Olga Tsareva

Different routes to success in cannabis

One of the enjoyable aspects of writing for Seeking Alpha is introducing readers to smaller companies that are taking an unusual and interesting approach to cannabis. These companies are mostly overlooked by analysts and the media, but offer something different — and potentially profitable — for the open-minded investor. Every new industry eventually consolidates around a few dominant companies through a process that takes many years. I discussed this in an article titled Trulieve: Why You Must Own This Future Dominant Cannabis Company. However, there is still great potential among other, smaller, companies. Their strategies for success are various, but each one has something that sets them apart. This difference opens an alternative path that may, or may not, lead to success, and makes them worthy of our attention. In this article we will discuss one such company: InterCure, Ltd (NASDAQ:INCR).

This report draws on a recent interview with InterCure CEO Alex Rabinovitch and a series of emails with Communications Officers Adam Haliva and Ori Mandelabum.

Courtesy of Intercure.

InterCure: The company

InterCure is an Israeli company listed on NASDAQ. Its home cannabis market is 100% pharmaceutical. There has been some discussion of adult use, but due in part to the dysfunctional government in Israel it’s still some ways off. Cannabis is very highly regulated. Patients must receive a prescription, and doctors must have a special license to prescribe. Legalization began after decades of research on medical cannabis (THC was first isolated in Israel in 1964), and has grown to the point that Israel, and InterCure in particular, are important players in the global industry ex North America.

The global cannabis market

Cannabis investors owe it to themselves to learn about the global market. This market will eventually exceed the North American market by several times. In addition, it is currently at a much earlier stage, and has a longer growth runway. Although the global market has its challenges, many of the barriers hindering North American companies are absent. There are no barriers to financial services or uplisting, and no confiscatory 280E taxes. Federal legalization is not paralyzed by special interest politics.

Two cannabis legalization models

There are two models for legal cannabis. Medical cannabis is the model for North America, with which we are familiar. Cannabis is legalized on a medical basis first. Companies and products are regulated but free to offer cannabis in any form. Eventually cannabis is legalized for adult use, and the two programs exist side by side.

The second approach is pharmaceutical cannabis, and it is the model in the entire rest of the world, 40 countries so far and counting. Cannabis is put in the same category as other drugs and supervised by the same regulatory bodies (compare to the US, where the FDA has been mostly silent). It is highly restricted, regulated and monitored from seed to sale. It is much more demanding in terms of expertise and resources than the North American medical model. The endgame is still adult use as liberalizing attitudes and regulation reach their final state, but as it will be regulated by the countries it is expected to be highly regulated too. Companies are willing to take on the extra challenges because of the huge growth potential in a nascent industry.

InterCure in Israel

InterCure has been building its pharmaceutical cannabis business since 2008. and is the biggest pharma cannabis manufacturer outside of North America. In Israel cannabis can only be sold in special pharmacies, and InterCure has the only chain of cannabis dedicated pharmacies. It is number one in sales in Israel, which has the highest percentage of cannabis users of any country in the world. In a European study cited by Israeli Cannabis Magazine 27% of adult Israelis used it in the past year, and 19% in the past month. The Czech Republic was second in annual use at 11.4% and France was third at 11.3%. The annual use is around 25% in the US according to a YouGov survey, and was 16% in 2018 according to the National Institute of Drug Abuse. 1.3% of Israelis have medical cannabis monthly prescriptions. In the latest earnings call, InterCure’s CEO estimates that number will eventually be as high as 5%,which would be 400% market growth. The company clearly has a strong domestic business base.

InterCure international strategy

InterCure has identified four other core target markets for growth: Germany, UK, Australia, and Austria. In addition, they have high demand for their branded products in other countries, including Switzerland and China. International expansion has been a successful growth strategy for companies based in Israel, with Wix (WIX), Sodastream and Teva (TEVA) being well-known examples. For ambitious companies it’s almost essential in a country of only 8.8 million people.

InterCure has been building its international capabilities for some years. They are currently number one in pharma cannabis sales in the world. They have six cultivation sites around the world and a supply chain reaching four continents. There are business relationships with a number of companies, including OrganiGram (OGI), Charlotte’s Web (OTCQX:CWBHF), Tilray (TLRY), Teva, and Cookies. Cookies is the most powerful cannabis brand in the world, years ahead of anyone else. I encourage readers to look at their website to see why.

Intercure Cookies branded store in Beersheva (Courtesy of Intercure.)

