RichVintage/E+ via Getty Images

Co-produced with Treading Softly

At what point do you feel like you’ve “made it”?

I remember when I got my first refrigerator with a water and ice dispenser built-in. My wife and I both really wanted a fridge with that feature. It seems silly that we both thought this was important, but you see for both of us growing up, having an ice dispensing fridge was a luxury we didn’t have.

It wasn’t something we got on our first fridge, we actually went through a few fridges before we arrived at the place where we decided to spend the extra to have one with that option. In a way, we attached financial success or the feeling of having “arrived” or “made it” to get a fridge with a water/ice dispenser. It was a fancy option that before that point we couldn’t justify splurging on.

Even today, as I fill my glass with ice I occasionally think back to the days when I’d open the freezer to find the ice cube trays were nearly empty. Or the ice would be frozen in so tightly I’d be smashing the tray as hard as I could to shake the cubes loose.

For many, when it comes to retirement saving, hitting seven figures in net worth is seen as “making it.” Being a millionaire has a nice ring to it. It rolls right off your tongue. Who wants to be a millionaire? Who doesn’t?

If we place it in perspective, $1 million using the 4% “safe-max” withdrawal system that is promoted by many financial advisors, would provide $40,000 in annual income. It is safe to say that for anyone with $1 million in their retirement account, $40,000 would be a stiff reduction in income. Worse, the financial advice that many peddle includes the necessity for you to sell shares every year to get that $40,000. So every year, you own a little less of the companies that built your retirement.

What if I told you, you could match that income output and not be forced to sell a penny in your shares? Sounds too good to be true right? Thankfully it isn’t. Dividend income investing is a tried and true form of investing with decades of data and history to back it up.

Today’s picks provide an average yield of over 11%, meaning with half a million, you would generate $55,000 annually. 37% more income with half the money, without selling a single share.

What do you do with that excess? You built your retirement by taking a portion of your income and investing it in the stock market because you know that the US stock market is the single greatest generator of wealth in the history of the world. Why would you want to sell off such an amazing source of wealth? You shouldn’t. Keep doing what you have always done – allocate a portion of your income to invest in the future.

Invest in high-yielding investments and use the excess income you are generating to reinvest and buy more shares. Own more of the companies in your portfolio, and watch your income grow. I get messages all the time from members who are amazed at how much their income grew when they adopted the Income Method.

Of course, we don’t suggest only holding 2 securities, we have a portfolio with over 40 picks targeting 8-10% average yields. These two excellent picks can get you started towards having a millionaire’s income stream even if you don’t have a million dollars.

Let’s dive in.

Pick #1: ARI – Yield 10.3%

What do you want to own when the inflation rate is rising, when businesses are sitting on large amounts of liquidity and interest rates are more likely to go up than down?

Real estate is a natural hedge against inflation, its value tends to rise with inflation, and often more quickly than inflation. When corporations have a lot of liquidity, you want to lend to them. Lending to those flush with cash is always a much lower risk than lending to those who are cash poor. Lending using a floating rate loan turns rising rates from a risk to a benefit.

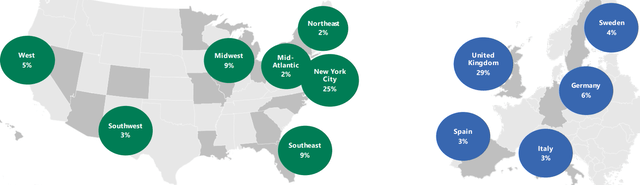

So we want to lend money to people buying real estate with floating-rate loans. This is what Apollo Commercial Real Estate Finance, Inc. (ARI) does. Most mortgage REITs focus on the U.S. alone, whereas ARI adds a little twist to its portfolio with exposure to Europe, primarily to the UK.

