NicoElNino/iStock via Getty Images

Intellicheck (NASDAQ:IDN) is an identity verification company that can reliably verify identification documents within milliseconds. With its technologies, databases, and platform, it is an invaluable resource for companies looking to eliminate fraudulent transactions.

Identity fraud is big business, and it’s only growing. It benefits all companies to put safeguards like IDN’s products in place. Bryan Lewis, the CEO of IDN, relayed that losses from identity fraud have increased to $52 Billion annually from $16.8 Billion just four years ago according to Javelin Strategy and Research. An increase of 200% in incidents of identity fraud is waking up financial service companies and other industries, and I believe IDN can become a key industry player in reversing this trend.

I liked IDN back in 2020 after the initial shockwave of the pandemic saw the share price fall from about $10 to just over $2.00 per share. After my article when IDN was at around $5 in April of 2020, the price proceeded to triple to over $15 per share before recently returning again to $2. At the time of my initial article, I believed that the pandemic had only exacerbated online financial fraud, and that IDN’s steady customer wins and market penetration justified a strong buy opinion.

Why did it fall so much, and was it fair? Fairness really doesn’t come into play in the usual sense of the word. This is the Market, after all, and stocks often overshoot on the way up and on the way down. I like to review a stock after a big plunge and see if the Market has thrown out the baby with the bathwater.

I think the company is worth a lot more, and we won’t have very long to wait before it becomes apparent. Against a complex macroeconomic backdrop, I think IDN finds itself in a favorable position for whatever may come.

IDN’s Business

IDN has developed a patented, frictionless, recurring-income model of fraud prevention that counts five of the top twelve financial institutions in the U.S. as customers. The business has a very low churn rate. according to the CEO in the Q4 conference call:

I’m happy to say as part of a general business review, we analyzed churn rate. And since 2018, the company has not lost in single major client to anything other than bankruptcy and all the financial services clients have grown their use cases.”

This is a great testament to IDN’s utility. I’m not aware of many other companies that have such a customer retention rate.

IDN’s services have expanded greatly from their beginnings in retail brick-and-mortar applications to digital transactions. Digital use has increased by 550% from 2019 to 2021.

IDN’s customers are finding new use-cases all the time. Customers have recently begun adding “returns without receipt” identity confirmation for example, a hotspot of financial fraud. In addition, a private-equity owned global media company and email provider also just onboarded to use IDN’s services. If somebody calls this email provider to get a password reset, the company uses IDN’s services to verify that person’s identity, thus preventing the scourge of email account takeovers.

Why did IDN fall?

I’ve reviewed all of IDN’s conference call transcripts from Q2 2021 onward and matched them against the stock performance. The biggest recent one-day drop came on November 11, 2021, following the Q3 2021 earnings release and conference call after the market closed on the previous day.

The Q3 2021 numbers came in at -.02 per share in net earnings, missing analyst expectations by .01, and revenue of $4.83 Million, beating analyst expectations by $505,050 per share. In the three days that followed, the stock price dropped about 30% from $8.71 to $6.03 including two days of 30 times the average volume.

Clearly, somebody decided that they didn’t like the numbers or what was said in the conference call.

IDN Stock Chart (TradingView via Seeking Alpha)

So what could have made some sellers stampede for the exits?

I’ve highlighted a few things from this call that I believe contributed to the deterioration of the share price.

Stimulus Savings

In his opening remarks, CEO Bryan Lewis stated,

We recognized that due to savings rates and stimulus received during the pandemic, right now, shoppers are not necessarily buying on credit or more importantly, opening new credit card accounts. While we believe this will continue to impact us in the short term, we believe that as things start to return to pre-pandemic levels and people begin to spend in a normalized way, this will drive credit card applications and additional card not present transactions.”

This explanation makes sense to me. During the heightened period of the pandemic, people were saving at higher rates, reducing the use of credit, and receiving stimulus payments that had a direct effect on both of those activities. IDN makes money every time a customer uses IDN’s offerings to confirm a person’s identification. Such use cases include when someone: 1) applies for a credit card, 2) wants to make a purchase but doesn’t have their credit card handy (a “card not present” transaction), or 3) wants to make a return without a receipt.

Implementation Interruptions

In an exchange with an analyst on the Q3 call, the CEO explained that 2 major clients had some internal technical development delays, which slowed the implementation of their IDN-related systems.

