Matteo Colombo

Introduction

The stock market is weakening again while I am writing this. Inflation is red-hot, forcing the Federal Reserve to hike more aggressively – at least, that’s the outlook. Stocks hate that, which means we’re once again finding ourselves in a less pleasant phase of the ongoing downtrend. The good news for long-term investors like myself is that this comes with new opportunities. However, the combination of high inflation and market weakness means we need to be careful what we buy. I have mainly bought dividend growth stocks so far this year as I believe that bear markets should be used to buy stocks that only rarely sell off. That’s more often than not caused by the value these stocks bring to the table. One of my favorites, which I do not yet own is Intercontinental Exchange (NYSE:NYSE:ICE). The company doesn’t have a high yield, but it has the capabilities to maintain strong long-term dividend growth, protecting income against inflation while making it extremely likely that capital gains outperform finance peers and the market, in general.

In other words, in this article, I will make the case for a dividend investment in what I believe is one of the best dividend growth stocks on the market.

While high inflation and market weakness aren’t fun, they provide us with tremendous opportunities.

So, bear with me!

This Market Is Tricky – To Put It Mildly

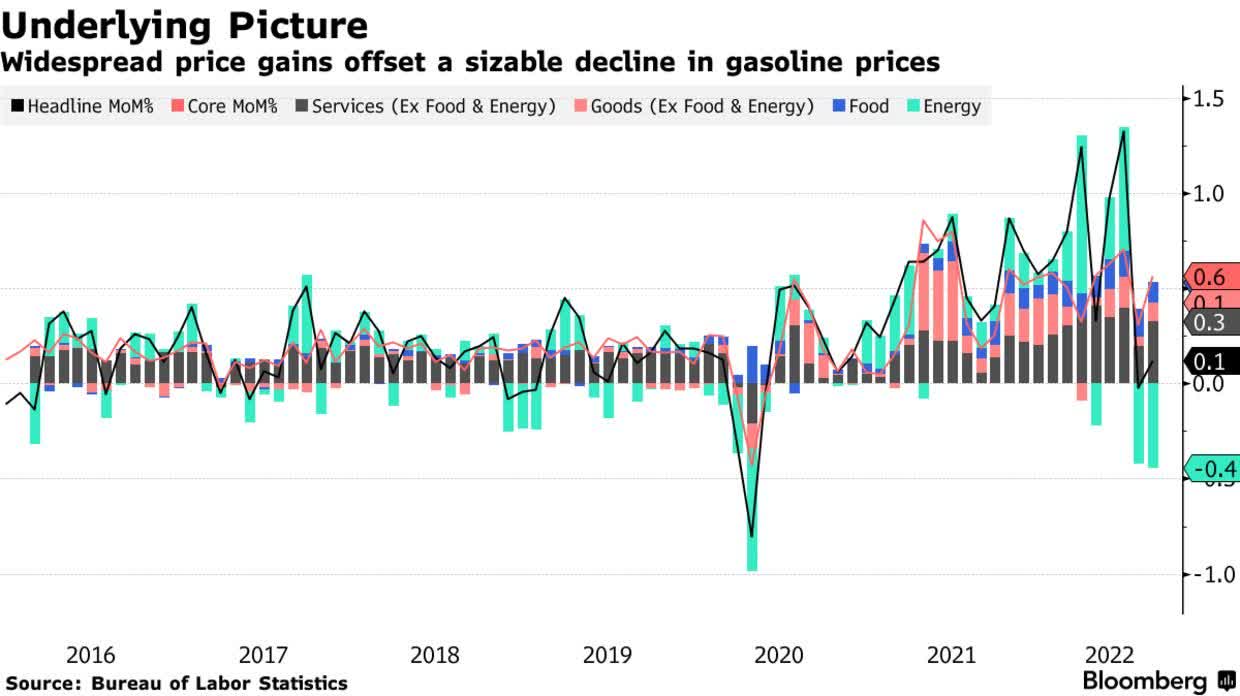

Boy did the market hate the latest inflation print. Core inflation (no energy and food) rose by 6.3% year-on-year in August. That’s up from 5.9% last month and above expectations of 6.1%. Core inflation was up 0.6% on a month-on-month basis, which is up from 0.3% in July and above expectations of 0.3%.

In other words, it was really bad. Especially because energy was actually deflationary. Inflation was up because services, goods, and food are now all capable of creating terrible inflation numbers on their own as the chart below shows.

Bloomberg

What this means is that the Federal Reserve is expected to continue to hike aggressively to control inflation.

