ArLawKa AungTun

The Long-Term Opportunity beyond the Short-term Mess

The third quarter saw a continuation of the ugly trend from the first half of the year. September was the worst month for stocks since 2008 and the first three quarters joined 1974 and 2002 as one of the three worst starts to a year ever. The headlines sound gloomy and leave little room for hope or optimism. Although things can certainly get worse from here in the near-term, we feel we are staring at one of the best setups for equities in our career.

We say this with Jason having founded the firm in early 2009 while our financial sector melted down and Elliot having started his career on a trade desk the week Bear Stearns went under. These opportunities do not come around often.

Unlike that of other commentaries, we’d like to call your attention to the key takeaways of this write-up at the outset.

- Today is a great time to invest for the long run, though the market may very likely experience more volatility before once again resuming its march higher.

- Our portfolio companies are built to come out of a recession stronger than they enter it. The businesses we invest in have strong balance sheets and the mandate to pursue constructive actions ranging from organic investment to acquisitions to repurchases. We expect meaningful market share gains from most if not all of our investments.

- Returns from here will be powered by a combination of growth and free cash flow, with the potential for modest multiple appreciation. On a forward basis, this is the best set-up for returns that we’ve seen since the inception of our firm during the depth of the credit crisis.

- We believe that the Biotech and life science tools and instruments verticals are the most interesting areas to hunt in today’s market for opportunity and they are likely the very sectors that will lead the next bull market. We have made a handful of investments through the past year that we think will support our next five years of returns.

Supply and Demand post COVID

The COVID crash two years ago was certainly scary and saw similar magnitudes of decline from peak to trough as we are witnessing today. We needed unprecedented levels of fiscal and monetary support to “build a bridge to normal” and create a pathway for once again resuming normal life.[1]

Today we are staring at normal, yet the prevailing narrative would have one believe that it is an even scarier backdrop than all of humanity relegated to their couches with people dying from a mysterious, novel virus. This is how emotions work. Events move fast nowadays, and we feel the prevailing myopia today is a form of the “recency bias” whereby people “place too much emphasis on experiences that are freshest in your memory.”[2].

In some ways, today’s challenged markets are a direct consequence of the COVID pandemic and society’s response–markets bounced back swiftly with a sugar rush from the parallel policy response and rapid vaccine development which combined to build a much shorter bridge to the other side. As a result, in the U.S. in particular, life got back to normal far quicker than most presumed. This sugar rush was premised on appropriate optimism before certain speed bumps emerged.

Supply chain bottlenecks and a surge in demand for goods while services were relegated temporarily unsafe, on the heels of factories and ports shutting down to protect worker safety challenged supply chains and led to surging costs. These bottlenecks remained in place and subsequently shifted to bottlenecks in labor once services reopened. To recalibrate demand with supply, companies began investing heavily in capital expenditures as the Federal Reserve Bank commenced harsh medicine to slow down soaring demand.

It is obvious that the Fed will inflict pains that spread from markets to the real economy, but it is similarly obvious to us that on the other side of this, we will enjoy the most balanced economy we have experienced in many of our adult lives.

Given the prevailing gloomy narrative, today is one of those moments when all of us should consider what can go right, rather than what else can go wrong from here. The next leg up for markets, unlike the COVID sugar rush, will be built on solid fundamentals and a surge in intrinsic value as supply chains normalize, margins resume their upward march and balanced top line growth returns.

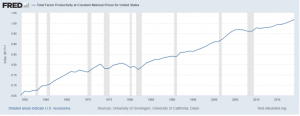

This will all get built on productivity gains due to actions taken during the harsh environments of the past few years. One of the great mysteries of the post Dot Com boom era has been the advance in technology without a commensurate surge in factor productivity. Over the last few years, we were beginning to see this stagnation end.

