Scott Olson

Despite a broader stock market decline, Dollar Tree (NASDAQ:DLTR) shares have performed strongly during 2022 on the back of a significant price increase at its core Family Dollar chain. While the Dollar Tree chain has performed well, Family Dollar (acquired in mid 2015) continues to struggle.

While current results are impressive, the turnaround of Family Dollar very much remains a ‘show-me’ story. In addition, while dramatic price hikes have caused gross and operating margins to soar, I am not convinced that this pricing strategy will prove sustainable in the longer-term. As such, I am avoiding Dollar Tree shares.

Price Increases Drive Strong Current Results

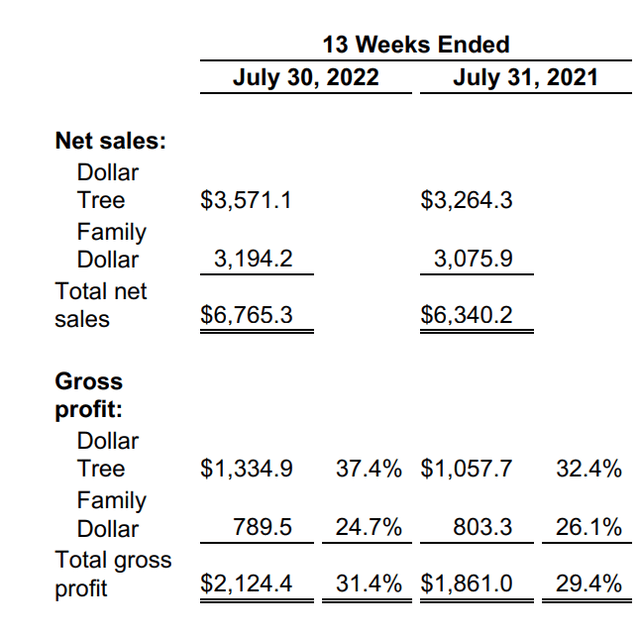

Dollar Tree was ahead of the inflationary curve as it dramatically increased prices in its Dollar Tree chain at the end of 2021. Prodded by activist shareholder Mantle Ridge, Dollar Tree ‘broke the buck’ and increased the price of most of the items from $1 to $1.25. This has led to a marked increase in both gross and operating margins as shown below.

Gross Margin Expansion (Dollar Tree 2Q22 Earnings Release)

As you can see above, the Dollar Tree segment experienced a significant increase in 2Q22 gross margins (+5%) which has driven gross and operating profit higher. A price hike of this magnitude (20%+) has an outsized positive impact on operating profit and operating expenses (rent, employees, utilities) have seen a more muted increase leading operating margins to expand by 5% year-over-year. Essentially the entire gross margin increase has flowed straight through to operating profit.

This price hike and associated increase in operating profitability are responsible for the entirety (actually more than the entirety as Family Dollar profits have gone backwards) of the expected 25% year-over-year increase in EPS from 2021 to 2022.

Family Dollar Remains Challenged

Despite the current strength in the Dollar Tree business, Family Dollar (which was acquired in 2015 and represents ~45% of group revenue) continues to struggle. 1H22 saw a very slight increase in revenue but operating profit has fallen by 52% year-over-year.

The Family Dollar acquisition has been a failure thus far. While the Dollar Tree business has consistently achieved low-teens operating margins, Family Dollar’s operating margins have been below 5% for almost the entire 7 years Dollar Tree has owned it.

It is important to understand that while the Dollar Tree concept is largely centered around an everything at the same low price ($1.25-$1.50) strategy targeting both low and middle-income consumers, Family Dollar is something different. Family Dollar does not have a core $1.25 price point for most items – instead it is basically a convenience store targeting lower income consumers in less affluent neighborhoods. Its core price positioning is generally inferior to competitors like Walmart (WMT) and it has a much narrower range of product.

While there have been numerous attempts by multiple management teams to try to ‘fix’ Family Dollar, I think the concept is fundamentally flawed as it struggles to compete on price and breadth of offering. This has resulted in consistently poor performance in same-store sales and profitability. The commentary below suggests management is ‘back to the drawing board’ in terms of how to fix Family Dollar:

2Q22 management commentary on Family Dollar (Seeking Alpha Transcripts)

While it is possible that management can fix its long troubled Family Dollar segment, this is very much a ‘show me’ story and given multiple failed attempts in the past (and unclear value proposition for the concept as a whole), I doubt we will see much improvement here.

Are Dollar Tree Earnings Sustainable?

While the Dollar Tree concept has seen a dramatic increase in profitability due to the massive price hikes implemented in 2022, I question the sustainability of this strategy. While Dollar Tree segment revenue has increased 11.6% year-over-year in the 1H22 on the back of significant price hikes, volumes (traffic) have declined:

2Q22 management commentary Transaction Count Decrease (Seeking Alpha Transcripts)

While this could be the result of consumers being pressured by inflation and being more cautious in spending, I suspect that the large price hikes have caused some consumers to shift spending to other retailers offering better value. This should become clearer to investors over the next 12-18 months. Should we see continued volume declines, Dollar Tree may have to walk back its price increases.

Conclusion

At 22.5x 2022 expected EPS, Dollar Tree stock is trading at the very high end of its 10 year historical trading range of 16-21x P/E. Investors seem to expect that not only are large pricing gains at the Dollar Tree brand sustainable but that there is a good chance that management will be able to turn around the long troubled Family Dollar Brand. Given the expensive valuation (versus historical average) and my concerns about both the Family Dollar turnaround and the sustainability of recent pricing gains, I am avoiding Dollar Tree shares.

Be the first to comment