Natali_Mis/iStock via Getty Images

Investment Thesis

Last year was a remarkable one for Intellia Therapeutics (NTLA). The emerging gene-editing biotech demonstrated the value of its CRISPR Lipid Nano Particle, “LPD,” platform by becoming the first biotech to edit human genes inside the body. Share price spiked before receding, following the recent growth-value rotation, opening an entry opportunity for those who wish to speculate on this exciting field.

This year, multiple catalysts can push shares higher, offering an opportunity for quick capital gains. In the coming weeks, NTLA is expected to provide data on its NTLA-2001 study targeting transthyretin amyloidosis, “ATTR,” a critical program that helped double its ticker last summer. The quality and strength of data from the previous release is a source of optimism this quarter.

Revenue Trends

NTLA is not profitable and won’t be for several years to come, but that is common for a development-stage biotech. However, its value stems from two sources:

- Intellectual property

- Potential gains from commercializing new therapies

NTLA has both these elements in its hip pocket. Its gene-editing platform is based on the 2020 Nobel-prize winning tech, CRISPR, a superior approach to gene editing in terms of safety and effectiveness. Last year, it became the first biotech to successfully edit liver genes inside a human body. Its propriety LPD technology opened the door for new applications targeting solid tumours such as lung and brain cancer, standing out from the crowded CAR-T, haematology, and ocular arenas.

In terms of commercialization, it is hard to pin down probabilities given the vast number of factors influencing end results, including drug pricing, medical community’s acceptance, FDA label restrictions and side effects. Thus, gaining FDA marketing authorization isn’t enough for a biotech to succeed as a business. This is especially true for gene-editing biotechs targeting rare diseases, making pricing a tricky issue. This is one lesson bluebird (BLUE) investors learnt after the ticker lost 70% of its value despite gaining marketing authorization for the first B-Thal gene therapy.

There is no guarantee that NTLA will succeed in commercializing its therapy, but NTLA ticker will fluctuate with changing probabilities of commercial success, mirroring new information released by management regarding its clinical programs. However, even if NTLA shares go south, chances of commercial success are enhanced by its market size.

NTLA’s most advanced program targets transthyretin amyloidosis, “ATTR”, which is fairly prevalent in the US and Europe. ATTR inflicts one in 100,000 individuals, which is less than the 1.8 per 100,000 prevalence of acute lymphocytic leukemia, a genetic disease that generates nearly $1.2 billion million for Novartis (NVS) and Gilead (GILD) from gene therapies Kymriah and Yescarta respectively, both of which were commercialized in 2018. Although ATTR has half the prevalence of ATTR, it is the only therapy available, unlike Kymriah and Yescarta, which competes against each other.

One advantage of NTLA’s platform is its scalability. There are different variations of amyloidosis, extending the potential market. Moreover, many therapies can be targeted by the same biomarkers of drugs currently under development. The company can reuse some of the technologies it develops for certain medicines on other diseases. The company has enough cash to continue developing its platform.

Financial Position And Valuation

NTLA ended 2021 with $1.1 billion in cash, enough to fund its programs for a few years. Its annual cash burn is $170 million, but I expect this figure to rise as it advances its programs. It has no debt, and if it needs cash, it will probably issue more shares. The current share price is strong, which means less dilution if and when the company raises capital.

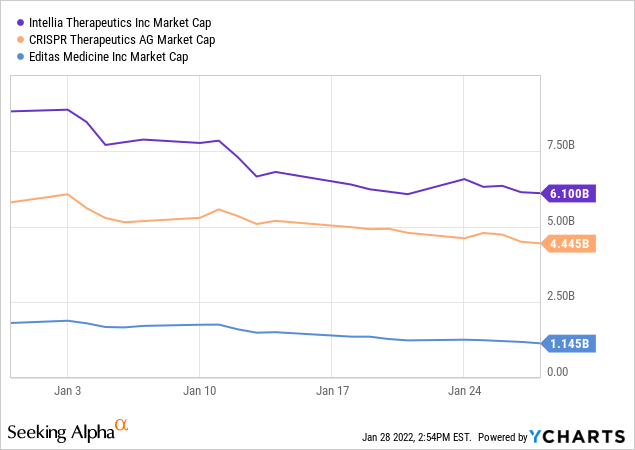

It is hard to express comparable valuation in figures given the technological and clinical differences compared to its peers. If we assume that all CRISPR gene companies have the same level of technological edge, we can see that NTLA has a higher valuation in terms of the market cap. But that’s a big if. There are technical differences that we can gauge to compare NTLA with its peers.

Editas (EDIT) seems the least technologically advanced (or the least brave), opting for a more trodden path for its clinical trials. Its most advanced clinical program targets leber congenital amaurosis, “LCA,” a disease that already has a gene therapy on the market. In fact, the first gene therapy approved by the FDA was Luxturna, commercialized in 2018 by Spark Therapeutics – now part of Roche (OTCQX:RHHBY) – for the treatment of LCA. Gene biotechs choose LCA to test their gene-editing platform because of ease of delivery, clarity of biomarkers, and robust literature around the disease, increasing chances of clinical trial success. EDIT’s other clinical programs focus on hemoglobinopathies, namely Sickle Cell Disease, “SCD,” and Beta-Thalassemia, which is an overly crowded market given that almost every gene therapy company I know has a program that targets haemoglobin gene mutations, namely SCD and B-Thal. bluebird bio, a legacy gene therapy company, gained authorization for Zynteglo to treat B-Thal a few years ago but failed to commercialize its therapy after national insurers in Europe refused to pay the asking price of $1.8 million. Both SCD and B-Thal gene therapy programs usually go hand in hand, given that both diseases are caused by a mutation in the same gene, HBB.

CRISPR also has chosen a more or less trodden path, using CAR-T therapies, a technology that depends on programming the patient’s white cells to attack cancers. However, its programs are more diverse and more prominent than EDIT, and have a higher chance of commercial success.

NTLA, on the other hand, made a big bet, and it paid off, becoming the first gene therapy company to target liver cells inside a human body, bringing humanity closer to treating diseases such as lung and brain cancer. It also has CAR-T programs, and an SCD program, but these augment a strong, differentiated pipeline. This, in my opinion, explains the difference in the market cap valuation of these emerging companies.

Summary

NTLA remains a speculative trade due to the uncertainty around clinical trial success and commercialization, which depends on the medical community’s acceptance, FDA label restriction, pricing, and adverse reactions. However, it derives its value from intellectual property potential monetary rewards if and when it commercializes its therapies. Its stock price will fluctuate to mirror changing probabilities of commercial and clinical success.

This quarter, the company plans to release new data from its clinical trials, creating a catalyst for ticker prices. I am buying the dip speculating on these trends, and I will hold for longer if the stock goes lower. After all, NTLA has decent chances of commercial success. The mainstream opinion within the academic community considers CRISPR a safer and more efficient gene editing technology than legacy methods, providing a safety net for management to seek “strategic option” such as M&A if the worst happens.

NTLA has a robust platform, enhancing its value, making it an attractive M&A target. However, I don’t believe that management considers this a strategic priority, rather a safety net if the ticker goes down. I don’t expect the company to issue more shares in the coming few quarters, but equity offering remains the primary source of liquidity.

Be the first to comment