onurdongel

Investment Thesis: InterContinental Hotels Group (NYSE:IHG) could see further upside on the basis of favourable exposure to U.S. domestic demand and further potential growth in free cash flow.

In a previous article back in May, I made the argument that InterContinental Hotels Group could see some downward pressure in the short to medium-term, as a result of inflationary concerns as well as the impact of COVID-19 lockdowns in China.

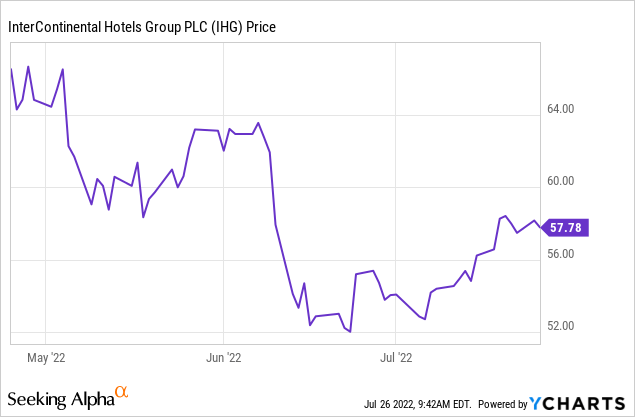

Since then, we have seen the stock take a slight decline into the summer months:

ycharts.com

The purpose of this article is to determine whether the stock could be in a position to see a rebound in upside from here.

Performance

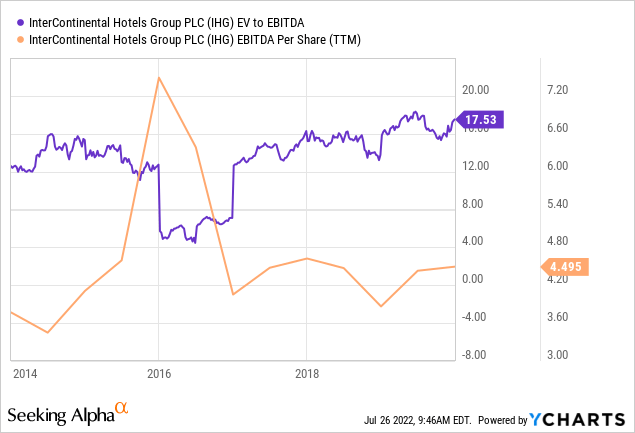

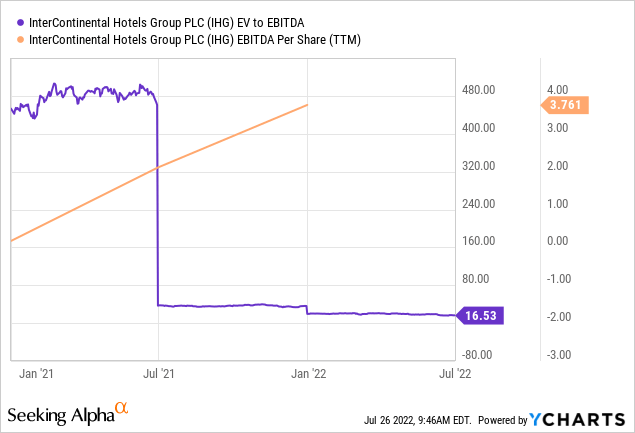

When looking at InterContinental Hotels Group from an earnings standpoint, we can see that the EV to EBITDA ratio is slightly lower than that seen pre-2020. However, we can also see that EBITDA has yet to recover to levels seen before the pandemic.

EV to EBITDA: 2014 to 2020

ycharts.com

EV to EBITDA: 2021 to present

ycharts.com

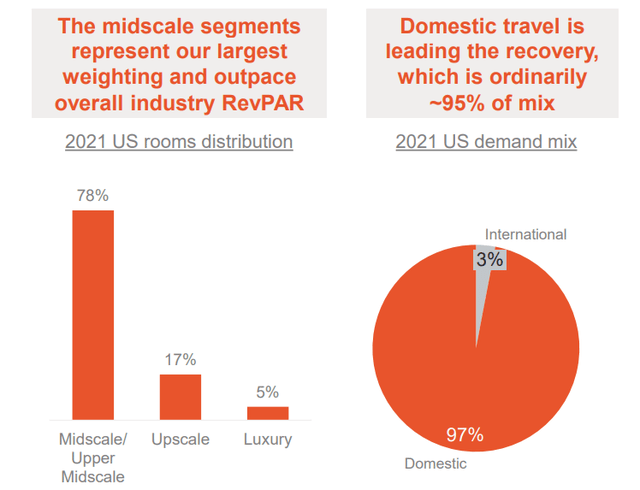

According to the company’s May/June 2022 Investor Presentation, InterContinental Hotels Group could find itself in a good position to withstand current macroeconomic pressures for a number of reasons.

