sanfel

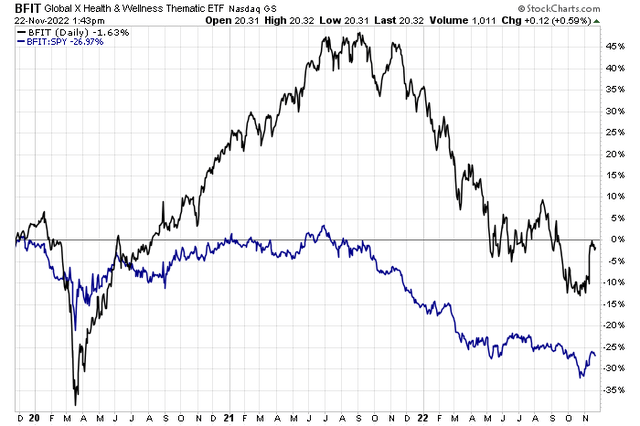

Health and fitness stocks did well coming out of the pandemic. A little-known ETF – the Global X Health & Wellness Thematic ETF (BFIT) – beat the S&P 500 from March 2020 through Q2 of 2021. Since then, however, it has been a struggle. Dick’s Sporting Goods (NYSE:DKS) has felt some of that weakness, but the stock reported strong Q3 results Tuesday morning. Is it a buy here? Let’s assess the playing field.

Wellness ETF Sharply Lower YoY

Stockcharts.com

According to Bank of America Global Research, Dick’s Sporting Goods is a full-line sporting goods retailer that offers a broad assortment of brand and private label sporting goods apparel, footwear, and equipment in a large box store format. The company also operates specialty standalone golf stores under the Golf Galaxy name and an Outdoor specialty store under the Field & Stream banner.

The Pennsylvania-based $8.5 billion market cap Specialty retail industry company within the Consumer Discretionary sector trades at a low 10.0 trailing 12-month GAAP price-to-earnings ratio and pays a small 1.7% dividend yield, according to The Wall Street Journal. The stock has an elevated 26.2% short interest, a remarkably high figure for a rangebound mid cap.

Shares traded up sharply on Tuesday after the retailer reported a solid earnings beat. Dick’s topped both on revenues and on per-share profit forecasts as well as producing strong comparable-store sales growth. Finally, the firm declared a $0.4875 dividend. Boosting shares was a positive outlook – Dick’s management team raised FY2022 comp store sales and earnings outlooks.

DKS is positioned well in a tough industry right now. Goods demand could be on the decline as people spent heavily on sports equipment during COVID. Moreover, ongoing challenges with key vendors such as Nike and Adidas are question marks in the near term. Big variables, which Dick’s seems to be executing well on, are its omnichannel presence and high-margin private label.

Downside risks include further deterioration of the macro environment and if there’s an uptick in gas prices. Some retailers already have reported that a slowdown was seen during the middle of last month, though retail sales data at large is strong. Upside potential comes from a continued rise in so-called solitary leisure.

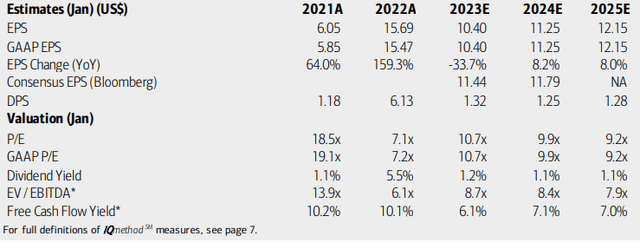

On valuation, analysts at BofA see earnings rising at a strong rate through 2025 after a challenging 2023. The Bloomberg consensus forecast is a bit more upbeat than BofA’s outlook. With about $11 of normalized earnings and solid growth, a market multiple would put the stock near $170, much higher than the current $115 price. Moreover, the stock trades at a reasonable EV/EBITDA ratio and spits off plenty of free cash flow. Overall, I like the valuation here.

Dick’s: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

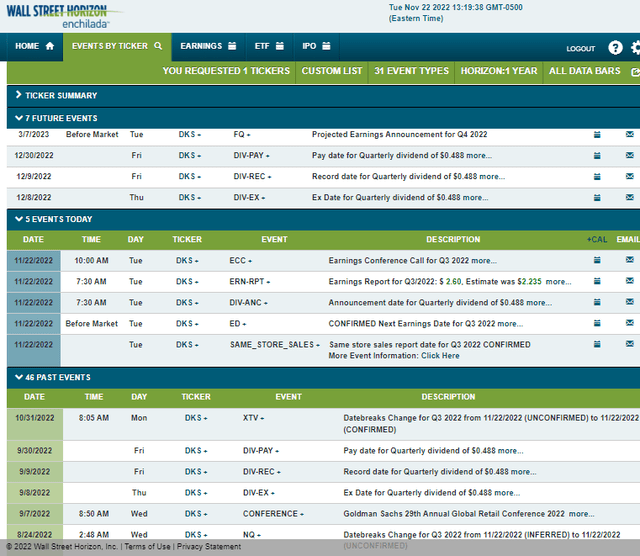

Looking ahead, corporate event data provided by Wall Street Horizon shows a projected Q4 2022 earnings date of Tuesday, March 7 before market open. Before that, though, the stock has an ex-dividend date of Thursday, Dec. 8.

Corporate Event Calendar

Wall Street Horizon

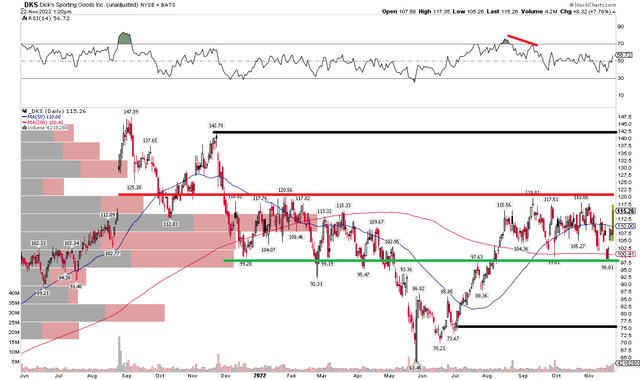

The Technical Take

Back in August, I had a cautious view on DKS as a short-term earnings play. The stock indeed halted at noted resistance, but the bulls did not let shares drop much. That’s impressive strength at such a key spot on the chart. What’s more, DKS is about unchanged from three months ago while the S&P 500 is materially lower. The stock has simply meandered, making the current range even more important.

A breakout above $120 would set up a bullish price objective to near $142 – the high from a year ago. Its extremely elevated short interest could accelerate an upside move on a break above $120. A bearish breakdown under $98 would trigger a measured move target of $76. For now, it’s a holding pattern on this attractively valued company.

DKS: A $98 to $120 Range Persists. Stay On The Sidelines For Now

Stockcharts.com

The Bottom Line

DKS is a near-term hold, but a long-term buy. While the charts suggest a “wait and see” approach, a low P/E following a string of good earnings reports is reason for fundamental optimism.

Be the first to comment