aeduard

Just over two months ago, I wrote on New Gold (NYSE:NGD), noting that I saw the stock as a Speculative Buy at US$0.61 with a kitchen-sink quarter behind it. Since then, the stock has risen over 35%, likely attributed to its rock-bottom valuation, with the stock briefly trading at less than 2x ultra-conservative FY2023 cash flow per share estimates ($0.40). While the thesis for the stock has weakened slightly since August, with gold breaking the pivotal $1,700/oz level, New Gold is at an inflection point and doesn’t have the same margin issues as some of its junior/mid-tier peers. So, with grades improving at Rainy River and a very accomplished Chief Operating Officer now on board, I would view pullbacks below US$0.76 as buying opportunities.

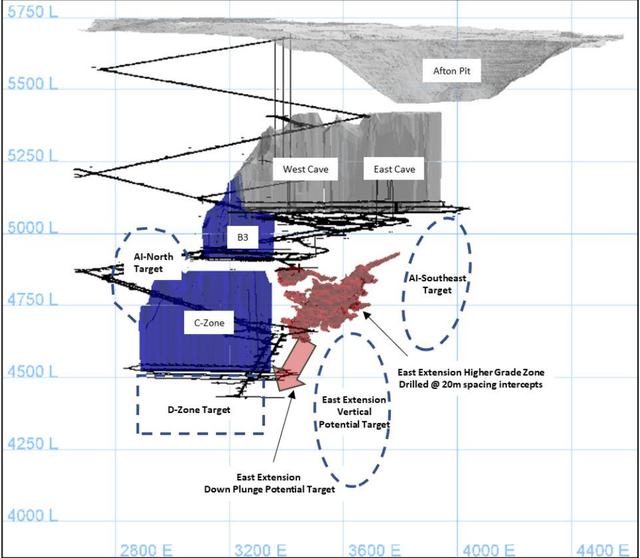

New Afton Operations (Company Presentation)

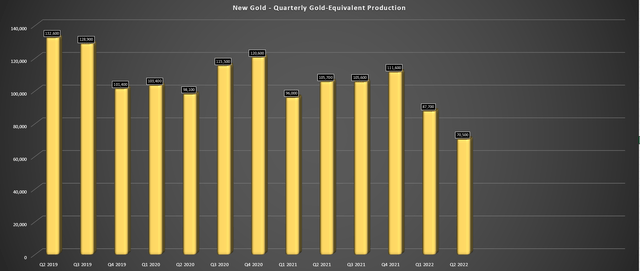

Q3 Production

New Gold released its preliminary Q3 results last month, reporting quarterly production of ~91,000 gold-equivalent ounces [GEOs], a 14% decline from the year-ago period. This was related to lower throughput at Rainy River and New Afton combined with much lower copper grades. The result was that gold production was only down slightly year-over-year to ~70,100 ounces, but copper production declined by over 45% to 8.5 million pounds. Given the softer quarter compared to the year-ago period and the tough Q2 due to heavy rainfall and flooding at Rainy River, production is sitting at just ~249,200 GEOs, 20% lower than last year’s levels as the company headed into Q4.

New Gold – Quarterly GEO Production (Company )

The good news is that the company has begun underground mining at Rainy River and expects to feed this much higher-grade material to the mill this quarter. As of the most recent update, Rainy River had 50,000 tonnes of material stockpiled at a grade of 2.53 grams per tonne of gold and 19.4 grams per tonne of silver, nearly triple the grades currently being fed to the mill (Q3 2022 head grade: 0.89 grams per tonne of gold). Meanwhile, New Gold received its much-awaited C-Zone permit last month and is currently ramping-up B-Zone production while C-Zone development continues to progress. So, while this will not show up in the 2022 results due to some one-time impacts, it has set the company up for a solid few years ahead.

Finally, from a cost standpoint, New Gold noted that while it can’t control inflationary pressures that impact its margins (especially fuel at Rainy River), it can work on reducing its consumption. The company is working on several initiatives, with the first being to widen the ramps at Rainy River to eliminate any single-lane areas of traffic that historically increased haul cycle times. Additional initiatives being looked at are refining the mine plan to reduce future rehandling and optimizing feed blending with underground material, as well as fleet reduction and component swap-out opportunities as the pit gets deeper and narrower. Finally, at the plant, it’s installed a more reliable liner package in the SAG mill to reduce unplanned downtime/maintenance and is optimizing the detoxification of the circuit to reduce reagent and consumable usage.