That’s a huge problem as core CPI inflation is at one of the highest levels in recent history, beating pre-Great Financial Crisis core inflation by more than 300 basis points. The Fed will need to get this under control without damaging the economy too much. As economic indicators are already weakening, it now seems that the Fed will have to hike even more aggressively into an economic slowing cycle.

Wells Fargo

According to Wells Fargo:

We think the road to returning inflation to target is still a long one, and we continue to look for the FOMC to press ahead with another 75 bps point hike at its meeting next week.

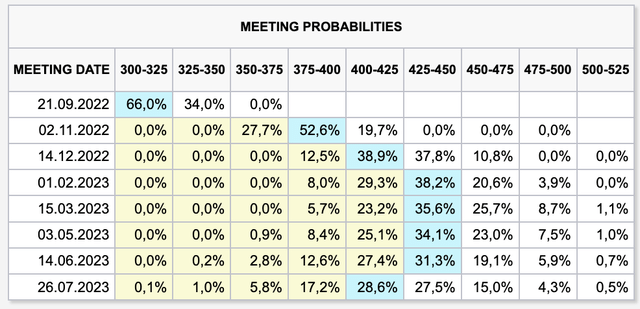

A 75 basis points hike is now widely accepted to be a done deal later this month as futures price in a 66% probability of a hike that big. However, the remaining 34% aren’t to the downside, but to the upside. There’s now a 34% probability that the Fed hikes by 100 basis points.

CME Group

I do not believe that this will happen and I’m not going to waste a lot of time discussing these probabilities, which change on a regular basis. What matters here is that we’re now on a path to a Fed funds rate of more than 425 basis points going into next year before the Fed is expected to ease in the second half of 2023.

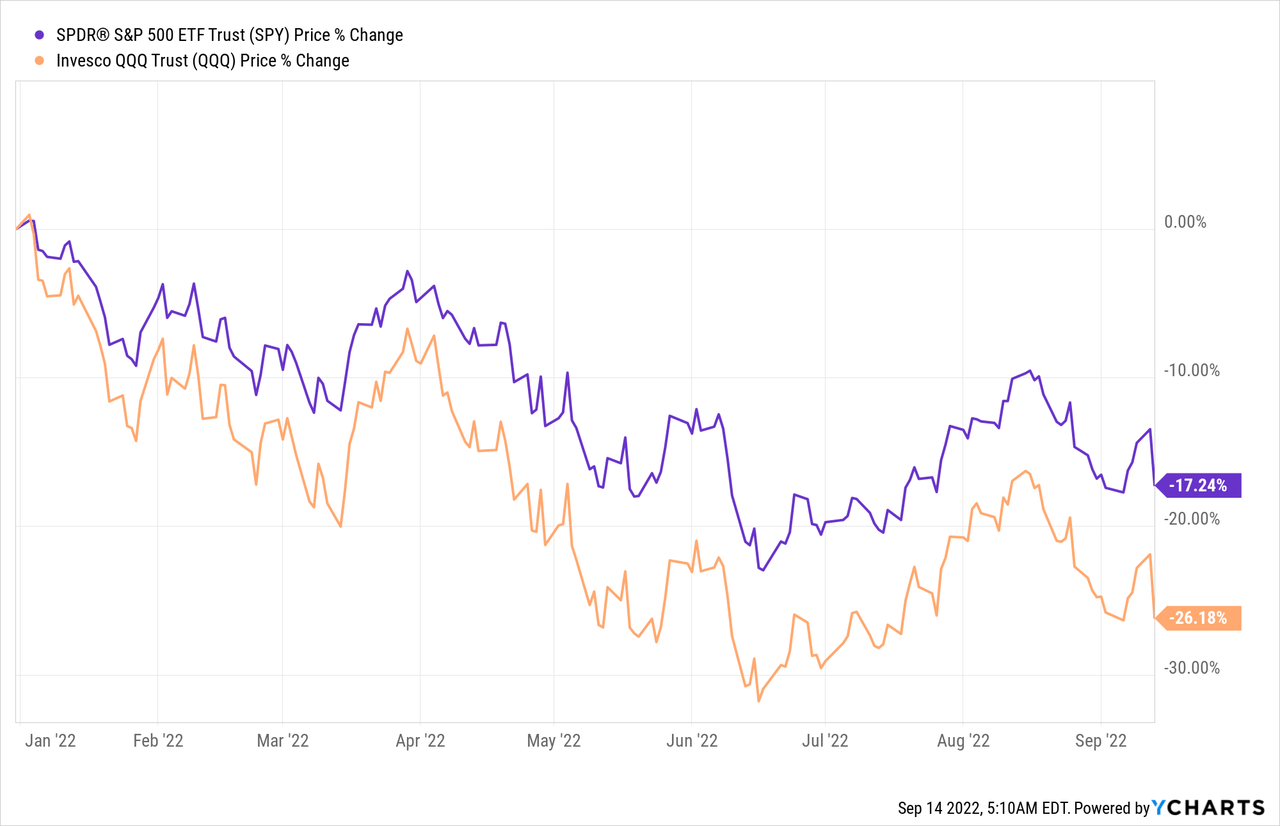

Needless to say, markets hate the mix of high inflation, lower economic growth expectations, and what seems to be an increasingly hawkish Fed. Hence, the S&P 500 is back to a performance of -17.2% year-to-date while the tech-heavy QQQ ETF (QQQ) is down more than a quarter.