Code-Freeze Crunch

The Q4 Conference Call on March 9 brought further share price weakness, amidst the broad market carnage (that should be familiar to most everybody.)

While the Q4 call illuminated many positives, such as many contracts renewing at higher prices, and customer wins from competitors with inferior tech, additional client development hitches pushed expected revenues out a bit further. CEO Lewis stated,

With all these exciting developments, tempering this as financial services company number two, which recently began a project that will enable them to extend credit to tens of thousands of additional merchants. This required financial services company number two, to put code freeze on all other development, which meant multiple retailers that have been expected to go live in the first half of the year will not. The above described project should be an interim delay to our short-term growth that they expect to resume integrations in the September timeframe. We believe this short-term pain now represents a likely long term gain as these new additional applications will need validations.”

This delay in revenues likely led to further share price weakness.

Bottom Line Blues

Increased sales and marketing headcount, R&D investments and stock-based compensation impacted the bottom line. In Q4 of 2021, IDN continued to increase investing in themselves. Sales and Marketing costs ramped up, and it’s a welcome development. These investments have been paying off according to the company, with inbound leads increasing rapidly and new customer wins.

Pernicious Postponement

May 11, 2022 Press release led to the final drop before the current beginnings to a recovery.

IDN was scheduled to release their Q1 2022 results on May 12 and host a conference call. Instead, they postponed the results and conference call in order to “to allow for additional time for the Company and the Company’s external auditors to complete the accounting analysis pertaining to the Company’s equity compensation program.” Sounds harmless enough, yet announcing such a postponement the day of the call, during a vicious multi-month stock market downturn that devastated the majority of the small and microcap stock universe, was bad timing or bad luck which didn’t sit well with some investors and the stock closed that day at $1.43. I should mention that three days prior, IDN replaced its CFO. The succession of events had to have some investors wondering how big this accounting issue was, and instead of just wondering and waiting for clarification, they got out.

As often happens when fear and uncertainty reign, May 12 ended up being the low of the year, and the stock has been recovering since.

The accounting issue ended up being an extremely trivial matter. Per the company on the rescheduled conference call,

During the first quarter of 2021 Intellicheck employees did a cashless exercise of incentive stock options. Due to an isolated administrative oversight resulting in part from the change in payroll providers, the company inadvertently did not remit payments to taxing authorities related to the shares surrendered for tax purposes.”

Though the stock market was, on the date of the rescheduled Q1 earnings release and conference call, in the middle of a horrible multi-day downdraft, IDN stabilized and has been marching upward steadily since then.

Financials

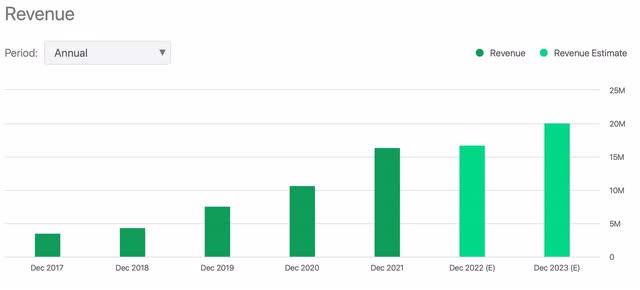

IDN has a year-over-year revenue growth of 61.46%.

Their annual revenue in 2021 was $16.39 Million.

Intellicheck Revenues (Seeking Alpha)

While analysts expect IDN’s revenues to be level in 2022 with 2021, they expect a resumption of revenue growth in 2023.

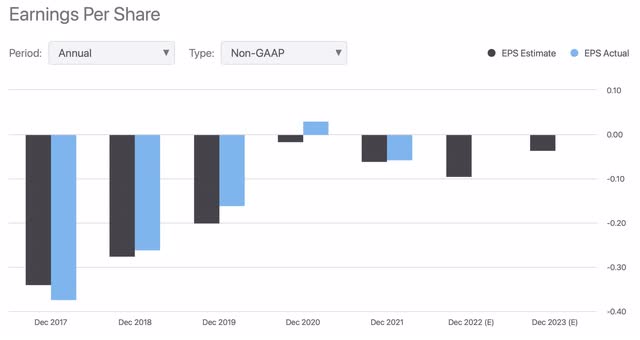

Earnings have consistently surprised to the upside, whether from analysts being conservative or from management setting expectations adequately. Given this history, and the information that we can get from the recent earnings reports and calls (detailed in the rest of this article) I think we could continue to see IDN outperforming the analyst estimates.

