Jonathan Kitchen

(This article was co-produced with Hoya Capital Real Estate.)

As I write this, the market is experiencing yet another decline this beautiful morning, October 10, 2022.

I have recently written ad nauseum concerning market events, including this article in which I explain why “the world of 4,818” faces a very uncertain future. Needless to say, not much has changed since, other than the Fed unequivocally reiterating a path of “higher for longer.”

At the same time, I have recently been watching the price action of 3 of the USA’s most influential companies; Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT). Certainly, these 3 companies led the run up that ended at the start of 2022. At the same time, AMZN is off its 52-week highs by roughly 40%, AAPL by 23%, and MSFT by 35%.

While-as you might expect from an author who writes under the pseudonym ETF Monkey-the overwhelming bulk of my portfolio is in ETFs, I am not averse to adding an individual stock or three if I feel that opportunity may be presenting itself. And so that’s what I was doing. While I can’t predict where the ultimate bottom of this bear market will be, I was watching these 3 stocks for what I felt might be a nice entry point to at least start averaging into them.

And then, in the course of my searching, I ran across an ETF which offered an opportunity to invest in all 3 in a reasonably significant way, under a single umbrella. That ETF is Invesco NASDAQ 100 ETF (NASDAQ:QQQM). In a spirit of full disclosure, I purchased a modest amount of this ETF in my personal portfolio this morning. In turn, that led me to write this article.

Why QQQM And Not QQQ?

Before I go any further, let me get one little detail out of the way right at the outset. In essence, QQQM is a newer, and smaller, version of Invesco QQQ Trust, Series 1 (QQQ). The difference? Boiled down as simply as I can put it, QQQM is marketed towards buy and hold investors and QQQ may be preferred for trading purposes. I will get into this distinction a little more, and why I chose QQQM, as the article continues.

Invesco NASDAQ 100 ETF – Digging In

Invesco NASDAQ 100 ETF is a fairly new offering in the world of ETFs. With an inception date of 10/13/20, it will be celebrating its 2nd birthday somewhere around the time you are reading this article. QQQM’s expense ratio is .15%.

Like its stablemate QQQ, QQQM is based on the NASDAQ-100 Index. The Fund will invest at least 90% of its total assets in the securities that comprise the Index. The Index includes securities of 100 of the largest domestic and international nonfinancial companies listed on Nasdaq. The Fund and Index are rebalanced quarterly and reconstituted annually.

The structure of this fund does present some challenges. Since it focuses exclusively on stocks listed on the Nasdaq index, quality large-cap companies that trade on other indexes such as the NYSE are, by definition, eliminated.

In addition, as compared to a total-U.S. market ETF, such as Vanguard Total Stock Market ETF (VTI) or iShares Core S&P Total U.S. Stock Market ETF (ITOT), QQQM’s focus on large-cap stocks means it also gives up growth opportunities that might be available from small-cap stocks.

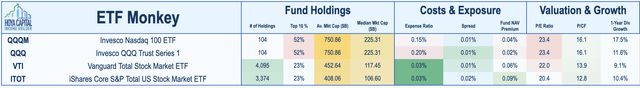

As a very high-level overview of how this plays out, have a look at this compact, yet comprehensive graphic, courtesy of Hoya Capital Income Builder.

QQQM/QQQ vs. Total-Market ETFs (Hoya Capital Income Builder)

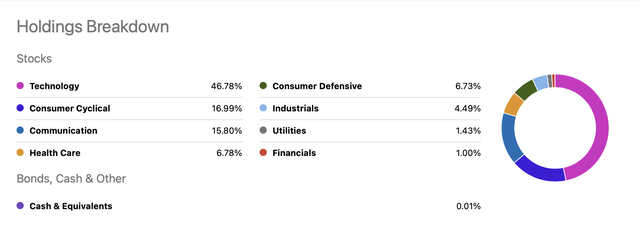

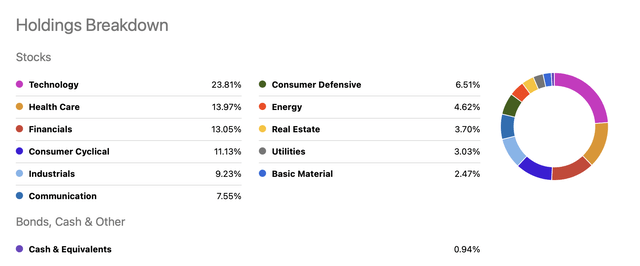

Let’s dig in a little further into how all of this plays out. The next two graphics are courtesy of Seeking Alpha, and offer a compact visual impression of how the sector weightings in QQQM compare with that of VTI, a total-US market ETF.

First, here is QQQM.

QQQM: Sector Holdings Breakdown (Seeking Alpha)

Next, a look at VTI.