Investor Presentation February 2022

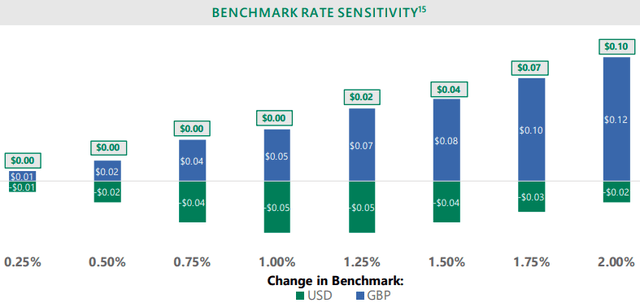

This diversification creates an interesting dynamic that we do not see with most US-centric mREITs. Commercial mREITs generally benefit from rising interest rates because the loans they make are primarily floating rates. However, they also borrow using floating rate debt as well. This creates a brief period where rising rates are actually a headwind to earnings because the money that mREITs lend typically have a “floor,” so when interest rates are near zero, the borrower pays the floor rate instead. As ARI has a good enough balance sheet to get loans that don’t have floors, then, when rates are near zero, ARI benefits.

In the UK, having a high floor isn’t common practice, so the dynamic is different. Every interest raise in the UK directly benefits ARI. As of Q4, the balance was nearly perfect, with interest rate raises in the UK causing higher net income offsetting equally sized raises in the U.S.

Investor Presentation February 2022

However, this assumes the central banks raised rates the same amount at the same time. The Bank of England has already raised rates three times, to 0.75%, while the Federal Reserve has only hiked rates once to 0.25%. This difference in central bank strategies is a positive for ARI, as the rise in income from the UK is greater than the decline in the U.S.

Despite this leg-up compared to peers, ARI has been slow to rebound. Likely because many investors are automatically selling anything with European exposure due to the conflict in Ukraine. This is an opportunity to snag ARI at a discount, as it is currently trading at about a 10% discount to book value.

We fully expect that ARI will go back to trading at a 5-10% premium to book value, providing 10-20% capital gains potential on top of a nearly 10% dividend!

Pick #2: ECC – Yield 13.0%

We have been very bullish on CLO equity as the world moves on from the ravages of COVID. It’s hard to believe that just a year ago, Eagle Point Credit Company Inc. (ECC) was only yielding 7.9%. We wrote an article a year ago predicting that ECC would start raising its dividend back up. Since then, ECC has raised its dividend three times, for a 75% increase. It paid out a $0.50 special dividend, and it has undistributed taxable income that will likely be paid out through a second special dividend at the end of this year. Despite all these dividend raises, the share price is only up about 10%.

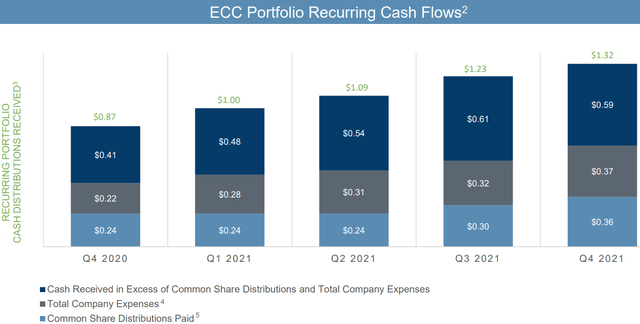

ECC continues to have massive amounts of cash flow, and we continue to see future dividend growth as extremely probable. Here is a look at ECC’s cash flow per share over the past year:

ECC’s cash flow per share increased by over 50%. Even though the dividend was raised substantially, excess cash after the dividend payment was $0.59/share in Q4. In 2019, ECC averaged $1.07/quarter in cash flow and only $0.155/share in cash in excess of the distribution.

ECC’s NAV is higher, its cash flow is higher, its dividend is safer, the future outlook is better, and yet it is trading at a lower price than it was before COVID.

