TiaClara/iStock via Getty Images

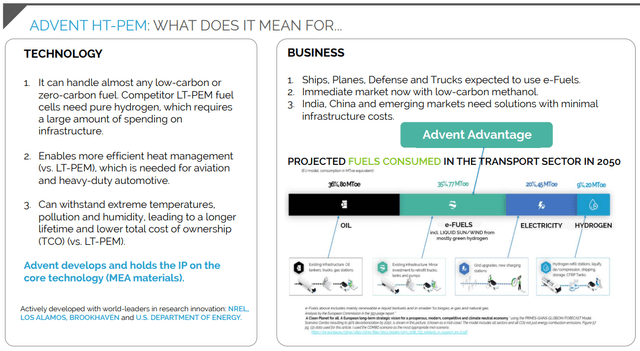

Advent Technologies Holdings (NASDAQ:ADN) or “Advent” labels itself “an innovation-driven leader in the fuel cell and hydrogen technology sectors” but in reality the company appears to be employing a roll-up strategy mostly focusing on high-temperature polymer electrolyte membrane (“HT-PEM”) technology on which the company holds some core intellectual property.

HT-PEM fuel cells don’t require pure hydrogen and can handle almost any low- or zero-carbon fuel. In addition, Advent asserts its technology to be highly resilient and enable a more efficient heat management.

Company Presentation

Advent used the recent ESG hype to obtain a backdoor listing by combining with SPAC AMCI Acquisition Corp. in February 2021. The transaction raised an aggregate $158.3 million in capital, including $93.3 million of AMCI’s cash in trust and $65 million from a PIPE investment led by Jefferies LLC and Fearnley Securities, Inc.

One week after becoming a public company, Advent acquired UltraCell LLC, a manufacturer of lightweight fuel cells for the portable power market for $4 million in cash. UltraCell has been an early adopter and customer of Advent’s HT-PEM technology.

In June 2021, Advent acquired the fuel cell systems businesses of fischer Group for an aggregate EUR52 million in cash and stock. The transaction included Denmark-based Serenergy A/S, a manufacturer of HT-PEM fuel cells and Germany-based fischer eco solutions GmbH, a provider of fuel-cell stack assembly and testing as well as production of critical fuel cell components, including membrane electrode assemblies (“MEAs”), bipolar plates, and reformers.

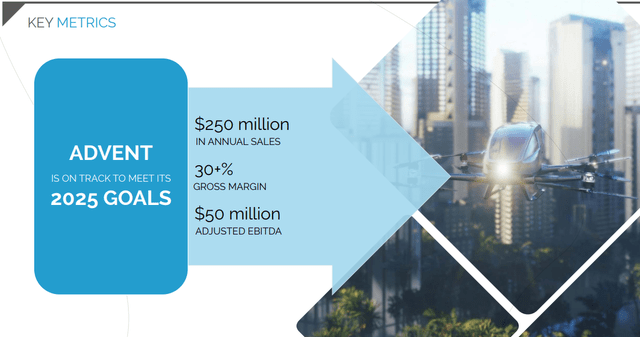

As a result, the company’s full-year sales increased from a paltry $0.9 million in 2020 to $7.1 million last year. On the Q4 conference call, management projected $23 million in sales for this year.

Apparently, there’s still some way to go for Advent to hit its $250+ million revenue goal by 2025 outlined in the company’s most recent presentation.

Company Presentation

Advent currently targets to enter mass production for its proprietary HT-PEM MEA technology in 2024.

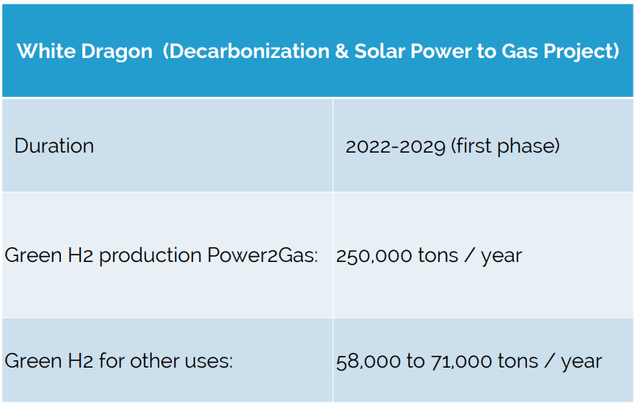

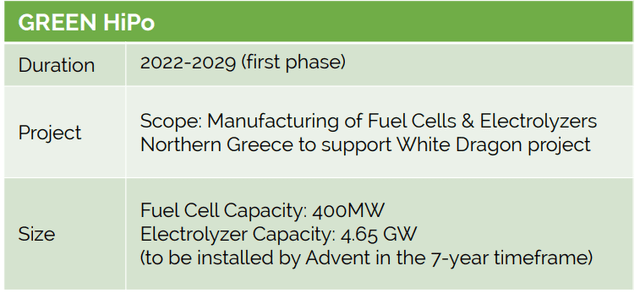

Another key aspect of the company’s business plan are two complementary, large-scale projects (“White Dragon” and “Green HiPo”) targeting green hydrogen and fuel cell / electrolyzer production in Greece. Advent hopes the projects will be approved and receive funding by the EU as so-called Important Projects of Common European Interest (“IPCEI”) later this year.