These initiatives, combined with a lower strip ratio and higher production, should help to reduce cash costs as the company benefits from better productivity and reduced consumables usage. So, while FY2022 is another year to forget with missed guidance and much higher costs year-over-year, the future remains very bright for the company with the past issues (poor grade reconciliation at East Lobe, heavy rainfall/flooding) and heavy capex in the rear-view mirror.

The New New Gold

While the New Gold of the past has left a lot to be desired, the new New Gold is a very different company despite having the two same assets. For starters, the company had added significant experience with the appointment of Patrick Godin as Chief Operating Officer, who spent a decade at Stornoway Diamond and was also VP Project Development for G Mining Services in 2008-2010, as well as VP of Operations at Canadian Royalties Inc. Most recently, Godin joined Pretium in 2020 as Chief Operating Officer and Vice President and helped to turn Brucejack into a more consistent underground operation ahead of its eventual $2.0+ billion takeover by Newcrest (OTCPK:NCMGF). So, having his expertise is a huge benefit for a company of New Gold’s size.

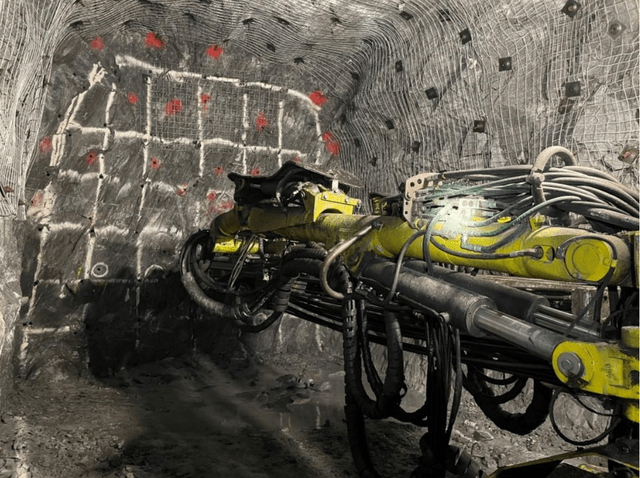

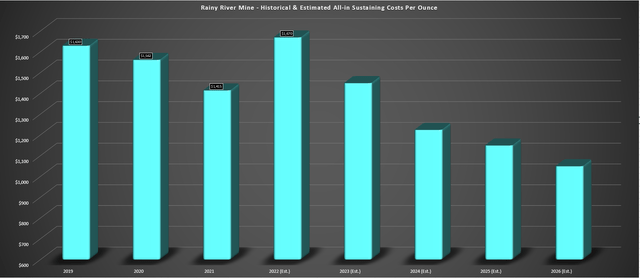

Rainy River Jumbo Drilling (Company Presentation) Rainy River – Projected Cost Profile (Company Filings, Author’s Chart)

From an asset standpoint, New Gold will benefit from a much lower strip ratio at Rainy River going forward, with the strip ratio improving to 2.1/1 vs. ~2.8/1 in 2021 and ~3.3/1 in 2022. In addition, the asset will benefit from a higher throughput (27,000 tonnes per day) and much higher grades being fed to the mill with a contribution from Rainy River Underground starting this quarter. Finally, sustaining capital is set to decline to an average of $79 million per annum (2024-2027), down from an average of $132 million in 2021 and 2022. This is expected to result in higher production and a significant drop in all-in-sustaining costs at the asset, with Rainy River turning into a ~300,000 GEO producer at sub $1,200/oz all-in-sustaining costs.

New Afton Exploration (Company Presentation)

Meanwhile, New Gold recently received permits for the C Zone at New Afton, extending the mine life and leading to much higher production at lower costs. As it stands, C Zone development has advanced over 1,000 meters, and exploration success in the East Extension suggests that even higher grades (~1.0% copper) could be brought into the mine plan at a low development cost, given their proximity to current infrastructure. Even without the benefit of the East Extension, though, copper and gold production at New Afton is expected to more than double from FY2022 levels to ~90,000 ounces and ~70 million pounds per annum. Assuming copper prices can rebound on the back of a favorable supply/demand outlook, New Afton would have extremely attractive margins vs. historical levels.

