JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Invesco Ltd. (NYSE:IVZ) reported good fourth-quarter results and finished 2021 strong. There is no doubt based on valuation metrics that the company is undervalued at the moment. It is also true that you can find better asset management companies to invest in, but IVZ is a decent company at a reasonable price.

However, there is a catch: the company’s extreme expansion in the Chinese market. I think in the short term it can be a significant advantage against its competitors. However, over the long term, unpredictable Chinese financial and investment regulations could ruin not only this advantage but possibly harm the company’s bottom line.

Business Model

Invesco is a publicly-traded investment management firm. The firm provides its investment services to retail clients, institutional clients, high-net-worth clients, etc. IVZ employs over 8000 people in 51 locations worldwide. Thirteen of these locations are in the Asia Pacific region, which emphasizes the company’s importance and long-term vision for this region.

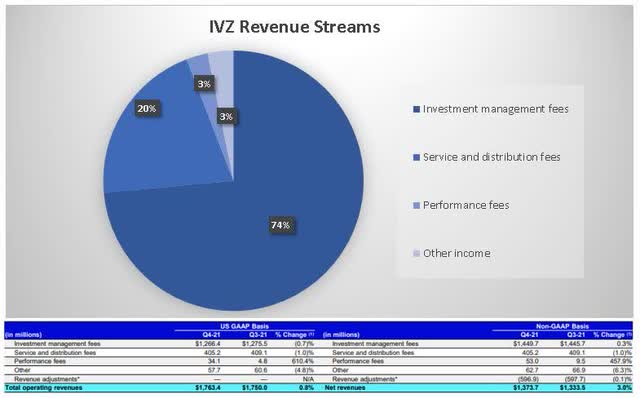

IVZ recognizes revenue from four different streams, but the investment management fees are responsible for the lion’s share of its income. Investment management services are satisfied over time as the services are provided and are typically based upon a percentage of the value of the client’s assets under management. The other significant income stream is the performance and distribution fees. These are fees on sales of external mutual funds, asset-based sales or marketing, and sales of an ETF such as QQQ.

IVZ Financials & Earnings

Q4 Results

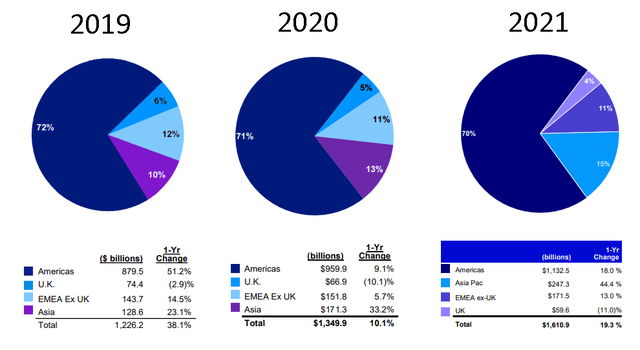

IVZ reported good fourth-quarter results. The company’s net long-term flows increased on a year-on-year basis by 27.6%, but decreased compared to Q3 numbers by 6%. Their period ending AUM could grow both on a year-over-year basis and previous quarter results. IVZ finished the fourth quarter with $1610.9 billion AUM. Their operating margin remained high as well (42%). The company also outperformed Q4 estimated EPS of $0.76 per share by 13% and reported an EPS of $0.86 per share. IVZ outperformed its previously estimated EPS figures 65% of the time and underperformed the figures 34.5% of the time in the last 7 years.

The company will announce its first-quarter results on April 26th, 2022, before the market open. We can already see that the company will very likely report worse results than in the last quarter as their AUM declined both in January and February. The assets under management decreased by 3.7% in January and by another 1.3% in February. Figures for March will come in a couple of days.

Valuation

Based on several factors, IVZ is undervalued. Seeking Alpha’s overall valuation grade is B. IVZ has a forward Non-GAAP P/E ratio of 7.52, better than the industry average and approximately 16.7% better than its 5-year average. Numerous other metrics show IVZ’s undervaluation such as the EV/EBITDA (30% better than sector median), price per sales (almost 40% better than sector median), etc.

