Justin Sullivan

SoFi Technologies (NASDAQ:SOFI) has such a bullish case that bears can only bring up fears on the stock-based compensation issue to hold the stock back. The fintech remains on a path to 50% growth and the issues facing the company are far overplayed. My investment thesis remains ultra Bullish on the stock, especially on the dip back to $5 again.

Stock-Based Compensation Myth

As with most companies going public, SBC is elevated due to the going public transaction. Any technology-related company has to pay aggressive stock compensation in order to attract the best software engineers in Silicon Vally and a lot of employment agreements include triggers for the company going public.

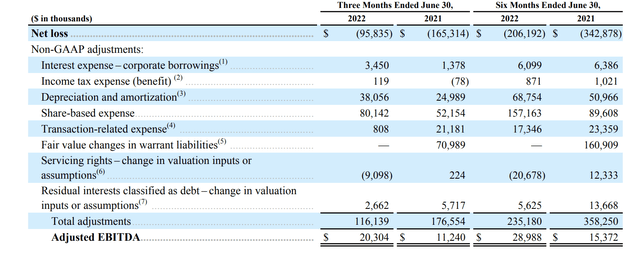

In the last quarter, SoFi reported SBC of $80 million setting off the red flags for some investors. Quarterly revenues were only $363 million, so the SBC is definitely a large portion of the revenue base at 22% in the quarter.

Source: SoFi Tech. Q2’22 earnings release

A lot of investors don’t appear to understand that SBC is a non-cash charge created by accountants. The actual impact to the business is the additional shares outstanding from issuing restricted stock units or stock options to employees.

Accountants created the SBC charge in order to analyze the effectiveness of management by assigning a charge to stock issued to employees in lieu of cash compensation. The advantages of SBC are creating an incentive for employees to stay with a company and aligning the employee interest with shareholders, but the disadvantage is diluting existing shareholders with the issuance of additional shares.

The problem is investors treating these non-cash expenses as anything other than the additional shares issued to employees. The cost to shareholders is the additional dilution

SoFi ended Q2 with 910 million shares outstanding, but the fintech reports a loss so the fully diluted share counts aren’t included in the income statement. The problem facing investors is the misunderstanding that share counts have surged in the last couple of years and not fully understanding the major boost in diluted shares was via the SPAC deal where the company raised $2.4 billion selling 240 million shares pushing the pro forma share count to 865 million prior to factoring in any dilutive shares.

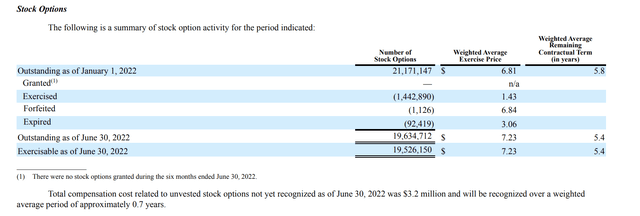

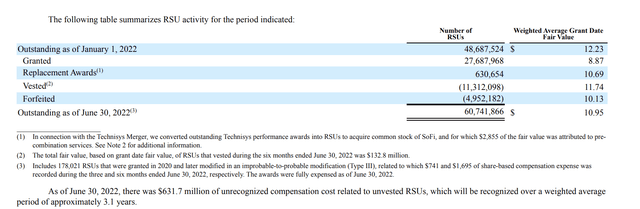

SoFi has a vast amount of stock options, RSUs and PSUs issued to employees that will vest and be exercised over the next 10 years or so. In total, the company has over 100 million total shares involved here, but management only issued 28 million RSUs in the 1H of the year.

The company has almost 20 million outstanding stock options, but the average exercise price is over $7. With the stock at $5, the stock options aren’t even in the money and the potential SBC charge is small.

The vast majority of the SBC impact going forward is related to RSUs. SoFi has $632 million worth of SBC to be recognized over a period of ~3.1 years amounting to $210 million per year going forward.

A big key here is that SoFi has only issued 28 million RSUs this year. These restricted shares were granted at nearly $9 amounting to $250 million worth of SBC, but the stock is down to only $5 now, Not to mention, a large amount of these shares may never even vest.

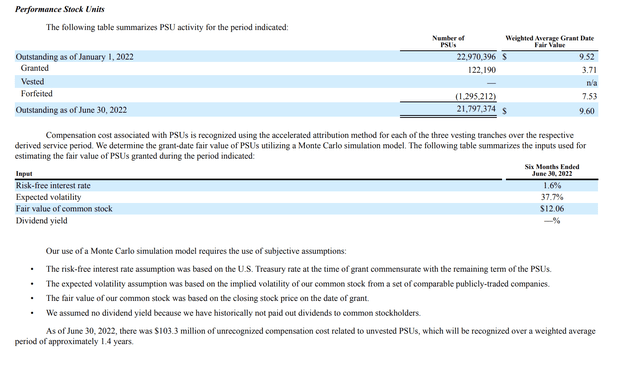

Performance stock units are the second most important category with $103 million in SBC costs over the next 1.4 years. The company had over 1 million shares forfeited in the 1H of the year.

As the CFO discussed in a recent interview at a Piper Sandler conference, the SBC charges are currently elevated due to the going public transaction. His forecast is for SBC charges to fall below 10% of revenues in a few years.

The real key going forward is that SBC is only actually the additional shares issued every year. SoFi would’ve had ~970 million diluted shares and the amount is closer to 1.0 billion now with an assumption that all of the new RSUs this year are exercised.

Don’t Sweat

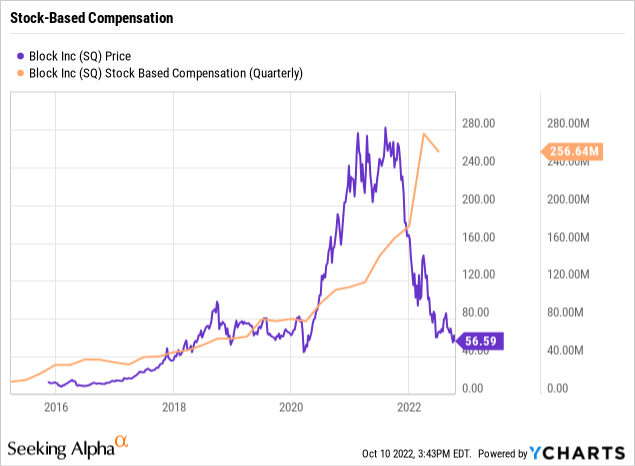

With a market cap of close to $5 billion, new stock issues of 30 million shares for an impact of $140 million are very immaterial. Block (SQ) had years of massive SBC growth and the stock rallied with no problems due to far higher expenses.

The mobile payments company reported quarterly SBC of $40 million back the years after going public. The amount soared to $160 million a quarter in 2021 when the stock had risen from $10 to $280.

Investors want performance and SBC only impacts the stock, if the company isn’t producing the performance to warrant the share dilution. SoFi plans to generate 50% revenue growth this year despite a student loan moratorium holding back revenue growth this year. The fintech is generating the performance where investors would completely ignore the minor share dilution this year, if the stock wasn’t stuck at $5.

Takeaway

The key investor takeaway is that shareholders stuck on SBC charges don’t actually understand how the calculations work. Too many of the charges are related to PSU shares issued years ago and triggered based on acquisitions and the SPAC deal.

SoFi isn’t wildly issuing new shares as the common misperception thinks. The company will normally face limited shareholder dilution ahead in a manner equal to the need to pay top employees via equity compensation.

The stock remains far too cheap trading at 2.5x ’23 sales targets while the company becomes very profitable next year.

Be the first to comment