Now, to get to the point of this article, there are basically two takeaways here. As someone who has invested close to 95% of my entire net worth in 24 dividend growth stocks, I’m currently not having the most fun. But that’s OK, and it was somewhat expected given market circumstances.

What matters is that we’re now in a situation of stock price weakness and a tricky economic environment that could mean above-average inflation on a prolonged basis.

When combining these issues, I believe weakness is a blessing for long-term investors as we get to buy stocks that not only protect investors against inflation but also generate outperforming total returns.

One of these stocks is Intercontinental Exchange.

Quality Dividend Growth

I keep encountering a major misconception. With inflation of more than 6%, some people believe that low dividend yields have a major disadvantage. That’s not necessarily true as we’re comparing apples to oranges here – especially when dealing with investors who need dividends to pay bills.

What matters is the rate of change. After all, inflation is a rate of change. A dividend yield is not. Dividend growth is a rate of change.

In other words, when dealing with higher (expected) inflation, I tend to prioritize dividend growth over a high yield.

Given this short explanation, you’re probably aware that I’m not going to present a high-yielding stock here, but a stock with high dividend growth.

That’s exactly what Intercontinental Exchange is known for: growth over yield.

With a market cap of $55.8 billion, the company behind the ICE ticker is the third-largest company in the financial data & stock exchanges industry. It is the second-largest operator of stock exchanges behind Chicago-based CME Group (CME), which I added to my portfolio this year.

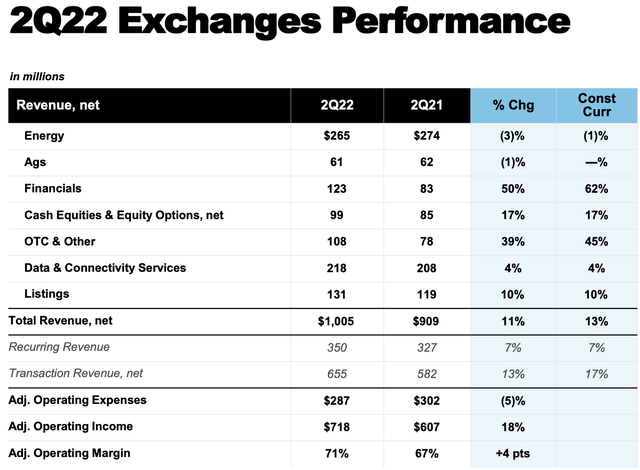

In 2021, the company generated 64% of its revenue from its exchange-related operations, which include energy products like Brent oil and Dutch TTF Natural Gas futures, agricultural commodities like orange juice and sugar, as well as financial tools to hedge interest rate risks. But more importantly, the company is known for owning NYSE.

Intercontinental Exchange

21% of sales came from fixed income and data services. This includes fixed income execution, CDS clearing, and data analytics, as well as other data and network services. In 2Q22, this segment did $512 million in revenues. $421 million of this was non-transaction recurring revenue, which is a big deal as ICE is slowly but steadily transforming into a company that isn’t just depending on exchange transaction volumes.

The remaining revenue came from the company’s mortgage technology segment, which did $297 million in 2Q22 sales, $160 of which was recurring.

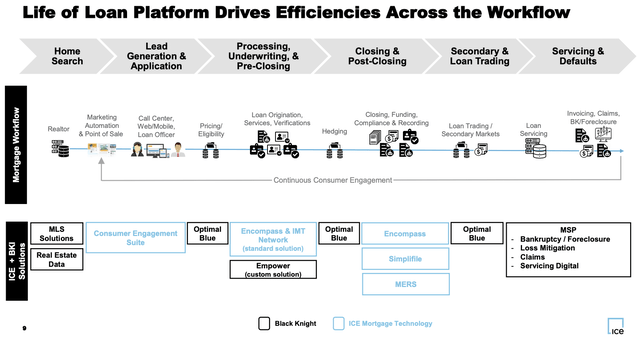

This mortgage segment is expected to become much larger after the pending acquisition of Black Knight. The transaction is expected to close in the first half of 2023, allowing ICE to become an even bigger player in the mortgage industry. However, not as a lender, but as a provider of the technology behind the buying process ranging from searching for a home and servicing the mortgage.