Firstly, domestic travel appears to be leading the recovery across the U.S. market, which accounted for 97% of the demand mix for 2021.

IHG Hotels & Resorts: Investor Presentation May/June 2022

This is encouraging as it indicates that even with travel bottlenecks and flight cancellations across Europe – the impact to the U.S. travel market this summer is likely to be limited.

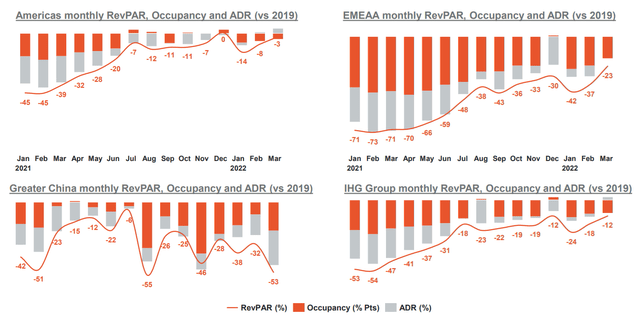

Additionally, when looking at RevPAR (or revenue per available room) trends for IHG – we can see that the Americas have been by far the most resilient – almost recovering to 2019 levels.

IHG Hotels & Resorts: Investor Presentation May/June 2022

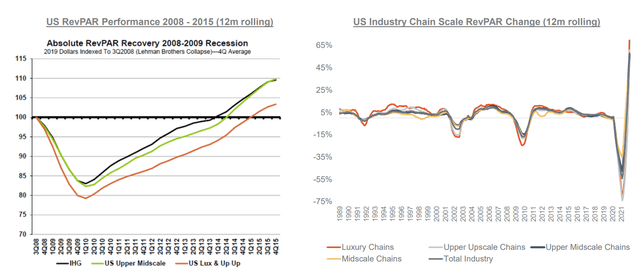

Additionally, when looking at U.S. RevPAR performance from 2008 to 2015, we can see that IHG led both the Upper Midscale and Lux & Up Up markets in the subsequent recovery:

IHG Hotels & Resorts: Investor Presentation May/June 2022

Additionally, 2021 revenue saw the Americas account for 55% of the total, with 21% and 8% for EMEAA and Greater China respectively.

From this standpoint, my previous article may have overestimated the impact of COVID-19 lockdowns in China. While this invariably has had an impact on RevPAR trends across the region – the recovery across the U.S. market has largely helped to make up for this.

Looking Forward

Notwithstanding inflationary pressures and potential volatility across the travel industry more generally – I take the view that InterContinental Hotels Group is one of the better placed companies in the industry to capitalise on the rebound in travel demand – given the company’s strong exposure to U.S. demand and encouraging RevPAR growth.

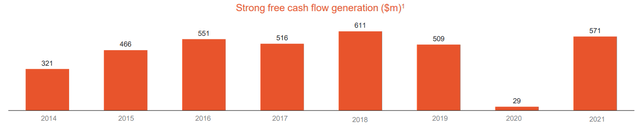

With half-year results set to be announced on 9 August, I will be paying particular attention to cash flow. While many companies across the hotel industry are seeing a rebound in revenues – this is also accompanied by an increase in operating expenses (such as sales and marketing) to fund greater demand. In this regard – investors are unlikely to be swayed by revenue performance alone, and will be looking to see if the company can translate this into cash growth.

However, InterContinental Hotels Group has also seen encouraging performance in this regard. We can see that net cash to total revenue rebounded strongly in 2021.

| 2019 | 2020 | 2021 | |

| Net cash from operating activities | 653 | 137 | 636 |

| Total revenue | 4627 | 2394 | 2907 |

| Net cash to total revenue ratio | 14.11% | 5.72% | 21.88% |

Source: InterContinental Hotels Group Financial Statements and Notes to the Group Financial Statements. Net cash to total revenue ratio calculated by author.

Additionally, free cash flow generation also saw a strong recovery from 2020 levels:

IHG Hotels & Resorts: Investor Presentation May/June 2022

Should we see further growth in free cash flow, then the stock could potentially see upside going forward – as IHG will have demonstrated an ability to generate cash in spite of inflationary pressures and a decline in Greater China revenue resulting from COVID-19 lockdowns.

Conclusion

To conclude, InterContinental Hotels Group has shown resiliency in the current environment, and is favourably exposed to a rebound in U.S. domestic travel demand. Should we see further growth in free cash flow for the upcoming half-year results, then I envisage further upside for the stock.

Be the first to comment