RB Stocker/iStock via Getty Images

A couple months ago, Mark Zuckerberg announced that Facebook (FB) was changing its name to Meta, as part of a corporate pivot towards the metaverse: online environments, including virtual and augmented realities, were individuals can engage in a myriad activities. Meta is going all-in on the metaverse, with a suite of products and services including virtual reality workspaces, augmented reality glasses, and virtual reality games.

Meta’s pivot is part of a larger tech shift towards the metaverse, and attendant products and services. Microsoft (MSFT) is investing quite heavily in video games, so are newcomers Epic Games and Roblox, as are Chinese companies like Tencent (OTCPK:TCEHY). Crypto startups are creating a vibrant economic ecosystem of virtual goods on the blockchain, including artwork (NFTs), finance (DeFi), and gaming (Axie Infinity). The metaverse is booming, and although there is no guarantee that it will permanently displace the current internet, it seems quite likely.

Investing in the metaverse seems like a reasonably good idea, which is where the Roundhill Ball Metaverse ETF (META) comes in. META is exactly what it says on the tin: a metaverse ETF, investing in companies focused on the development and support of virtual / augmented reality products and services. The fund’s holdings include video game developers, software developers, and computer hardware manufacturers.

META’s potential returns are quite high, as the fund’s holdings are growing quite rapidly, and will likely see continued growth as the metaverse is further developed.

META’s risk, volatility, and potential losses are quite high as well, as the fund focuses on companies with sky-high valuations. Worsening economic conditions or market sentiment should cause valuations to tumble, ultimately resulting in significant losses and underperformance.

META is a classic high-risk high-reward investment opportunity, and appropriate for aggressive growth investors looking for exposure to the Metaverse.

META – Overview

META is an ETF focusing on the metaverse. It is technically an index ETF, tracking the Ball metaverse Index. In practice, the fund’s underlying index is a bespoke index, whose strategy, holdings, and weights are strongly dependent, and at the discretion of, the fund’s investment management team. As such, I consider META to be closer to an actively-managed fund than to an index fund, for all intents and purposes.

META focuses on the metaverse which, according to the fund’s management team, is the successor to the current internet. The metaverse will encompass countless virtual worlds, accessed through either virtual reality headsets, or augmented reality electronics (smart glasses, smart phones, etc.). People will be able to socialize, play, work, and engage in myriad activities in the metaverse. It will have its own economy, centered on the creation and commercialization of virtual goods.

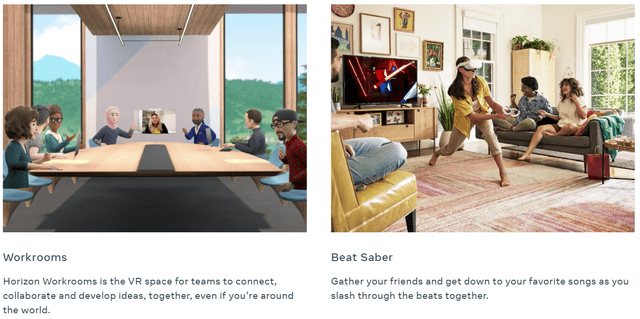

The metaverse is still under development, and although there is no guarantee that it will ever be technology or commercially successful, there are some, let’s say, prototypes available. Meta (Facebook), has already built software allowing workers to have meetings in virtual reality spaces, with the use of virtual reality headsets.

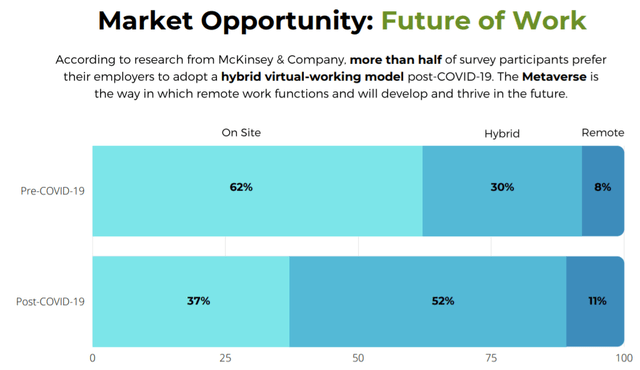

Zuckerberg seems quite optimistic about the technology, and it does seem potentially revolutionary considering the increased prevalence of working from home. Time will tell if the product is successful.