[3] Total Factor Productivity at Constant National Prices for United States (Fred Economic Data)

We believe that the investments undertaken by companies to grapple with supply chain bottlenecks and the challenging COVID environment will underlie a surge in productivity once the economy normalizes. This will free up resources for further investment, creating what could be a virtuous cycle. These investments will also help quell inflation, because our economy will end up with a modest degree of excess capacity and far greater efficiency while demand and supply return to more balanced levels.

The investment recipe for the next decade of returns:

With respect to our portfolios, we are not just idly standing by with the companies that have dragged down portfolio performance during this bear market. We constantly review each portfolio company on a first-principles basis and assess its risk-reward relative to the opportunity set as it exists today. We have sold several of the positions we had previously intended to hold for many years, in part because they may have had fissures we did not recognize, but also in part because we are seeing some far better places to allocate that capital.

We are keenly focused on companies with a combination of resiliency and opportunity. This means our ideal company today has the balance sheet and earnings power in order to profitably weather this current storm, but also ample firepower and channels through which to improve their business for even better results on the other side of what may or may not be a recession. To state it bluntly: we do not want to, nor will we own companies which do not have the power to improve their business through a downturn.

As we demonstrated in our Q1 letter, our companies are incredibly well capitalized, with an abundance of excess cash and this is even more true today as we have moved pieces around.[4] With higher interest rates, in some cases, the cash balances alone will fund the entirety of a company’s capital expenditures, in other cases it will support substantial repurchases and in a few cases it will result in accretive acquisitions in what’s emerging as an incredibly attractive buyer’s market.

Numerous of our positions have what we think are hard floors. When we say hard floors, it does not mean the stock price will hold above those levels forever, but it does mean over time not only will those levels act as fundamental support, they will be a source of power to the upside for share prices.

Cash flowing businesses should not trade for less than the value of the cash on their balance sheet, though some are flirting with that level in today’s environment. That is a price to value disconnect that simply cannot persist for long periods of time. The market will impose a certain set of actions on a company if management itself will not act to remedy the situation, so while not a hard floor on where a stock can trade, something like balance sheet cash is indeed a floor on what a cash flowing business can be worth over time.

Our companies are in position to act offensively rather than defensively through this troubled environment, and they control their own fates. Although some have consumer sensitivity, many have little correlation in their key drivers to macro events. These companies simply must continue to execute, and leadership must make smart choices.

To contextualize this moment historically, In November of 2008 the S&P 500 made a momentum low and the worst of the financial crisis seemed past to some; however, by the second week of March 2009, the market registered a low that was 23.3% below the price at the end of November. We are pointing this out for two critical reasons:

- Although the S&P made new lows in March, many stocks, especially in the technology space, never made new lows after November. It is impossible to know which companies will and will not make new lows were markets to fall further, but when there are outstanding businesses trading at downright cheap valuations and substantial long-term upside, it is worth making the investment even if there could be more near-term downside. Even if markets fall further, you might not get a better shot at some great businesses that will drive returns over the next decade. When we deployed our first investment dollar as a firm back on February 2, 2009, we did so with this exact impetus.

- While it is very easy to say from our seats today that November 2008 was an obviously awesome buy, people who put their money to work that month in “the market” had to sit through an immediate, steep drawdown on the way to far better returns. In short time frames, it is exceptionally hard to nail the exact time with precision, though were one to zoom out the answer becomes obvious. Stated another way: if your timeframe is longer than a few minutes or months, now is an exceptionally great time to put money to work in equities.

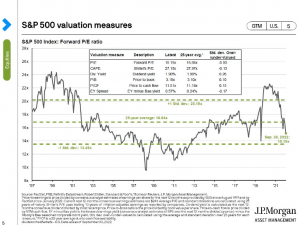

One way we can visualize the opportunity today is by looking at the S&P 500’s P/E over time. As of today, we are on the low end of the fair value range:

[5] S&P 500’s P/E over time (jpmorgan)

P/Es certainly have been lower, and they certainly can go lower than they are today, though over time, an investor’s returns from these levels will likely end up the cumulative sum of growth and free cash flow yield. Investors might even get multiple appreciation, though we need not bank on it. Further, although many are concerned about inflation, one reality of equities is that growth is exposed to nominal, not real rates of economic activity, especially in companies who deploy intangible capital and charge take rates on business (like payments or even advertising).

