MarsBars/E+ via Getty Images

Inflation has once again come front and center this week, with March inflation report indicating that prices rose by 8.5% YoY. This gives new meaning to the expression “cash is trash” as it becomes increasingly expensive to hold money. That’s why it pays to buy income-generating assets that can help one to preserve their hard earned wealth. This article highlights why Owl Rock Capital (NYSE:ORCC) may be a solid choice for those seeking high income in inflationary times, so let’s get started.

Why Owl Rock Capital?

Owl Rock Capital is a business development company that was founded in 2015. It’s the second largest BDC by assets, and is externally managed by Owl Rock Capital Advisors. The company is focused on providing debt financing to middle market companies with annual EBITDA in the $10-250M range.

Like other quality BDCs, Owl Rock is focused on providing direct lending solutions. This allows the company to originate and service its own loans, which gives it more control over the quality of its portfolio. This is reflected by the fact that 90% of its loans are senior secured, with 75% first lien and 15% second lien investments.

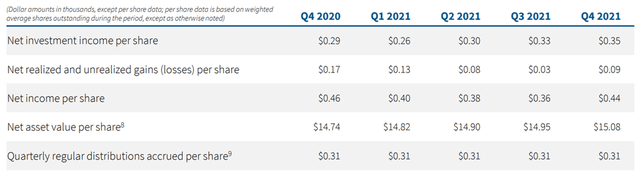

It’s also done a good job of growing its NAV/share. ORCC’s NAV per share has grown in each consecutive quarter since last year, currently sitting at $15.08. Moreover, the dividend is well-covered at a 78% payout ratio based on the aggregate net income over the past 4 quarters, as shown below.

ORCC Fundamentals (Investor Presentation)

Looking forward, ORCC is well-positioned with plenty of dry powder, as it has a robust $1.8 billion in liquidity, comprised of cash and undrawn debt capacity. It’s also reasonably leveraged, with a debt-to-equity ratio of 1.13x, sitting well below the 2.0x statutory limit, and just 0.1% of the fair value of ORCC’s loans are in non-accrual status. Furthermore, ORCC should benefit from a rising rate environment, as 99% of its loans are floating rate.

Risks to ORCC include the potential for a recession, as highlighted by the Bank of America (BAC), due to surging consumer prices. This could result in pressures on ORCC’s portfolio companies. Management highlighted the impact of rising rates, and sees their portfolio companies being able to weather rate hikes, as noted during the recent conference call:

We are assessing the impact of a rising rate environment on our borrowers’ ability to service their debt. Our borrowers benefit from strong interest coverage metrics today. And based on our analysis, we believe they have sufficient cushion to manage if rates increase in line with the current market expectation. While we’ll continue to monitor these issues closely, overall, our observations suggest that the positive tailwinds from healthy consumer spending and strong demand will outweigh these headwinds in 2022.

I see value in ORCC at the current price of $14.86, considering that it’s currently trading below its NAV/share of $15.08. I believe a premium is deserved, considering the recent track record of NAV increases and the overall size and quality of the portfolio. Sell side analysts have a consensus Buy rating with an average price target of $15.64. This could translate to a potential one-year 14% total return including dividends.

Investor Takeaway

Inflation is back with a vengeance, and this has investors searching for income-generating assets. Owl Rock Capital may be an attractive option, as it’s focused on providing debt financing to middle market companies. The company has strong fundamentals, including a well-covered dividend, and is reasonably leveraged with plenty of dry powder. I see value in ORCC at the current price for high income in the current inflationary environment.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

Be the first to comment