inarik/iStock via Getty Images

A drop of just 3.7% in the Inter Parfums (NASDAQ:IPAR) share price over the past year, compared to a 16.9% drop in the S&P 500 (SP500) is one of the stock’s most striking characteristics. Its long-term performance has also exceeded that of the broader index. This sounds like a good place to start for the New York-based manufacturer and marketer of perfumes for luxury brands like Montblanc, Jimmy Choo and Coach. It also helps that the $56 billion global fragrances industry is thriving, with growth expectations for the coming years at between 5-8%.

Strong post-pandemic growth…

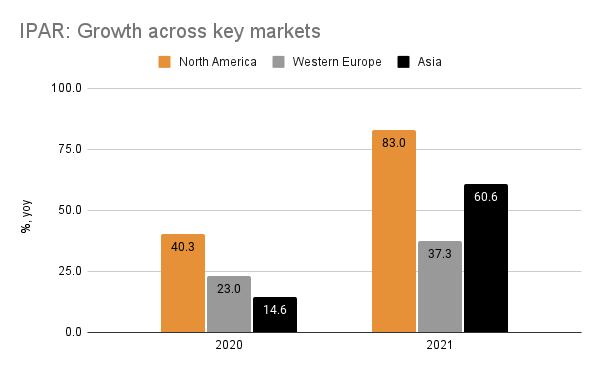

This is also visible in Inter Parfums’ growth, which showed a healthy 23% increase in 2021, compared to 2019. Even its latest numbers for the first nine months of 2022 showed a good 16% increase on a year-on-year (YoY) basis. The company’s diversification across markets and products is also encouraging. North America led its sales with a share of 40% in 2021, while Europe was a distant second with a 23% share and Asia’s share was at sub-15%. While North America’s share could be smaller, it’s a relatively recent phenomenon. It was still big at 33% in 2019 but 7 percentage points is a big jump to make in a short period of time. This is accounted for by massive post-pandemic sales growth in the market of over 80%, in what was popularly seen as the release of ‘pent-up demand’. Both Europe and Asia saw a declining share in the year, despite strong growth as a result (see chart).

Source: Inter Parfums

… but can it last?

With the US technically in a recession now, however, the diversification can show greater balance in the next year. So far its US sales have been strong, with a 62% increase in the first nine months of the year. But that could taper off going forward.

At the same time, Western Europe is expected to slow down next year too. Already, with a strong US dollar in play, revenues from the geography have been affected. Even though they showed a real increase of 12% YoY in the third quarter of 2022, the euro’s weakness resulted in a negative 4% growth in dollar terms. As a result, in Q3, the company’s sales slowed to 7%. For the year-to-date, sales from the region have been a muted 4% too.

Further, its long-term growth has been both muted and inconsistent. Its 10-year CAGR is at 3.4%, which includes four years of negative growth. One of these is the COVID-19 year of 2020, which impacted most companies. But even discounting that, it’s hard to ignore that growth of just 5.6% as late as 2019. If there was a reasonable explanation for why its growth can continue after post-pandemic effects of pent-up demand and growth in households’ savings during lockdowns taper-off, that would be comforting. In the case of L’Oreal (OTCPK:LRLCY), for instance, which I recently wrote about, the jump in its e-commerce sales looks promising. I’m not as sure if that’s the case here.

Impressive margins

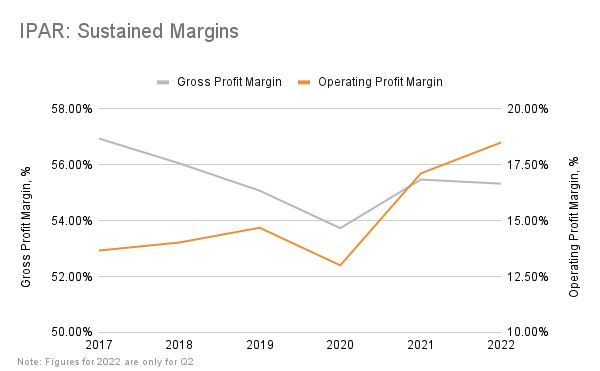

At the same time, in a high inflation-driven slowdown, its strong margins are a relief. And unlike its revenue growth, Inter Parfums’ margins have actually been high for a long time. For Q2 (the latest available), for instance, its gross margin is at 55.3%. It has ranged between 53-56% for the last six years. This is much higher than that for the S&P 500 at around 30% and for the consumer staples sector at 32.6%. Its operating margin of 18.5% is also decent, in fact since the pandemic it has reported stronger results on this metric than earlier.

Source: Seeking Alpha

There is however an oddity worth pointing out here. In Q4 2021, it actually reported an operating loss for which there is a limited explanation. It calls the quarter “atypical” in that it splashed more than usual on marketing, but its sales still fell short. It might have been a one-off event but it’s one to bear in mind since economic challenges continue.

Inter Parfums’ net margins have been sub-10% for many years, but at the end of last year, they were at touching distance from them. And so far this year, they have been higher, coming in at 11.3% in Q2 2022. This is encouraging in the current times.

Justifiably high market multiples

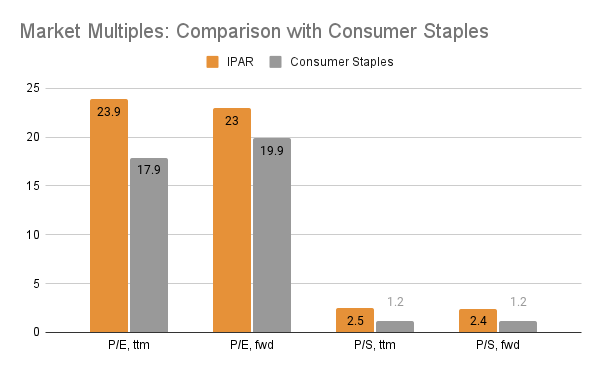

Coming to its multiples, compared to the consumer staples sector, they seem high no matter how we look at them. Its twelve months trailing price-to-earnings (TTM) (P/E) ratio at 23.9x is higher than the 17.9x for the sector. And its price-to-sales (P/S) ttm ratio is double that of the sector. Ditto for its forward multiples. But this is justified for three reasons. The first is its performance. Both its revenue and earnings growth have exceeded the sector in the past and are expected to continue doing so. So it’s not hard to see why investors are ready to pay a premium for the stock.

Source: Seeking Alpha

Next, its historical P/E ratio isn’t much lower either. It dropped to a low of 18.5x in 2020 at the time of the stock market crash during the pandemic. In fact, its median level has been at a much higher 35.9x over this time. By that logic, it actually trades below its historical average.

Finally, comes its share price performance, which is where I started the article. Not only has it performed better than the S&P 500 over the past year, at 346.1%, its 10-year returns are also double that of the index, making another case for a premium on the stock. Also, its relatively better performance over the past year has kept its P/E elevated at a time when many other stocks have seen sharp drops.

What next?

In sum then, we have a high-growth company with improving net margins at a time of high inflation. Its share price performance has also been relatively better off this year than the broader markets and historically, and yet it’s trading at a P/E lower than its historical average. There could be some challenges over the next year as its big markets slowdown especially given its past inconsistent growth, but on balance, it is a good buy for the long term in my opinion.

Be the first to comment