This is important as people consider whether we will or will not have a recession. One distinct possibility that is not getting considered by most is the potential for nominal earnings to continue growing while real earnings contract. This would indeed be recessionary, but in the grand scheme it would be supportive of equity valuations. One truism of equities is that inflation gets passed on, unlike with bonds where the value is inevitably diluted.

The math gets even better for those companies who deploy intangible assets and/or who have considerable pricing power. This is where we are focused, and this is what we own in our portfolios today.

Scanning Biotech and Life Sciences for Opportunity

All of the preceding is an important preface to how we are thinking about and acting on our portfolios today. We have not sat still with the positions we have owned in the past. This has been a time of action for us and we have made one of the most dramatic changes in our exposure in our history–over this year, we have purchased shares in many healthcare, specifically pharmaceuticals, biotechnology and tools and instruments companies.

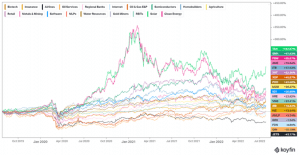

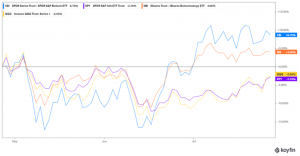

Amazingly this has been an era of profound scientific innovation, but valuations have compressed meaningfully over the last half decade in the space. This has been the worst stretch for the sector in recent memory, yet the advances fundamentally are incredibly real. These are long duration assets, with diverse levers to pull to enhance value. Let us briefly review the backdrop and then we will discuss some of our specific positions in the space. As of late July, only three sectors in the entire market had a worse last three years than did biotech:

The performance was even worse as measured by XBI instead of IBB, an ETF populated with more small capitalization companies:

And these measurements were taken after one of the best three month stretches for the sector relative to the NASDAQ ever!

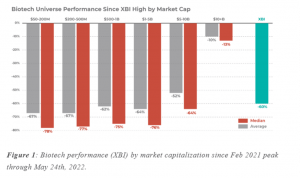

Visualizing performance across market caps makes clear just how decimated the smaller companies have gotten over the past few years:

[6] Biotech performance (XBI) by market capitalization

What went wrong for biotech and adjacent spaces?

- Starting multiples were far too high in 2015. We think that was a mini bubble in biotech.

- There was far too much hype during the COVID lockdowns about biotech curing all of society’s ills.

- Too many companies went public in a short period of time with projects that never should have been funded. It became challenging for investors to sift through those who deserved the capital vs those who were merely pretenders. Worse yet, it created a wall of supply that this space dominated by specialists could not absorb.

- The FDA experienced a backlog of requests during COVID and companies had challenges with enrollment due to lockdowns and other health restrictions. This lengthened the average trial timeframe, and in a world where time is money, the pressure on valuations became very real.

- Sector specialists got crushed relative to the market and faced large redemptions, exacerbating existing pain-points in the space. The only sources of liquidity for reinvestment in biotech thus came from liquidity events, which is part of why even good news events at individual companies had been met with muted enthusiasm by the market.

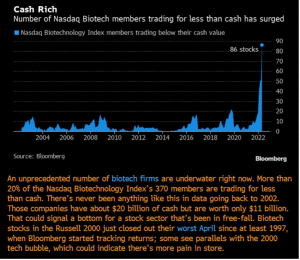

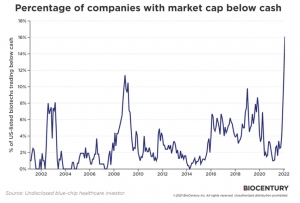

At the end of the second quarter, there were more biotech companies trading at less than their actual cash value than ever.