To summarize, the new New Gold is undergoing a significant transformation after years of underperformance with higher costs/higher capex and what’s been a molasses-pace turnaround, but necessary to prepare for several years of substantial cash flow generation ahead. In addition, the company has a much stronger balance sheet with $277 million in cash, $650 million in liquidity, and much lower debt following smart moves by CEO Renaud Adams, who joined the team in 2018 with a long-term vision. So, given the significantly improved free cash flow profile and the transition from a high-cost producer to a much lower-cost producer, New Gold could have a significant re-rating on deck, assuming it executes successfully. Let’s take a look at the valuation:

Valuation & Technical Picture

Based on ~688 million fully-diluted shares and a share price of $0.90, New Gold trades at a market cap of $619 million. This valuation is currently below some developers’ market caps and is a very reasonable valuation for a company with two operating assets in safe jurisdictions. The problem is that until recently, it’s been difficult to value New Gold at anywhere near the valuation of its mid-tier peers, given that its all-in sustaining-cost profile has been well above the industry average (2020-2022 average AISC: $1,590/oz), translating to razor-thin margins. However, as discussed, it should begin to close this wide gap if it can see a dramatic improvement in margins going forward (Rainy River Underground, C-Zone at New Afton).

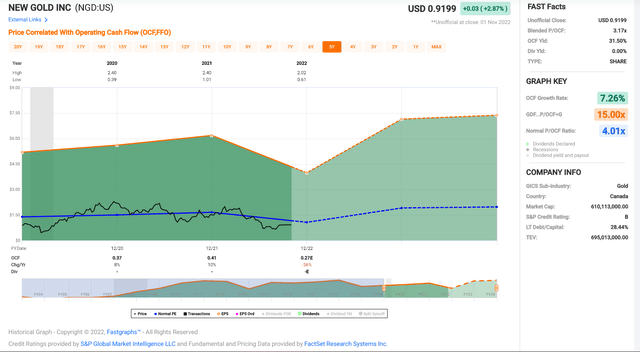

New Gold – Historical Cash Flow Multiple (FASTGraphs.com)

Looking at the chart above, we can see that New Gold has traded at an average of ~4.0x cash flow on a 5-year average basis and closer to ~5.0x cash flow on a 10-year average basis. Currently, the stock is trading at just 2.25x cash flow at a share price of $0.90, based on ultra-conservative FY2023 cash flow estimates of $0.40. Based on what I believe to be a very reasonable conservative multiple of 3.0x cash flow (40% discount to 10-year average), I see a fair value for the stock of $1.20, translating to a 33% upside to its 18-month price target. Let’s look at the technical picture:

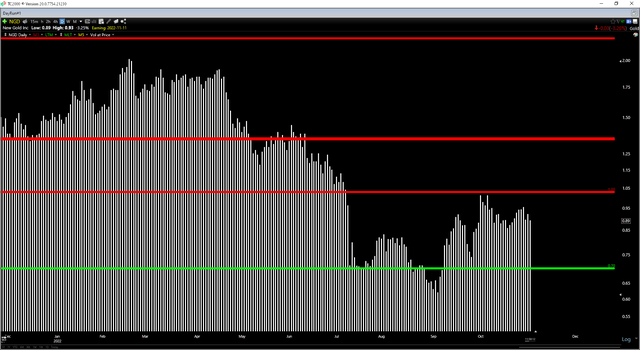

While NGD has a meaningful upside to fair value if it can execute successfully and assuming gold prices don’t continue to make new lows, the stock remains in the upper portion of its support/resistance range ($0.70 – $1.03). The result is that it has a short-term reward/risk of 0.70 to 1.0 from a share price of $0.90. This doesn’t mean that the stock must head lower, but I prefer buying as close to support as possible when buying turnaround stories. So, while NGD may be in a better position to see margin improvement than some of its mid-tier peers as we near C-Zone Production and see higher grades hit the mill at Rainy River, the ideal buy-point comes in at $0.76, within 7% of support.

Summary

New Gold has had another challenging year, and while H2 2022 will be much better than H1 2022, this is still expected to be a disappointing year from a margin standpoint. This is because New Gold is expected to report negative AISC margins on a full-year basis, with the potential for (-) $150/oz AISC margins if the gold price can’t get off the mat this quarter. That said, the company’s future looks much different than the past three years, which is what investors should focus on. So, while the New Gold of yesterday may leave a lot to be desired, I see the stock as a Speculative Buy below $0.76, with the new New Gold being a much different company.

Be the first to comment