yullz

The Chart of the Day belongs to the electrical contractor EMCOR Group (EME). I found the stock by sorting the Russell 3000 Index stocks, first by the most frequent number of new highs in the last month and having a Trend Spotter buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker first signaled a buy on 10/11, the stock gained 26.34%.

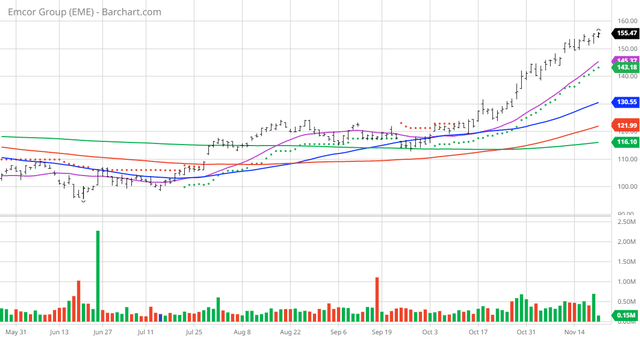

EME Price vs Trend Seeker & 20, 50, 100, 200 DMA ( )

EMCOR Group, Inc. provides electrical and mechanical construction, and facilities services primarily in the United States and the United Kingdom. It offers design, integration, installation, starts-up, operation, and maintenance services related to electrical power transmission, distribution, and generation systems; energy solutions; premises electrical and lighting systems; process instrumentation in the refining, chemical processing, and food processing industries; low-voltage systems, such as fire alarm, security, and process control systems; voice and data communications systems; roadway and transit lighting, signaling, and fiber optic lines; heating, ventilation, air conditioning, refrigeration, and geothermal solutions; clean-room process ventilation systems; fire protection and suppression systems; plumbing, process, and high-purity piping systems; controls and filtration systems; water and wastewater treatment systems; central plant heating and cooling systems; crane and rigging services; millwright services; and steel fabrication, erection, and welding services. The company also provides building services that cover commercial and government site-based operations and maintenance; facility management, maintenance, and services; outage services to utilities and industrial plants; military base operations support services; mobile mechanical maintenance and services; services for indoor air quality; floor care and janitorial services; landscaping, lot sweeping, and snow removal services; vendor management and call center services; installation and support for building systems; program development, management, and maintenance for energy systems; technical consulting and diagnostic services; infrastructure and building projects; small modification and retrofit projects; and other building services. It offers industrial services to oil, gas, and petrochemical industries. EMCOR Group, Inc. was incorporated in 1987 and is headquartered in Norwalk, Connecticut. (Yahoo Finance)

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 42.40+ Weighted Alpha

- 20.17% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 122.78% in the last month

- Relative Strength Index 66.88%

- Recently traded at $154.80 with 50 day moving average of $130.55

Fundamental factors:

- Market Cap $7.40 billion

- P/E 20.57

- Dividend yield .39%

- Revenue expected to grow 11.10% this year and up another 6.80% next year

- Earnings estimated to increase 9.90% this year, an additional 17.50% next year and continue to compound at an annual rate 1.00% for the next 5 years

Analysts and Investor Sentiment — I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 4 strong buy opinions in place on this stock

- Analysts have price targets from $145 to $165 with an average of $161

- The individual investors following the stock on Motley Fool voted 240 to 12 for the stock to beat the market with more experienced investors voting 56 to for the same result

- 13,400 investors are monitoring this stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Ranked Overall

Ranked in Sector

Ranked in Industry

Quant ratings Beat The Market »

Dividend Grades

Be the first to comment