Intercontinental Exchange

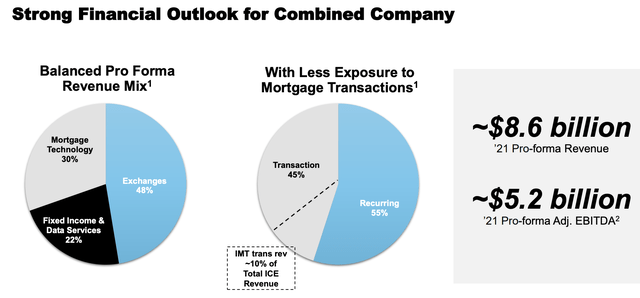

This deal is expected to push the company’s exchange exposure below 50%, making mortgage technology the second-largest segment with roughly 30% of total sales. Total recurring revenue will account for 55% of total sales, which means ICE is turning into a finance powerhouse instead of a transaction-dependent exchange player.

Intercontinental Exchange

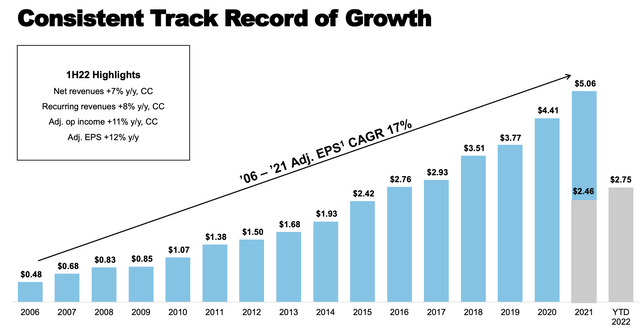

The beauty of ICE is that the company is fast growing. Between 2006 and 2021, the company has grown EPS by 17% per year, including the Great Financial Crisis. In the first half of this year, EPS is up 12% despite economic challenges.

