niphon

After CEO Pat Gelsinger proclaimed Intel (NASDAQ:INTC) would IPO key asset Mobileye for $50 billion, the valuation has plummeted due to a weak market. Regardless, the chip giant still appears moving food speed ahead on taking the auto tech company public despite the weak market. My investment thesis remains Bearish on Intel with another sign the company is desperate for cash to compete in the capital intensive chip manufacturing business.

Mobileye IPO

Last week, Intel filed to take Mobileye Global (MBLY) public despite an IPO market that has been historically weak. The planned listing saw the expected valuation of the business targeted at delivering autonomous driving at scale cut by 40% to only $30 billion.

Intel expects to only a sell a fraction of the business leaving the chip giant as the controlling owner. Mobileye is seeking to list under their prior ticker symbol “MBLY”. The chip giant bought the company for $15.3 billion back in 2017.

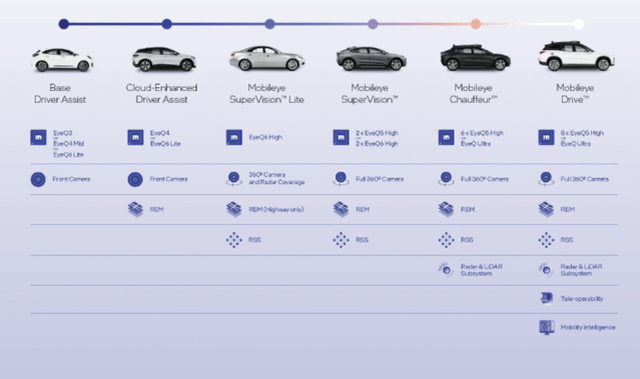

Mobileye has dominated the ADAS market with ~800 vehicle models and 50 OEMs incorporating the EyeQ chip. The big question is whether Mobileye will dominate the transition to autonomous driving with a whole host of OEMs developing internal systems and the likes of Tesla (TSLA) parting ways with Mobileye.

The suggestion has been that Intel wants to sell a 10% to 20% stake in Mobileye to raise capital for their aggressive move into building new foundries. The move made sense with a premium valuation of $50 billion where the company could raise $5 billion by unloading a small 10% position. Also, the independent shares could allow Mobileye to attract more talent with stock-based compensation not as appealing when the stock is tied to Intel.

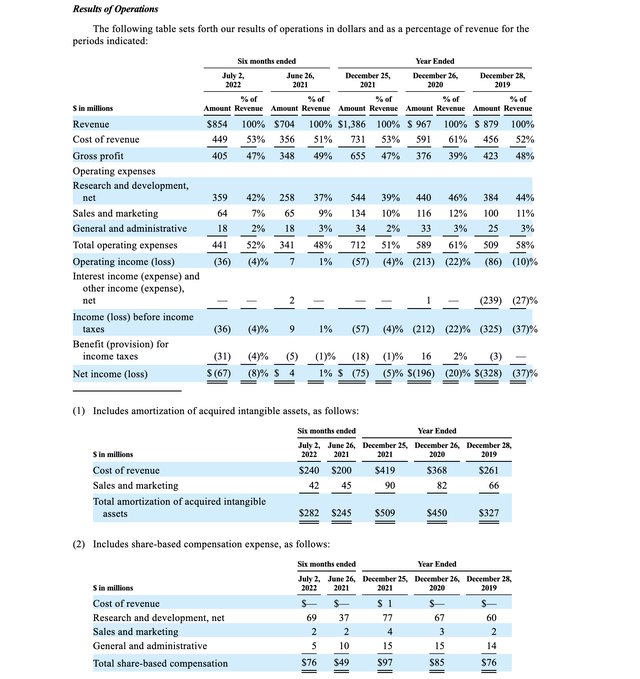

The company reports solid results, though misunderstood by some seeing the original numbers highlighting negative gross profits. Mobileye reported revenues grew 41% to reach $460 million in the last quarter. The auto division reported $190 million in operating income.

The SEC filing showed the GAAP numbers with a massive loss for the 1H of the year. The loss headline was misleading with the inclusion of a $141 million quarterly charge for amortization of intangibles related to the Intel buyout of Mobileye at an elevated price. After excluding SBC, the company actually has a solid profit in a sector with explosive growth.