[7] Biotech companies trading at less than their actual cash value

There is an obvious caveat in biotech about cash, considering many companies are burning rather than earning money; however, with well-funded research plans, interesting setups start emerging. Companies had raised plenty of cash in the preceding boom years and IPOs fell off a cliff. That wall of supply was no longer a problem. We truly got intrigued when three critical events happened in short-order.

- Regeneron (REGN), a company we know well and have owned shares in for years, made the first acquisition in its history on April 20, 2022. They did this by acquiring Checkmate Pharmaceuticals for $10.00/share after it was trading for barely north of $2.00 the day before. Why such a premium? Checkmate had over $3.00 in cash per share, meaning the company was trading with a negative enterprise value. The inflection from negative enterprise value to positive value requires far more than the typical takeover premium. [8]

- Another reality of negative enterprise value is that the market is begging companies to dissolve. This happened in the space on May 23, 2022 when Catalyst Biosciences (CBIO) struck a deal with Vertex Pharmaceuticals (VRTX) to sell their main assets and subsequently dissolve the company. Before the news, Catalyst shares were trading for $0.40 with $1.09 cash per share. The dissolution will distribute over $2.00 in value to shareholders.[9]

- Big pharma entered the game on June 3, 2022, with Bristol-Myers Squibb (BMY), whose shares we own, announcing an acquisition of Turning Point Therapeutics. Bristol paid a 125% premium to purchase a leading pre-approval platform. In the process, the third largest holding in the XBI was sold, creating a cash pool that would almost by definition get recycled around the space.[10].

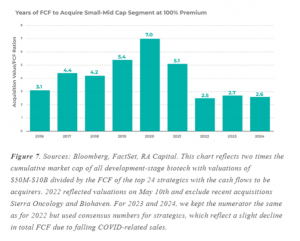

The potential acquirers in the space are incredibly well capitalized. According to work done by RA Capital, at the lows in May, the large pharmaceutical and biotech companies could have acquired the entire small and mid-cap space at a 100% premium using merely two and a half years of free cash flow.

[11] Years of FCF to acquire small-mid cap segment at 100% premium (Sources: Bloomberg, FactSet, RA Capital.)

This is part of our rationale for owning Bristol-Myers. They are a fantastic company in their own right, generating considerable cash flow, but are challenged by a patent cliff that will be a headwind to revenues. Decimated valuations across the sector make it much easier to replace lost revenue at low prices.

To this end, management teams at Pfizer (PFE), Merck (MRK), Abbott (ABT) and J&J (JNJ) have all been vocal about their M&A intents. The biggest impediment to date is how swiftly the downturn materialized and the magnitude of peak to trough price declines. Would be sellers are thus reluctant to engage in deal talks until things either stabilize for some period of time or prices recover. We think things are getting closer on both fronts.

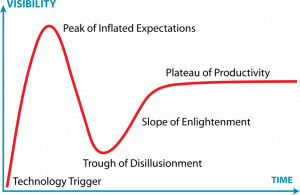

We think biotech stocks experienced a “peak of inflated expectations” in the Gartner Hype Cycle on the heels of strong advancements in CGTs but now are distinctly in a “trough of disillusionment”:

[12] Trough of Disillusionment (Wikipedia)

Cell and Gene Therapy (CGT) are critical pieces of the future of the industry. In 2020, Jennifer Doudna and Emanuelle Charpentier won the Nobel Prize in Chemistry for their paper entitled “A Programmable Dual-RNA-Guided DNA Endonuclease in Adaptive Bacterial Immunity.”

In this paper, Doudna and Charpentier shared their discovery of a system in bacteria to defend against invading viruses with the ability to “program the CaS9 endonuclease to cleave specific DNA sequences to generate double-stranded DNA breaks.”[13] Effectively Doudna and Charpentier discovered a way to edit the human genome.

