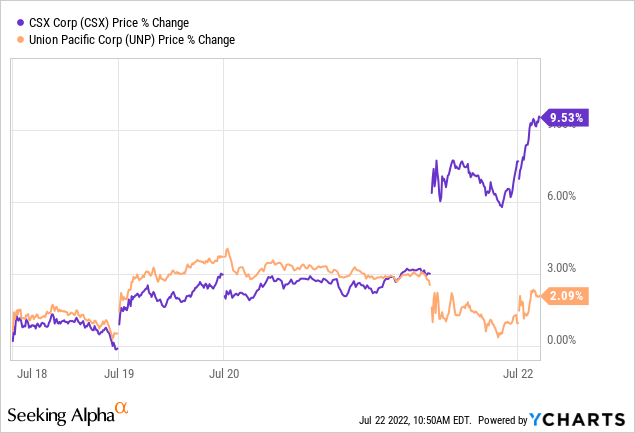

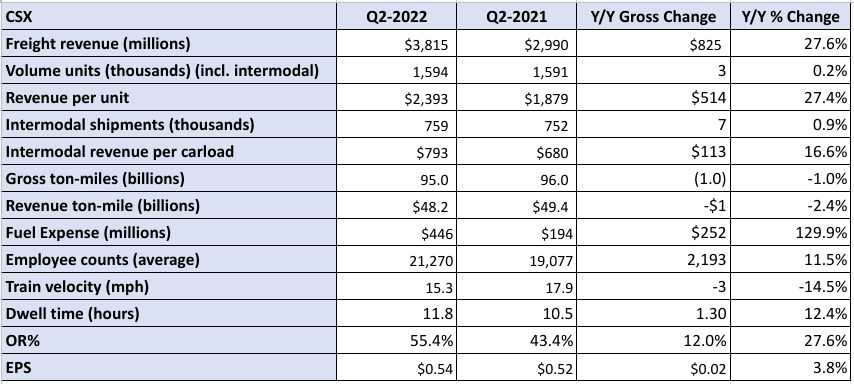

This week, both CSX and UNP reported earnings. CSX did $3.82 billion in revenue, $150 million higher than expected. Its GAAP EPS beat by $0.06 as it came in at $0.54. That’s up 3.8% year on year.

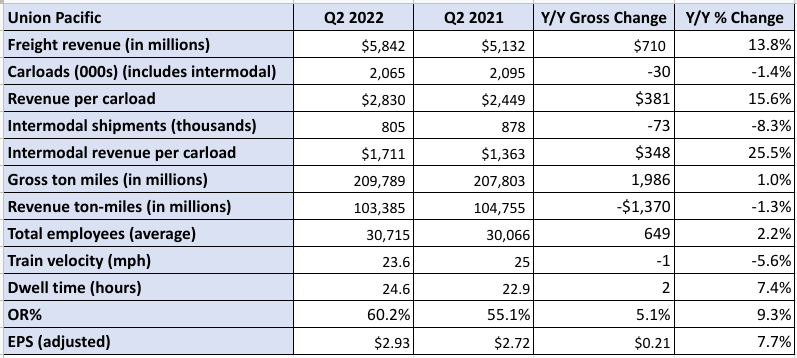

Union Pacific also beat both top and bottom-line estimates. Revenue came in at $6.27 billion, $160 million higher than expected. GAAP EPS beat by $0.08 as it rose by 7.7% to $2.93.

Yet, the stock market reaction was different for both:

In order to be prepared for Norfolk Southern’s earnings, we need to figure out why that is.

As FreightWaves puts it, CSX did rather well when it comes to operating efficiencies.

“We’re in great shape to handle whatever traffic comes to us … We only have one restriction right now and it’s crews, and we’re doing everything we can possibly do to hire as many people as we can,” President and CEO Jim Foote told investors during CSX’s earnings call Wednesday afternoon.

The freight railroad’s executives were surprised that the attrition rate of new hires was higher than what CSX has previously experienced or anticipated, and so the focus now is to look at compensation strategies as well as analyze the reasons for the attrition and find ways to improve the vetting of new hires, according to Foote and others on the call.

CEO Foote said that the target of 7,000 train and engine employees can be achieved by the end of the third quarter. 7,000 is roughly where CSX was prior to the pandemic. If these employees are indeed qualified (instead of rushed through training), we’re dealing with fantastic news here.

After hitting its target (it’s 6,700 now), the railroad will continue to hire new employees.

FreightWaves

Even more important, the railroad expects to continue to improve service metrics in the second half of this year despite aggressive hiring.

We’re really in a great spot if we had the folks that we need to move the business. So, our terminals, as a matter of fact, 90% of our home terminals are running very well. Our flat switching terminals are running well. Where we get congestion a little bit of bottleneck is different crew change points where we don’t have crews to keep those trains moving and we got to make a decision on which train moves quicker than a different train. So, very confident that the network is better than probably what it was in 2019 and we’re ready to go once we get the folks trained up.

We’re obviously dealing with expectations here. However, it’s a truly promising development that does warrant the post-earnings surge.

So, what about UNP?

First of all, the company saw its operating ratio increase to 60.2%. That’s an increase of 510 basis points. Yet, the company’s freight revenue growth was high enough to still push up earnings per share.

FreightWaves

What’s interesting is that CEO Fritz did mention that PSR did not cause the decline in service quality:

“Let me start first by saying emphatically that PSR is not the cause of our problems in the second quarter,” he said. “When you look at our pre-transformation to today, all of that head count change is because we took work out of the network, we run one-third fewer trains, which required one-third fewer locomotives and also one-third fewer people running the trains and maintaining the locomotives. So, we took work out of the network that didn’t need to be there because we were touching cars more than we needed to and we had too many special commodity unit trains running around the network.”