VTI: Sector Holdings Breakdown (Seeking Alpha)

It can quickly be seen that QQQM is extremely heavily focused on the Technology sector, with almost a 2-to-1 relative weighting as compared to the total US market. Consumer Cyclical and Communication, between them, are also close to a 2-to-1 relative weighting as compared to the total US market. In contrast, Health Care is far less heavily weighted and Financials are all but nonexistent in QQQM.

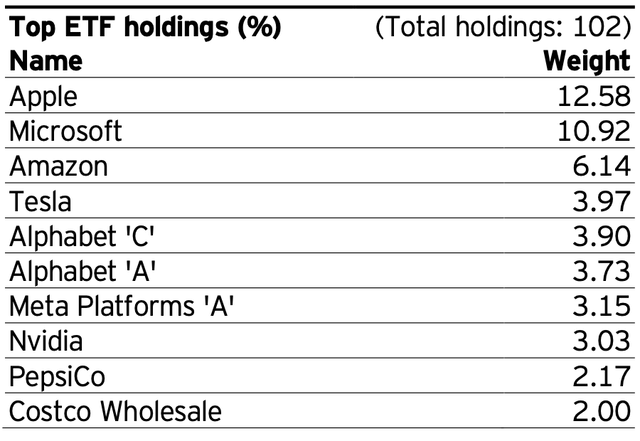

With that background, let’s turn to QQQM’s Top 10 holdings. In this instance, I turned to the fact sheet provided for QQQM by Invesco.

QQQM: Top 10 Holdings (Invesco QQQM Fact Sheet)

Here, however, is where we come full circle. At the outset of the article, I shared that I had been closely tracking the prices of AAPL, AMZN, and MSFT, and considering opening small initial positions in them as individual stocks.

As it happens, I discovered that AAPL, AMZN, and MSFT just happened to be the 3 largest holdings in QQQM, with roughly 30 cents of every dollar invested in QQQM effectively an investment in these 3 stocks. In contrast, an investment of $1.00 in VTI would represent roughly 14 cents in these 3 stocks. So, roughly a 2-to-1 increase in focus if one selects QQQM.

As I looked closer, the next thing that jumped out at me is that the two classes of Alphabet (GOOG) (GOOGL), at a combined weighting of 7.63%, are actually the 3rd-largest holding in the fund. As it happens, if interested, one can find multiple articles right here on Seeking Alpha featuring the belief that GOOG and GOOGL represent exceptional values in here. With these included, now we are up to almost 38 cents of every dollar invested in QQQM.

The other stocks represented bring the total weighting of QQQM’s Top 10 holdings to 51.59%, emphasizing once again that this is a very focused fund.

Bottom line for me, though? With PepsiCo (PEP) and Costco (COST) also included, I get my heavy focus on the three stocks I had initially been following and, for the most part, additional stocks that I am very happy to own rounding out the Top 10.

Why Did I Stash QQQM in My Roth IRA?

That brings us to the last part of our discussion. While it was a pleasant happenstance that my chosen title formed a rhyme, the idea behind it is a little more substantial.

It all has to do with asset location (not allocation, location). I wrote a fairly extensive primer on the topic awhile back. You might find it very helpful, particularly if you are at, or nearing, retirement age.

In brief, we can divide the asset location question into 3 subsets of accounts: 1. Taxable, 2. Tax-deferred, and 3. Tax-exempt. As it happens, the question of what assets you stash where can make quite a difference in the bill you ultimately owe the tax man, and thus your long-term results.

In my case, as a recent retiree, in line with the principles described in that primer, I am interested in placing assets with the greatest potential for growth in my Roth IRA. And QQQM represents exactly that. An asset with potential for significant growth, assuming I have a reasonably long time horizon before I need to access the funds.

With that explanation, you are likely also grasping my choice of QQQM over QQQ. Early in the article, I featured that QQQM is marketed towards buy and hold investors and QQQ may be preferred for trading purposes.

You see, QQQ is about as liquid of an ETF as one could hope for. It trades in massive quantities each and every market session. If one is an active trader, the difference between QQQ’s expense ratio of .20% and QQQM’s slightly lower .15% is of far less consequence than QQQ’s miniscule trading spread.

On the other hand, as explained above, clearly I am a buy and hold investor. As a result, over time, QQQM’s lower expense ratio is attractive to me. While the difference is small, over several years it will add up.

Summary and Conclusion

As a recent retiree, my personal portfolio is relatively conservative. At the same time, at 60 years of age, and assuming I manage to keep myself in relatively good health, my investment horizon could easily span between 25 and 30 years.

While I have certain viewpoints about what may happen over the near term, as summarized in the conclusion of my last article here on Seeking Alpha, my investment in QQQM is not about that. It is very much about starting to dip my toe in a segment of the market that has been beaten up very badly of late with an eye to potential outperformance many years down the road.

Be the first to comment