Amazingly, this discovery in 2012 is on the brink of clinical approval. As Doudna recently said, “The thing about Crispr [sic] that’s so remarkable is that the timing was right,” because often, these discoveries take years to evolve into practically deployable technologies.[14] With CRISRP, we are on the brink of ready and simultaneously, the door is wide open for scientists to further research and discover ways in which gene editing can be deployed clinically for absolving people of genetic diseases, new ways of fending off cancers, and a whole lot more.

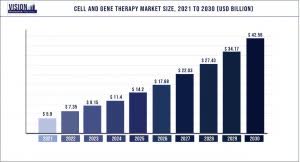

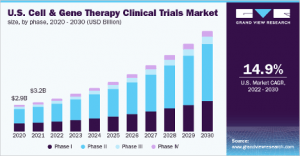

With CRISPR as a key driver, the CGT market is set to grow base case by a 15% CAGR through 2030, with some analysts estimating a nearly 40% CAGR. This would have the market size jumping from approximately mid-single digit billions to between $30 and $42.5 billion in value. There are estimates as high as $90 trillion in value.[15] The manufacturing services alone tied to CGTs are expected to become a nearly $14 billion industry by 2026—well within our investment time horizon.[16]

[17] cell and gene therapy market size growth trends (biospace.com) [18] Cell gene therapy clinical trials market ( grandviewresearch.com)

The widespread in valuation estimates can depend on how one defines CGTs and what supporting services are needed to support the industry, as well as probabilistic estimates for the likelihood of success for known treatments in the pipeline. Critically, we think irrespective of the inevitable size, it has become clear that CGTs are the future of the industry, and a slew of new tools are necessary to support the industry’s development from the research phase through manufacturing and patient delivery.

There will be numerous winners from the pharmaceutical and biotech companies themselves to the life sciences tools and instrument providers beneath them. These developments are so important that recently the White House issued an Executive Order preparing broad support for the biotech and biomanufacturing industries, including a substantial financial commitment.[19] According to the Executive Order, “Industry analysts suggests that bioengineering could account for more than a third of global output manufacturing industries before the end of the decade—almost $30 trillion in terms of value.”[20]

Generalists in a Specialists’ World

We began our deep dive on this space in February 2022, identifying several ways we could capitalize on the downturn. Many generalist investors avoid these spaces, though we think the opposite should be the case. Specialists have an advantage in understanding the science; however, the perspective can get clouded and feel different from within a space. When the entire sector is beat up every day, specialists tend to feel the gloom and feel the pressure.

Capital leaves the space and even those who have great new idea have little capacity to grow a position. Without a crossover generalist bid, the incremental buyers are few. This creates a greater degree of inefficiency in pricing. Moreover, these areas are some of the least economically sensitive and are supported by powerful forces from numerous angles, ranging from innovation to an aging population.

We have always viewed a broad mandate and capacity to move around amongst and between sectors as a critical source of advantage for generalists, and never has that been more true than our endeavors today. After all we have a long-professed affinity for low valuations, strong fundamentals and little cyclicality.

To begin our hunt, we started with blunt force: screening for high cash as a percentage of market cap. We then proceeded to studying companies with high quality partnerships. Next, we looked for companies with insider stock purchases on the open market and companies owned by elite sector specialists who were not selling down their stakes. Last and most important, we isolated on biotech adjacent areas, that supply the industry but have experienced stock price declines alongside the industry.

Specifically, we have done deep dives on numerous life science tools and instruments companies and bought positions in a few already. Our work here remains an ongoing process and we feel an emerging familiarity accelerating our process cycling through ideas and compounding knowledge within niches of the sector. Better yet, we have a growing network of specialists in the area who have been helpful in explaining the science and the significance behind the products and services that different companies have to offer

What truly catches our eye is that these companies are often already highly profitable with robust and expanding margins and are not by definition binary securities that will either be worth a lot or nothing and have a long duration opportunity to dominate their markets. We are incredibly excited about the companies we have found and have a deep bench of companies we continue to learn about.