Intercontinental Exchange

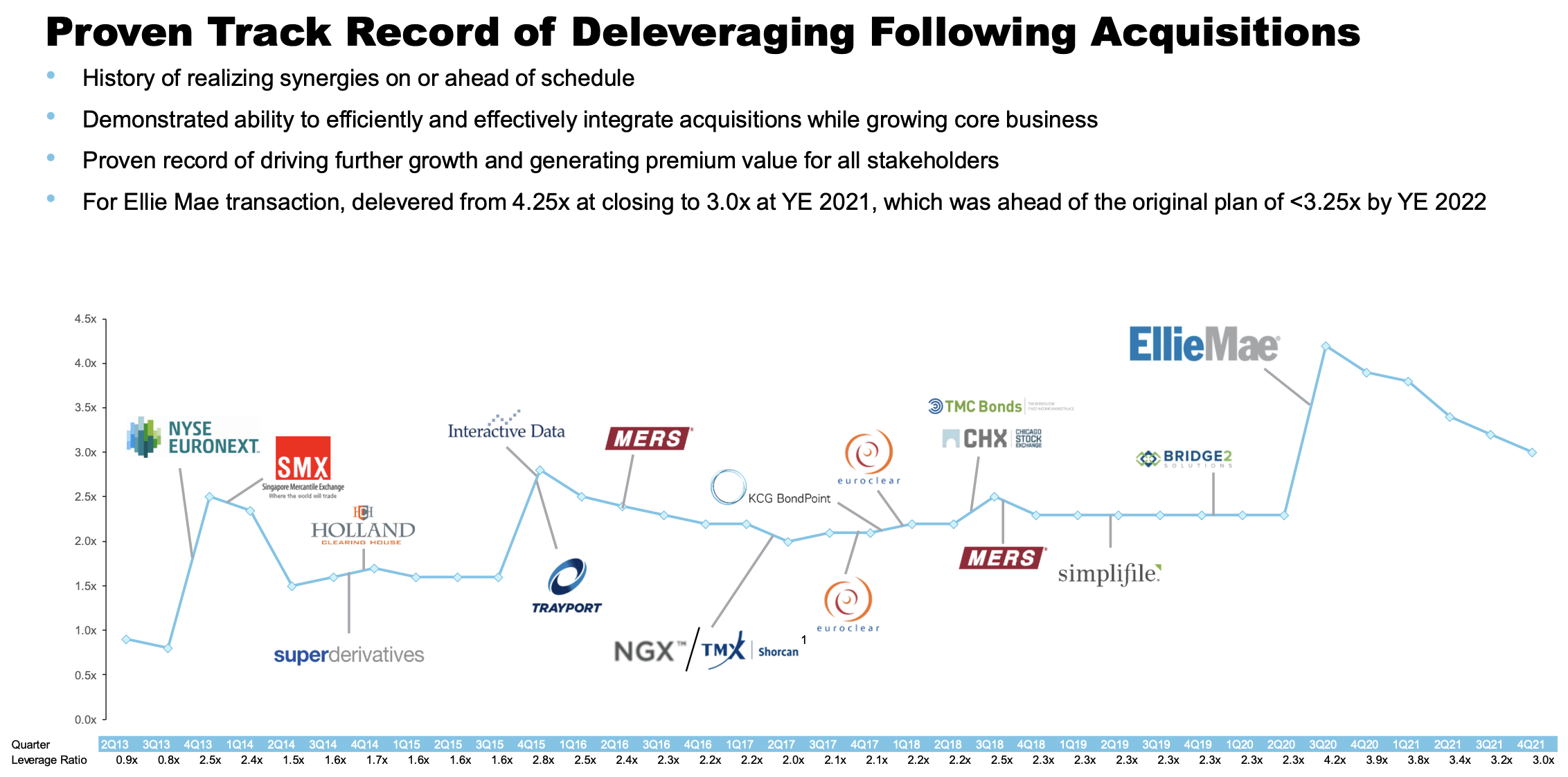

This is not organic growth, far from it, actually. The company is an aggressive acquirer of growth, which explains why it’s a dividend growth stock instead of a high-yielding financial company. It has other priorities than getting rid of excess cash through high dividends.

However, the company’s acquisitions, so far, have been highly successful, leading to strong free cash flow growth. Hence, the chart below accomplishes two things. It shows the company’s acquisitions since 2013 and the net leverage ratio, which has remained stable despite high-volume deals. Even the Ellie Mae deal was followed by 1.5 years of rapid deleveraging.

Intercontinental Exchange

With regard to Black Knight (the aforementioned mortgage technology giant):

[…] the company offered to buy Black Knight for $13.1 billion with an enterprise value of $16 billion – in other words, the deal comes with roughly $3.0 billion in net debt that will be added to the ICE balance sheet (that technically increases the deal value).

The transaction breakdown is 80% cash and 20% equity. 20% equity will consist of shares ICE issues to Black Knight shareholders. The company bought Black Knight at a 15x 2022 adjusted EBITDA valuation (EV/EBITDA).

The company is funding this deal with $8.0 billion in new debt consisting of commercial paper, a term loan, and bonds. It will increase the leverage ratio at 4.1x gross debt to adjusted EBITDA.

The company will work on reducing gross leverage to 3x by the end of 2024. Share buybacks will be suspended until gross leverage is below 3.25x EBITDA.

The dividend policy will NOT be impacted.