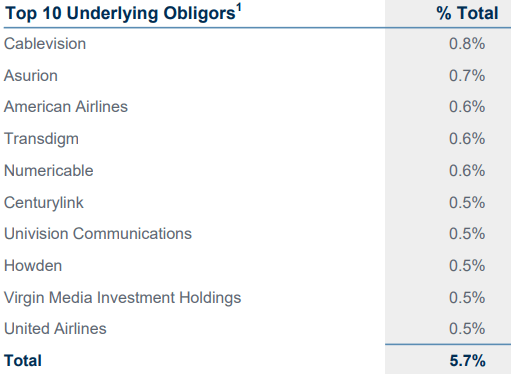

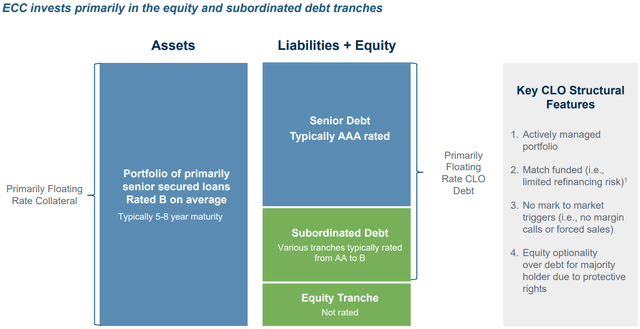

Let’s take a look at how ECC makes money. ECC buys “CLO equity” positions. CLOs are bundles of senior secured loans issued to companies with “B” credit ratings. On a balance sheet, these are usually referred to as “term loans” or “bank loans.” Many borrowers are publicly traded companies, all borrowers have credit ratings from major rating agencies.

We are not talking about small unknown companies. Here are ECC’s top 10 borrowers, you probably recognize a few names.

Quarterly Update – 4Q 2021

Banks don’t like to hold loans on their balance sheets. Why? Because they make money from originating new loans. They want to free up their capital, and not have to wait for the borrowers to pay them back.

CLOs buy these loans from banks and then resells them to investors. CLOs are “securitized”, meaning that the bundle of loans is broken into “tranches.” Buyers can pay a premium to be at the front of the line and be the first to be paid. When the borrowers make payments, the CLO manager pays the senior tranches first, and then the junior tranches and the CLO equity gets to keep everything else, it looks something like this.

The senior tranches serve as a debt obligation for the CLO. They receive a predetermined interest rate, which has far more to do with the premium that institutions like banks or insurance companies are willing to pay for the extra security than it does with what the underlying borrowers are paying. Buyers of AAA tranches are essentially the same buyers who are paying for U.S. Treasuries.

The “equity” tranche is the one tranche that is paid primarily based on what the underlying borrowers are paying. When institutions are paying large premiums for the senior tranches, it’s the equity tranche that benefits. The managers of the CLO are major holders of the equity and get most of their profits from the success of the equity position.

Defaults are at historically low levels and are expected to remain extremely low. Even when defaults do occur, the senior secured position of leveraged loans often means little to no actual loss. For example, the first default for 2022 occurred with a “distressed debt exchange” from Diamond Sports Group, which was held by 364 CLOs. Some unsecured bondholders accepted a lower principal amount in exchange for higher interest rate bonds. The term loans were exchanged at par, so the borrower still owes the same amount of money to the CLOs after the exchange as it did before the exchange, and the covenants of the new loans are more stringent. It counts as a default, but the actual loss to ECC? Nothing.

Sometimes, the market just needs to wake up and smell the cash flow, but before it does, I’m going to grab some more shares of ECC.

Shutterstock

Conclusion

Today, we looked at two outstanding picks for locking in and reaping excellent income from our current rising rate and inflation environment. We’ve been highlighting names like these for a while to help retirees and income investors position their portfolios effectively.

ECC continues to fly below the radar of the general market, even while out-earning its dividend, raising it, and paying out special dividends along the way.

ARI benefits from rising rates on both sides of the Atlantic Ocean and we project it returning to trading at a premium to book value instead of a discount.

For you, these both offer you a route to unlock more income from your hard-earned money. I strongly believe that nothing makes money quite as well as money does. You worked hard for years to create the balance of your retirement portfolio. Now it is high time it worked just as hard, or harder, for you.

You can achieve a millionaire’s income stream, and with it, even become a millionaire as your income outpaces your expenses and builds your total net worth. Don’t spend your retirement draining your net worth, constantly worried about whether you will outlive your nest egg. Spend it building your income and your portfolio to new heights.

I believe in you. Do you believe in yourself?

Be the first to comment