InterCure’s strategy is to replicate the pharmaceutical model they have developed successfully in Israel. Other companies, like Tilray, Canopy Growth (CGC) and Curaleaf (OTCPK:CURLF), are starting to operate in the international arena, but none have InterCure’s expertise, experience, or record of success. By getting established early they will be well positioned when countries reach the promised land of adult use. When that happens, the company with the best infrastructure, relationships and brands will be in a powerful position to be one of the dominant companies.

InterCure’s unique asset

InterCure has one additional powerful and unique advantage. The Chairman of the Board is Ehud Barak. To illustrate the impact, imagine that a combination of Colin Powell and Barack Obama became the Chairman of a company like Green Thumb (OTCQX:GTBIF). Mr. Barak is a former Lt. General in the Israeli Defense Forces and the most decorated soldier in Israel’s history. He was defense minister and deputy prime minister in several governments. He has also served as Prime Minister of Israel. Mr. Barak is not a figurehead. He has a long time involvement in cannabis and helped InterCure import the first cannabis into Israel after the import ban ended in 2017.

Ehud Barak and INCR team at TSX market opening from southern cultivation site. (Courtesy of Intercure.)

Risks

There are risks with any emerging growth industry company. In InterCure’s home market, while there is continuing slow liberalization, the regulatory environment is challenging. In one recent example, when the cannabis licenses for a group of doctors were suspended, it materially harmed the company’s results for the quarter. The domestic market is also highly competitive. Everyone wants to do business in a country with the highest proportion of cannabis users in the world. InterCure has demonstrated superior execution so far, to become number one there, and must continue that trend. The international market is also becoming highly competitive, Tilray, Curaleaf, Canopy, and other big firms have moved into the space.

InterCure announced Q2 2022 results on August 15

Highlights:

-

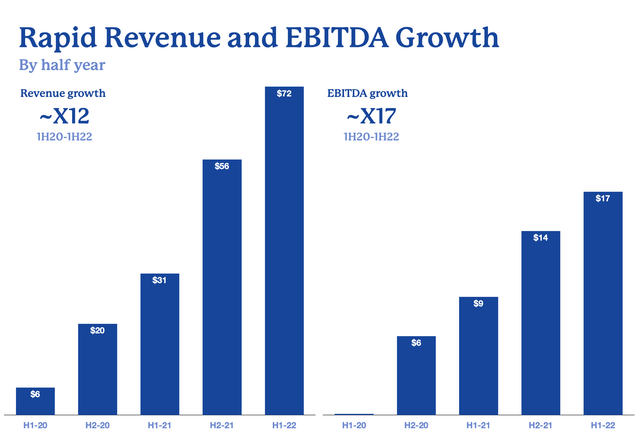

Revenue was $37 million [CAD], up 9% sequentially and 100% over Q2 2021.

-

Gross profit was up 16% to $16 million, for a respectable gross margin of 43%.

-

Operations cash flow was positive for the eighth consecutive quarter at $.3 million, and the cash balance is $96 million.

-

Adjusted EBITDA was up 4% sequentially to $9 million, for a relatively low 23% margin.

-

Net income was $6 million, or $0.13 per share.

First half comparisons are in the chart below

Quarterly history is in the table below:

| Q2 2020 | Q3 2020 | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | |

| Revenues | 4,398 | 8,847 | 10,654 | 12,997 | 12,997 | 17,786 | 31,341 | 34,302 | 37,466 |

| Gross Profit | 1,893 | 4,229 | 5,230 | 6,066 | 6,066 | 7,576 | 14,398 | 14,100 | 16,336 |

| GP Margin | 43% | 48% | 49% | 47% | 47% | 43% | 46% | 41% | 44% |

| Adjusted EBITDA | 619 | 2,739 | 3,409 | 3,958 | 3,958 | 4,601 | 8,294 | 8,375 | 8,696 |

| Adjusted EBITDA Margin | 14% | 31% | 32% | 30% | 30% | 26% | 26% | 24% | 23% |

Cannabis followers would agree these numbers compare favorably to recent results from North American companies.