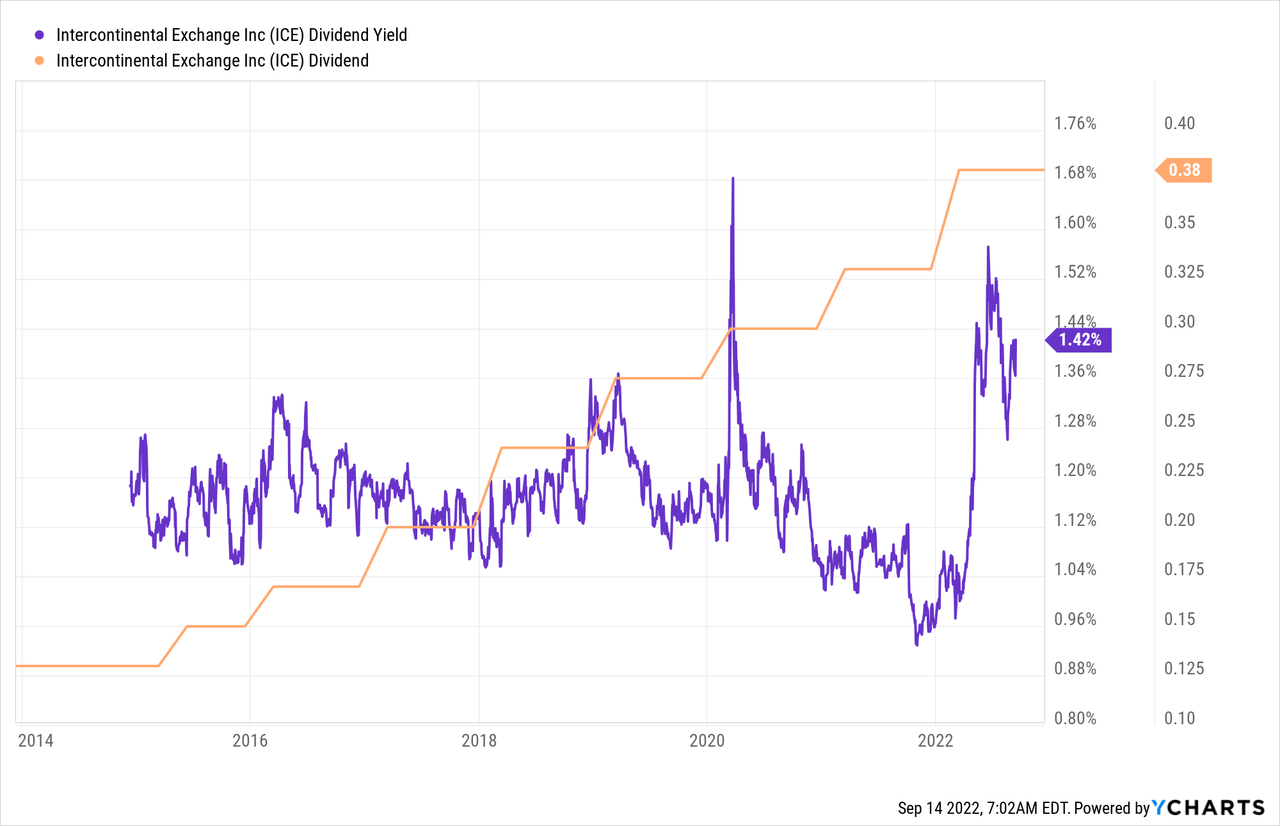

With that said, the company currently pays a $0.38 per share per quarter dividend. That’s $1.52 per year per share or 1.5% of the stock price.

A 1.5% dividend yield isn’t a lot. At least not for income-oriented investors. But that’s OK as ICE is focused on growth over high yield.

Hence, it’s a good thing that dividend growth is high, otherwise, my thesis would be out of the window. ICE initiated its dividend in 2013. Since then, it gradually grew growing, on average, by 18.7% per year over the past five years.

These are the most “recent” hikes:

- February 2022: 15.2%

- February 2021: 10.0%

- February 2020: 9.1%

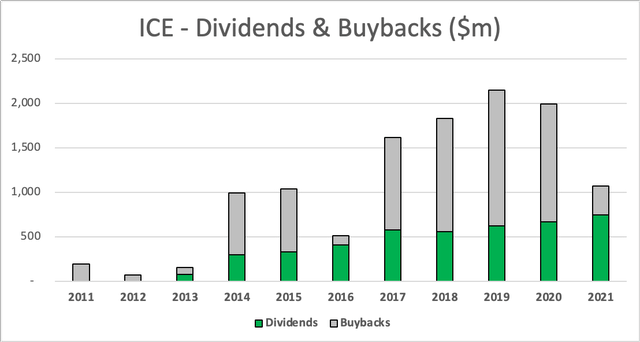

Moreover, during the past 10 years, the company has mainly emphasized buybacks as a way to distribute cash with lower buybacks after major acquisitions.

Author

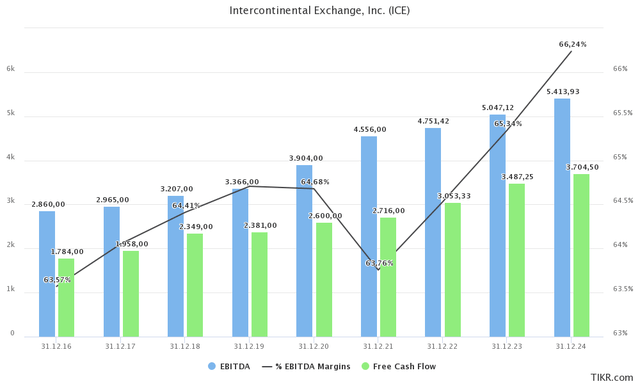

It also helps that the dividend outlook is quite good. In this case, I’m not talking about any official outlook but the company’s free cash flow expectations.

Next year, the company is expected to boost free cash flow to $3.5 billion. That’s 6.3% of the company’s market cap. This is provided by steadily rising margins and higher sales growth. An FCF yield this high supports the company’s 1.5% yield, rapid debt reduction, and aggressive future dividend growth and buybacks, once the aforementioned leverage target has been reached.

TIKR.com

With that said, there’s more good news.

