LUNAMARINA/iStock via Getty Images

Over the last year, Sylvamo Corporation (NYSE:SLVM), which produces and supplies printing paper, has been trading more like a high-growth tech stock than a supplier of paper products.

In early October 2021 it was trading at approximately $23.00 per share, and started a volatile but upward run, eventually reaching the recent 52-week high of $57.38, before slightly pulling back to the mid-$56s.

It continues to put out solid numbers, but after its big upward run, and some commentary from management in its recent earnings call, the company appears to be poised for a correction sometime in the next couple of months, as typical seasonal volume, a couple of maintenance outages, supply chain restraints, rising costs and contractor delays will probably more than offset some pricing strength going forward.

While I believe the company has a lot of growth left in it, in the near term it’s highly probable its share price is going to take a hit.

In this article we’ll look at some of the recent earnings numbers, the combination of headwinds that will temporarily slow down the company’s momentum, and how to think if SLVM over the longer term.

Some recent numbers

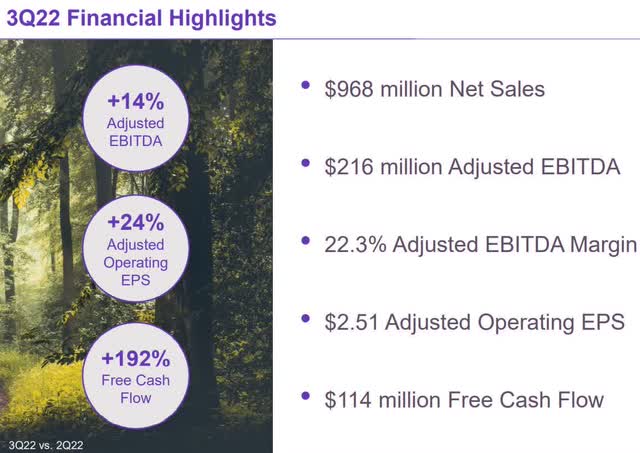

Revenue in the third quarter was $968 million, up 6.61 percent year-over-year, beating by $68.63 million. Net income in the reporting period was $109 million, or $2.44 per share, up from net income of $84 million or $1.89 per diluted share in the second quarter of 2022.

Adjusted earnings in the third quarter was $112 million, or $2.51 per share, up $22 million from the adjusted earnings of $90 million, or $2.02 per share in the prior quarter.

Adjusted EBITDA in the quarter was $216 million, with a margin of 22.3 percent. That was compared to adjusted EBITDA of $189 million, and a margin of 20.7 percent sequentially.

Of the three major markets it competes in (Europe, Latin America and North America), Latin American adjusted EBITDA generated the highest margins in the quarter, finishing at 27 percent, followed by North America with 20 percent, and Europe with 18 percent.

Free cash flow soared from $39 million in the second quarter of 2022 to $114 million in the third quarter of 2022.

The company cut debt to under $1 billion in the reporting period, with a gross debt-to-adjusted EBITDA ratio now under 1.5x for the last 12 months, as of the end of the third quarter.

In the fourth quarter the company guides for adjusted EBITDA to drop to $180 million to $190 million, confirming some of the weakness I see in the near term.

Short-term headwinds

Below are listed the various headwinds the company faces in the fourth quarter and the first quarter of 2023. They are:

Lower seasonal volume, rising seasonal costs, Fx impact, two maintenance outages, compensation accruals, supply chain constraints, and contractor delays.

Where the challenge lies, and where investors should primarily focus on are, the price and mix in the near term versus input costs.

In the third quarter the company did well because price and mix was up $60 million compared to the second quarter of 2022. So even though input costs jumped by $46 million in the third quarter, price and mix more than offset that, resulting in the good numbers. The company isn’t going to have the same results in the next couple of quarters.

Price and mix in the fourth quarter are expected to increase from $30 million to $35 million. At the same time inputs are projected to come in at a range of $35 million to $40 million, based upon Fx effects and seasonably higher costs in the European and North American markets. Add to that the estimated $21 million in maintenance costs coming from expenses associated with outage, and it shows the company isn’t going to enjoy the numbers it has been producing over the last year. Another factor in play is the delay in certain projects in 2022 that will be pulled forward to the fourth quarter and into 2023. Contractor delays and supply chain constraints were the reason for that, so the company guides for an additional $20 million in spending in 2023.

With that in mind, it means some of the numbers for 2022 would have been somewhat lower, although the projects would have been boosting performance for the company quicker, so that delay and increased spend will probably result in some downward pressure on earnings in 2023, although if pricing and mix hold up in the latter half of 2023, it should offset that.

But in the near term it’s going to have an impact on the company’s results, which when combined with a share price that has been soaring, is likely to bring a correction that it has been due for, even if it wasn’t facing the headwinds in front of it.

The final headwind is compensation accruals, which wasn’t included in prior guidance.

Conclusion

SLVM has a strong management team in place that has the determination, commitment, and ability to execute on its strategy. It has performed very well over the last year in growing the business, and after a short period of headwinds, by which I mean the fourth quarter of 2022 and first quarter of 2023, the company is positioned to continue its upward climb.

I’m not suggesting it won’t start before the second quarter of 2023, only that the possibility is strong that it will be under pressure in one or both of the quarters mentioned above. The timing of it is of course unknown as to specifics.

For investors interested in the company, I do think it’s prudent to wait until the headwinds have their short-term effect on the company before taking a position. As mentioned earlier, it has been trading more like a tech stock than a printing paper company, so is prone to wide swings in its share price.

And earlier in 2022 it had a big drop of about $24 per share to its 52-week low. And while it has been moving up in a stair-step pattern since then, it is due for a correction even with the headwinds mentioned in the article. But the combination of the headwinds and high share price points to a potential deep correction sometime soon.

I would wait till it bottoms out and confirms it’s sustainably off its bottom before taking a position.

Further out, I like what I see with the company, and after the expected correction it should take another run at its 52-week high, and probably break through it into the mid to high $60s in 2023, more than likely in the second half.

The only thing is see stopping that is a prolonged and deep recession that force companies to cut back on spending

Be the first to comment