There are many virtual reality games available, including Beatsaber, Half-Life Alyx, and Blade and Sorcery. Players use virtual reality headsets and motion capture sensors to interact with virtual environments, objects, and even other players. Virtual reality games are fully interactive, immersive, although graphics are still somewhat rudimentary, and latency is a constant issue.

Most famous of all is the most commercially successful augmented reality game in history, Pokémon Go. The game allowed players to catch Pokémon, fantasy animal collectibles, in real-world locations through their cellphones. It was incredibly popular, the most popular app in history at a point, and quite fun too, in my opinion at least.

The metaverse will have a rich economy, based on the creation and commercialization of digital goods. We already have NFTs, basically digital artwork, example below, and lots of games sell other types of digital goods too.

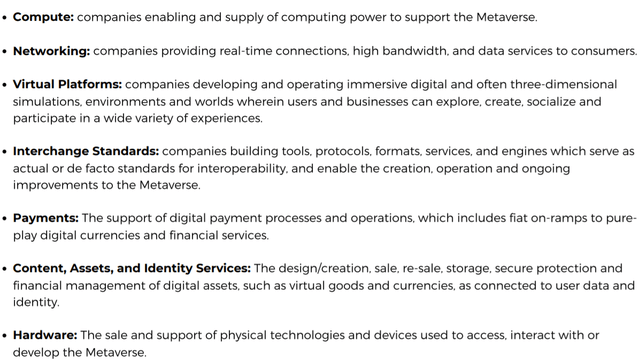

The metaverse will encompass all of the above, and more. META aims to profit from the development, commercialization, and increased popularity of the metaverse, by investing in companies with exposure to said industry. Specifically, the fund invests in companies involved in the following:

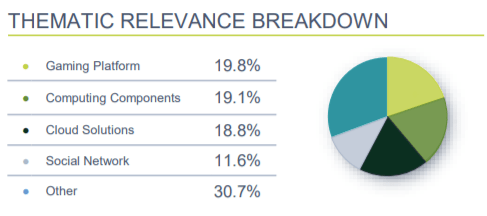

The above seems like a self-explanatory, reasonable, exhaustive list of companies directly / indirectly involved with the metaverse. META’s thematic exposure and holdings are as follows:

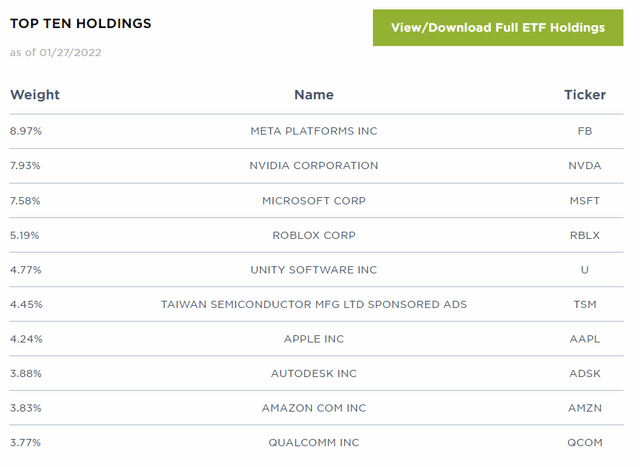

META’s holdings and industry exposures are clearly reflective of its niche / themes. As an example, Nvidia (NVDA) is the premier developer of computer graphics cards, necessary for virtual gaming and the like. Meta (FB) is going all-in on the metaverse, and is investing hundreds of millions in developing new products in the space. Roblox (RBLX) is a multi-player video game developer, which allows players to build their own games, virtual worlds, and the like. These are all companies which should benefit from the development and popularization of the metaverse, and are perfect fit for a fund like META.

META’s strategy and holdings provide investors with several key benefits and drawbacks. Let’s have a look at these, starting with the benefits.