As generalists in a specialty area, we have come to appreciate several big differences between TMT and other well populated generalist areas. We also increasingly believe it has become more myth than reality that consumer areas are easier for generalists to understand than a sector like healthcare.

Many TMT analysts today are far less concerned with figuring out an intrinsic value than with anticipating the next directional change in high frequency alternative data sets. Consequently, volatility in stocks greatly exceeds that of fundamentals. In healthcare, partly due to the duration of the assets themselves and partly due to the lack of high frequency data, investors take a far more long-term view.

Where we are planting seeds (in alphabetical order)

Each of our investments so far in the space has a direct nexus to CGT, though despite our enthusiasm for the CGT market, we did not find these pieces through a top-down lens of seeking out CGT investments. Rather, it was bottoms up analysis that led us to these pieces, but the top-down view helped support our intrigue as we conducted our analysis. Collectively, these companies have diverse revenue drivers and risk profiles, alongside an inexpensive valuation.

- Azenta (AZTA) now trading below book with $2b+ of dry powder in the form of cash and a high return, fast growing business at the core, led by a fantastic management team with a proven history. Cash is a whopping two thirds of the company’s market cap, because AZTA is what we call an “orphaned security.” We view this cash balance as one of those “hard floors” mentioned above. The company came into existence out of a semiconductor capital equipment business called Brooks Automation. Management divested the Brooks business near the peak of semi sector valuations and committed to plow the entire proceeds into logical adjacencies for their fledgling life science business. How did a semiconductor company get into life sciences? They had built a uniquely capable robotic arm that when outfitted to a cryogenic freezer became the dominant automated storage solution for frozen biologic assets. This led AZTA into storage-as-a-service and other product and service-related adjacencies. AZTA already has over 100 CGT customers, generating 10% of the company’s revenue that is growing at a swifter rate than the core business. Critically, CGTs are far more reliant on cryogenic storage at numerous points in their lifecycle, from clinic through treatment and as treatments are commercialized, far more of AZTA’s unique solutions will be necessary. As it stands today, the core business is trading at a high single digits EV/EBITDA multiple on their FY 2023 (which they are nearly one quarter into) and the company can either repurchase large chunks of shares or acquire great assets at what are now far better prices . We think AZTA right here is one of the better risk/rewards of our career.

- Bristol-Myers Squibb (BMY), which we referenced above, boasts a double-digit free cash flow yield that gets divided roughly equally between repurchases, a dividend and M&A in what is the best environment for acquisitions perhaps ever. In 2019, BMY acquired Celgene, who had one of the better corporate development programs in the industry. We view this as a great outlet for us as generalists considering a company like BMY should truly thrive with the ability to acquire outstanding assets and science at depressed valuations. We touched on the Turning Point acquisition above and we expect the company to be increasingly active in the M&A landscape. Importantly, Celgene also came to BMY with a phenomenal CAR-T platform. CAR-T is a cell therapy that activates the body’s immune system to target cancers. This will be a key growth vector alongside M&A in overcoming the company’s patent cliff.

- Cytek Biosciences (CTKB) in our last letter. We believe CTKB is taking on an industry with an installed base of 50,000 flow cytometers growing approximately 8% annualized, with superior technology, a cost advantage versus all competitors and a mere 2.5% of the opportunity capture. Fueled by a massive stash of dry powder, they can build the razor to complement their already valuable blade. The company is profitable (on an EBITDA and cash flow basis) and growing swiftly, for far more reasonable multiples than some TMT companies boasting similar metrics trade with, even after the recent selloff! CTKB’s industry-leading flow cytometers are favored in the research stages by CGT companies. Beyond research, one of the critical growth areas for CTKB in the coming years will be in the clinical space, meaning diagnostics. CTKB is actively developing diagnostic tools that will serve as companions alongside cell therapy treatments. This is an area that receives little accord in today’s valuation, but can become quite meaningful down the line.