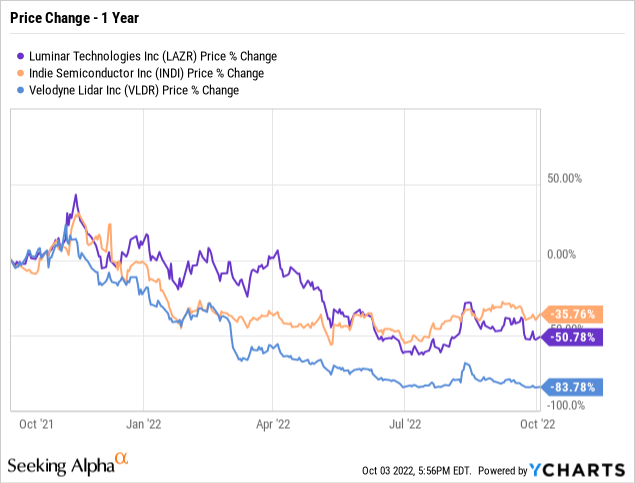

Note, Mobileye is only reporting revenues at an annualized rate of $1.7 billion. An IPO price of $30 billion appears very stretched when other auto tech related companies such as Luminar Technology (LAZR), indie Semi (INDI) and Velodyne Lidar (VLDR) have fallen at clips above 50% in the last year. These stocks have fallen far more from the peak levels where Intel listed the $50 billion valuation.

In addition, the stock would trade at nearly 20x current sales estimates. With the division growing at a 40% clip, Mobileye might generate somewhere above $2 billion in revenues in 2023. A P/S multiple closer to 10x forward sales appears elevated in this market.

Based on design wins through July 2, the company forecasts 266 million vehicles by 2030 deployed with Mobileye driver-assisted technology. The amount is more than double the 117 million vehicles already deployed with their technology.

In total, Mobileye forecasts the ADAS market to have a near-term TAM to be approximately $40 billion and the long-term TAM to be approximately $480 billion by 2030. The content in each vehicle will grow dramatically as the market shifts from ADAS to AVs.

The massive growth in the market opportunity could definitely warrant a higher valuation multiple, but the above auto stocks aren’t rallying on this clear opportunity. Mobileye is probably a higher quality company, but the market isn’t fond of such growth stocks right now.

Intel Appears Desperate

Intel rushing to IPO Mobileye is another sign of bad management. The IPO market has been the worst in two decades since the dot.com bubble bust in 2000.

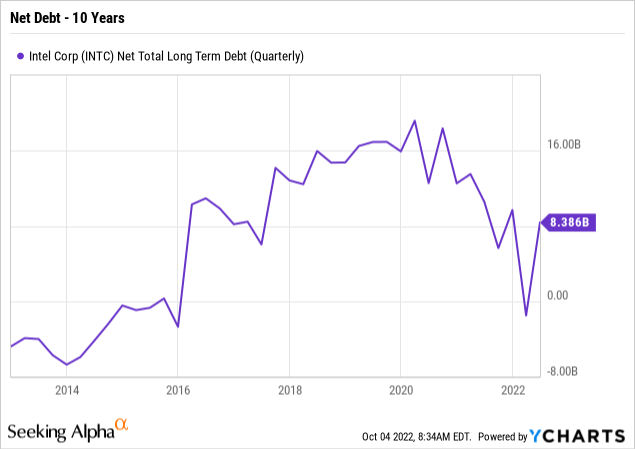

The chip giant has net debt of over $8 billion while planning to spend a reduced $23 billion in capex this year. Intel doesn’t even plan to produce much in the way of positive cash flows while obtaining government money and paying out $12 billion annually on the dividend.

In essence, Intel appears to be cashing out a portion of a hot technology division in order to continue paying the dividend. One has to wonder if the IPO even reaches the market due to the $30 billion valuation probably needing to be cut again to $20 billion. Chip giant might not end up with the necessary cash to warrant the IPO.

Takeaway

The key investor takeaway is that Intel is oddly pushing forward with the Mobileye IPO, even though the market is very weak. The chip giant needs to raise cash to fund capex and cover the large dividend payout, but the crashing prices for auto tech doesn’t warrant rushing to market now.

The stock isn’t appealing here with Intel continue to make bad moves.

Be the first to comment