Outperformance & Valuation

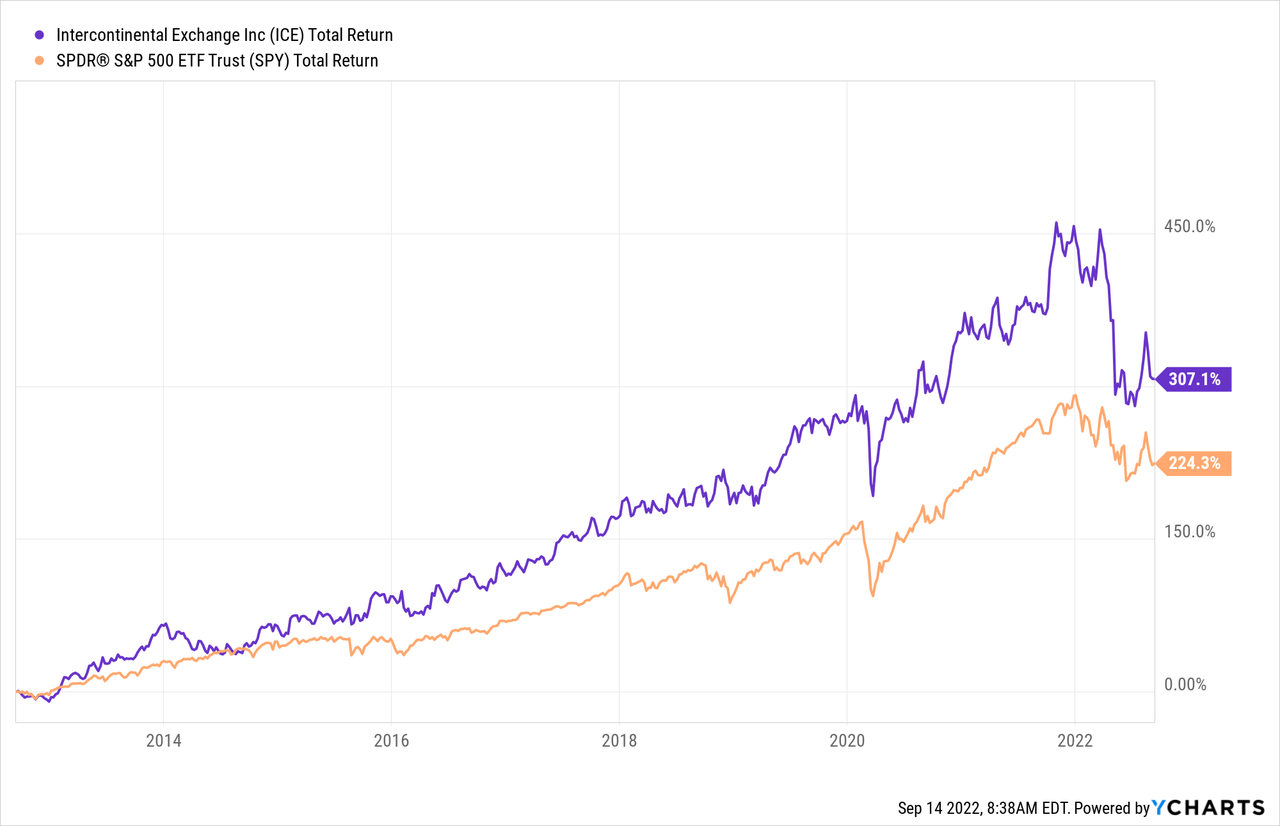

One of the best things about dividend growth backed by a solid company is that it more often than not leads to outperformance.

Over the past 10 years, ICE shares have returned 307% including dividends, which beats the S&P 500 by a considerable margin.

