Canan turan

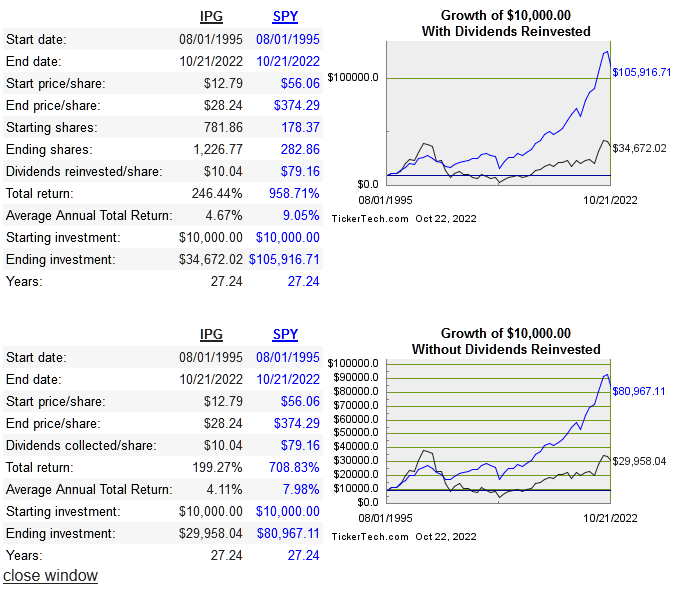

The Interpublic Group of Companies (NYSE:IPG) is one of the largest and oldest ad agencies in the US. It has been publicly traded since the early 70’s and the share price peaked in the late 90’s, but have never gotten back to that level. Below is the long term share price performance:

dividend channel

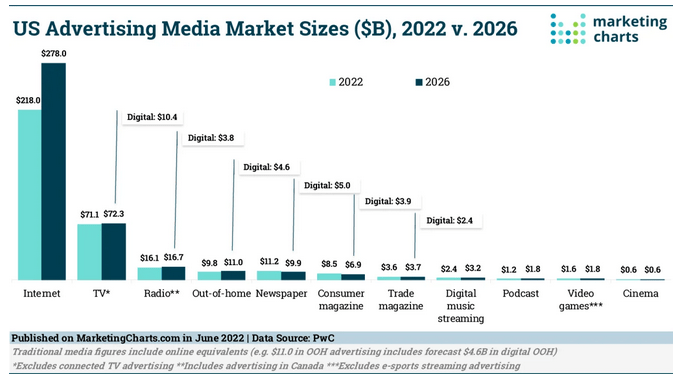

The biggest secular headwind for traditional ad agencies has been the rise of digital marketing, specifically Google (GOOG) and Meta (META) dominating that category. While it’s true that the legacy businesses obviously compete digitally as much as they can, there is still basically no way to capture significant market share from the big tech companies mentioned.

Below are projections of the traditional versus digital advertising market

marketing charts

Below are the return on capital and earnings metrics compared with peers:

|

Company |

Revenue 10-Year CAGR |

Median 10 Year ROE |

Median 10-Year ROIC |

EPS 10-year CAGR |

FCF/Share |

|

3.9% |

21.3% |

10.6% |

9.2% |

18.5% |

|

|

0.3% |

36.3% |

13% |

7% |

-2% |

|

|

0.9% |

13% |

7.4% |

-3.6 |

9.7% |

|

|

15.7% |

16.5% |

9.4% |

15.6% |

6.5% |

Capital Allocation

The big story around capital allocation is the fact that their biggest acquisition brought on a lot of debt, so repurchases were canceled to focus on deleveraging instead. They had traditionally repurchased a lot of shares for most of their history, but in 2018 they stopped buying back shares in order to focus on paying down debt used to acquire Acxiom.