Intellicheck Earnings (Seeking Alpha)

As of the end of Q1 2022, IDN had just over $11 Million in cash on the balance sheet.

They had a low 18.67 Million shares outstanding at the end of Q1 2022, which was stable with the 18.48 Million shares out at the end of Q1 in 2021.

Why IDN’s Stock Should Rise Again

Every one of the above factors is no longer an issue. In addition, new business, stabilization of operating expenses, service price increases, should all contribute to positive future trends and a corresponding stock price rise.

I’ll highlight some of these positive tailwinds below. But first, some words about the economy and credit.

Inflationary Pressures and Recession Fears

There is a lot of fear out there about a recession. Typically, recessions do occur when the Fed raises rates at such a rapid clip to tame inflation. The Fed has only so many levers to pull, and none of them involve increasing the supply of scarce goods (the supply side of the equation), so they reason that by pulverizing demand (by raising interest rates) they can get inflation down. While this usually works, it’s a blunt instrument and has ripple effects in the economy of course. The question is, if there is a recession, how mild will it be? A recession has historically been understood to be two quarters of decline in GDP readings. In 2008, the National Bureau of Economic Research (NBER), official recession judge, decided to define recessions differently. The NBER currently defines a recession thusly:

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough.”

The gist of it is that defining a recession is a bit more amorphous than generally thought. In any case, it is possible that a recessionary period will affect many industries and thus the stock prices of companies in those industries.

I think that IDN has a strong hand both right now and in a recessionary period. Inflationary periods like the one we are in now can result in declining real income and savings rates, and greater reliance on credit cards and loans. Recessionary periods likewise can see increased credit card use as borrowing increases to fill gaps between household income and spending when income and employment takes a hit.

Here’s a data point to back up the idea that inflationary periods like now should be good for IDN:

Last week, BofA (BAC) reported that aggregate credit and debit card spending climbed 11% from a year earlier, with credit card spending up 16% and debit card spending rising 6%.

More credit and debit card use leads to more account applications and ID checks, which equals more business for IDN.

During recessionary periods, in addition to consumers seeking out more credit options, companies will be looking to save money everywhere, and therefore IDN’s fraud protection services should continue to be in high demand. When margins are squeezed, companies tighten their belts wherever they can. Fraud is extremely costly, so IDN should benefit from clients’ margin compression.

Back to the tailwinds shaping up for IDN:

New Business

On the most recent quarterly conference call we learned that IDN is working with yet another top 12 bank (which makes 6 out of the 12 leading financial institutions in the U.S.) This one happens to be one of the top five banks. They are going through the standard security audit, which IDN says they are very confident that they will pass, just like they have all of the others at other bank clients.

IDN also just announced a global media company as a new client in the account takeover prevention space. So, we see that new business keeps coming in and new use-cases for IDN’s technology and services continue to be discovered.

They are scheduled to begin two new pilots with large banks this quarter (Q3 2022). Per the CEO,

The first is a bank holding company headquartered in the south with almost 2,800 branches. This bank plans to start with digital new account openings and we’ll then add the bank branches. This pilot is expected to start in Q3. The second pilot also involves a bank holding company and is also located in the south with over 1,400 branches. This bank is going to do it in the opposite order. They will start in the bank branches and then move to digital account opening. This pilot is also expected to start in Q3.”

Recently, IDN’s customers have been expanding their use cases for the identification verification service that IDN provides. One example mentioned in the Q1 2022 call is as follows:

On the retail client front, I’m pleased to report another important development. Our off price retailer that started out using Intellicheck for parsing to prepopulate applications at their 3000 locations and that we just renewed for a three-year deal, has completed the rollout of an additional use case at their locations. In addition to credit applications, they have now begun using us for no receipt returns. They expect that this will double their previous volumes and early indications show that to be the case.”

I like to see the continuous flow of new business, and the CEO has said that the latest clients have been using up their “buckets” of transactions much faster than the clients anticipated.

New Partnerships Expanding Reach

IDN has also partnered with a company that allows for authentication of international documents, continuing to broaden their use cases and applications beyond their North America-centric business.

Here’s some color from the Q1 2022 call about additional use cases and expanding reach:

Financial services company number seven has extended the use of our services to Canada for both document validation and facial recognition. Financial services company number eight has signed on to validate passports starting at the end of June. This is an important milestone as financial services company number eight becomes our second major client to commit to using our technology solutions for international documents.”