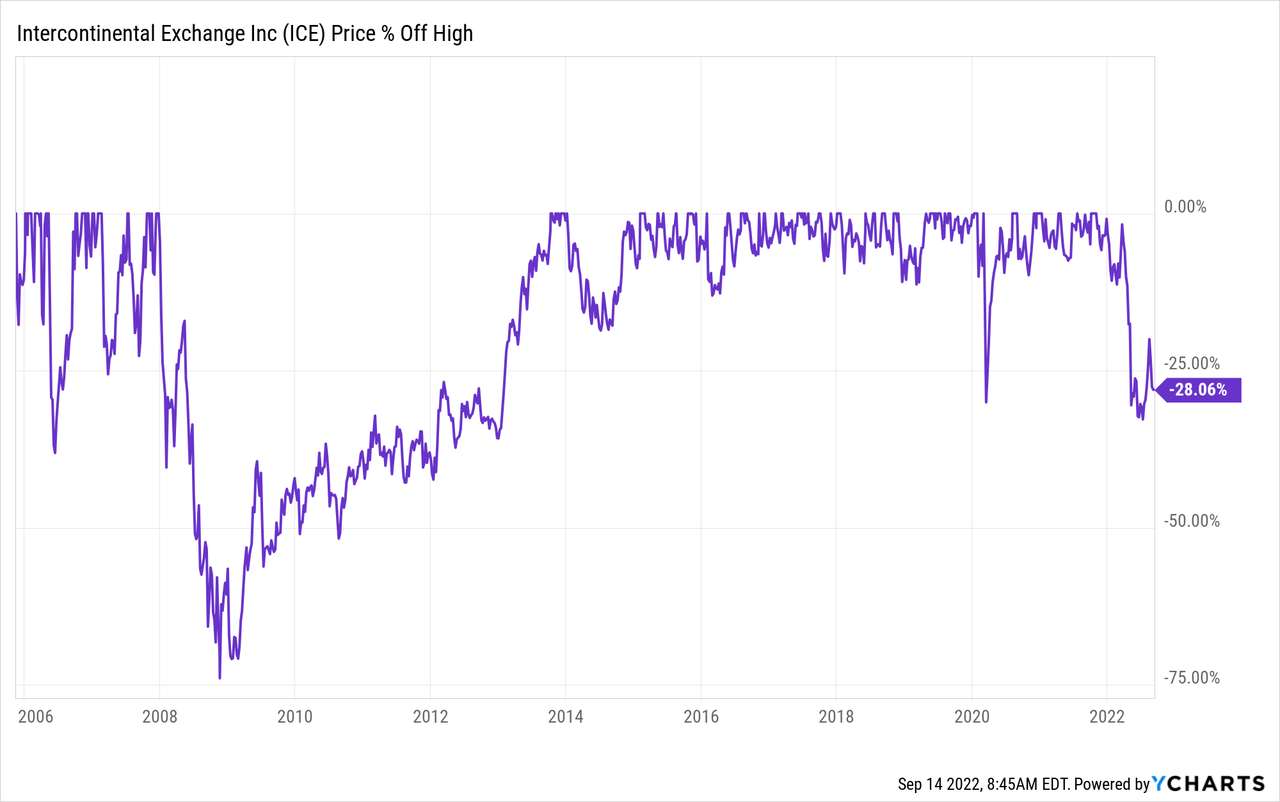

It also helps that ICE is offering us a discount. The stock is currently 28% below its all-time high. This makes it one of the worst sell-offs since the Great Financial Crisis.

The company is now trading at a $68.4 billion enterprise value consisting of its $55.8 billion market cap, $12.4 billion in expected 2023 net debt, and a mere $200 million in pension-related liabilities.

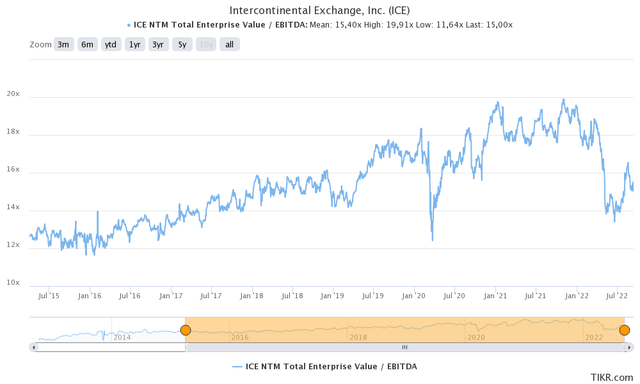

This is 13.5x 2023E EBITDA of $5.05 billion. That’s the lowest valuation since early 2017, which I think is a great deal in addition to the company’s implied 2023 FCF yield of more than 6%.

TIKR.com

Takeaway

Markets are in turmoil. Inflation is high, economic growth is slowing, and the Fed is eager to hike rates until inflation is under control.

While this isn’t fun for existing positions, it allows investors to buy great stocks at attractive prices. In this case, I looked into Intercontinental Exchange, which doesn’t offer a very high yield. However, it does offer high (expected) dividend growth thanks to a stellar business model, which is rapidly evolving and expected to generate rapidly accelerating free cash flow.

I have little doubt that ICE shares will continue to outperform the market on a long-term basis as the company moves to a business model allowing it to deeper penetrate the mortgage industry resulting in higher recurring earnings on top of its highly profitable exchange business.

If you’re a dividend growth investor looking to add financial exposure, I think this stock is one of the best picks in the sector. The only reason I don’t own it yet is that I own CME Group and Nasdaq Inc. (NDAQ) already. I am looking to diversify a bit before adding more similar companies to my portfolio.

(Dis)agree? Let me know in the comments!

Be the first to comment