- MaxCyte (MXCT) was also covered in our last letter. Shares have risen from trading at less than half cash to now a little north of one third cash. The company boasts minimal burn and is loaded with optionality in the form of 72 treatments under development using their technology, all in the CGT area, any of which upon approval would pay royalties that are likely more valuable than the entire enterprise value of the business. At core, MXCT is built on a nearly 80% recurring revenue base featuring the razor and blade business model. In the next few months, one of MXCT’s partners will learn whether the FDA approves their treatment for commercial launch. This would offer important validation and open many doors for the company. Although such events can be volatile to the up or downside, we do not view this as a binary event for the company given the technology fundamentally works and there are numerous possible pipeline assets under development leveraging MXCT’s platform.[21]

- Regeneron (REGN) has been a stalwart of our portfolio for several years now. The company is investing mightily in R&D to capitalize on their platform for innovation, moving into oncology, nearly 10% of their market cap in cash and potent cash generation each year fueling this investment. We think the oncology pipeline is valued at either $0 or less by many analysts out there, meanwhile we think it is an emerging platform, leveraging REGN’s dual discovery platforms of the Regeneron Genomics Center (RGC) and the Veloci-Suite. Recently the company presented initial data on the CD28 target which could be a profound breakthrough in the treatment of hard cancers. Although trial outcomes remain years away, the value of the oncology pipeline is certainly greater than zero. Why else would the recent President and CEO of Memorial Sloan Kettering Cancer Center join the board of directors were there not belief behind the pipeline in immunology?[22] It seems like an opportunity to us that Wall Street does not share this enthusiasm. Beyond the company’s core competency in antibodies, REGN has leveraged its RGC and Veloci-Suite into impactful partnerships with CGT industry leaders like Alnylam (ALNY) and Jennifer Doudna’s Intellia (NTLA). These partnerships include equity stakes and shared costs and revenues for key pieces of these respective company’s pipelines.

Summing it all up

There is no shortage of attention to Federal Reserve Bank actions, Consumer Price Index reports and a slew of macro data. In the short term, the market is extremely susceptible to manic and depressive moods dictated by this data. In the long run, fundamental drivers will reward quality businesses, but for today macro takes center stage. Eventually, as it always does, this macro-obsession will end and great companies with solid fundamentals will once again regain favor on Wall Street. For now, this is an opportunity for those like us who take the long-term point of view.

Thank you for your trust and confidence, and for selecting us to be your advisor of choice. Please call us directly to discuss this commentary in more detail – we are always happy to address any specific questions you may have. You can reach Jason or Elliot directly at 516-665-1945. Alternatively, we’ve included our direct dial numbers with our names, below.

Warm personal regards,

Jason Gilbert, CPA/PFS, CFF, CGMA, Managing Partner, President

Elliot Turner, CFA, Managing Partner, Chief Investment Officer

|

Past performance is not necessarily indicative of future results. The views expressed above are those of RGA Investment Advisors LLC (RGA). These views are subject to change at any time based on market and other conditions, and RGA disclaims any responsibility to update such views. Past performance is no guarantee of future results. No forecasts can be guaranteed. These views may not be relied upon as investment advice. The investment process may change over time. The characteristics set forth above are intended as a general illustration of some of the criteria the team considers in selecting securities for the portfolio. Not all investments meet such criteria. In the event that a recommendation for the purchase or sale of any security is presented herein, RGA shall furnish to any person upon request a tabular presentation of: (i) The total number of shares or other units of the security held by RGA or its investment adviser representatives for its own account or for the account of officers, directors, trustees, partners or affiliates of RGA or for discretionary accounts of RGA or its investment adviser representatives, as maintained for clients. (II) The price or price range at which the securities listed. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment