Chip Somodevilla

Rock bottom

If I had been told last year that Intel (NASDAQ:INTC) would reach $25 per share I would not have believed it for a second, yet the reality of the facts is this. By now, very little remains of the old Intel from an economic point of view, in fact from being a company with stable free cash flow today the situation has totally changed. Recent long-term investments coordinated by Pat Gelsinger have wiped out free cash flow and are causing more than one concern. The masses have completely lashed out at this company in recent months, and when that disastrous Q3 2022 was released I expected the worst, which surprisingly did not happen. In fact, since that day, Intel has gained almost 20% in the following 3 weeks. But why has a disastrous quarterly brought so much excitement? The answer, in my opinion, is that expectations on Intel have been lowered to such an extent that it is difficult to further aggravate the situation. As Pat Gelsinger stated, “This is the bottom, we’re rebuilding from here.”

Suffice it to say that in Q3 2021 Intel reported EPS of $1.71, but expectations for Q3 2022 were only $0.34. It was enough to get EPS of $0.59 for Intel to have a double-digit positive pre-market. But is Intel really that ruined?

Semiconductors are the oil of the future

As a first aspect, to evaluate Intel I think it is necessary to highlight the prospects of the industry in which it operates since it is the most important aspect of my investment thesis.

The global semiconductor market was worth $527.88 billion in 2021 and analysts estimate it could reach $1.38 trillion by 2029 (12.20% CAGR). Basically, we are talking about an already huge market that will not slow down its growth in the coming years. Why there are such high expectations is easy to guess: semiconductors are the bone structure of a society increasingly geared toward tech solutions. Their importance is such that Pat Gelsinger himself has described them as the oil of the future, and the location of key factories may avert a global crisis. Just as oil has defined the geopolitical chessboard of the past 50 years, similarly semiconductors will define the new one.

Everything digital runs on semiconductors, and it is just essential that we build these fabs where we want them.

At this point a question arises. Who is currently winning the semiconductor race?

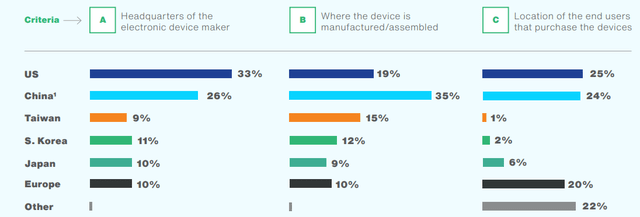

Unfortunately for the West, about 71% of manufactured/assembled chips come from Asia, and a large part of their demand comes from Western countries. But there is more.

The U.S. and Europe are completely dependent on a single company in cutting-edge chip manufacturing, TSMC (TSM). This company produces about 90% of the best chips out there and has a 53% market share in the foundry market. In addition, it is the only company along with Samsung capable of producing 5-nanometer chips.

Without TSMC’s chips, the West grinds to a halt, which is why the United States is intensifying its relationship with it. To expand domestic production of chips, an agreement was made in 2020 in which TSMC will build a factory in Arizona that will be operational starting in 2024. The problem with this is that fortifying relations with Taiwan is intensifying geopolitical tension between the United States and China. Chinese President Xi Jinping has certainly made no secret of his desire to reunify Taiwan, just as President Biden has repeatedly reiterated that in the event of an attack there will be U.S. intervention. Certainly it is still premature to talk about a potential armed conflict, but this black swan should not be overlooked since China does not seem determined to change its position.

Currently, the main suppliers of chips are TSMC, Samsung (OTCPK:SSNLF) and Intel, respectively, in order of importance. There is no question that the first two companies have a distinct advantage over Intel in terms of technology, but at the same time they possess an underlying geopolitical risk that leads me to exclude them from any possible investment regardless of their market position. I realize that this reasoning can be criticized as being too pessimistic, but I am not imposing my idea, I am simply sharing it. Investing in TSMC or Samsung does not make me comfortable in the long run as I believe that geopolitical tensions will escalate to such an extent that relations between the West and the East will be minimized. We are already observing this today with the different stances regarding the armed conflict between Ukraine and Russia, not to mention the continuing debates between China and the United States regarding trade agreements and many other issues.

Intel, therefore, is the only one among the three that does not present a geopolitical risk. Moreover, since no Western company in this sector has the same capital at its disposal, it represents the greatest hope for the West to close the gap with the East. No competitor can spend tens if not hundreds of billions like Intel in building new factories in America and Europe in the next 5-10 years. In addition, some of this investment will receive several subsidies through the Chip Act, a signal that Western governments will do what they can to support semiconductor companies’ research and development.

On the latter point, it should also be emphasized that by competitors I mean not only current ones (AMD above all), but also potential ones. There are significant barriers to entry in the semiconductor industry since it requires large initial investments in setting up factories. For a company starting from scratch this could be an insurmountable wall. What’s more, the further semiconductor technology goes, the more expensive the factories will be.

So, to sum it all up, my key points of my bullish thesis on Intel are the following:

- Semiconductor market expected to grow strongly in the coming years and Intel is the Western company with the most capital available to invest.

- Heavy investment in new factories in America and Europe that will reduce dependence on Eastern chips.

- It is in the interest of Western governments that the largest semiconductor company can have a bright future. The semiconductor market is becoming more of a political issue than an economic one.

- Worsening China-U.S. partnership that will gradually divide the world into two blocs: the East and the West. As a result, potential problems with both TSMC and Samsung.

Competition with AMD

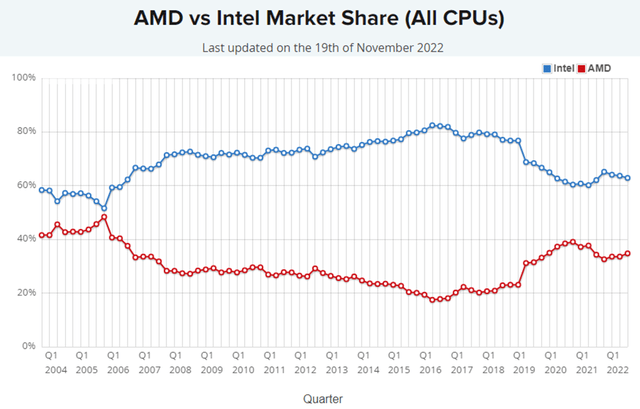

I have the utmost respect for AMD’s (AMD) excellent work in recent years, but we are talking about two companies that to date still have totally different orders of magnitude. This is one of the most discussed aspects but often this divergence, which in my opinion is fundamental, is not highlighted. In 2021 Intel generated revenues of $79.02 billion while AMD “only” $16.43 billion. So, these are two companies that present a totally different economic availability. Suffice it to say that Intel plans to invest up to $80 billion in Europe alone over the next 10 years on the entire semiconductor value chain, which would be impossible for AMD.

Certainly in recent years the gap between the two companies has narrowed, thanks to AMD’s management and at Intel’s fault for often appearing late on new launches. In fact, AMD’s LTM revenues were $22.82 billion while Intel’s dropped to $69.54 billion. The gap relative to the market share of the sectors in which they both operate has thinned, but Intel still remains ahead overall. Predicting how the competition between these two companies will evolve is very complex, but in recent weeks there have been signs of an Intel recovery.

On September 27, AMD released the Ryzen 9 7950X, which was the world’s fastest consumer-oriented processor. The moment of glory was very short-lived, however, because after not even a month, on October 20 Intel released the Core i9-13900K “Raptor Lake,” the current fastest processor in the world. This processor is not better in all areas, especially in power consumption, but in terms of performance it is currently unbeatable. Moreover, the most surprising aspect is that Intel has decided to sell it at a lower price than its competitors. The Core i9-13900K sells for $589 while the Ryzen 9 7950X around $670. This decision was a strong signal that Intel wants to regain consumer confidence, even at the cost of achieving lower margins in a very complicated macroeconomic environment. After years of delays and various complications, it now appears that Intel is slowly building the foundation for a new growth cycle.