Company Presentation

Company Presentation

After using $61.4 million in cash last year, Advent’s cash position was down to $79.8 million at the end of Q4. Assuming quarterly cash burn of $15 million going forward, the company would have to raise additional capital twelve months from now at the latest point.

With the ESG hype fading over the course of 2021, Advent’s shares sold off alongside industry peers like Plug Power (PLUG), Ballard Power (BLDP), FuelCell Energy (FCEL), Bloom Energy (BE) and fellow SPAC deal Hyzon Motors (HYZN).

After the expiration of all remaining lock-up agreements in early February, the stock lost another 50%. On Tuesday, the share price briefly dropped below $2, a new all-time low.

But on Wednesday shares rallied 80% on massive volume after Advent announced a “technology assessment, sales, and development agreement” with Hyundai Motor Company (“Hyundai”):

Under the agreement, Hyundai will provide catalysts to Advent for evaluation in its proprietary Membrane Electrode Assemblies (“MEAs”), while Advent intends to support Hyundai in fulfilling its fuel cell project needs, through:

Developing inks and structures using IFAT catalysts, which will then be evaluated by IFAT. Following evaluation, Hyundai will determine whether IFAT or standard catalysts will be used for this project.

Supplying MEAs throughout the development/commercialization cycle (“Advent MEAs”) for testing, evaluation, and optimization under conditions set by Hyundai.

Assisting Hyundai with the use and specifications of MEAs as well as their implementation into Hyundai’s designs.

Following the completion of the first phase of the project, the companies will collaborate closely to set out specific product requirements, collaborative product goals, as well as milestones for achieving established goals and plans for phase 2, which shall also include Advent’s stack cooling technology.

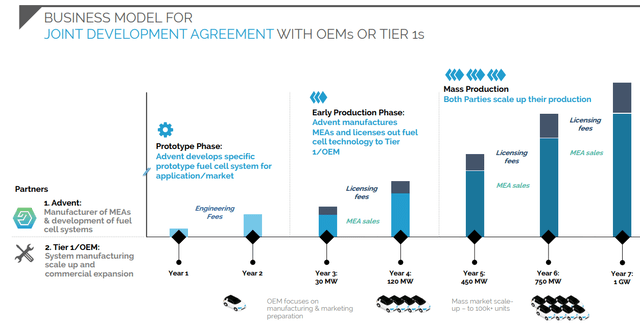

In fact, the agreement marks an important milestone in the company’s business strategy of partnering with OEMs to achieve scale in MEA production and generate licensing fees:

Company Presentation

That said, things tend to move slow when it comes to fuel cell development and I do not expect the agreement with Hyundai to be an exception but at least it validates the company’s business approach to some extent.

While financial terms have not been disclosed, I do not expect any material near- or medium-term revenues being derived from the agreement.

At this point, it’s impossible to assess the potential long-term value of the transaction but Wednesday’s $85 million increase in market capitalization appears somewhat overdone.

But given how beaten down the company’s shares had been prior to the announcement, I wouldn’t be surprised to see the stock rally for another day or two with momentum traders chasing the shares.

Unfortunately, the momentum crowd is well known for moving to assumed greener pastures sooner rather than later which is likely to result in the shares giving back a good chunk of their gains next week.

Absent further strategic partnership announcements or similar big news, investor focus is likely to revert to the company’s near-term capital needs and overly aggressive 2025 top- and bottom-line targets.

Bottom Line

While Wednesday’s agreement with Hyundai marks an important step in Advent’s business strategy, the transaction is unlikely to result in material near- or medium-term financial benefits to the company.

Like basically all of its peers, the company remains mostly a story stock at this point.

Expect shares to resume their downtrend after momentum traders have left for assumed greener pastures and investor focus reverts back to the company’s near-term capital needs and ambitious 2025 sales and profitability projections.

A short sale could yield decent near-term results for speculative investors with the ability to stomach outsized volatility for the next couple of sessions.

That said, shares might be hard to borrow following Wednesday’s rally but this should change on Friday or early next week at the latest point.

From my experience, it’s important to wait until trading volume has started to decrease before entering a short position. As always, don’t bet the farm on short positions and adequately manage your risk.

Be the first to comment