Moreover (UNP explains where it went wrong):

Instead, the service disruptions occurred because “we ran the network tight,” Fritz continued. “And we did not recognize the stack up of risks that were in front of us, with COVID continuing to impact crew availability, (volume) growth coming on and normal weather events. When you run tight, you just don’t have a lot of opportunity to recover quickly. We got into trouble and inventory grew on us, and we had to take some pretty significant measures to fix that. And we did in the second quarter.”

UNP also updated its full-year guidance. The railroad expects an operating ratio of 58% vs. prior guidance of 55%.

Now onto Norfolk Southern, in addition to offering trainees more money as we briefly discussed in this article, the railroad is offering starting bonuses of up to $5,000.

As conductors make $67,000 on average in the first year of work, this really adds up. Moreover, wages rapidly rise for good employees:

“One of the clear benefits of our industry is the opportunity for future advancement and the potential for increased earnings,” said Brad Dodd, Director of Talent Acquisition at Norfolk Southern. “Through their seniority, conductors will be promoted to a locomotive engineer position that has guaranteed minimum annual pay of approximately $94,000, along with benefits. Many of our engineers earn more than $100,000 with the work opportunities at their locations.”

With that said, I believe next week’s earnings could be good. If the company shows that it’s able to hire the required employees, it could make a very bullish case during its earnings call – just like CSX did. As both CSX and NSC are far less dependent on the West Coast (no direct transportation), I think there is a very strong case that NSC reports better results than UNP and builds a stronger bull case – without having to admit that it indeed “messed up” when it comes to capacity availability.

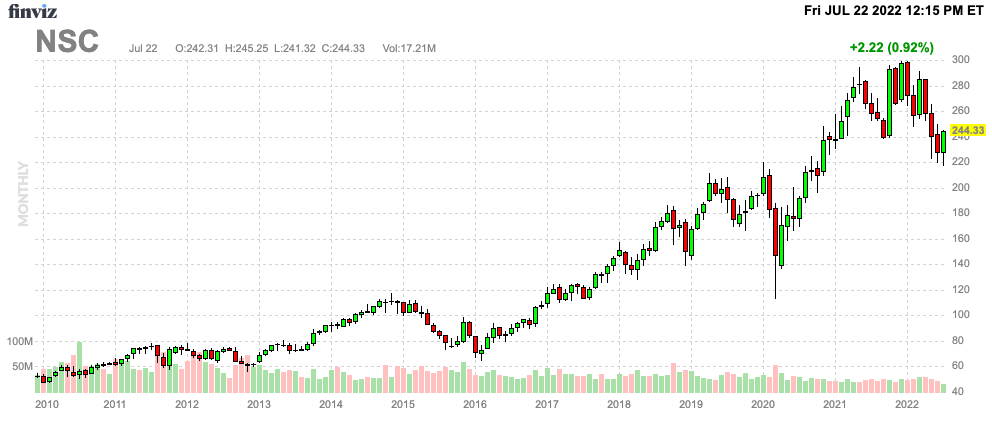

FINVIZ

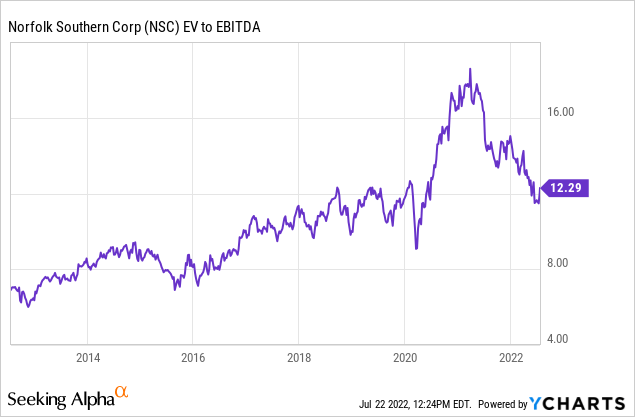

If that happens, I think the door is open for a share price recovery to $270. After all, Norfolk remains attractively valued.

Using its $58.2 billion market cap, $14.2 billion in expected 2023 net debt, and $580 million in pension-related liabilities, we arrive at an enterprise value of $73.0 billion. That’s 11.4x next year’s EBITDA estimate of $6.4 billion.

It’s not deep value, but it erases the entire post-pandemic surge in the stock’s valuation.

While I don’t put too much value on earnings (we get four per year, which adds up on a long-term basis), I’m going to buy more NSC shares if the stock dips ahead of earnings next week.

I believe the company will beat earnings and report good operating results – or at least a better outlook when it comes to operating efficiencies.

Takeaway

Next week’s Norfolk earnings are going to be exciting – regardless of whether they will be good or bad. The railroad is reporting earnings after its two biggest peers CSX and UNP reported earnings this week. CSX did very well as it signaled that it can maintain high operating margins while (successfully) boosting hiring and retaining trainees. Union Pacific didn’t fall off a cliff, but it did admit that errors have been made as a result of a changing transportation situation after the pandemic. The company signaled that it won’t achieve its operating ratio target this year.

Norfolk Southern also has stepped up hiring, using better pay and additional rewards to attract new trainees. I believe it’s a step in the right direction. Given that NSC doesn’t directly service West Coast ports, I believe the company can follow its peer CSX when it comes to beating guidance and revealing positive comments.

While I’m looking to expand my NSC position next week (pre-earnings), we need to take into account that economic growth is weak. Moreover, the risks of labor strikes are still present, although lower than before.

In other words, if you like Norfolk’s valuation, please buy gradually. Do not start a big position right from the get-go. For example, buy 25% now and add gradually over time. While a lot of weakness has been priced in, we should not expect a sudden rally to new all-time highs as headwinds continue to be persistent.

(Dis)agree? Let me know in the comments!

Be the first to comment