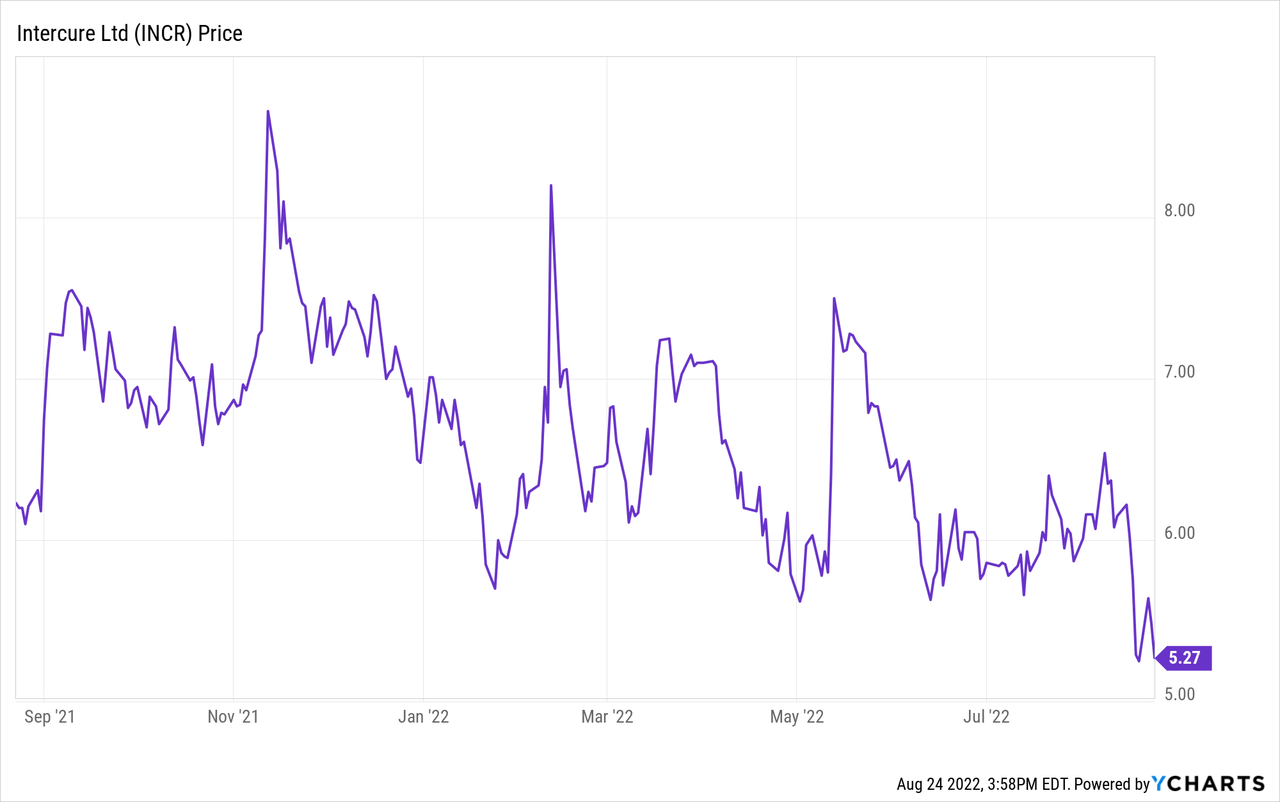

Stock Price

InterCure went public almost exactly one year ago, and in that time the stock price has declined from $6.75 to $5.27 at time of writing. This is significantly better than North American companies, and may be evidence of a healthier cannabis climate outside the US and Canada. The forward PE estimate for 2022 is 15, and 9 for 2023. Unlike Q2 reports on this side of the Atlantic, the company anticipates sequential growth in Q3 and Q4, and has not lowered revenue or EBITDA projections.

Investment recommendations

InterCure provides an opportunity to get into a company early while most investor attention is focused elsewhere. On Seeking Alpha it currently has 730 followers, compared to 23,840 for Trulieve (OTCQX:TCNNF) and 99,490 for Israeli Teva. It has quietly become the leader in a domestic market with potential growth of 400%. It has also become a leader in global pharmaceutical cannabis, which will eventually dwarf North America, in my opinion. It has not reached this position by luck; results through the latest quarter demonstrate superior management and execution.

I give InterCure a Buy recommendation. Investors may want to build a position gradually to see how things play out over the next year or so. Investors don’t need to be concerned about missing out with a gradual approach; there are potentially many years of growth ahead. Daily volume is low, so buy orders should have a limit price. As the stock chart above shows, price fluctuations can be sudden and large.

InterCure is one of the most exciting cannabis companies I have seen in three years of covering the sector. Over the next few years I believe more and more investors will be participating in the InterCure journey.

Be the first to comment