Insiders are buying

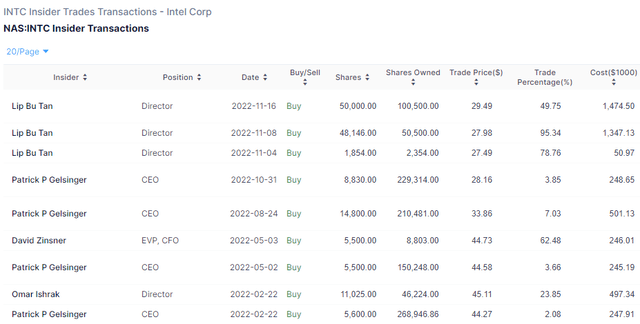

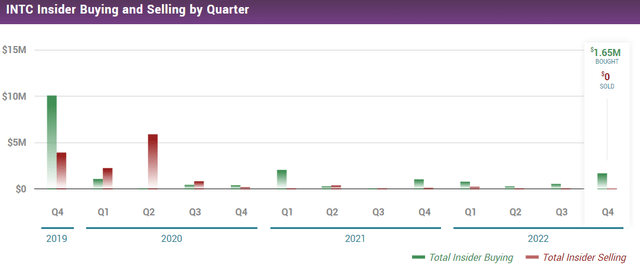

When an insider sells there may be multiple reasons, but when an insider buys there is only one reason. I tend not to consider this aspect in my investment theses, but in this case I think it is useful to discuss it since we are talking about repeated purchases with increasing amounts.

Lip Bu Tan has invested $2.87 million in about 2 weeks, Patrick Gelsinger continues to average down and other management members are also increasing their positions. No one knows Intel better than these people, so this is encouraging news for shareholders.

For the past 3 quarters there have been no sales, only purchases. What is more, such purchases are increasing more and more quarter by quarter.

How much is Intel worth?

This is a million dollar question and no one can answer it with certainty. Intel’s recent investments have completely disrupted its free cash flow and the new plants are still under construction. It is also complex to estimate how profitable they will be because there are too many variables to consider.

- The two new plants in Ohio cost $20 billion and are expected to be open by 2025. However, the company has already indicated its intention to invest up to $100 billion to build six more plants in the next decade.

- Construction of the two new plants in Magdeburg costing €17 billion will only begin in early 2023 and are expected to be operational by 2027.

These two are not Intel’s only investments, in fact there are also several expansion plans such as those in Ireland costing €12 billion. There is still a lot of uncertainty about how these investments will affect long-term free cash flow, but we certainly know that in the short term Intel will continue to struggle. No one likes low free cash flow, but I think this is the price we have to pay to get greater benefits in the long run. Big projects always take time, but financial markets are often impatient and tend to punish those who sacrifice the present for higher returns in the future.

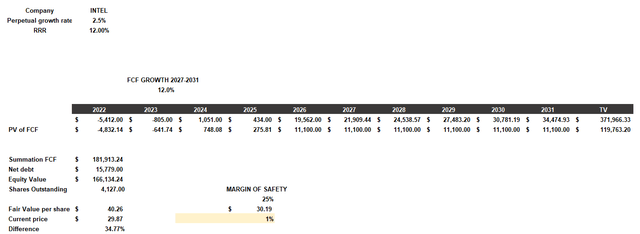

Anyway, I have calculated Intel’s fair value through a discounted cash flow. This model will be constructed as follows:

- The discount rate or RRR will be 12%. Since Intel is currently a risky investment, I have included a desired annual return higher than the historical return of the S&P500.

- Free cash flow estimates from 2022 to 2026 belong to TIKR Terminal analysts. From 2027 to 2031 I have entered a 12% growth rate based on expected growth from the global semiconductor market. The perpetual growth rate will be 2.50%.

- Outstanding shares and net debt were obtained from TIKR Terminal.

According to my assumptions, to get a 12% return per year from Intel we need to buy it below $40 per share. At the current price, we have a margin of safety of about 25%, so I consider the company highly undervalued. What’s more, I think I have included inputs that are also quite conservative:

- We are assuming that Intel will generate negligible free cash flow until 2025, and then return to growth and reach a free cash flow of $34.47 billion in 2031. This is not such a high figure considering that Intel in 2020 generated a free cash flow of $20.93 billion and by 2031 there will be many more operating plants.

- I may have considered an RRR too high for a company like Intel. Asking 12% per year from a company with a beta of 0.73 while the risk-free rate is below 4% is probably too much to ask. If I had followed the theory by including Intel’s WACC, the fair value would have been much higher and consequently the annual return lower. In any case, Intel is undervalued even by entering a discount rate of 12% per year, and that says a lot.

Overall, as much as Intel can be a risky investment my opinion is that it is worth it. We know that the global semiconductor market will play an increasingly important role given the growing use of technology, and we also know that the West is too dependent on Eastern chips. To avoid any geopolitical risks or supply chain issues (which we are still paying for), Western governments are trying to stimulate the growth of this industry by supporting the best companies in it. At the moment, Intel is the only Western company that can afford to invest so much in this market, and with Patrick Gelsinger at the helm I believe in a future where these investments will be worth the billions spent.

Be the first to comment