META – Benefits

Outstanding Growth and Potential Returns

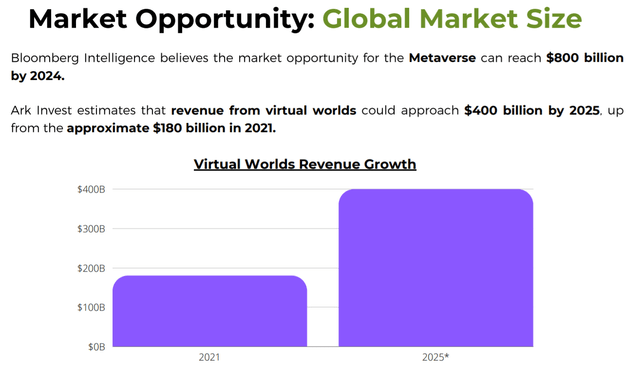

META’s holdings operate in a booming industry, with most market analysts expecting robust growth moving forward. As per the fund’s management team, Bloomberg analysts expect these companies to 4x their revenues by 2024. Ark Invest, the world’s most successful innovation growth investment managers, believes the segment will double in size by 2024.

The coronavirus pandemic accelerated some of the trends underpinning META, especially in regards to working from home, which should boost revenues for these companies further.

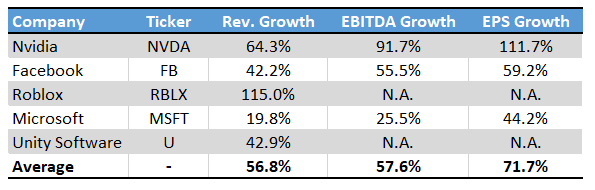

Importantly, the above are not simply purely speculative projections, but reflective of current trends. META’s holdings are already growing very rapidly, and are well-positioned to continue growing as current trends continue. The following are 1Y growth rates for selected financial metrics of META’s five largest holdings.

Seeking Alpha – Chart by author

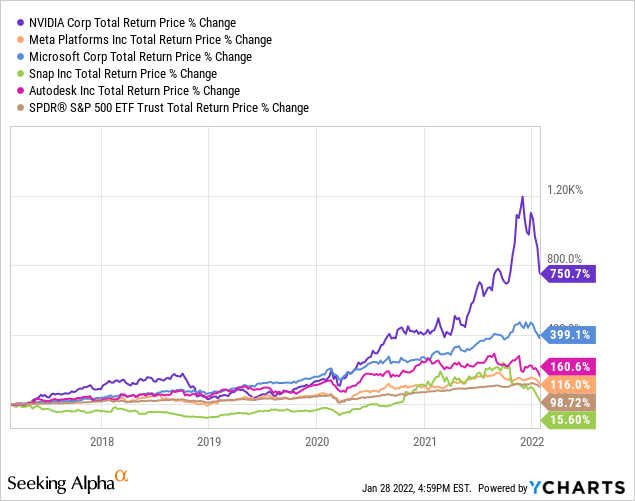

Strong revenue, earnings, and cash-flow growth should lead to market-beating returns, as has been the case for most of the fund’s holdings throughout the years (I’ve purposely excluded a couple holdings which only recently IPOed).

META’s core investment thesis is quite simple.

The metaverse is seeing explosive growth as consumers and workers shift to virtual spaces. Companies focusing on the metaverse have seen strong growth too, and are likely to see further growth as the industry continues to expand. Growth should lead to market-beating returns, as has been the case for the past few years.

It is a simple, reasonable investment thesis, in my opinion at least.

Strong Investment Management Team

META is technically an index fund, but, in practice, it behaves more like an actively-managed fund. META’s strategy, holdings, and hence performance, are strongly dependent on the fund’s investment management team. A good management team should be able to select strong, best-performing industry stocks, leading to market-beating returns. A less competent management team should be unable to do so, ultimately resulting in underperformance, perhaps even losses. Although this is almost always the case for a fund, it is particularly important for funds focusing on growth stocks and niche industries, in which conditions are highly volatile, and constantly in flux. Things can only go so wrong investing in boring utilities, things can go very, very wrong investing in speculative growth stocks.

META’s performance is strongly dependent on its management team, and it has an outstanding management team, which bodes well for the fund’s future performance. META’s investment management team includes executives with experience in the larger tech companies, including Nvidia, Amazon (AMZN), and Meta, as well as those focusing on video game development, a core metaverse segment. META’s management team has the experience, capabilities, and knowledge necessary for the fund to succeed, in my opinion at least.