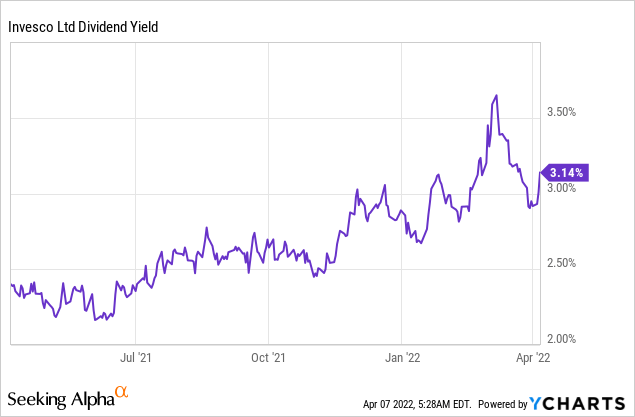

We can see the same trend when analyzing its dividend yield. You could have bought IVZ with a better dividend yield than 3.1% only 12% of the time in the last 12 months. The company has decent return on equity, ROA and ROI figures. However, while they are lower than most of its peers such as Franklin Resources (BEN), this does not make IVZ a bad company.

Company-Specific Risks

In the long term, I can see two major risk factors for IVZ. One of them is a company-specific risk, and the other is more asset management segment related.

Redemptions and shifting among client portfolios are ongoing risk factors. This could be caused by investors reducing their investments in general or in the market segments in which they focus. Investors may take profits from their investments when positive returns occur or due to poor investment performance. The fees they earn vary with the types of assets being managed, with higher fees earned on actively managed equity and balanced accounts, along with real estate and other alternative asset products, and lower fees earned on a fixed income, stable return accounts, and certain passively managed products.

And here comes the 20-year trend of the rise of passive investment vehicles. It is expected that domestic passive investing will overtake actively managed funds by 2026 (non-domestic a bit later). So, over the next five years, IVZ’s revenue will change, and if not watched carefully, it can decline due to the shift to lower-fee accounts.

The company experienced extensive growth in the Asia Pacific region, especially in China. IVZ could almost double its AUM in 2 years in this region and now it is responsible for 15% of its total portfolio. In China, new investor regulations can come in fast relative to the U.S. or the EU. Policy and regulatory scrutiny should be seen as ongoing risks when it comes to investing in China, to be carefully monitored and integrated into company research and portfolio management.

If this trend continues by 2025, realistically, one-fourth of IVZ’s AUM and income will come from this region, especially from China. Therefore, any geopolitical risk or regulatory change can negatively affect IVZ’s income and it can strike by lightning with no clouds in the sky before predicting the storm like with Chinese tech stocks. Now the geopolitical factors need to be valued accordingly despite almost all Chinese tech stocks being undervalued based on traditional valuation metrics.

Fourth Quarter 2019, 2020, 2021 Results

My Take on IVZ’s Dividend

Current Dividend

IVZ has a forward dividend yield of 3.14%. The company has been paying a consecutive dividend for 13 years and has a 1-year dividend raising streak. This is due to the pandemic, because the management had to cut the dividend to take off some pressure from the company’s cash flow. I believe this restructuring went well, and now IVZ has plenty of positive cash flow to pay dividends in the future. Before the COVID-19 outbreak, the management had a nice 10-year consecutive dividend raising period, and I believe this trend can continue. This theory is supported by an almost 10% dividend increase last year.

Future Sustainability

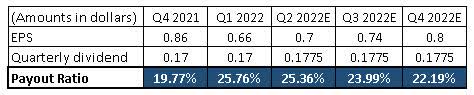

There is no doubt that the current 25%-ish payout ratio is safe and sustainable in the long term. IVZ usually announces its increased dividend alongside its first-quarter results, so I expect the management to announce the new dividend at the end of April. According to the analysts’ estimate averages, they expect a 4.4% dividend increase this year, which means the new dividend can be $0.1775 per share quarterly instead of the current $0.17 per share.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final Thoughts

Although in January and February AUM declined by approximately 5% combined, IVZ performed well in 2021. It still has strong growth potential in the Asian Pacific region. Numbers are solid, the company is undervalued and the dividend yield is attractive. In addition, I expect a dividend increase in April. There is only one question that remains: What do you make of the Chinese expansion? In my opinion, in the next 2-3 years, it will not make any difference, but in the longer term, it can turn out ugly for IVZ. Let me know your thoughts in the comment section.

Be the first to comment