In the Q3 2021 call, the CEO spoke about other partnerships with Point-of-Sale terminal providers:

First, we signed an agreement with one of the largest providers of inventory and point-of-sale systems for the cannabis industry. Integration is complete, and we have begun joint marketing efforts targeting their customers. We have also signed agreements with 2 major point-of-sale system providers to the hospitality industry to incorporate ID validation into their systems. Collectively, these 2 point-of-sale system providers represent over 2,400 bars and restaurants. Integration with both is now underway.”

IDN Raising Prices to Customers

In the latest quarterly earnings calls, CEO Bryan Lewis stated that the newest customers are paying higher rates than IDN previously charged. When existing customer contracts come up for renewal, higher rates are built into these new contracts. Some examples thrown out was a contract increasing 16% in year 2 with no discount for volume, and one three-year contract that has a year two increase of 87% and a year three increase of 33%.

Companies cannot raise rates unless the service is valued. IDN’s customers must be seeing plenty of examples of the value IDN brings, and large increases such as this will be reflected in the top line.

Insiders Step Up and Buy

In situations like these involving small/microcap companies and stock price stumbles, my general rule is not to buy unless insiders are as well, or they have a large stake in the company already. I want to see that the company is not just a regular paycheck to them, but an investment.

IDN insiders have indeed been taking advantage of the share price discount.

CEO Bryan Lewis stepped up just after the Q1 release and purchased 28,180 shares at around $1.70/share on 6/16 and 6/17 and 1250 more on 6/21, bringing his total to 263,216.

Newly hired, seasoned CFO Jeffrey Ishmael showed his confidence in IDN by buying 30,200 shares at about $1.70 on 6/16 and 6/17 as well, then buying 5,800 more on 6/21, 20,013 more on 6/23 at prices up to 1.83, and topping off with 4,000 more on 6/24 at prices up to $1.95 giving him 60,013 shares.

Director Guy Smith added 4,000 shares, bringing his total up to 248,492 shares.

Cautions

While I believe the risk/reward ratio is very favorable for IDN, it is still a microcap stock and small companies’ share prices can be very volatile. IDN does not have a high volume of daily trading, so large sells or buys can contribute to the volatility. Also, despite IDN’s obvious utility to companies across a range of industries, it’s possible that if a recessionary period comes and leads to “belt-tightening”, that companies could be short-sighted and cut back on IDN’s services too. I think this would be made up for through increased usage coming from consumers applying for more credit during such a period. In addition, IDN’s clients include some massive global financial institutions, and implementation timelines sometimes slip. The bigger the company, the more slippery the timeline, it seems. So, I try to keep that in mind when anticipating a company turnaround.

Conclusion

Sometimes the Market overreacts and good companies’ stock prices get pummeled. This is my favorite time to buy a stock as the risk/reward ratio becomes extremely favorable. Did some delays in implementations, global uncertainties, a massive stock market rout and accounting snafus trip up IDN? Absolutely. Is IDN worth more than around $2.60 per share, equaling a market cap of only about $50 Million? Absolutely, in my opinion. Far more. IDN’s gross margins are a terrific 90.7%, and when all the new customer rollouts, expanded uses and service price increases mentioned above hit the top line, earnings should flow strongly to the bottom line.

After all, IDN has been flirting with net profits in the last couple years, and I think their actions are bringing them very close to consistent profitability. On the Q4 call, the CFO estimated that operating expenses would level out at $5 million per quarter. This is after some heavy investments IDN recently made in their technology platform, marketing and sales staff. In Q1 operating expenses were in the ballpark of estimates at $4.5 million.

I’ll conclude with some shocking data mentioned by IDN in the Q1 2022 conference call: In the last year alone versus the previous year, account fraud in checking and savings accounts increased 73% to $7.8 billion. Account takeover losses soared 90% to over $11 billion. Consumer liability rose 672%, with an average of $1,551 loss per victim. It’s abundantly clear that lenders, banks and retailers need to get a handle on these incidents of identity fraud as they lose both money and customers. IDN has been widening its marketing reach to inform potential clients about IDN’s less-than-20-millisecond solution to stopping this out-of-control financial drain. It’s a win-win solution for any business, in any kind of economic climate.

Be the first to comment