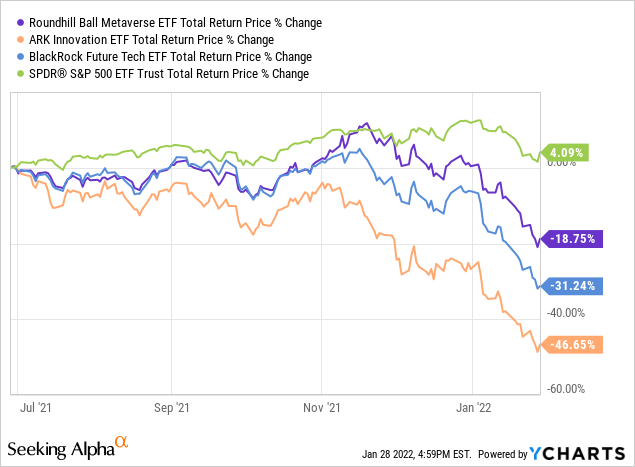

Reasonable Performance Track-Record

Finally, META’S performance track-record is reasonable, but quite short. The fund has outperformed the ARK Innovation ETF (ARKK), the largest innovation growth fund in the market, and the BlackRock Future Tech ETF (BTEK), my top industry choice, since inception in mid-2021. It is an incredibly short track-record, and so not all that material, but the results are encouraging.

On a more negative note, the fund has underperformed the S&P 500 since inception. Underperformance was mostly due to tough industry conditions and bearish market sentiment. As mentioned above, as this is an incredibly short performance track-record, I do not consider these results to be all that material.

META – Drawbacks

Undiversified Niche Holdings

META is an incredibly undiversified fund. The fund invests in a relatively low number of securities: 44. Most broad-based equity index funds invest in hundreds, some even thousands, of securities, as do most actively-managed equity funds. META is also very concentrated, with its top ten holdings accounting for just over 55% of its value.

META’s concentrated, undiversified holdings increase portfolio risk and volatility, and make the fund’s performance strongly dependent on the performance of a couple of its holdings. Expect the fund to significantly underperform if Nvidia or Meta underperform, for instance. As mentioned previously, this is rarely the case for broad-based equity index funds, or even actively-managed equity funds.

Making matters worse, is the fact that the fund’s holdings all focus on an extremely niche industry: the metaverse. META does not invest in defensive sectors, does not invest in other asset classes besides equities, and all of its holdings focus on a particular tech niche. If the metaverse flounders, or if investors grow bearish about the industry, the fund will almost certainly underperform, and by a lot. Most funds are more diversified, and so these issues are minimized, but that is most definitely not the case for META.

Due to the above, and as a risk-reduction measure, allocations to META should be kept relatively small. A 5% allocation, max, seems reasonable, in my opinion at least.

Sky-High Valuation

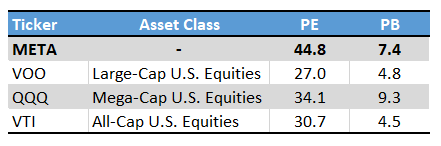

META focuses on high-growth large-cap tech stocks, an industry segment which has seen skyrocketing returns, share prices, and valuations for years. Due to this, META’s valuation is quite high, and much higher than that of most broad-based equity indexes.

META’s sky-high valuation will almost certainly be a drag on the fund’s performance moving forward, and might result in significant losses and underperformance if industry conditions or investor sentiment were to worsen. Although this is the case for most investments, it is particularly important for investments with rich valuations and comparatively low cash-flows and dividends. A high-yield stock might generate sufficient dividends to cover deficient capital gains, but that is most definitely not the case for META.

Above-Average Level of Risk

META’s concentrated, undiversified, niche holdings, combined with its sky-valuation, make it a relatively risky fund and investment. META could suffer significant losses and underperformance relative to its index, and to a much greater degree than the average growth fund, actively-managed fund, or equity fund. META is a risky investment, and only appropriate for aggressive growth investors.

Conclusion

META offers investors exposure to the metaverse, the under-development virtual world successor to the current internet. The metaverse is still in its infancy, but is already seeing explosive growth. Further growth is likely to continue, which should lead to strong, market-beating returns in the coming years. On the other hand, the fund’s holdings are quite concentrated, and very risky, which could lead to losses and underperformance if economic or market conditions were to worsen.

META is a classic high-risk high-reward investment opportunity, and appropriate for investors looking for exposure to the metaverse.

Be the first to comment