Below we’ll take a look at FCF and how it has been used, in USD millions:

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

FCF |

188 |

420 |

521 |

513 |

313 |

726 |

388 |

1,331 |

1,680 |

1,880 |

|

Div |

115 |

138 |

159 |

196 |

238 |

280 |

322 |

363 |

398 |

428 |

|

Buybacks |

351 |

482 |

275 |

285 |

303 |

300 |

117 |

n/a |

n/a |

n/a |

|

Debt Repayment |

402 |

602 |

351 |

2 |

2 |

325 |

105 |

403 |

504 |

1,571 |

|

Acquisitions |

146 |

62 |

54 |

41 |

52 |

31 |

2,310 |

1 |

5 |

16 |

So far the acquisition has done more to boost FCF versus the top line. Margins have also improved at every level since the acquisition. Since this extra FCF has been used to pay down debt, it’s clear that it has been a beneficial buyout as long as debt is continually reduced. With dividend growth also being a key part of the picture, the best returns can only come with dividends being reinvested as a long term investment. Longer term debt is currently $4.3 billion.

Risk

At this point the risk is mostly tied to capital allocation. The same way that spending the principal of an investment slows down the ability of compound interest to work its magic, interrupting a consistent share reduction strategy or doing a mix of share dilution and random buybacks during a shorter period defeats the purpose of trying to boost EPS in the long run via share reduction.

So the real risk is not from secular decline as much as poor capital allocation. I would have preferred a minimal amount of repurchases in addition to debt repayment but it will be worth paying attention to the rate of buybacks going forward.

Valuation

Below is a comparison of price multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

IPG |

1.1 |

7 |

12.9 |

3.2 |

4.1% |

|

OMC |

1.2 |

7.3 |

20.4 |

3.8 |

4.1% |

|

WPP |

0.8 |

5.5 |

13.3 |

1.8 |

4.9% |

|

ZD |

3.1 |

10.9 |

12.4 |

2 |

n/a |

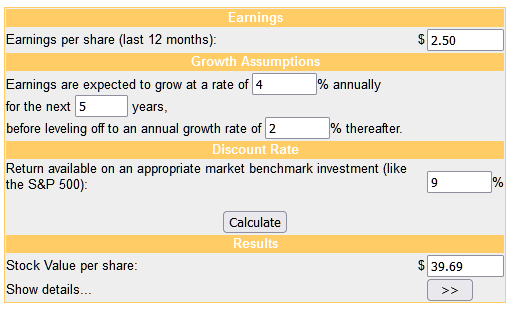

There isn’t any discount to be found on a pricing basis, all of the closest sized competitors trade at similar multiples and the dividend yields are also extremely close. The yield is close to what I would want to receive at a minimum for an established, legacy business. Below is the DCF model:

money chimp

The returns on capital have been above average for the past two years, but I don’t see this as a new era of higher returns emerging. It is more unique to changes caused by Covid rather than the business quality simply improving. Even though the price is currently lower than my appraisal above, it’s not at a level where I can realistically see outperformance down the stretch.

So yes, it is undervalued, but I do look for quality as the main margin of safety and with IPG, the quality is about average. This doesn’t mean it’s a bad business but it’s not a great industry, and the only way to outperform will be legendary capital allocation going forward. Again the capital allocation isn’t bad, but it’s only going to lead to average returns for shareholders at today’s price.

Conclusion

IPG is another example of legacy business that is in a shrinking industry. The capital allocation skills are vital from here on out, and so far I do like what I see. The major acquisition in 2018 is paying off, and a combination of further debt reduction and an increase in repurchases should absolutely boost EPS over time.

The company is not priced far away from its peers as far as multiples, but I do think it’s undervalued intrinsically. My reservation lies in the ability to generate above average returns even at this undervalued level. The informal model I follow is that if I can’t see any way possible for prices to increase 10x over the next decade, move on to something else, unless it’s specific to dividend income. If repurchases get ramped back up and share prices offer closer to a 5% dividend yield, I would consider buying, for now this is a hold.

Be the first to comment